Crypto onboarding has long been a pain point for both newcomers and seasoned users. The friction of Know Your Customer (KYC) checks, combined with fragmented payment systems, often derails the promise of instant, borderless transactions. But in 2025, we’re seeing a seismic shift: progressive KYC frameworks and regional payment rails are reimagining what easy crypto onboarding can look like.

The Evolution of Progressive KYC in Crypto

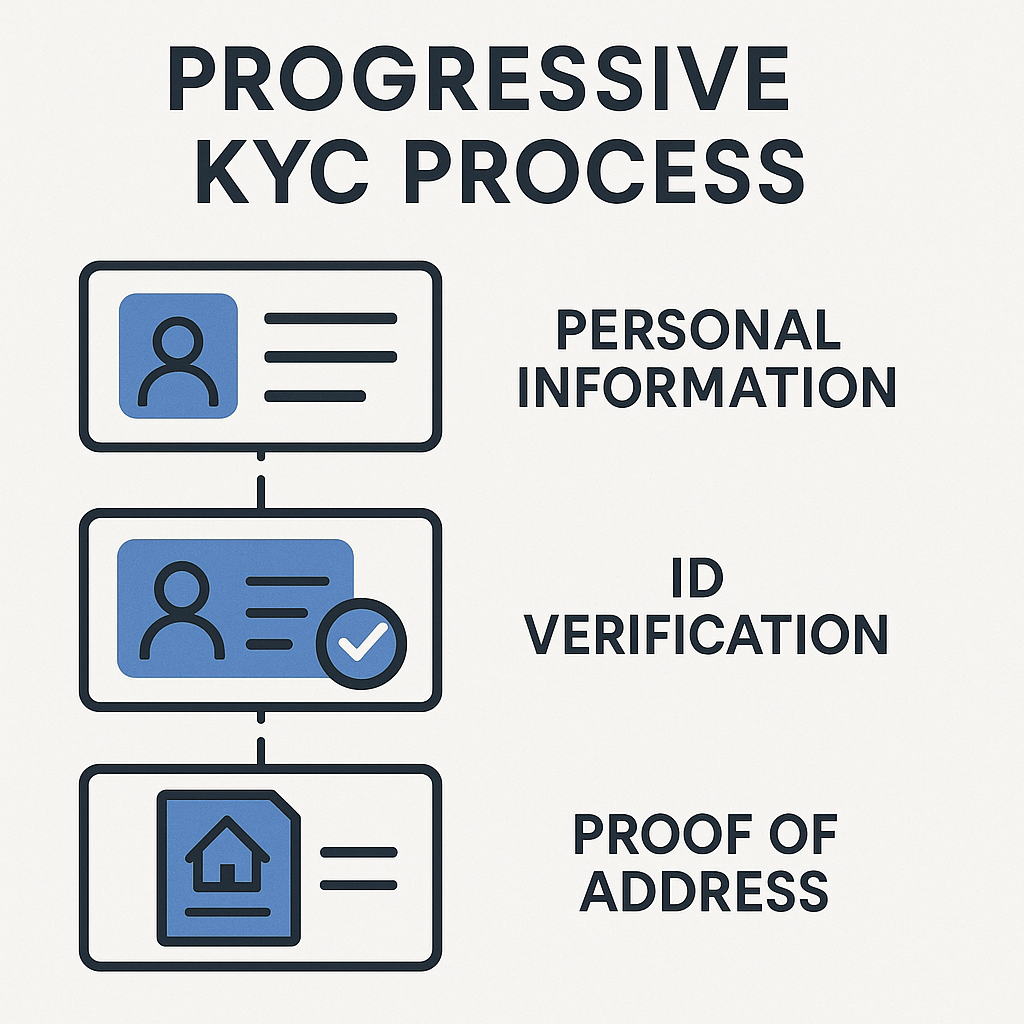

Traditional KYC processes have been rigid—one-size-fits-all, intrusive, and prone to causing onboarding drop-offs. Enter progressive KYC: a dynamic approach where user verification scales with their activity or risk profile. Instead of asking for everything upfront, platforms now request only what’s necessary at each stage.

