Stepping into the world of cryptocurrency can feel like arriving in a new city at night—exciting, but full of unknowns. Whether you’re drawn by stories of Bitcoin millionaires or simply want to understand what all the fuss is about, crypto onboarding doesn’t have to be intimidating. In this guide, I’ll walk you through the essentials, helping you avoid common pitfalls and build a foundation for safe, confident participation in this dynamic space.

Why Crypto? Understanding the Appeal

The surge in interest around digital assets isn’t just hype. Cryptocurrencies offer a new way to store value, transfer funds globally, and even participate in decentralized finance projects—all without relying on traditional banks. For some, it’s about financial sovereignty; for others, it’s about curiosity or investment potential. But before you start moving money into Bitcoin or Ethereum, it’s important to understand what makes these assets unique—and risky.

- Decentralization: No single entity controls the network.

- Transparency: Transactions are recorded on public blockchains.

- Volatility: Prices can swing wildly—sometimes within hours.

If you’re still unsure whether crypto fits your goals or risk tolerance, take a moment to read our guide on crypto vs stocks.

Your First Steps: Setting Up Safely

The number one rule for newcomers is simple: safety first. The decentralized nature of crypto means there’s no customer service hotline if something goes wrong. Here’s how to get started without putting your funds—or your identity—at risk.

Essential Steps to Secure Your First Crypto Wallet

-

1. Choose a Reputable Wallet Provider: Select a trusted wallet app or hardware wallet from well-known companies to ensure your funds are safe.

-

2. Download from Official Sources: Always download wallet software from the official website or app store to avoid malicious versions.

-

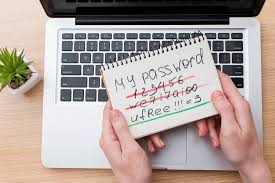

3. Create a Strong Password: Use a unique, complex password for your wallet. Avoid reusing passwords from other accounts.

-

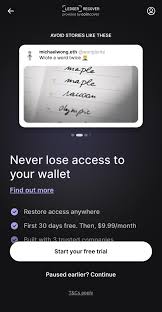

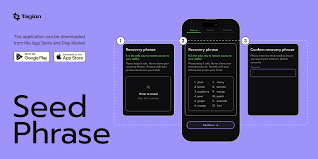

4. Back Up Your Recovery Phrase: Carefully write down your wallet’s recovery phrase and store it in a secure, offline location. Never share it online.

-

5. Enable Two-Factor Authentication (2FA): Add an extra layer of security by enabling 2FA if your wallet supports it.

-

6. Double-Check Security Settings: Review your wallet’s security settings and adjust them for maximum protection before using your wallet.

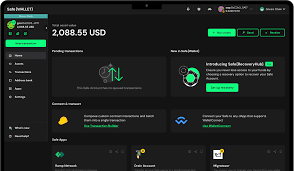

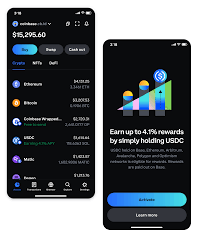

You’ll need a digital wallet before you can buy or receive any cryptocurrency. Wallets come in many forms—from mobile apps like MetaMask, to hardware wallets such as Ledger or Trezor. Each has its own tradeoffs between convenience and security. If you’re unsure which is right for you, our detailed comparison on the best crypto wallets for beginners breaks down your options.

“In crypto, self-custody means self-responsibility. Learn how wallets work before moving significant funds.” — Marcus Ellison

Navigating Exchanges: Where to Buy Your First Crypto

You’ve set up your wallet—now what? Most people purchase their first coins through an exchange platform such as Coinbase, Binance, or Kraken. These platforms act as bridges between traditional money (fiat) and cryptocurrencies.

When selecting an exchange, prioritize security features (like two-factor authentication), transparent fee structures, and compliance with local regulations. For step-by-step help with account creation and verification processes, see our article on how to buy Bitcoin safely online.

Avoiding Common Scams & Mistakes Early On

The early days are when most newcomers fall victim to scams or make costly mistakes—often because they rush in without understanding basic security principles.

- Never share your wallet seed phrase—not even with support staff.

- Avoid clicking suspicious links in emails or social media DMs.

- If it sounds too good to be true (guaranteed returns!), it probably is.

- Start small: Only invest what you can afford to lose while learning the ropes.

If you want more real-world examples of scams—and how users recovered—we’ve compiled stories at our dedicated page on common crypto scams and prevention tips.

