Every few months, the question resurfaces among investors and newcomers alike: Is now a good time to buy crypto? The answer is never simple. Cryptocurrency markets are notorious for their volatility, dramatic headlines, and cycles of hype and despair. Yet, behind the noise, there are patterns, trends, and signals that can help guide your decision—if you know where to look. This article will break down the current landscape and arm you with the context you need to make an informed move in the digital asset space.

The Current Crypto Market Landscape

To assess whether it’s a good time to buy crypto, it’s crucial to understand what’s happening in the market right now. As of mid-2024, we’re seeing:

- Bitcoin hovering near its recent all-time highs after a prolonged bull run.

- Ethereum gaining momentum thanks to renewed interest in decentralized finance (DeFi) and upcoming protocol upgrades.

- Altcoins, including Solana and Avalanche, experiencing sharp rallies followed by equally sharp corrections.

- Spot Bitcoin ETFs bringing new institutional money into the space.

This environment is both exciting and perilous. The influx of retail investors has contributed to price surges, but also increased the risk of sudden downturns. It’s worth noting that regulatory clarity remains elusive in many jurisdictions—a factor that injects further uncertainty into the equation.

What Drives Crypto Prices Right Now?

The forces shaping crypto prices are more complex than ever before. In 2024, several factors are at play:

Key Factors Influencing Crypto Prices Today

-

Regulatory Developments: Changes in government policies and regulations can have a profound impact on crypto prices.

-

Market Sentiment: Investor confidence, fear, and media coverage often drive short-term price movements.

-

Macroeconomic Trends: Factors like inflation, interest rates, and global economic stability affect demand for digital assets.

-

Technological Advancements: Upgrades to blockchain networks and new innovations can boost investor optimism.

-

Adoption by Institutions: Increased participation from banks and large companies tends to legitimize and stabilize the market.

Macroeconomic conditions, such as inflation rates and central bank policies, have started impacting digital assets much like they do stocks or bonds. Meanwhile, ongoing developments in blockchain technology—like Ethereum’s move toward greater scalability—are fueling optimism among long-term believers.

You should also consider sentiment cycles. When mainstream media focuses on record highs or celebrity endorsements (think back to Dogecoin mania), retail FOMO can drive prices up fast—but corrections are just as swift when sentiment turns sour.

Risks You Can’t Ignore

No discussion about buying crypto would be complete without addressing risk management. While some see current prices as an opportunity for outsized gains, others warn of potential bubbles or regulatory crackdowns looming on the horizon. Here are some risks you should keep front-of-mind:

- Scams and hacks: Sophisticated phishing attacks and rug pulls remain rampant.

- Custody concerns: Not your keys, not your coins—are your assets really safe?

- Regulatory uncertainty: Governments worldwide continue to debate how cryptocurrencies fit into existing legal frameworks.

- Market manipulation: Thinly traded altcoins are particularly vulnerable to pump-and-dump schemes.

Navigating FOMO: Smart Entry Tactics

If you’re feeling anxious about missing out—or worried about buying at a peak—you’re not alone. Many experienced investors use strategies like dollar-cost averaging (DCA) or setting limit orders rather than going all-in at once. This approach can help smooth out volatility over time and reduce emotional decision-making.

DCA explained: How regular investments can reduce risk in volatile markets

It’s also wise to diversify across different coins and sectors within crypto instead of betting everything on one asset class or token. For more tips on building a resilient portfolio:

How to diversify your crypto portfolio for stability

The bottom line? Timing any market perfectly is nearly impossible—even for seasoned pros. But by understanding what drives price movements today, being aware of risks unique to this asset class, and adopting disciplined entry tactics, you can position yourself more securely regardless of short-term swings.

Before you hit “buy,” pause to consider your own risk tolerance and investment horizon. Crypto’s allure is undeniable, but its volatility can quickly turn excitement into anxiety. Ask yourself: Are you prepared to weather sudden 30% drops? Can you stomach the regulatory uncertainty that might send prices tumbling overnight? If not, a smaller allocation or a slower entry may be prudent.

Signals Worth Watching

While no one can predict the future, there are certain signals that seasoned investors monitor to gauge whether it’s an opportune moment to enter—or wait. These include:

