Crypto onboarding in the United States is on the edge of a major shift. Senator Cynthia Lummis’s latest crypto tax relief plan, unveiled in mid-2025, is poised to clear away some of the thorniest tax barriers that have long stifled everyday DeFi adoption. If you’ve ever hesitated to use your crypto for small purchases or got tangled in reporting headaches from staking and lending, this bill could change your experience next year.

What’s Actually in Senator Lummis’s Crypto Tax Relief Plan?

This isn’t just another vague regulatory promise. The bill zeroes in on practical pain points for both new and experienced crypto users:

- De Minimis Exemption: No capital gains tax on transactions under $300, with a $5,000 annual cap. That means you can buy coffee or pay for services with crypto without tracking every penny for the IRS (source).

- Mining and Staking Tax Deferral: No more paying taxes on rewards you haven’t sold yet. You’ll only pay when you cash out (source).

- Lending Alignment: Lending your tokens won’t trigger an immediate taxable event, it’ll be treated like traditional securities lending.

- Wash Sale Rule: No more selling and instantly rebuying tokens to harvest losses; a 30-day rule now applies.

- Simplified Charitable Donations: Donating actively traded tokens to charity no longer requires expensive appraisals.

The End of Double Taxation and Why It Matters for DeFi Onboarding

If you’ve used DeFi platforms or dabbled in staking and lending, you know how quickly tax complexity can kill momentum. Previously, U. S. users risked double taxation: getting taxed when earning staking rewards or lending yields, then again when eventually selling those assets. That was a non-starter for many newcomers wanting to dip their toes into decentralized finance.

Lummis’s bill aims to end this double taxation nightmare by deferring taxes on mining and staking rewards until assets are actually sold. This single change removes a huge psychological (and financial) barrier for first-time DeFi users who want to participate without hiring an accountant at every turn.

How the $300 De Minimis Rule Could Revolutionize Everyday Crypto Use

The de minimis exemption is more than just a technical tweak, it’s the linchpin that could finally let Americans use crypto like cash for small transactions. Until now, every coffee purchase or micro-payment could trigger complex capital gains reporting. With this rule, up to $5,000 per year in small transactions will be tax-free (details here).

Top Ways the De Minimis Exemption Eases DeFi Onboarding

-

Eliminates Tax Headaches for Small Transactions: The $300 de minimis exemption means users can swap, spend, or move crypto on DeFi platforms like Uniswap or MetaMask without triggering capital gains tax reporting for each small transaction.

-

Streamlines Everyday Crypto Payments: With the exemption, using stablecoins such as USDC or Dai for daily purchases on platforms like Coinbase Wallet becomes as simple as using cash, removing complex tax calculations for each payment under $300.

-

Reduces Onboarding Friction for New Users: New DeFi users on platforms like Aave or Compound can experiment with lending, borrowing, or swapping assets in small amounts without the burden of tracking taxable events, making the learning curve less intimidating.

-

Encourages Microtransactions and Innovation: The exemption supports use cases like NFT purchases on OpenSea or micro-investments via Balancer pools, enabling users to participate in DeFi with low-value transactions that previously required complex tax documentation.

-

Promotes DeFi Adoption for Everyday Spending: Integrations with payment cards from Crypto.com or BitPay allow users to spend crypto for routine expenses, now without worrying about tax on every coffee or ride-share under $300, thanks to the de minimis rule.

