Converting local currency to crypto has never been more accessible—or more nuanced—than in 2025. As the ecosystem matures, users are demanding faster onboarding, lower fees, and seamless integration with everyday payment tools. Whether you’re a first-timer or a seasoned investor, understanding the latest fiat-to-crypto guide 2025 is crucial for efficient and secure asset acquisition. Below, we dissect the seven easiest and most up-to-date ways to convert your local fiat currency into digital assets, leveraging the best exchanges, payment methods, and onboarding innovations.

1. Binance: Zero-Fee Bank Transfers & Instant Card Purchases

Binance continues to lead with its zero-fee bank transfer options for many regions, making it an unbeatable choice for cost-conscious buyers. Instant credit and debit card purchases remain available for those who value speed over fees—ideal for market moves that can’t wait. The streamlined KYC process ensures compliance without excessive friction.

This combination of zero-fee transfers and instant card support makes Binance a go-to platform for both new users and high-frequency traders seeking to convert local currency to crypto efficiently.

2. Coinbase: Apple Pay & Google Pay Integration for Seamless Mobile Onboarding

The rise of mobile-first onboarding is epitomized by Coinbase‘s integration with Apple Pay and Google Pay. Users can now buy crypto directly from their mobile wallets in just a few taps—no need to enter card details or leave the app ecosystem. This seamless approach not only streamlines the process but also enhances security by leveraging biometric authentication.

If you’re looking for an intuitive entry point into crypto using familiar payment methods, Coinbase’s mobile integrations are hard to beat in 2025.