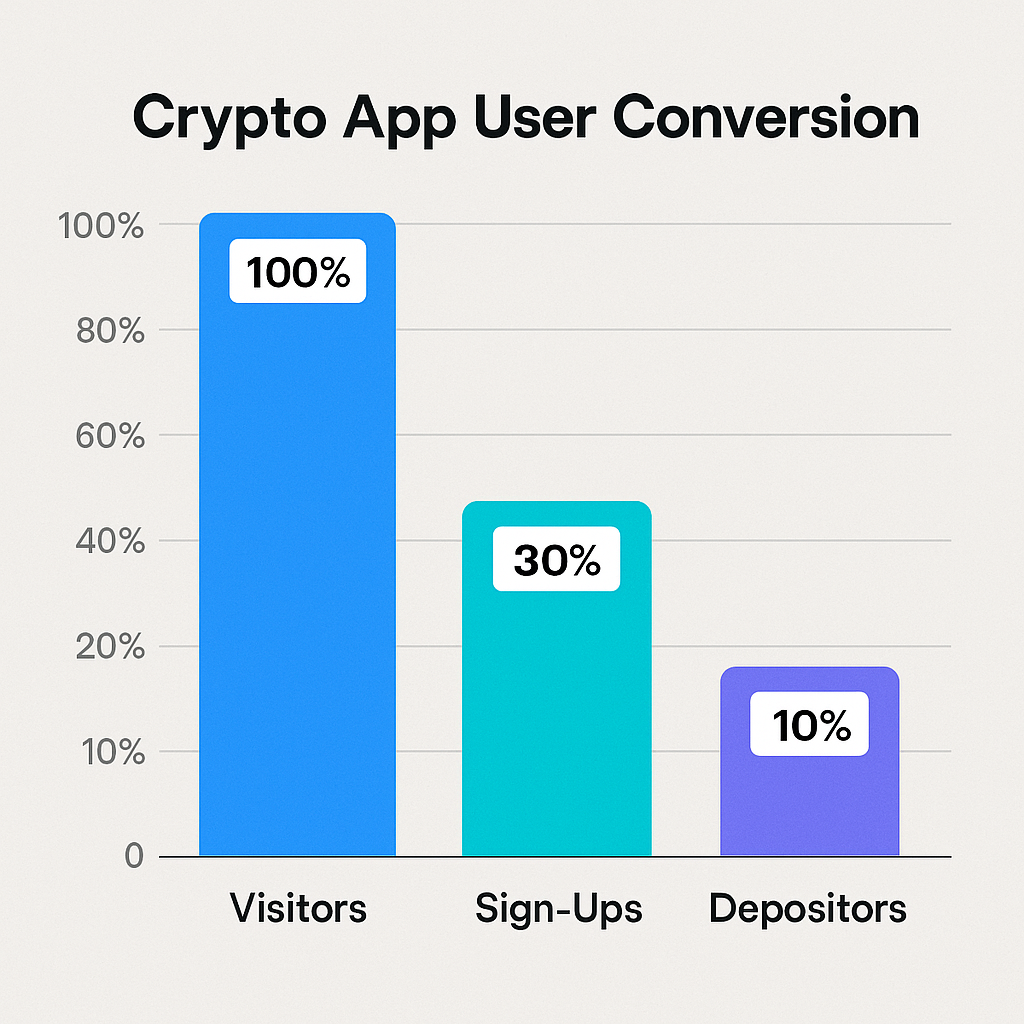

This shift isn’t just about compliance; it’s about conversion. By reducing friction for low-risk users and reserving deeper checks for high-value transactions, exchanges and wallets can boost sign-ups without exposing themselves to regulatory risks or fraud.

Key Benefits of Progressive KYC in Crypto Onboarding

-

Faster User Onboarding: Progressive KYC enables users to start transacting with minimal information, reducing friction and accelerating the registration process.

-

Improved Conversion Rates: By lowering initial barriers, more users complete the onboarding journey, resulting in higher conversion rates for crypto platforms.

-

Enhanced Compliance Flexibility: Platforms can dynamically adjust KYC requirements based on transaction size or risk profile, ensuring regulatory compliance without overburdening low-risk users.