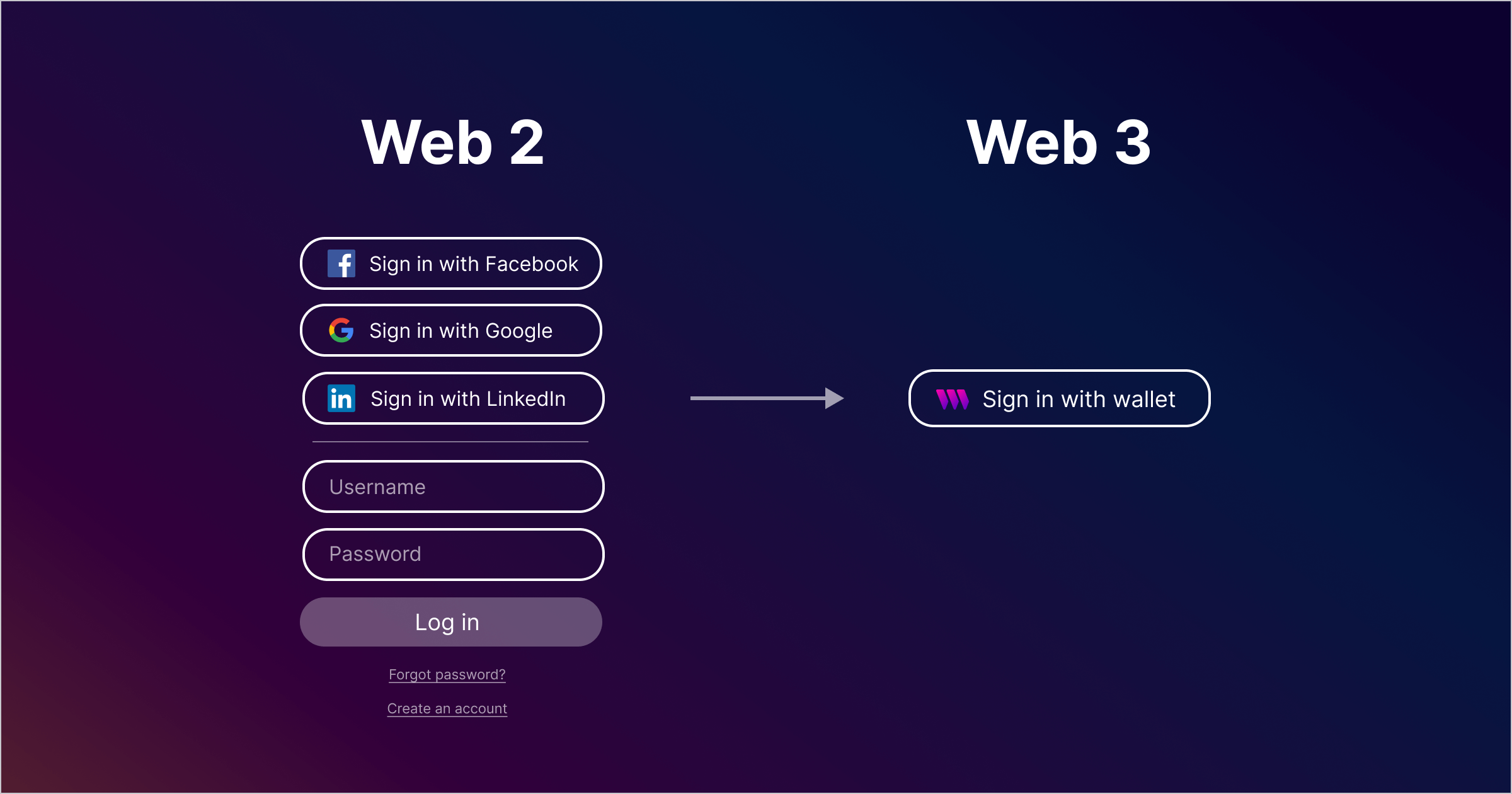

This change is set to lower the entry barrier dramatically, especially for people experimenting with stablecoins or Layer 2s on DeFi apps who don’t want their first step into Web3 to land them in an IRS audit.

The Security Angle: Why Simpler Tax Rules Mean Safer Onboarding

Simpler rules don’t just mean less paperwork; they also mean fewer mistakes that could expose users to audits or scams posing as “tax solutions. ” By aligning crypto lending with traditional securities treatment and clarifying taxable events, Lummis’s plan reduces confusion that bad actors often exploit during onboarding flows.

Security in DeFi is about more than just smart contract audits and wallet hygiene. It’s also about knowing exactly when you owe taxes and what triggers a taxable event. Under the old system, this was a minefield, one wrong move could mean a surprise bill or, worse, falling for phishing schemes promising “tax help. ” With the Lummis bill, the lines are clearer: small transactions are off the IRS radar up to $300 each, and lending your tokens won’t set off tax liabilities you didn’t expect.

For new users, this is critical. When onboarding into DeFi protocols, whether it’s swapping tokens on a DEX or experimenting with yield farming, knowing you won’t get blindsided by reporting requirements builds trust. That trust is essential for healthy growth in the U. S. crypto ecosystem.

Crypto Lending Gets Real: No More Surprise Tax Events

Lending your assets on DeFi platforms has always come with an extra layer of anxiety: would moving tokens trigger a taxable event? The Lummis plan finally brings crypto lending in line with traditional securities lending, meaning no taxable event when you lend out your coins. This will likely unlock more liquidity across protocols and make onboarding easier for users who want to earn passive income without unexpected IRS complications (details here).