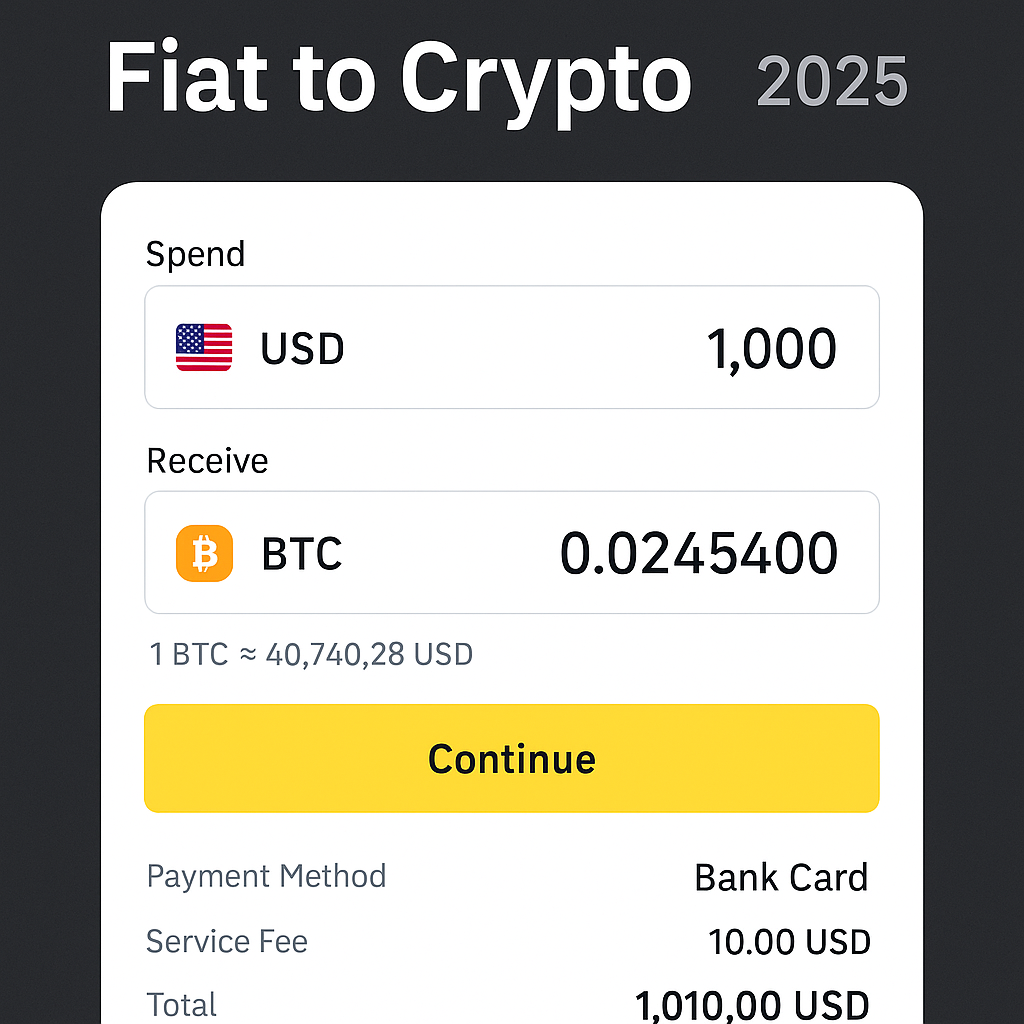

3. Bybit’s Fiat Gateway: Local Currency Conversion With Low KYC Hurdles

Bybit‘s fiat gateway stands out for its low KYC requirements compared to traditional exchanges—especially attractive if privacy is a priority or if you need quick access without paperwork bottlenecks. The gateway supports multiple local currencies and offers competitive rates on top coins like BTC and ETH.

7 Easiest Ways to Convert Fiat to Crypto in 2025

-

Use Binance for zero-fee bank transfers and instant credit/debit card purchases. Binance’s streamlined onboarding allows users to convert local currency to crypto efficiently, with competitive rates and robust security.

-

Buy crypto with Apple Pay or Google Pay on Coinbase for seamless mobile onboarding. Coinbase’s integration with popular mobile wallets makes purchasing crypto as simple as a tap, ideal for users seeking convenience and speed.

-

Leverage Bybit’s fiat gateway for local currency conversion with low KYC requirements. Bybit offers a user-friendly platform supporting multiple fiat currencies and payment methods, minimizing onboarding friction.

-

Utilize Kraken’s ACH and SEPA support for fast, secure fiat-to-crypto deposits in the US and EU. Kraken’s trusted infrastructure ensures reliable transfers and a wide range of supported digital assets.

-

Opt for regional payment solutions like Paytm (India) or PIX (Brazil) on supported exchanges. These localized methods make crypto accessible to a broader audience by leveraging familiar payment rails.

