The world of crypto onboarding is more exciting than ever, but it’s also become a prime hunting ground for sophisticated scams. One of the most devastating is the so-called “pig butchering” scam, where fraudsters build trust with victims over weeks or months before orchestrating elaborate investment cons. In 2024 alone, these scams caused an estimated $5. 5 billion in losses across 200, 000 cases, underscoring just how widespread and costly they’ve become (Cointelegraph).

Why ‘Pig Butchering’ Scams Are More Dangerous Than Ever

Recent enforcement actions have put the spotlight back on these schemes. In a high-profile case, Coinbase worked with the U. S. Secret Service to seize $225 million in USDT linked to pig butchering operations, an unprecedented move that highlights both the scale of the problem and the power of blockchain forensics (Cryptonews). Many of these scams are run from Southeast Asia, often involving trafficked workers forced into online crime.

But enforcement alone isn’t enough. As authorities crack down, scammers are evolving their playbook:

- DeFi Exploitation: Instead of fake websites, scammers now lure users into connecting wallets to malicious smart contracts on real DeFi platforms.

- AI-Powered Deception: Generative AI creates ultra-realistic fake profiles, websites, and even voice calls, making scams harder to spot.

- Faster Fraud Cycles: The average scam now lasts just 42 days, down from 271 in 2020, giving victims less time to notice red flags.

If you’re new to crypto or helping someone get started, understanding these evolving tactics is essential for safe crypto investing.