Key Indicators for Crypto Market Timing

-

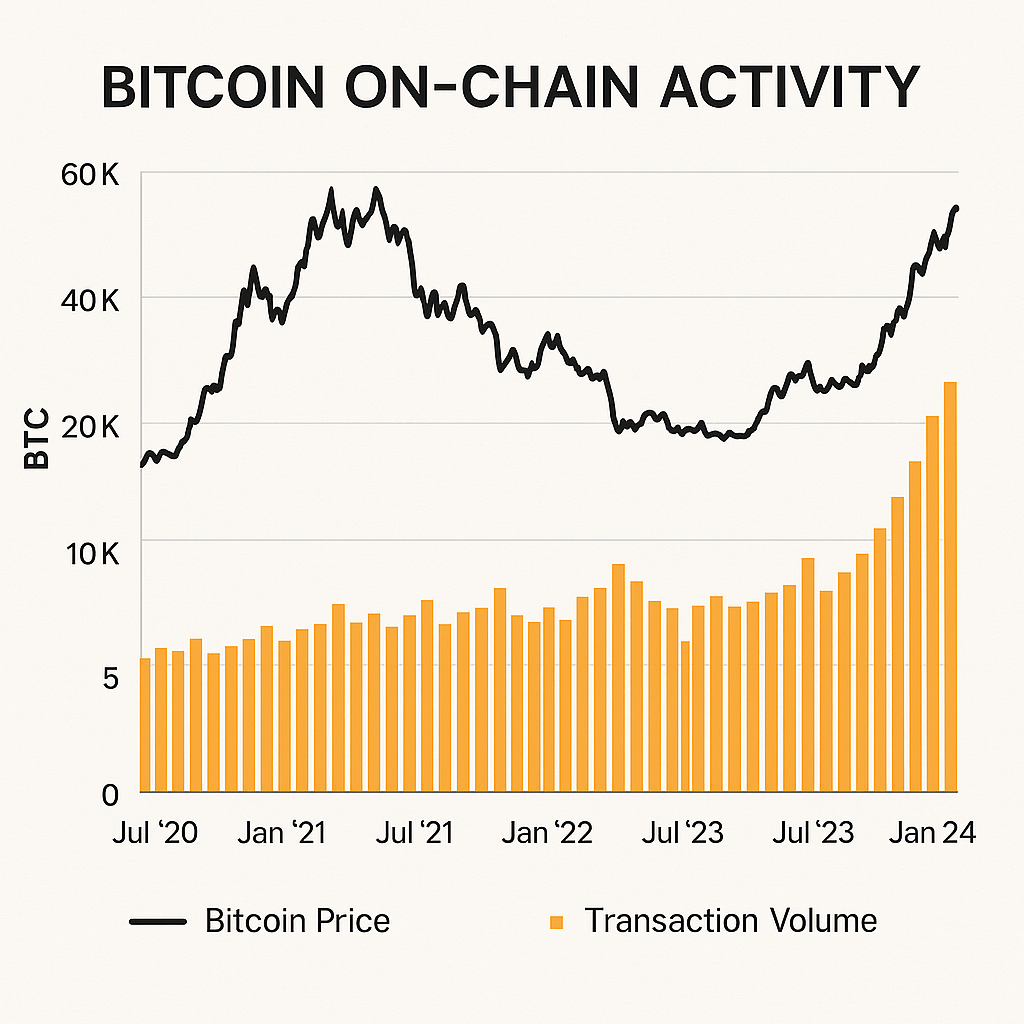

Bitcoin On-Chain Activity: Rising transaction volume and active addresses often signal increased market participation and potential bullish momentum.

-

Exchange Reserve Levels: Declining crypto reserves on exchanges typically indicate investors are moving assets to cold storage, suggesting a long-term holding sentiment.

-

Stablecoin Inflows: Significant inflows of stablecoins to exchanges can point to upcoming buying pressure as traders prepare to purchase crypto assets.

-

Funding Rates: Elevated or negative funding rates in perpetual futures markets may reveal excessive optimism or fear, helping to identify potential market reversals.

-

Macro Economic Indicators: Off-chain factors like inflation rates, interest rate changes, and regulatory news can heavily influence crypto market sentiment and timing.

Keep an eye on on-chain metrics like wallet activity and exchange inflows/outflows, which can hint at big moves before they hit the headlines. Social sentiment analysis tools also offer clues about whether the crowd is euphoric or fearful—often a contrarian indicator.

Don’t underestimate macroeconomic news, either. A surprise rate hike or regulatory announcement can instantly reshape the landscape. For deeper insights, consider following respected analysts on platforms like Twitter and YouTube who break down these trends in real time.

Common Mistakes to Avoid

Many newcomers make costly errors when entering the crypto market for the first time. Here are some pitfalls to sidestep:

Common Mistakes When Buying Crypto

-

Ignoring Research: Many buyers skip thorough research and invest based on hype, leading to poor decisions.

-

Falling for Scams: Fraudulent schemes and phishing attacks are common—always verify sources before investing.

-

Neglecting Security: Failing to use secure wallets or strong passwords puts your assets at risk.

-

Panic Buying or Selling: Emotional reactions to market swings can result in significant losses.

-

Overinvesting: Putting in more money than you can afford to lose is a serious risk in the volatile crypto market.

- Panic buying after a price surge: Chasing green candles rarely ends well.

- Ignoring security basics: Failing to use two-factor authentication or secure wallets leaves you exposed.

- Lack of research: Blindly following hype without understanding the project’s fundamentals is risky business.

- Over-leveraging: Using borrowed money amplifies both gains and losses—often disastrously so in volatile markets.

Crypto safety checklist: Protect your assets before you buy

What Are Experts Saying?

The debate among industry experts remains fierce. Some point to blockchain’s growing adoption by major financial institutions as evidence that digital assets are here to stay; others warn that current valuations already price in years of future growth. It’s wise to seek out multiple perspectives—and remember that even professionals disagree about timing.

Should You Wait? Or Act Now?

Your decision ultimately comes down to personal circumstances—financial goals, risk appetite, and conviction in crypto’s long-term potential. If you believe blockchain technology will reshape industries over the next decade, periods of volatility may represent opportunity rather than threat. But if sleepless nights over price swings aren’t worth it, there’s no shame in staying on the sidelines or starting small with a test amount.

The best investors focus less on perfect timing and more on disciplined execution and long-term thinking.

Do you think now is a good time to buy crypto?

With the crypto market always changing, we’re curious about your thoughts. Are you feeling bullish or cautious right now?

Resources for Responsible Investing

If you’re ready to take the plunge—or just want to keep learning—equip yourself with trustworthy resources before making any moves:

- Crypto beginner’s guide

- Latest crypto news updates

- How to buy crypto safely: Step-by-step guide

- Understanding crypto volatility

- Storing your coins securely

The cryptocurrency landscape never stands still—and neither should your approach. Stay vigilant, keep learning, and don’t let hype override careful planning. Whether you choose to invest today or observe from afar, knowledge is your best defense against regret in this rapidly evolving space.