-

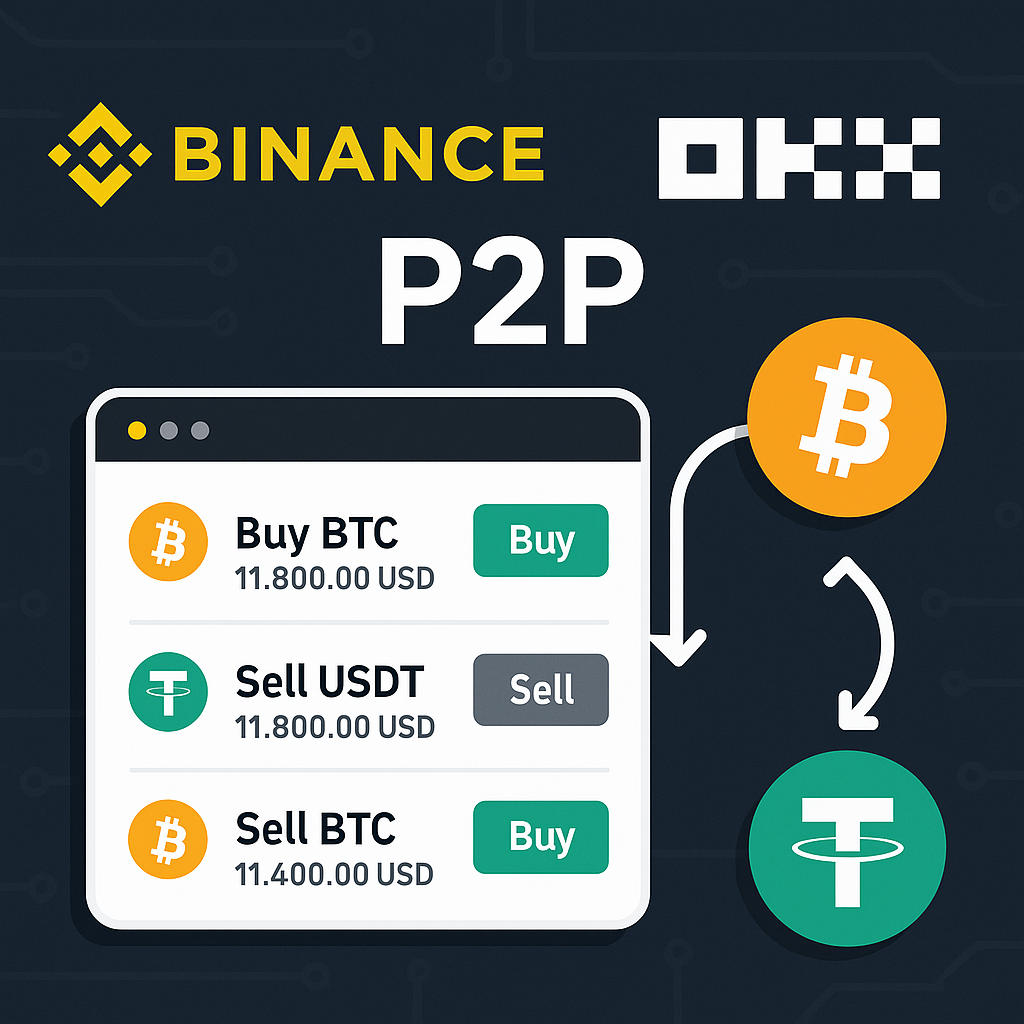

Purchase crypto through peer-to-peer (P2P) marketplaces such as OKX or Binance P2P for flexible payment methods. P2P platforms enable direct trades between users, supporting various currencies and payment types.

-

Try Revolut or Cash App’s integrated crypto purchase features for direct fiat conversion within popular finance apps. These apps allow users to buy, sell, and hold crypto alongside their regular banking activities.

This makes Bybit an excellent option for those who want fast onboarding without compromising on compliance or range of supported currencies.

4. Kraken: Fast ACH & SEPA Deposits For Secure US/EU Conversions

Kraken remains a staple among US and EU users thanks to its robust support for ACH (in the US) and SEPA (in Europe) bank transfers. These rails offer quick settlement times—often within hours—and are backed by Kraken’s reputation for security and transparency.

If minimizing risk while maximizing speed is your goal, Kraken’s fiat deposit options are among the most reliable ways to onboard funds into crypto in these major markets.

5. Regional Payment Solutions: Paytm, PIX & Localized Onboarding

For users outside North America and Europe, regional payment solutions have become a game-changer. Platforms like Paytm in India and PIX in Brazil are now integrated into leading exchanges, offering a frictionless way to buy crypto with familiar local apps. This removes the need for international transfers or currency conversions, reducing both cost and complexity.

Exchanges supporting these methods often provide tailored onboarding flows that respect local regulations and consumer habits. As a result, users experience seamless fiat-to-crypto conversion that feels native to their financial ecosystem.

6. Peer-to-Peer (P2P) Marketplaces: Maximum Flexibility With OKX & Binance P2P

If you need more control over payment methods or wish to transact outside conventional banking rails, P2P marketplaces such as OKX and Binance P2P are indispensable. These platforms connect buyers and sellers directly, supporting payments via bank transfer, mobile wallets, cash deposits—even gift cards in some regions.

P2P platforms typically feature escrow protection, live chat negotiation, and robust reputation systems to minimize risk. However, users should remain vigilant—always verify counterparties and use platform-recommended safety protocols.

7. Finance Apps With Crypto Integration: Revolut & Cash App’s Direct Fiat Conversion

The convergence of traditional fintech and crypto is best illustrated by apps like Revolut and Cash App. In 2025, these platforms offer direct crypto purchases from your existing balance—no external exchanges or transfers required. For many users, this all-in-one approach simplifies portfolio management while providing instant access to Bitcoin or Ethereum at competitive rates.

Because these services are built atop highly regulated financial infrastructure, they’re especially appealing for those prioritizing compliance and ease of use over deep asset selection or advanced trading features.

Choosing The Right Method For Your Needs

The diversity of options means there’s no single “best” way to convert local currency to crypto—your optimal path depends on factors like region, preferred payment method, privacy concerns, speed requirements, and fee sensitivity.

- If you want zero-fee transfers: Use Binance’s bank transfer option where available.

- If you’re all-in on mobile: Coinbase with Apple Pay or Google Pay offers unrivaled convenience.

- If privacy is paramount: Bybit’s low KYC gateway or P2P marketplaces give you more discretion (but do your due diligence).

- If you rely on local fintech: Seek out exchanges supporting Paytm or PIX for tailored onboarding.

- If you prefer mainstream apps: Revolut and Cash App integrate seamlessly with your daily finances.

Which fiat-to-crypto method do you prefer in 2025?

There are now more ways than ever to convert local currency to crypto. Which of these top options is your favorite or most trusted for 2025?

The Future of Fiat-to-Crypto Onboarding

The landscape will only continue evolving as regulatory clarity increases and payment technology advances. Expect even tighter integration between banks, wallets, and crypto exchanges—alongside broader support for regional solutions as adoption spreads globally. Staying informed about the latest trends ensures you’re always leveraging the most efficient tools available for your market.

[tweet: A discussion thread about zero-fee crypto purchases on Binance in 2025]