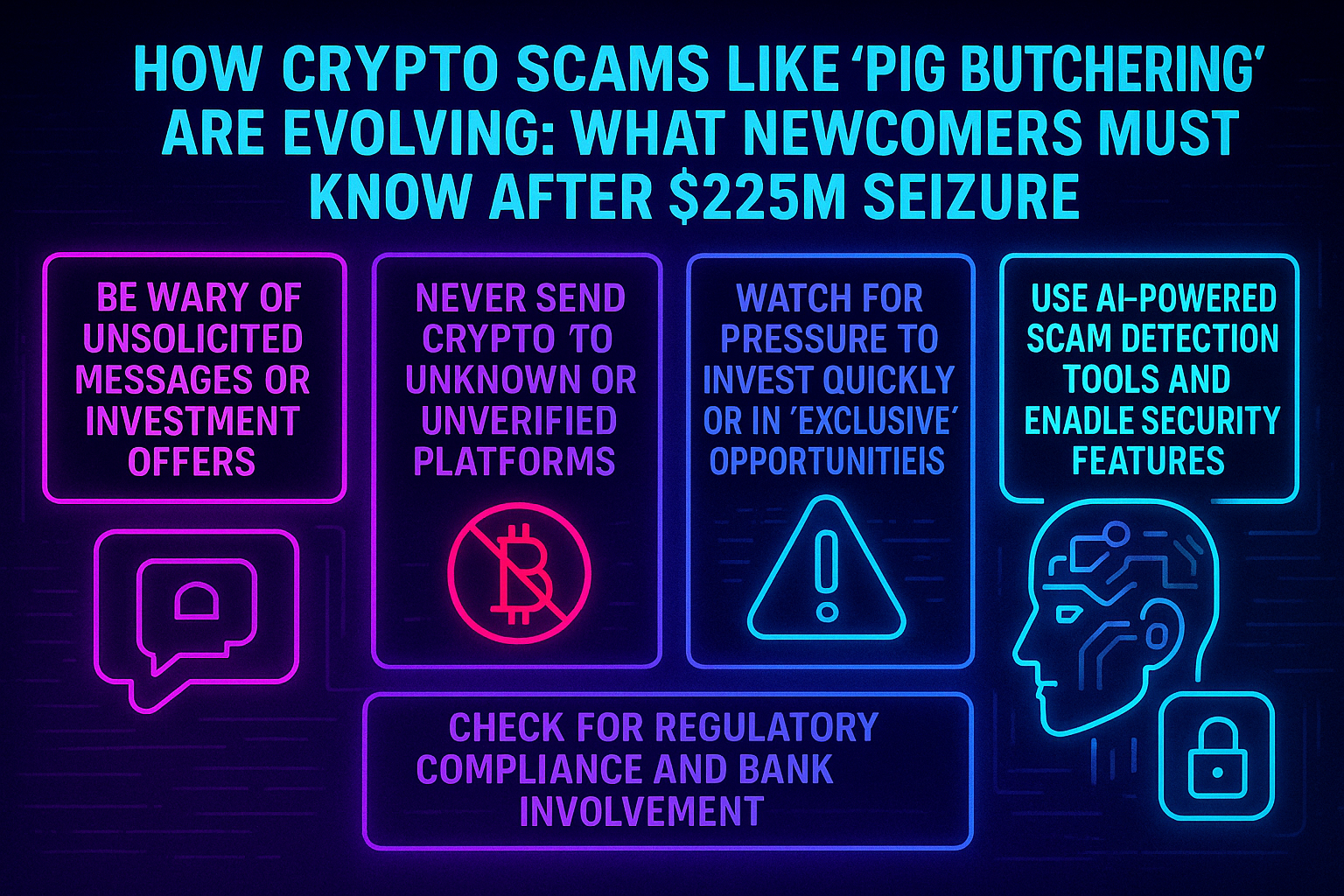

Top 5 Red Flags and Tips for Spotting Pig Butchering Scams

Top 5 Tips to Spot and Avoid Pig Butchering Scams

-

Be Wary of Unsolicited Messages or Investment Offers: Scammers often initiate contact via social media, dating apps, or messaging platforms with friendly conversation before steering you toward crypto investments. If someone you don’t know starts discussing investments, proceed with extreme caution.

-

Watch for Pressure to Invest Quickly or in ‘Exclusive’ Opportunities: Pig butchering scammers build trust over weeks, then create urgency by claiming limited-time deals or high returns—legitimate investments never require rushed decisions or secretive opportunities.

-

Use AI-Powered Scam Detection Tools and Enable Security Features: Leverage updated scam detection tools (some exchanges now offer built-in alerts) and always enable two-factor authentication to protect your accounts. These features help spot suspicious activity and prevent unauthorized access.