-

Better User Experience: Users only provide additional information as needed, creating a smoother and less intrusive onboarding experience.

-

Scalable Risk Management: Progressive KYC allows for real-time risk assessment and tailored verification steps, helping platforms efficiently manage diverse user profiles.

As SardineAI Corp points out, this balance between security and user experience is critical as the industry matures. It’s not just about ticking boxes—it’s about building trust while keeping barriers low.

The Rise of Regional Payment Rails

If you’ve ever tried to buy crypto from outside North America or Europe, you know the struggle: limited fiat onramps, high fees, and confusing settlement times. Regional payment rails—like India’s UPI, Brazil’s Pix, or Nigeria’s NIP—are changing that equation by plugging local financial infrastructure directly into global crypto markets.

This trend is accelerating as payment rails evolve. Companies like Stripe now bridge stablecoins with ACH or SEPA transfers; others facilitate instant swaps between local currencies and major cryptos. The result? More people worldwide can access digital assets using familiar methods—no more jumping through hoops just to get started.

How These Trends Are Shaping Easy Crypto Onboarding in 2025

The convergence of progressive KYC and regional payment rails is more than a technical upgrade—it’s a fundamental rethinking of how people interact with crypto. Here’s what we’re seeing:

- User-first onboarding: Platforms adapt verification requirements based on real-time risk signals rather than blanket demands.

- Local accessibility: Users fund wallets via their favorite local apps or banking networks—no need for international wires or expensive third-party services.

