Bitcoin has just reached an astonishing new all-time high, surging to $118,775.00 as of July 13,2025. This milestone is more than just a number – it’s a signal that the crypto landscape is evolving rapidly, shaped by both market forces and sweeping changes in US policy. For anyone curious about entering the world of digital assets, these developments are rewriting the rules of onboarding for new investors.

Trump Administration’s Crypto-Friendly Policies: A Game Changer

The return of President Trump to the White House has brought with it a dramatic shift in how the US approaches cryptocurrency regulation. Within his first 100 days back in office, Trump signed executive orders to establish a Strategic Bitcoin Reserve and a broader U. S. Digital Asset Stockpile, sending clear signals that crypto is now a national priority (AP News). These moves have been accompanied by appointing pro-crypto officials like SEC Chair Paul S. Atkins and AI and Crypto Czar David O. Sacks.

The impact? Regulatory oversight has been loosened, making it easier for exchanges and startups to operate without fear of sudden crackdowns. The administration’s support for stablecoins and memecoins has also helped legitimize sectors previously seen as speculative or fringe.

“The majority of what we’ve seen so far has actually been the removal of regulatory oversight for the crypto industry. “

Bitcoin Hits $118,775: Why This ATH Matters for New Investors

Seeing Bitcoin at $118,775.00 isn’t just historic – it’s transformative for onboarding newcomers into crypto. This price surge is fueled by more than hype; it reflects growing institutional adoption and confidence sparked by government backing. When national policy aligns with market innovation, barriers fall away for everyday investors.

The psychological effect of such a high price can’t be overstated. For many beginners searching “how to buy Bitcoin 2025” or “crypto onboarding for beginners, ” this rally validates their curiosity while raising fresh questions about timing and strategy.

Bitcoin Price Prediction 2026-2031 After New $118K ATH and Trump Administration Policies

Forecasts consider the impact of crypto-friendly US regulatory changes, strategic Bitcoin reserves, and market adoption trends following Bitcoin’s July 2025 all-time high.

| Year | Minimum Price | Average Price | Maximum Price | Potential % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $85,000 | $120,000 | $160,000 | +1.0% | Potential consolidation after ATH; policy tailwinds, but possible profit-taking and volatility |

| 2027 | $95,000 | $140,000 | $185,000 | +16.7% | Renewed institutional inflows as Trump policies mature; volatility possible near US elections |

| 2028 | $110,000 | $170,000 | $220,000 | +21.4% | Mainstream adoption accelerates; possible ETF/401(k) integration; halving event impact |

| 2029 | $135,000 | $210,000 | $285,000 | +23.5% | Global macro factors favor BTC as digital reserve; increased regulatory clarity |

| 2030 | $155,000 | $250,000 | $340,000 | +19.0% | Bitcoin competes with gold as macro hedge; tech upgrades expand use cases |

| 2031 | $170,000 | $285,000 | $400,000 | +14.0% | Mature phase: institutional dominance, potential for new ATHs, but slower growth |

Price Prediction Summary

Following the Trump administration’s pro-crypto shift and Bitcoin’s $118K ATH, BTC is poised for a period of consolidation, followed by renewed growth driven by mainstream adoption, regulatory clarity, and macroeconomic trends. While volatility remains, especially around major policy changes and global events, the long-term outlook is bullish, with the possibility of Bitcoin challenging traditional safe havens like gold by 2030-2031.

Key Factors Affecting Bitcoin Price

- Trump administration’s crypto-friendly policies and regulatory clarity

- Establishment of a US Strategic Bitcoin Reserve

- Mainstream and institutional adoption (including ETFs, pensions, and 401(k)s)

- Global macroeconomic environment (inflation, de-dollarization, geopolitical tensions)

- Technological upgrades (scalability, security, Layer 2 solutions)

- Competition from other digital assets and central bank digital currencies (CBDCs)

- Market cycles (post-halving effects, profit-taking, and corrections)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Easier Onboarding: How Regulations Are Opening Doors

The Trump administration’s hands-off approach means that compliance hurdles are lower than ever before. Exchanges can streamline Know Your Customer (KYC) processes without sacrificing security, making account creation faster and less intimidating for first-timers.

