Crypto investors, rejoice: the real estate world is finally catching up to the digital asset revolution. In a historic move on June 25, 2025, the Federal Housing Finance Agency (FHFA) ordered Fannie Mae and Freddie Mac to recognize cryptocurrency holdings as valid assets in mortgage risk assessments. This isn’t just a technical tweak – it’s a seismic shift that could fundamentally change how crypto holders approach home buying in the United States. If you’ve ever wondered whether your Bitcoin or Ethereum stash could help you qualify for a mortgage, the answer is now a resounding yes.

Why Fannie Mae and Freddie Mac’s Crypto Policy Is a Game Changer

For years, crypto investors faced a frustrating paradox: despite holding significant wealth in digital assets, most banks and mortgage lenders ignored those holdings during loan applications. Traditionally, only cash, stocks, or other fiat-based assets counted toward your financial profile. But with this new directive from the FHFA, both Fannie Mae and Freddie Mac are now required to include crypto held on U. S. -regulated centralized exchanges as part of your asset base when assessing mortgage risk.

This means your Bitcoin or Ethereum balance can be used to strengthen your application – no need to liquidate your coins into dollars first. It’s a recognition that digital assets are here to stay and are playing an increasingly important role in personal finance.

How Does Crypto Asset Recognition Work for Mortgages?

This policy doesn’t mean you can buy a house directly with Bitcoin (at least not yet). Instead, it allows you to count your crypto holdings as part of your net worth when applying for a traditional home loan backed by Fannie Mae or Freddie Mac. Here’s what you need to know:

Key Requirements for Using Crypto in Mortgage Applications

-

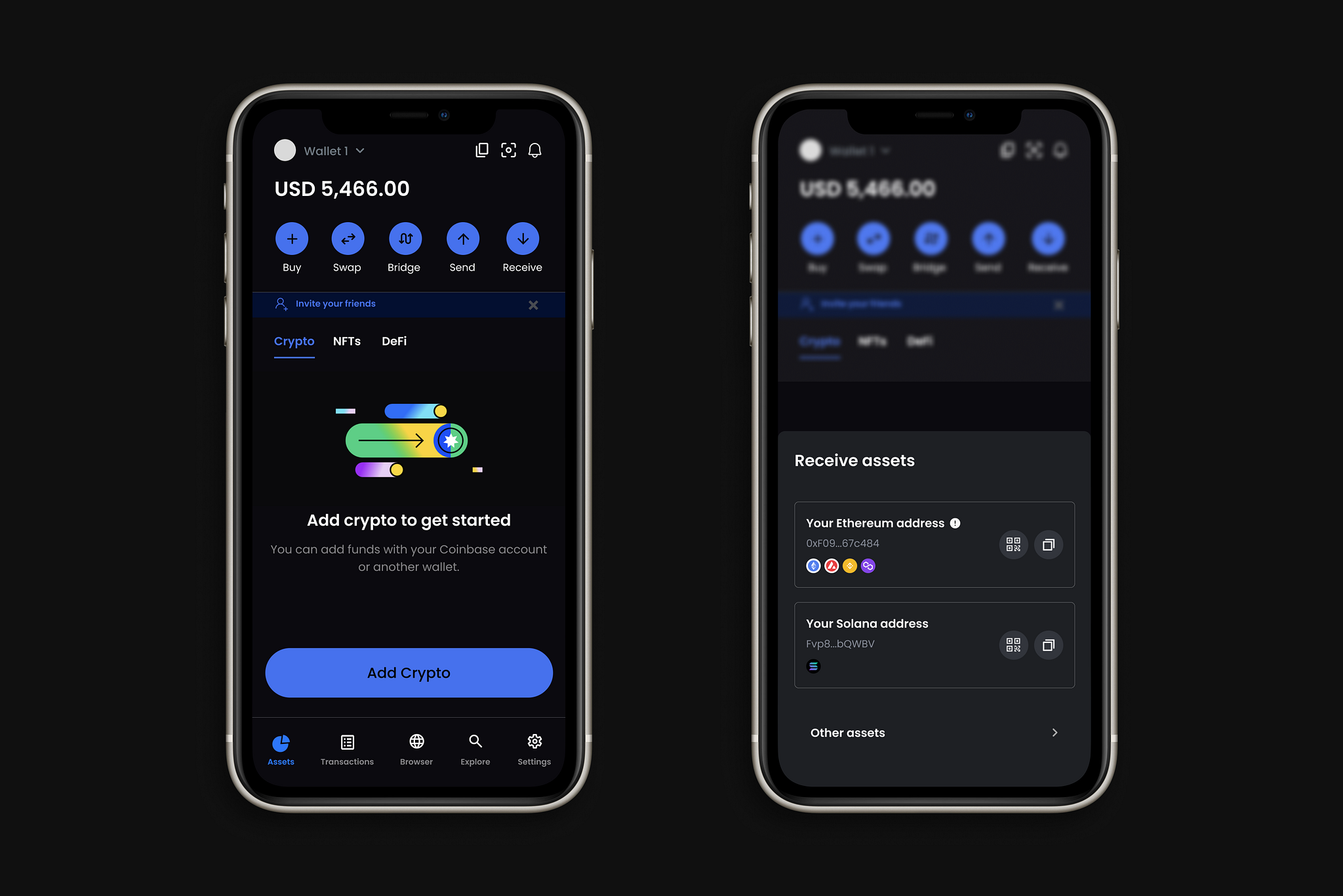

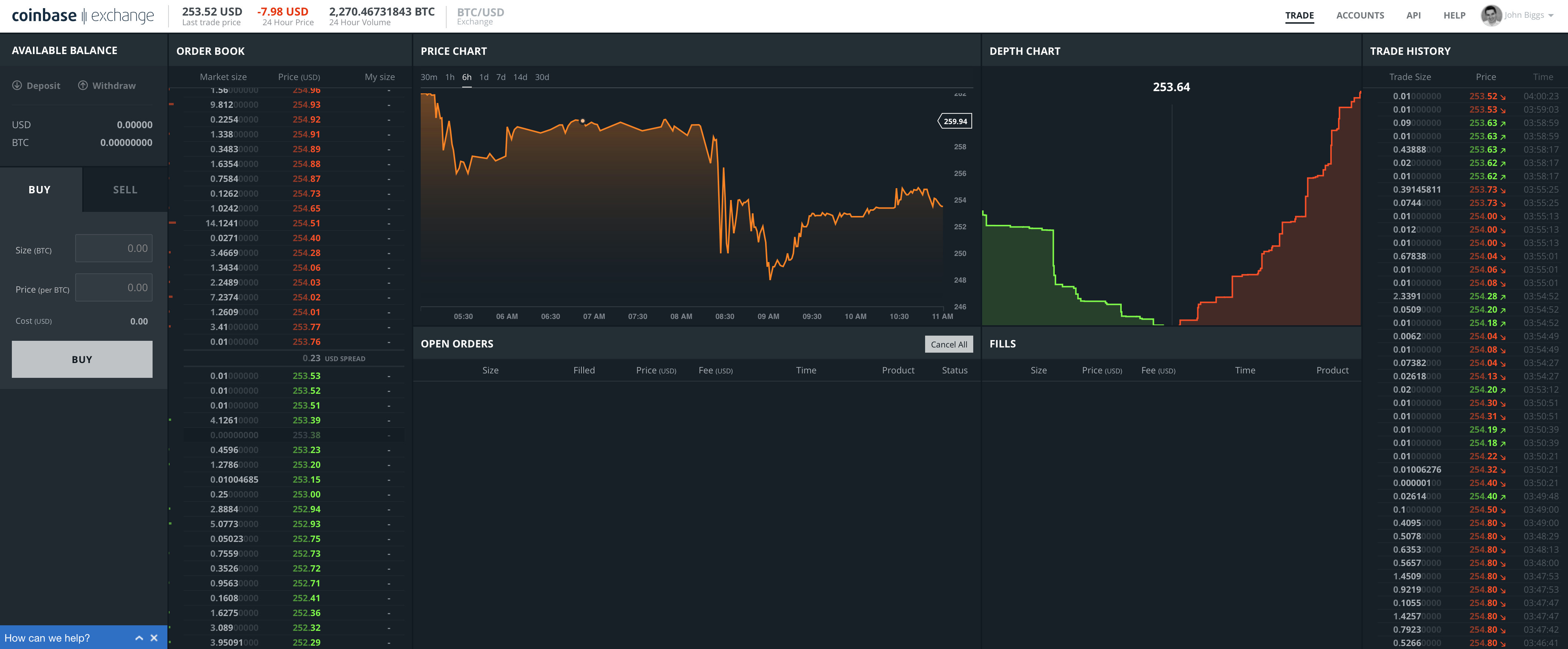

Crypto assets must be held on U.S.-regulated centralized exchanges. Only digital assets stored on exchanges regulated by U.S. authorities, such as Coinbase or Gemini, are eligible for consideration in Fannie Mae and Freddie Mac mortgage applications.

-