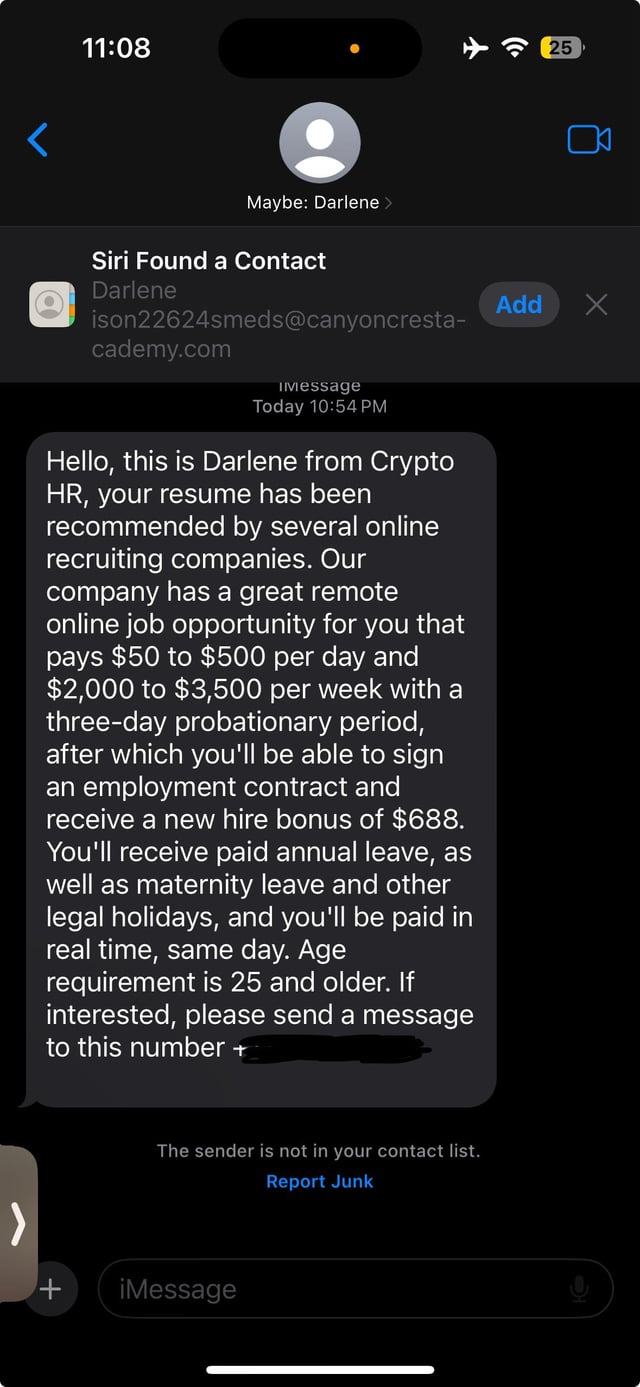

The First Red Flag: Unsolicited Messages or Investment Offers

This is where almost every pig butchering scheme begins. Scammers reach out via social media DMs, dating apps, or messaging platforms with friendly banter designed to build trust. Once rapport is established, they pivot the conversation toward crypto investments, often sharing screenshots of big profits or “exclusive” opportunities.

If someone you don’t know starts chatting about investments out of nowhere, even if they seem genuinely interested in your life, be skeptical. Legitimate financial advisors or crypto educators won’t cold-message you asking for money. For more details on how these initial contacts work and what makes them so convincing, check out this breakdown from Mass. gov.

Avoid Sending Crypto to Unknown or Unverified Platforms

The next step in most pig butchering scams involves convincing you to move funds off reputable exchanges onto obscure platforms or directly into wallet addresses controlled by scammers. They may claim these are “special investment apps” or “partnered exchanges. ” Remember: Your safest bet is sticking with major regulated exchanges like Coinbase, Kraken, or Gemini. Never send crypto based solely on advice from an online acquaintance.

If someone insists you deposit funds into an app you’ve never heard of, or won’t provide proof that their platform is registered with regulators, it’s a giant red flag. Even genuine-looking apps can be fronts for theft if not properly vetted.

The Pressure Tactics: Limited-Time Offers and Urgency

Pig butchering scammers excel at psychological manipulation. After weeks (or sometimes just days) of building trust, they’ll suddenly present a high-return offer that’s “only available today” or “about to close. ” This manufactured urgency is designed to bypass your critical thinking and get you to act fast without due diligence.

No legitimate investment opportunity will require immediate action under threat of missing out. Step back and consider why someone would pressure you so hard if their offer was truly above board.

Scammers count on your fear of missing out and the emotional connection they’ve built to cloud your judgment. If you ever feel rushed or pressured into investing, treat it as a blaring warning sign. Take your time, consult trusted friends, and do independent research before making any moves.