This new era is also marked by educational initiatives led by both government agencies and private firms eager to welcome retail investors safely into the fold. With clearer guidelines around tax reporting and asset custody, confusion that once scared off beginners is steadily being replaced by step-by-step guidance.

Top Resources for New Crypto Investors in 2025

-

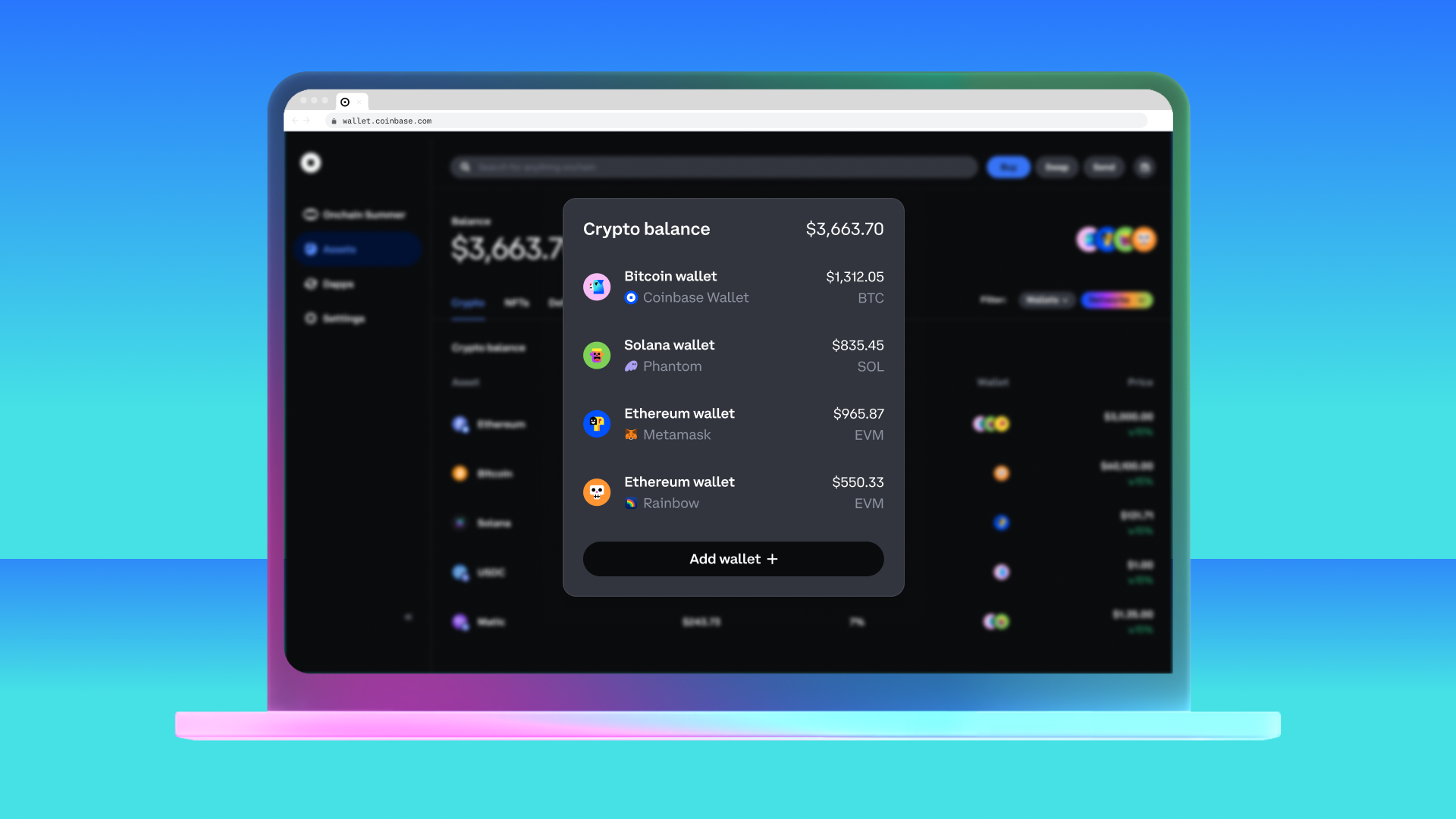

Coinbase — As one of the largest and most user-friendly crypto exchanges, Coinbase offers an intuitive platform for buying, selling, and managing cryptocurrencies. Its educational hub is packed with guides, videos, and up-to-date news—ideal for beginners navigating the latest market highs, like Bitcoin’s $118,775 ATH.