Practical DeFi Onboarding Tips for 2025

Essential Security Tips for DeFi Onboarding in 2025

-

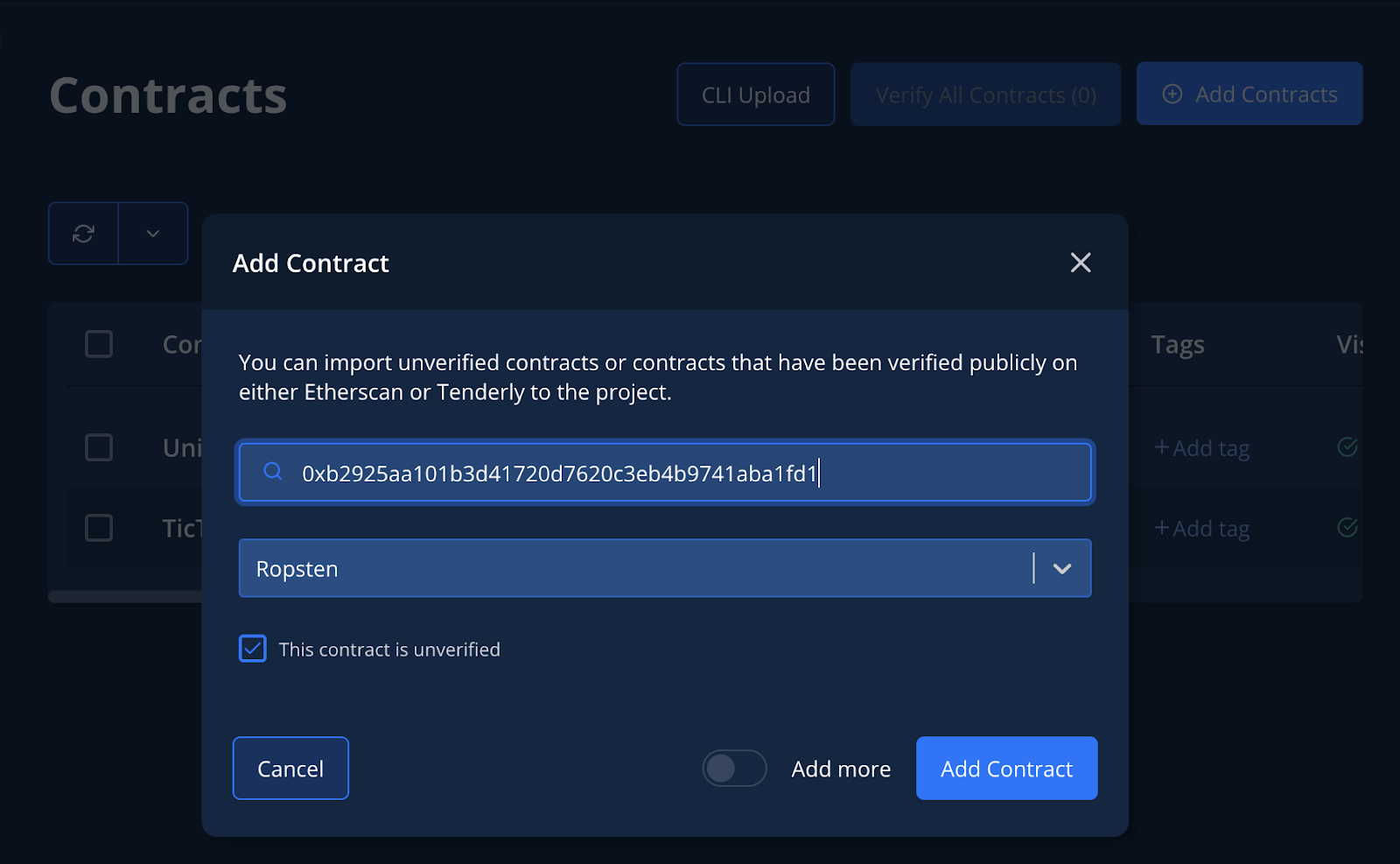

Verify Smart Contracts Before Interacting: Always check the official website and contract addresses of DeFi protocols. Use trusted sources like Etherscan or DefiLlama to confirm you’re interacting with legitimate contracts and not malicious clones.

-

Enable Multi-Factor Authentication (MFA): Secure your accounts on major DeFi aggregators and bridges (e.g., MetaMask, 1inch) by enabling MFA where available. This adds an extra layer of protection against unauthorized access.

-

Monitor Transaction Limits and Tax Thresholds: With the new $300 de minimis exemption, track your transaction sizes and frequency using portfolio trackers like CoinTracker or ZenLedger to avoid exceeding the $5,000 annual cap and maintain compliance.

-

Stay Updated on Regulatory Changes: Follow reliable sources such as Cointelegraph, The Block, and Senator Lummis’s official site for the latest on US crypto regulations, ensuring your DeFi activities remain compliant and secure.

The wash sale rule is another important update. While it closes some aggressive tax loss harvesting strategies, it also clarifies what’s allowed, reducing gray areas that scammers have exploited with fake “loss harvesting” services.

Charitable Crypto Donations Simplified

If you’re donating actively traded tokens to charity, there’s good news: no more costly appraisals required. You’ll be able to donate digital assets much like stocks, a win for both donors and nonprofits looking to accept crypto contributions (learn more).

Senator Lummis’s plan doesn’t fix every issue facing U. S. -based crypto users, but it does eliminate some of the most counterproductive barriers to entry. By reducing audit risk, clarifying taxable events, and making small-scale usage practical again, this bill could finally make DeFi onboarding as straightforward as signing up for any other financial app.

Leave a Reply