No conversion to U.S. dollars required. Applicants can list the value of their cryptocurrency holdings without converting them to cash, simplifying documentation and preserving their crypto positions.

-

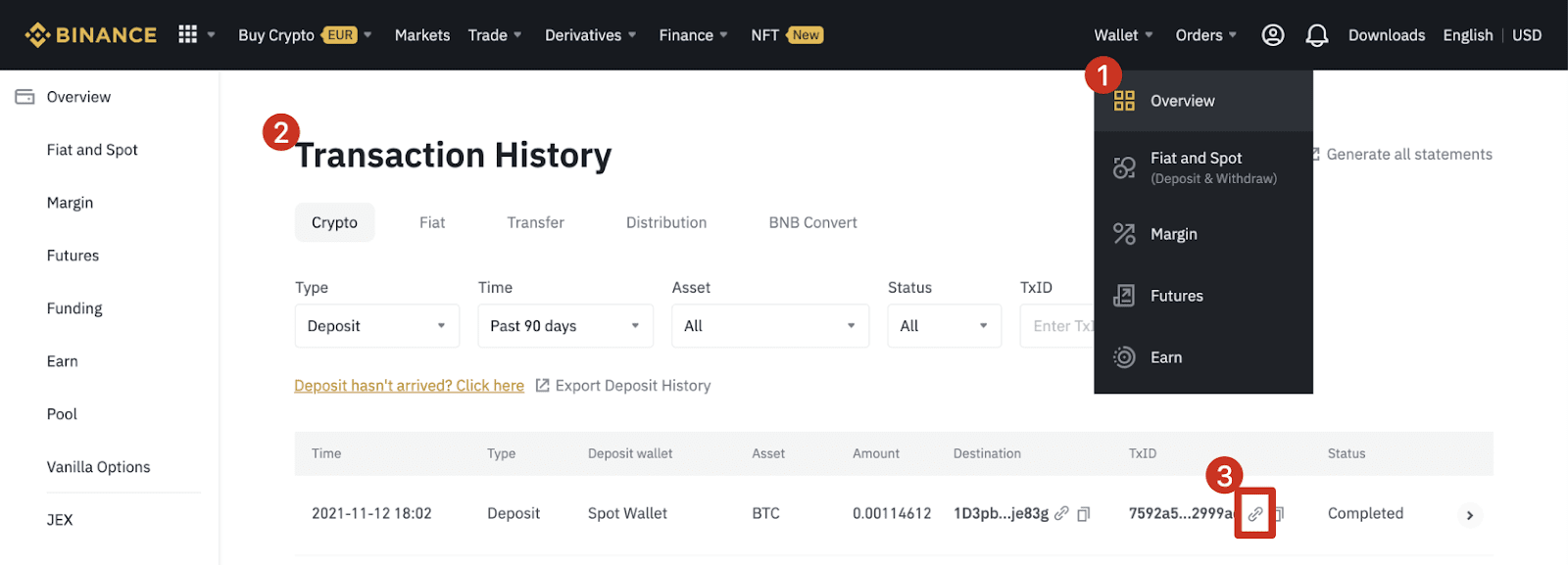

Proof of ownership and account statements are mandatory. Borrowers must provide official statements or documentation from the exchange verifying ownership and the current value of their crypto assets.