The Language of Crypto: Decoding Jargon Fast

The technical language around blockchain can feel like a secret code designed to keep outsiders confused. But don’t worry—you don’t need a computer science degree! Here are some terms every newcomer should know:

Essential Crypto Terms Explained

-

Blockchain: A secure, digital ledger that records all cryptocurrency transactions in a transparent and tamper-proof way.

-

Private Key: A secret code that grants access to your crypto funds. Never share this with anyone.

-

Public Address: Your unique crypto receiving address, like an account number, which you can safely share to receive funds.

-

Seed Phrase: A series of words that can restore your wallet and funds. Write it down and store it securely.

This foundation will help you make sense of articles, videos, and social posts about cryptocurrency—and avoid misunderstandings that could lead to mistakes. For an expanded glossary (with real-world analogies), check out our resource on the essential crypto terms everyone should know.

Building your crypto confidence isn’t just about memorizing terms or following a checklist. It’s about cultivating the right habits, learning from others’ experiences, and staying alert to new developments. The crypto landscape evolves rapidly—what was true last year can shift overnight, especially as regulations change or new technologies emerge.

Growing Your Knowledge: Where to Learn and Who to Trust

Reliable information is your best defense against confusion and costly errors. Unfortunately, misinformation is rampant in crypto circles. Always cross-reference advice, particularly when it comes from social media influencers or anonymous online forums. Stick to established resources like BuyingCrypto, official project websites, and well-known educational platforms.

Top Trusted Crypto Education Resources

-

Coinbase Learn: Comprehensive guides and tutorials for beginners, covering everything from blockchain basics to trading safely.

-

Binance Academy: Free educational articles and videos on cryptocurrencies, security, and blockchain technology.

-

CryptoCompare: In-depth reviews, news, and educational content to help users make informed decisions.

-

Investopedia Cryptocurrency Section: Trusted financial encyclopedia with detailed explanations and practical tips for crypto newcomers.

-

CoinGecko Learn Crypto: Easy-to-understand guides and glossaries to demystify crypto terms and concepts.

It’s also wise to join communities where you can ask questions without fear of ridicule. Places like r/CryptoCurrency on Reddit or beginner-friendly Discord servers offer real-time support and crowd-sourced wisdom. Remember: no one knows everything in this space—don’t be afraid to admit what you don’t know.

Practicing Good Security Hygiene

Your digital security habits will determine your long-term success (and peace of mind) in crypto. Even seasoned investors occasionally slip up—so make these practices routine from day one:

- Enable two-factor authentication (2FA) on every exchange and wallet that supports it.

- Store backup copies of your seed phrase offline, in multiple secure locations.

- Regularly update your device software and use reputable antivirus tools.

- Double-check addresses before sending funds; one typo can mean permanent loss.

If you’re unsure whether your setup is secure enough, our guide on crypto security basics offers a thorough walkthrough of best practices for every level.

Taking Your First Steps: Making Your Initial Crypto Purchase

The moment you first buy cryptocurrency feels significant—like crossing a threshold into uncharted territory. Don’t rush it. Start with a small amount so you can practice transferring coins between your exchange account and personal wallet safely. This hands-on experience is invaluable for building confidence before moving larger sums.

If you encounter any hiccups along the way—delayed transactions, confusing error messages—don’t panic. Most issues have straightforward solutions if you pause and research before reacting. Our troubleshooting section at BuyingCrypto troubleshooting hub covers the most common problems faced by beginners.

Staying Curious: What Comes After Your First Crypto Buy?

You’ve made your first purchase—now what? For many, this sparks curiosity about topics like staking rewards, NFTs, or decentralized finance (DeFi). Resist the urge to dive headfirst into every new trend; instead, focus on deepening your understanding of core concepts before branching out into more advanced territory.

- What is DeFi?

- How do NFTs work?

- Earning passive income with crypto

- Crypto tax basics in your country

The best approach is slow and steady growth—expand your knowledge base alongside your portfolio size. If curiosity pulls you toward more experimental projects or altcoins, always research thoroughly and never invest money you can’t afford to lose.

Navigating the world of cryptocurrency doesn’t require technical genius or nerves of steel—it requires patience, skepticism where warranted, and a willingness to keep learning. The journey may be unpredictable at times but remember that every expert was once a beginner wrestling with their first wallet setup or confused by blockchain jargon.

If you’re ready for deeper dives or want tailored help as you progress beyond the basics, our team at BuyingCrypto is here to support you every step of the way—whether it’s clarifying advanced topics or helping recover from those inevitable early missteps. The future of finance isn’t waiting for anyone; but with careful onboarding, it’s yours to explore securely and confidently.