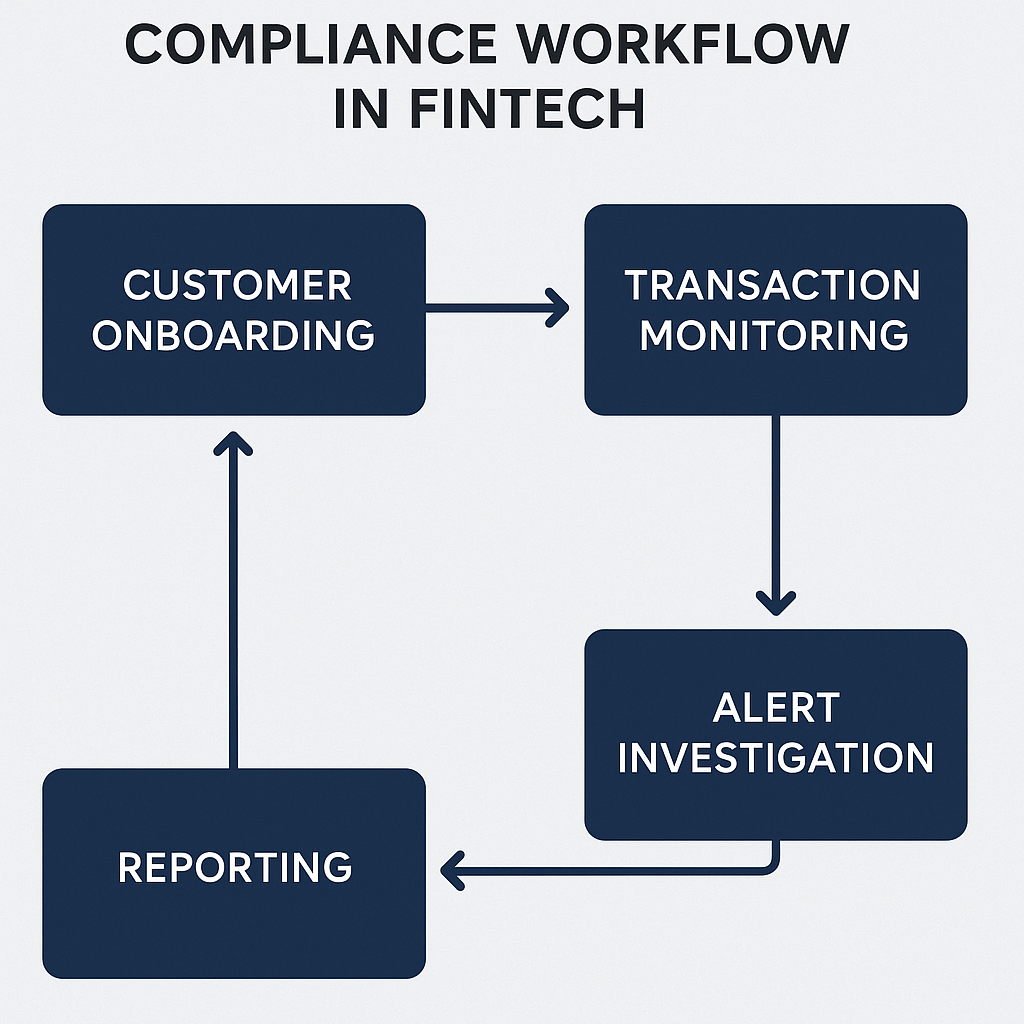

- Smoother compliance: Automation tools streamline background checks without sacrificing thoroughness or speed.

This isn’t hypothetical. In regions from Southeast Asia to South America, projects are already leveraging these trends to onboard millions who were previously excluded by legacy systems.

[list: Examples of companies pioneering regional payment rails in the crypto space]

For crypto businesses, the payoff is clear: conversion rates soar when onboarding feels natural and localized. But this transformation also demands new strategies for fraud prevention and regulatory alignment. As regional payment rails become gateways to global crypto networks, the need for nimble, context-aware KYC becomes even more pronounced.

Balancing Security, Compliance, and User Experience

One of the most compelling aspects of progressive KYC in crypto is how it allows platforms to dynamically calibrate their approach. For instance, a user in Brazil funding an account via Pix might only need basic ID checks for small transactions—while larger transfers or suspicious activity trigger deeper verification. This layered approach not only deters bad actors but also fosters trust among newcomers wary of excessive data collection.

Meanwhile, integrating regional payment rails isn’t just about adding more fiat onramps. It’s about respecting local norms, regulations, and user preferences. Platforms that succeed here invest in partnerships with local banks, payment processors, and compliance providers—ensuring smooth settlements and robust anti-fraud controls.

The technology stack powering these advances is rapidly maturing. Open banking APIs, AI-powered risk engines, and blockchain analytics now make it possible to deliver seamless onboarding without compromising on security or compliance. The result? A future where accessing crypto is as intuitive as sending a text or scanning a QR code.

What Does This Mean for Global Crypto Accessibility?

The implications go far beyond convenience. By lowering entry barriers through easy crypto onboarding, we’re witnessing the democratization of digital finance:

Key Drivers of Global Crypto Accessibility

-

Progressive KYC lowers onboarding barriers by allowing users to access basic services with minimal information, gradually increasing verification as usage grows.

-

Regional payment rails enable local currency transactions, making it easier for users worldwide to buy and sell crypto using familiar payment methods.

-

Layered compliance adapts to user risk profiles, ensuring regulatory requirements are met without creating unnecessary friction for low-risk users.

-

Localized solutions foster trust and adoption by addressing the unique regulatory and financial landscapes of different regions.

-

Seamless integration of KYC and payments streamlines the user journey, reducing drop-off rates and encouraging broader participation in the crypto ecosystem.

This is especially transformative in emerging markets where traditional banking infrastructure lags behind mobile adoption rates. With regional rails like UPI or M-Pesa integrated into major exchanges, millions gain direct access to savings tools, remittances, and investments previously out of reach.

The next wave of innovation will likely focus on interoperability—connecting disparate payment networks so users can move value across borders with minimal friction or cost. Already, some providers offer stablecoin-based accounts that bridge local rails with global liquidity pools.

Staying Ahead: What to Watch in 2025

If you’re considering entering the crypto space—or expanding your reach globally—now’s the time to pay attention to these trends:

- Automated merchant onboarding using AI-driven compliance tools

- Partnerships between exchanges and KYC specialists for faster retail access

- Open banking solutions that aggregate accounts and streamline financial data collection

- Stablecoin settlement options integrated with traditional payment systems

- Enhanced fraud prevention powered by real-time transaction monitoring

The bottom line? The future of easy crypto onboarding lies at the intersection of smarter compliance and hyper-local payments. As these capabilities mature—and as more regions plug into global networks—the promise of open finance inches closer to reality for everyone.