Leverage AI Scam Detection Tools and Security Features

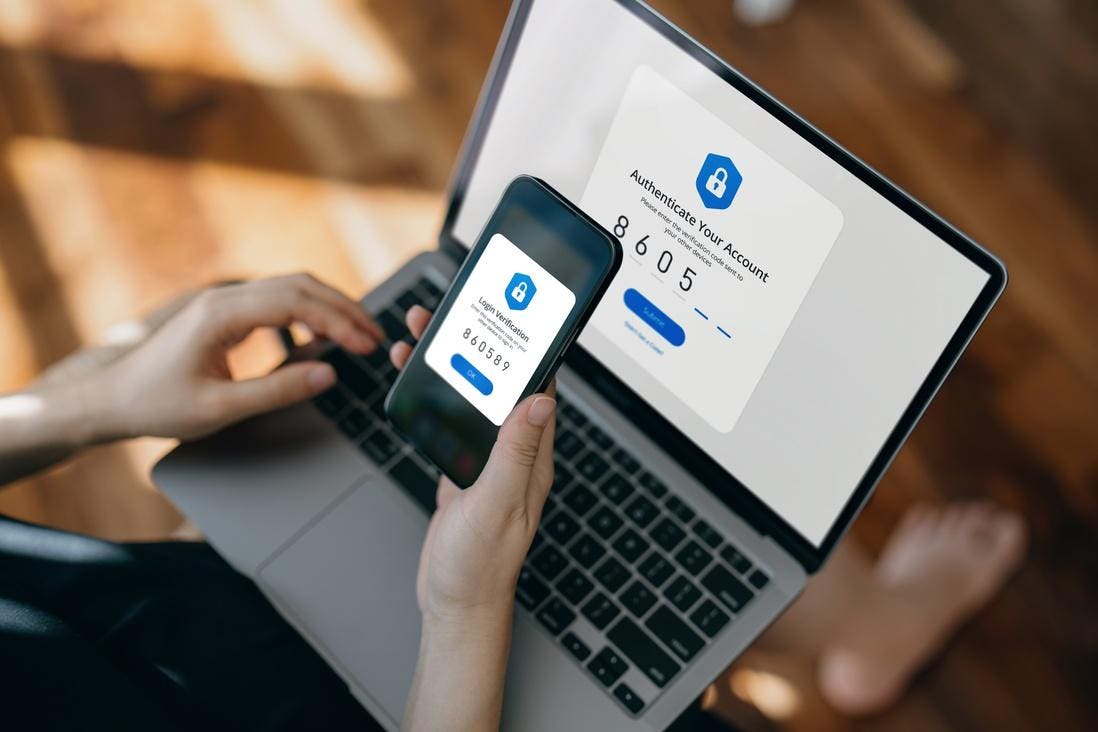

With scammers now deploying advanced generative AI to craft convincing fake profiles, websites, and even voice messages, staying ahead requires more than just gut instinct. Many reputable exchanges are fighting back by integrating AI-powered scam detection tools that analyze suspicious activity in real-time. Enable these alerts wherever available, and always activate two-factor authentication (2FA) on your accounts.

Two-factor authentication adds a crucial layer of security by requiring a code from your phone or authentication app in addition to your password. This simple step can block most unauthorized access attempts, especially if scammers try to hijack your account after gaining partial information through social engineering.

Regulatory Compliance Matters: Check for Licensing and Bank Involvement

Before sending money anywhere, verify that the crypto platform is registered with US regulators like FinCEN or the SEC. Legitimate investment platforms will display their regulatory status clearly on their websites, and won’t ask you to route funds through personal bank accounts or unconventional payment channels.

If someone insists you wire money to an individual’s bank account or use opaque payment methods (like gift cards or third-party apps), consider it a major red flag. These tactics are designed to make recovering funds nearly impossible if things go wrong. For more on how compliance protects users, see recent actions by Coinbase and Tether in freezing scam-linked wallets (Cryptonews).

Top 5 Tips to Spot and Avoid Pig Butchering Scams

-

Be Wary of Unsolicited Messages or Investment Offers: Scammers often initiate contact via social media, dating apps, or messaging platforms, starting with friendly conversation before steering you toward crypto investments. If someone you don’t know unexpectedly offers investment advice, proceed with extreme caution.

-

Watch for Pressure to Invest Quickly or in ‘Exclusive’ Opportunities: Pig butchering scammers build trust over weeks, then create urgency by claiming limited-time deals or high returns. Legitimate investments never require rushed decisions or pressure to act immediately.

-

Use AI-Powered Scam Detection Tools and Enable Security Features: Leverage updated scam detection tools—some exchanges now offer built-in alerts—and always enable two-factor authentication (2FA) to protect your accounts from unauthorized access.

Empowering Yourself as a New Crypto User

The crypto landscape is constantly shifting, but so are scam tactics. By recognizing these five core red flags:

- Unsolicited messages or investment offers

- Requests to send crypto to unknown/unverified platforms

- Pressure for quick decisions via exclusive deals

- Lack of AI-powered security features and not using 2FA

- No visible regulatory compliance or odd banking requests

You’ll be far better equipped to navigate the world of safe crypto investing. Don’t hesitate to leverage community resources, report suspicious activity, and help educate others, especially those just starting their own crypto onboarding journey.

If you’re ever unsure about an opportunity or encounter something that feels “off, ” step away, ask questions, and consult reliable sources before proceeding. Staying informed is your best defense against even the most sophisticated scams.