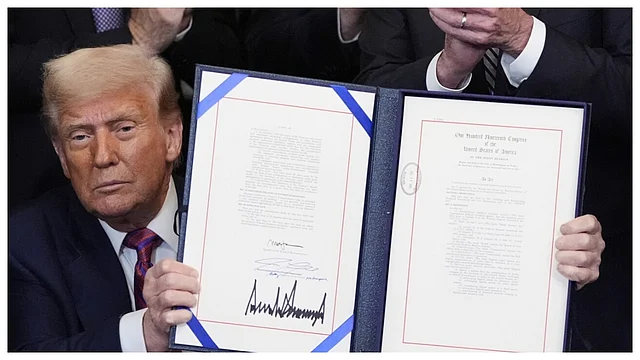

The landscape for decentralized finance (DeFi) and stablecoins in the United States has fundamentally shifted. On July 18,2025, President Donald Trump signed the Guiding and Establishing National Innovation for U. S. Stablecoins Act (GENIUS Act) into law. This is the first comprehensive federal framework for stablecoin regulation, introducing new expectations for onboarding users and projects alike. As the crypto industry digests these sweeping changes, it’s clear that compliance, transparency, and consumer protection are now front and center in US crypto law onboarding.

GENIUS Act Onboarding: What Changes for Stablecoins?

The GENIUS Act targets payment stablecoins, digital tokens pegged to the US dollar or other high-quality liquid assets. Under this law, only approved US-based entities can issue payment stablecoins. These issuers must register with the Office of the Comptroller of the Currency (OCC), maintain a strict 1: 1 reserve backing, and submit to regular audits. This means that every Polygon Bridged USDT (USDT) token in circulation, currently priced at $1.00: must be fully backed by actual dollars or equivalent assets.

For onboarding new users to DeFi platforms using stablecoins, this regulatory clarity is a double-edged sword. On one hand, it builds trust among mainstream users wary of algorithmic or unbacked coins; on the other hand, it significantly raises compliance costs and operational hurdles for issuers and platforms alike.

Compliance Requirements Reshape DeFi Onboarding

Stablecoin issuers are now required to implement robust anti-money laundering (AML) programs aligned with the Bank Secrecy Act. This includes customer due diligence during onboarding, transaction monitoring, and mechanisms to freeze or reject suspicious transactions. For DeFi platforms integrating these coins, onboarding flows must adapt:

- User Verification: Platforms may need to collect more information from users at sign-up to meet issuer requirements.

- Asset Screening: Only compliant stablecoins will be supported on major US-facing DeFi protocols.

- User Education: Clear disclosures about risks related to non-compliant or algorithmic stablecoins will become standard.

The GENIUS Act also bans non-fiat-backed algorithmic stablecoins from being offered by permitted issuers within the US market. Projects relying on such models face exclusion unless they overhaul their structures, a major shift for both developers and users accustomed to permissionless onboarding.

Operational Impact: Costs Up, Trust Also Up?

The increased scrutiny brings higher operational costs for both issuers and DeFi platforms seeking to onboard US customers. Licensing fees, regular audits, AML systems, all represent significant investments. Yet these measures are designed to prevent collapses like those seen with unbacked coins in previous years.

This regulatory certainty could strengthen mainstream adoption by making compliant stablecoins more attractive as reliable payment rails within DeFi ecosystems. Meanwhile, demand for compliance infrastructure, analytics tools, payment processors specializing in regulated crypto, will likely surge as projects scramble to meet new standards.

Some DeFi platforms may respond by partnering with established, fully compliant stablecoin issuers or integrating third-party compliance solutions directly into their onboarding processes. This will likely create a more fragmented landscape, where only certain assets are accessible to US users, but it could also reduce the risk of sudden delistings or regulatory crackdowns.

Broader Implications for Crypto Onboarding in 2025

The GENIUS Act’s influence extends beyond just stablecoins. Its comprehensive approach to supervision and enforcement sets a precedent for other areas of crypto law onboarding. Decentralized exchanges (DEXs), lending protocols, and wallets will need to reassess their onboarding flows to ensure they do not inadvertently support non-compliant assets or issuers.

For new users entering DeFi in 2025, the onboarding journey is likely to be more structured and transparent than ever before. Expect clearer disclosures about asset backing, redemption rights, and platform compliance status. While this may add friction compared to previous years, it also reduces risks associated with opaque or fly-by-night projects.

Top 5 Onboarding Changes After the GENIUS Act

-

Mandatory Licensing for Stablecoin IssuersAll payment stablecoin issuers must now register with the Office of the Comptroller of the Currency (OCC) and obtain federal approval before operating in the U.S. This restricts onboarding to stablecoins issued by licensed entities only.

-

1:1 Reserve Backing RequirementStablecoins must be fully backed by U.S. dollars or high-quality liquid assets on a 1:1 basis, with regular audits. Onboarding will focus on assets that meet these strict reserve standards, increasing user confidence in stablecoin stability.

-

Enhanced AML/KYC ComplianceDeFi platforms and stablecoin issuers must implement robust Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures, including transaction monitoring and customer verification, to comply with the Bank Secrecy Act.

-

Exclusion of Algorithmic StablecoinsAlgorithmic stablecoins without fiat backing are now prohibited. DeFi onboarding will shift toward accepting only fiat-backed stablecoins, requiring platforms to delist or restrict non-compliant assets.

-

Clear Consumer Redemption and Protection RulesThe Act mandates transparent redemption processes, ensuring users can convert stablecoins to U.S. dollars on demand. Issuers are now liable for delays or insolvency, improving user protections during onboarding.

As regulatory clarity increases, so does institutional interest. Major fintechs and banks now have a clear path to participate in stablecoin issuance or integrate regulated digital assets into their offerings. This convergence of traditional finance and crypto could accelerate mainstream adoption, but only for projects willing to meet the new standards.

What About International Users?

It’s worth noting that while the GENIUS Act directly governs US-based issuers and platforms serving Americans, its ripple effects are global. Many international projects may choose to comply voluntarily if they want access to US liquidity or partnerships with American institutions. Others might geofence US users or maintain separate pools of compliant versus non-compliant assets, a technical and operational challenge that could reshape how DeFi protocols present themselves worldwide.

Looking Ahead: Opportunities Amid Regulation

Despite concerns about higher costs and increased oversight, many industry voices see long-term upside in this regulatory shift. By establishing clear rules for what constitutes a legitimate stablecoin, and who can issue one, the GENIUS Act may help weed out bad actors while paving the way for responsible innovation.

This framework is already prompting creative solutions: some startups are developing modular compliance tools designed specifically for DeFi onboarding compliance; others are exploring hybrid models that combine on-chain transparency with off-chain identity verification.

For now, Polygon Bridged USDT (USDT) remains steady at $1.00, reflecting both market confidence in compliant stablecoins and the immediate impact of tighter oversight (source). As more platforms adapt their processes, and as users become accustomed to new norms, DeFi onboarding is poised for a period of rapid evolution marked by greater security, trust, and mainstream legitimacy.