-

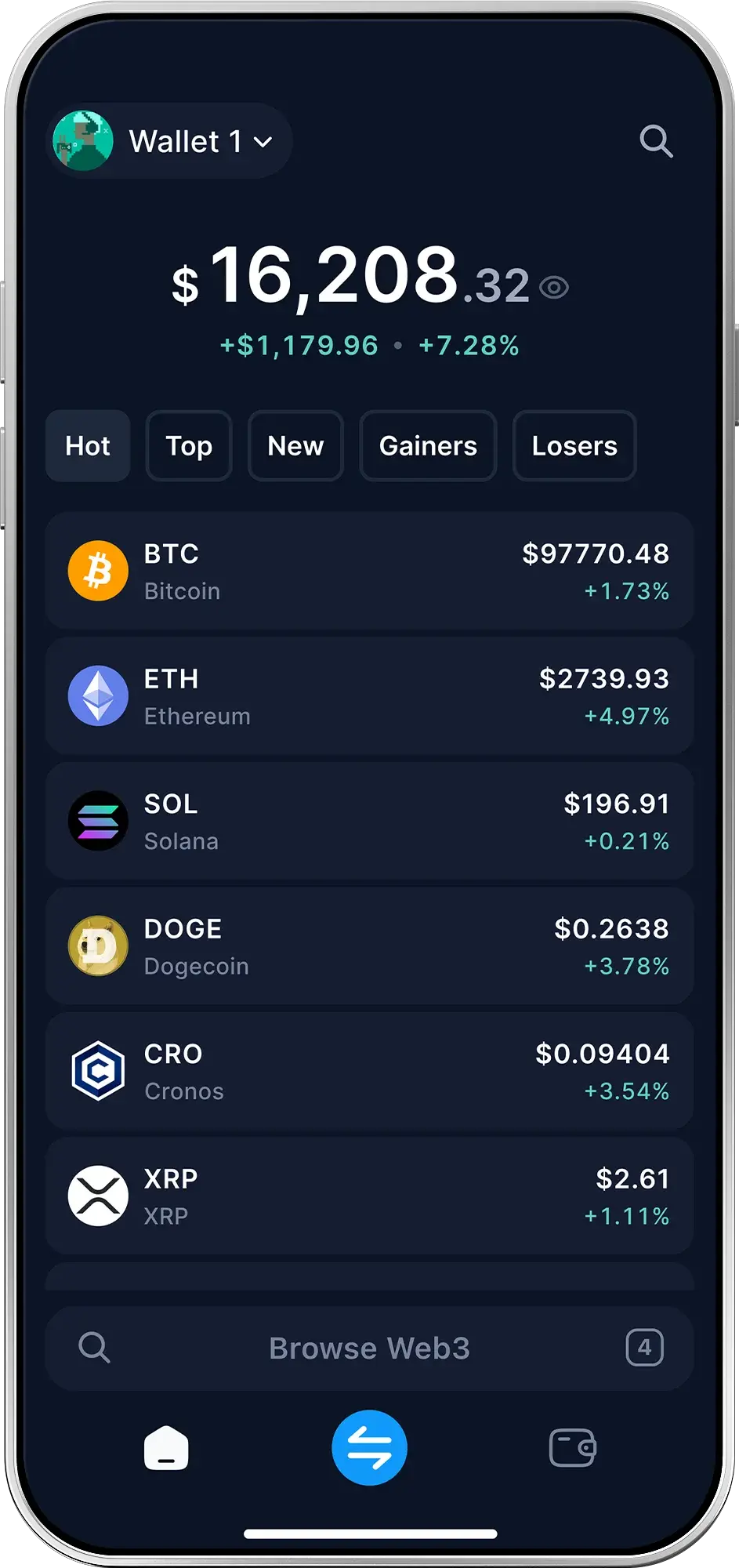

Only established cryptocurrencies are accepted. Major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) are recognized, while lesser-known or unlisted tokens may not qualify.

-

Assets must be verifiable and liquid. The crypto holdings must be easily valued and quickly convertible to cash if needed, ensuring they meet Fannie Mae and Freddie Mac’s liquidity standards.

- Your crypto must be held on U. S. -regulated centralized exchanges. Think Coinbase or Gemini – not DeFi wallets or offshore platforms.