-

Binance Academy — Binance’s free educational platform provides comprehensive tutorials on blockchain basics, trading strategies, and security tips. The Academy is regularly updated to reflect new regulations and market trends, making it a go-to for those entering the market during the Trump administration’s pro-crypto shift.

-

Investopedia Cryptocurrency Section — Trusted by millions, Investopedia’s crypto section breaks down complex topics, from Bitcoin’s price surges to regulatory changes under President Trump, in clear, approachable language. Their step-by-step guides are perfect for new investors.

-

Ledger Academy — Security is crucial in crypto, and Ledger Academy offers essential lessons on self-custody, hardware wallets, and protecting your assets. With more investors joining after the recent market rally, these resources help you stay safe while exploring digital assets.

-

r/CryptoCurrency (Reddit) — This active community forum connects new and seasoned investors to discuss news, share tips, and analyze trends. With over 7 million members, it’s a valuable space for real-time insights on the evolving crypto landscape in 2025.

-

U.S. Securities and Exchange Commission (SEC) Crypto Resources — The SEC’s official site now features updated guides reflecting the Trump administration’s latest policies, including information on the Strategic Bitcoin Reserve and digital asset regulations. It’s a must-visit for understanding the legal landscape.

The Ripple Effects on Altcoins and Stablecoins

While Bitcoin takes center stage at $118,775.00, other digital assets are benefiting too. Trump’s strategic reserve isn’t limited to BTC – it includes several top cryptocurrencies, hinting at broader adoption across the sector (AP News). The result? More diverse portfolios among new investors who now see legitimacy in assets beyond just Bitcoin.

Another key change is the normalization of stablecoins and memecoins within mainstream portfolios. With the administration’s explicit support, these assets are no longer relegated to speculative side bets. Instead, they’re being integrated into the strategic reserve and discussed in policy circles, giving them a newfound legitimacy that makes them more approachable for newcomers. This shift opens the door for investors who may have felt priced out of Bitcoin but are still eager to participate in the crypto ecosystem.

Practical Steps for Beginners: How to Buy Bitcoin at $118,775

If you’re new to crypto and feeling both excited and overwhelmed by Bitcoin’s $118,775.00 price tag, you’re not alone. The good news is that you don’t need to buy a whole Bitcoin, fractional ownership means you can start with as little as a few dollars. Here’s what onboarding looks like today:

Thanks to simplified KYC and improved user interfaces across major exchanges, opening an account is more straightforward than ever. Many platforms now offer guided onboarding journeys tailored specifically for beginners, taking you from registration through your first purchase with clear prompts at every step.

Security remains paramount. While regulations are friendlier, reputable exchanges still emphasize two-factor authentication and robust withdrawal controls. Always use strong passwords and consider hardware wallets if you plan to hold significant amounts long term.

Community Buzz: What Investors Are Saying

The conversation around Trump’s crypto-friendly stance is vibrant, and sometimes polarizing, across social channels. Some hail it as overdue modernization; others worry about potential risks from rapid deregulation or political entanglement with digital assets.

Regardless of where you stand politically, there’s no denying that the current environment has made it easier than ever for everyday Americans to get started in crypto. Market optimism is high, but so too is the call for personal responsibility, do your own research before diving in.

Looking Ahead: Is This Just the Beginning?

With institutional investors pouring in and Washington signaling ongoing support, some analysts believe we’re only at the start of a much larger adoption wave (AP News). However, volatility remains part of crypto’s DNA, newcomers should approach with both enthusiasm and caution.

- Stay informed: Policy can change quickly; keep an eye on official announcements.

- Diversify: Don’t put all your funds into one asset, even if it’s Bitcoin at an all-time high.

- Leverage educational resources: The best way to avoid costly mistakes is by learning from trusted sources before making big moves.

The intersection of historic prices like $118,775.00 and pro-crypto policy has created a unique window for new investors, a time when access is easier but diligence matters more than ever. Whether you’re here for the technology or chasing returns, today’s onboarding journey is smoother thanks to these seismic shifts in regulation and market sentiment.