Stepping into the world of cryptocurrency can feel a bit like learning a new language. From “blockchains” to “private keys,” crypto is full of jargon that can leave beginners scratching their heads. But don’t worry—understanding these essential terms is your first step toward confidently buying, selling, and managing digital assets. Whether you’re looking to buy your first Bitcoin or simply want to decipher crypto news headlines, this glossary will break down the must-know concepts in plain English.

Core Crypto Concepts You Can’t Ignore

Let’s start with the basics. These foundational terms will help you make sense of almost every conversation in the crypto space:

Essential Crypto Terms Explained

-

Blockchain: The foundational technology behind cryptocurrencies, acting as a secure, decentralized digital ledger for recording transactions.

-

Wallet: A digital tool or app that securely stores your cryptocurrencies and allows you to send or receive digital assets.

-

Exchange: An online platform where you can buy, sell, or trade cryptocurrencies safely and efficiently.

-

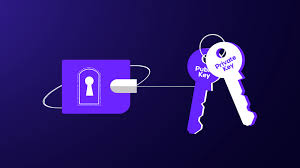

Private Key: A unique, secret code that gives you access to your crypto funds—keep it safe and never share it!

-

Public Key: An address you share with others so they can send you cryptocurrency, like your crypto email address.

If you master just these five, you’ll already be ahead of most newcomers. But let’s keep going—crypto has plenty more lingo that’s worth understanding.

Popular Coins and Tokens Explained

You’ve probably heard names like Bitcoin, Ethereum, and Dogecoin. But what actually sets them apart? Here are some key distinctions:

- Bitcoin (BTC): The original cryptocurrency, designed as digital money for peer-to-peer transactions.

- Ethereum (ETH): A platform for building decentralized apps and smart contracts—think of it as programmable money.

- Altcoin: Any cryptocurrency that isn’t Bitcoin. This includes everything from Ethereum to meme coins like Dogecoin.

- Stablecoin: Cryptocurrencies pegged to stable assets like the US dollar (e.g., USDT or USDC), designed to minimize price volatility.

- Token: Digital assets created on existing blockchains (often Ethereum) that can represent anything from voting power to real-world assets.

Navigating Crypto Security: Keys, Addresses, and More

Your security in crypto depends on understanding a few critical terms. Let’s break them down:

- Private Key: Like the password to your bank account—never share it! Whoever has this key controls your funds.

- Public Address: Your “account number” on the blockchain; safe to share when receiving funds.

- Seed Phrase: A series of words that back up your wallet. Lose this, and you could lose access forever.

- Hot Wallet vs Cold Wallet: Hot wallets are connected to the internet (convenient but less secure), while cold wallets are offline (safer for long-term storage).

If you take away one thing: Never share your private key or seed phrase with anyone—not even tech support!

The Role of Exchanges and How They Work

A huge part of getting started with crypto is learning how to use an exchange. Here’s what you need to know:

- Exchange: Online platforms where you buy, sell, or trade cryptocurrencies. Some popular ones include Coinbase and Binance.

- CEX vs DEX: CEX stands for Centralized Exchange—think traditional companies with customer support. DEX means Decentralized Exchange—peer-to-peer trading without intermediaries.

- KYC (Know Your Customer): The process exchanges use to verify your identity before letting you trade or withdraw funds.

If you’re curious how exchanges actually work behind the scenes—or how they differ from traditional banks—a quick video explainer can be invaluable.

Now that you have a handle on the essentials, let’s dig into some terms that often trip up new investors. Crypto is more than just buying and selling—it’s a whole ecosystem with its own rules and rhythms.

DeFi, NFTs, and Other Buzzwords

You’ll see these acronyms and terms everywhere in crypto discussions. Here’s what they really mean:

- DeFi (Decentralized Finance): A movement to recreate traditional financial services—like lending or trading—using blockchain technology without banks or brokers.

- Liquidity: Refers to how easily you can buy or sell an asset without affecting its price. Highly liquid markets have lots of buyers and sellers.

- NFT (Non-Fungible Token): Unique digital assets (like art, music, or collectibles) verified on the blockchain. Each NFT is one-of-a-kind, unlike cryptocurrencies such as Bitcoin.

- Smart Contract: Self-executing contracts with rules written in code. They power everything from DeFi to NFT marketplaces.

- Gas Fee: The fee paid to process transactions or run smart contracts on blockchains like Ethereum. Fees can spike during busy periods!

Common Trading Slang & Market Terms

The crypto community loves its slang—and sometimes it feels like everyone’s speaking in code. Here are some must-know phrases for reading charts, joining forums, or following the latest trends:

Essential Crypto Trading Slang Explained

-

HODL: Originally a typo for “hold,” this term means to keep your crypto assets rather than selling, especially during market dips.

-

FOMO: Short for “Fear Of Missing Out,” FOMO describes the anxiety of missing a profitable trade, often leading to impulsive buying.

-

FUD: Stands for “Fear, Uncertainty, and Doubt.” FUD refers to negative news or rumors that can cause panic selling in the market.

-

ATH: This means “All-Time High,” marking the highest price ever reached by a cryptocurrency.

-

Bear/Bull Market: A bear market is when prices are falling and sentiment is pessimistic, while a bull market is characterized by rising prices and optimism.

Learning these will help you decode social media threads and avoid falling for hype—or panic—when prices swing wildly.

Security Reminders: Avoid Common Pitfalls

The fastest way to lose money in crypto? Ignoring basic security advice. Here are some quick reminders every beginner should internalize:

- Protect your private keys and seed phrases at all costs.

- Watch for scams: If something sounds too good to be true, it probably is.

- Enable two-factor authentication (2FA) on all your accounts.

- Avoid clicking random links or downloading files from unknown sources—even if they look official.

Expanding Your Vocabulary: Next-Level Terms

Ready to go beyond the basics? As you get more comfortable, you’ll encounter advanced terms that signal deeper involvement in the space:

- DAO (Decentralized Autonomous Organization): A group run by code and community votes instead of managers—often used to govern projects or funds collectively.

- Staking: Locking up your coins to support network operations (like validating transactions) in exchange for rewards.

- Mining: Using computers to solve complex puzzles and add new blocks to a blockchain—miners earn coins as a reward.

- Airdrop: Free distribution of tokens by a project, often as a promotion or reward for early supporters.

- Fork: A change in blockchain rules that creates two separate versions—sometimes leading to new coins (like Bitcoin Cash).

Test Your Knowledge!

If you’ve made it this far, you’re already better equipped than most beginners. Want to check your understanding? Take our quick quiz below—you might surprise yourself!

Crypto Terms for Beginners: Quick Quiz

Test your understanding of essential crypto terms every beginner should know. Choose the best answer for each question.

Keep Learning—and Stay Curious

The world of crypto is always evolving—new terms pop up all the time as technology advances and communities grow. Bookmark this glossary for future reference and don’t hesitate to revisit it when you encounter unfamiliar jargon. For more guides tailored specifically for newcomers, check out our resource on how to safely buy Bitcoin step-by-step.

If something doesn’t make sense right away—that’s normal! Crypto is complex but absolutely learnable with patience and curiosity.

If there are other terms you keep stumbling over or want explained in plain English, let us know! The BuyingCrypto community is here to support your journey every step of the way.

Which crypto term was hardest for you to understand at first?

Crypto has a language of its own! Let us know which term gave you the most trouble when you started learning about crypto.