- No forced conversion: You don’t have to sell your tokens for dollars just to prove you have reserves. Your digital portfolio counts as-is.

- The value is based on current market prices at the time of application. Volatility still matters!

- You’ll need documentation: Expect lenders to ask for statements or screenshots verifying your balances and transaction history.

This opens up more flexible options for buyers who have built wealth through crypto investing but want to keep their coins rather than cashing out at an inconvenient time.

The Ripple Effect: What This Means for Crypto Mortgage Approval

The implications are huge for anyone interested in crypto mortgage approval. By allowing borrowers to include digital assets alongside traditional ones, Fannie Mae and Freddie Mac are making homeownership more accessible – especially for younger buyers who’ve grown their portfolios digitally rather than through old-school savings accounts.

This also marks a significant step toward mainstream acceptance of cryptocurrencies within regulated finance. As more buyers leverage their holdings without needing awkward conversions or costly tax events, we’re likely to see increased demand from tech-savvy millennials and Gen Zers looking to break into real estate without abandoning their favorite coins.

Of course, there are still some hurdles and nuances that crypto holders need to be aware of. Lenders will scrutinize the source of your crypto, looking for compliance with anti-money laundering (AML) regulations. If you’ve moved assets between wallets or exchanges, be prepared to provide a clear paper trail. And since only coins held on U. S. -regulated centralized exchanges count, assets in DeFi protocols or cold wallets won’t make the cut for now.

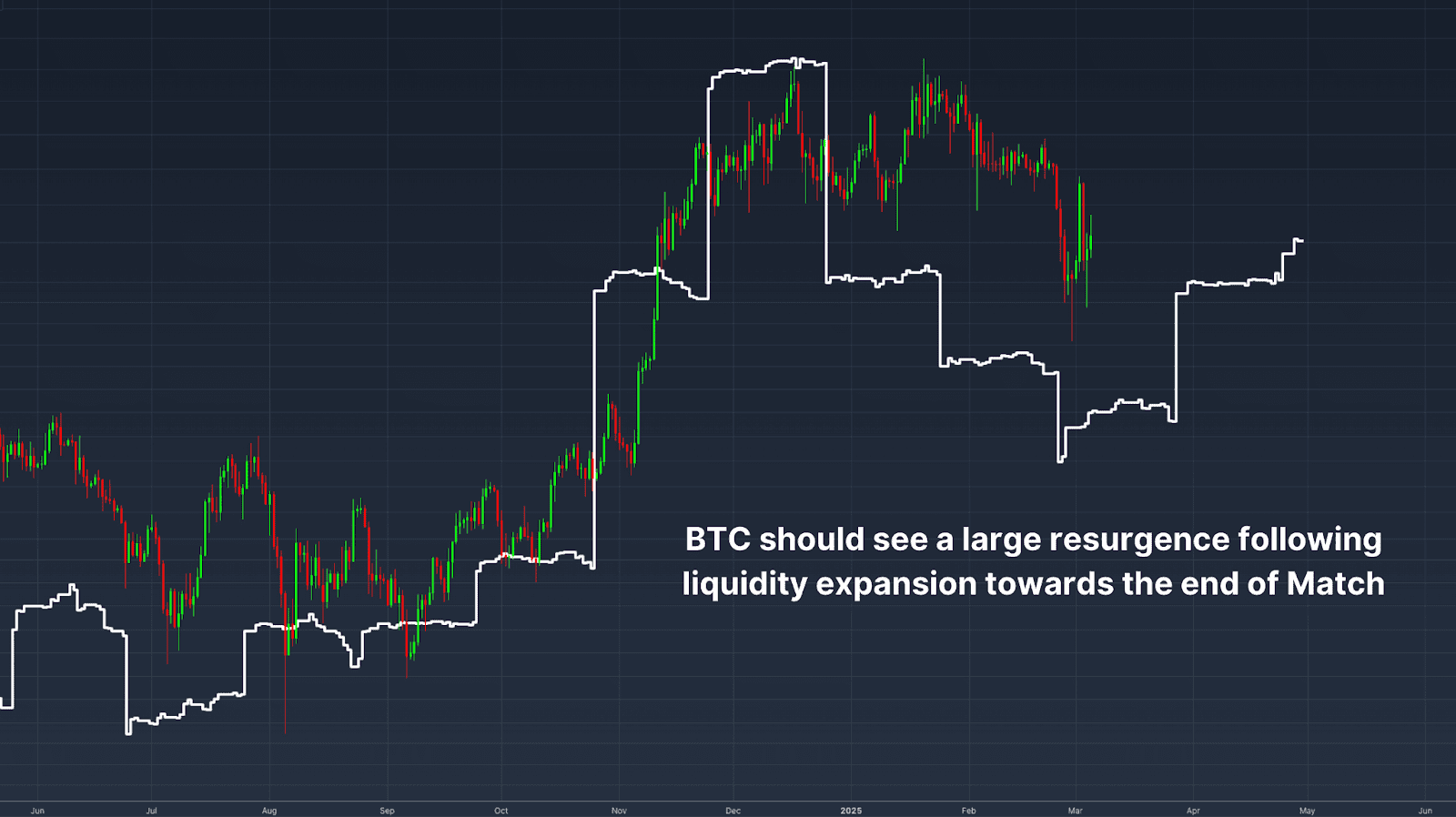

Another key consideration: crypto’s notorious volatility. The value of your digital assets could swing wildly between pre-approval and closing. Most lenders will use the current market price at the time of your application, but they may also factor in recent price history or require updated statements before final approval. This means timing could play a major role in how much buying power your crypto provides.

Practical Steps for Crypto Investors Eyeing Real Estate

If you’re ready to leverage your digital portfolio for a home loan, here’s how to set yourself up for success:

Steps to Prep Your Crypto Portfolio for a Mortgage

-

Download Official Account StatementsObtain official, dated account statements from your exchange showing your crypto balances. Most lenders will require these documents to verify your holdings and asset history.

-

Organize Your Crypto Transaction HistoryPrepare a clear record of your crypto transactions for the past 2-3 months. This helps underwriters confirm the source of funds and ensures compliance with anti-money laundering rules.

-

Check Supported Crypto AssetsVerify that your holdings are in major cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH), as these are most likely to be recognized by lenders. Less common coins may not be accepted.

-

Maintain Stable Asset ValuesKeep your crypto portfolio’s value stable leading up to your application. Sudden large withdrawals or transfers can raise red flags for underwriters and delay approval.

-

Consult a Mortgage Specialist Familiar with CryptoWork with a mortgage broker or loan officer who understands the new crypto asset guidelines. They can help you navigate documentation and lender requirements efficiently.

Start by consolidating eligible assets onto major U. S. -regulated exchanges well ahead of applying. Gather thorough documentation, transaction histories, monthly statements, and proof of ownership, to streamline verification with lenders. Stay alert to market conditions; if prices surge, consider locking in your application sooner rather than later.

Potential Pitfalls and What to Watch For

This policy shift is exciting, but it’s not without risks or open questions. For one, not all lenders will adopt these guidelines at the same pace, some may be slower to update their underwriting processes or may add extra hoops for crypto holders. Also, regulatory clarity around taxation and reporting remains a work-in-progress; consult both a mortgage advisor and a tax professional who understand digital assets before making major moves.

There’s also the issue of privacy and security. Providing detailed exchange records can expose sensitive information about your holdings, make sure you’re working with reputable lenders who have robust data protection policies in place.

Pro tip: If you’re new to combining crypto with real estate finance, join online communities or forums where early adopters share their experiences navigating this new process.

Looking Ahead: The Future of Buying a House With Crypto

This move by Fannie Mae and Freddie Mac is just the beginning. As more traditional financial institutions recognize the legitimacy of digital wealth, we could see further innovations, perhaps even direct home purchases using stablecoins or smart contracts down the line. For now, though, this change represents an unprecedented opportunity for crypto investors to unlock homeownership without sacrificing their digital nest eggs.

If you’ve been waiting for mainstream finance to catch up with Web3 innovation, 2025 is shaping up as your year. Stay tuned, the intersection of real estate and blockchain is just getting started!