American crypto users, get ready for a whole new onboarding experience. The landscape just shifted in a big way, thanks to the freshly signed GENIUS Act and a wave of new US crypto regulations. If you’ve ever wondered how to start with crypto in the US or what these changes mean for your favorite stablecoins, you’re in the right place. Let’s break down what’s happening and why it matters for everyone from total beginners to blockchain veterans.

GENIUS Act Crypto Onboarding: What’s Actually Changing?

The Guiding and Establishing National Innovation for U. S. Stablecoins (GENIUS) Act is not just another piece of legalese – it’s a game-changer for anyone using or considering stablecoins like USDC or USDT. Signed into law by President Trump on July 18,2025, this act lays out strict rules for who can issue payment stablecoins in the United States. Only approved, US-based entities can do so, and they must register with the OCC (Office of the Comptroller of the Currency), keep a strict 1: 1 reserve backing, and submit to regular audits. (AP News)

But what does that mean if you’re just trying to buy your first stablecoin or sign up at a crypto exchange? Here are some of the biggest shifts:

Key Onboarding Changes for US Crypto Users Under the GENIUS Act

-

Stricter Identity Verification (KYC/AML): All major crypto platforms, like Coinbase and Kraken, now require more comprehensive identity checks during sign-up. Expect in-depth document uploads and real-time verification to comply with the Bank Secrecy Act.

-

Only Approved Stablecoins Supported: Platforms can now only offer stablecoins issued by OCC-approved US entities with 1:1 reserve backing. Popular options like USDC and Pax Dollar (USDP) remain available, while algorithmic stablecoins are excluded.

-

Transparent and Instant Stablecoin Redemption: New rules require issuers to guarantee clear, on-demand redemption of stablecoins for US dollars, boosting user confidence and reducing withdrawal risks.

-

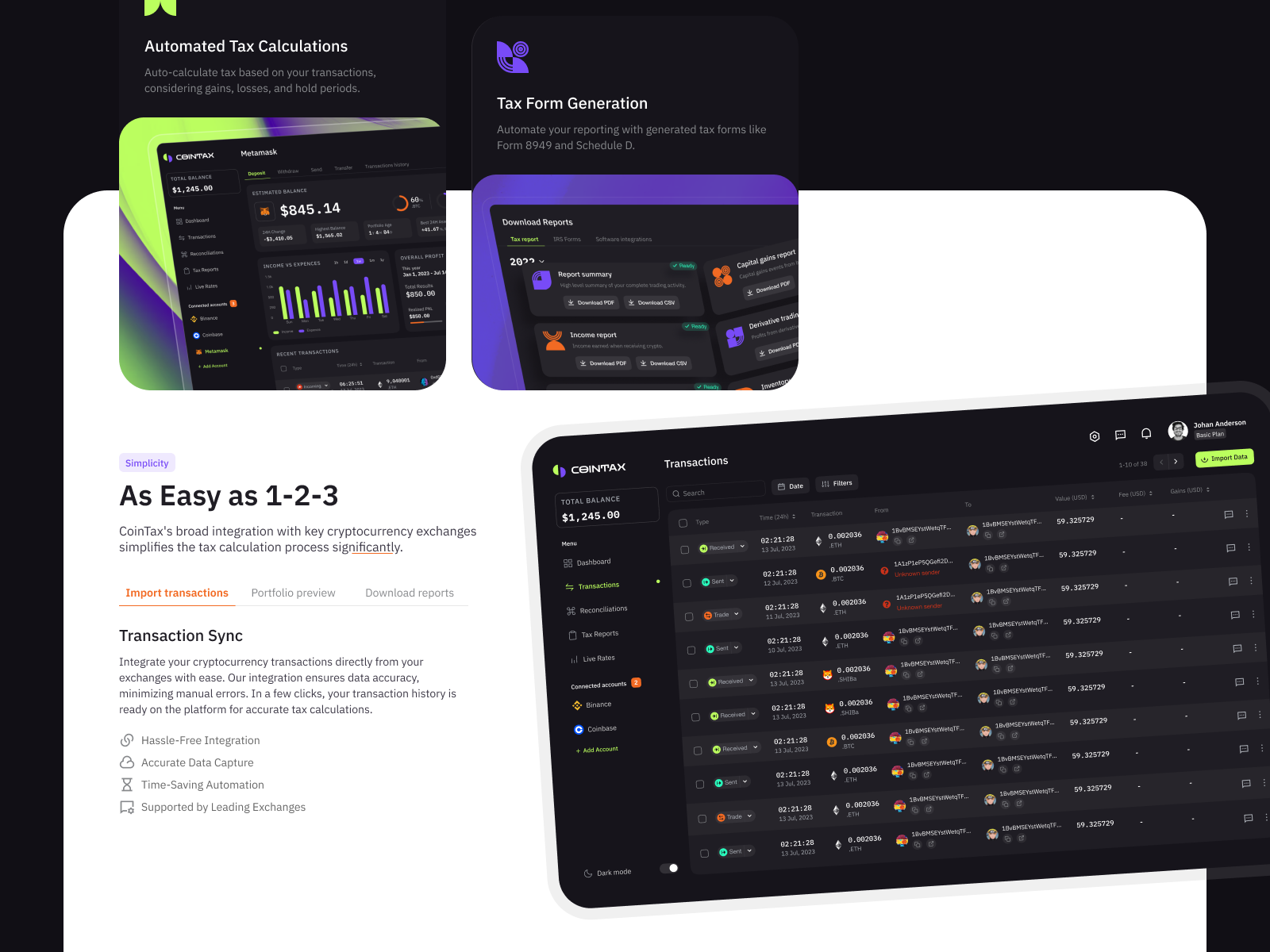

Automated Tax Reporting for Users: Exchanges such as Coinbase and Gemini must now provide automated IRS tax forms for transactions over $600, making it easier for users to stay compliant.

-

State-Specific Access Restrictions: Platforms operating in states with unique regulations, like New York (BitLicense), may limit certain crypto services based on your location. Always check if your state is supported before onboarding.

Enhanced Compliance: More Steps, More Security

This is where things get real for new users. The GENIUS Act pulls stablecoin issuers squarely under the Bank Secrecy Act. That means robust Anti-Money Laundering (AML) and Know Your Customer (KYC) checks are now mandatory – not just best practices. When you sign up at any compliant platform, expect more thorough identity verification than ever before.

You’ll likely need to provide government-issued ID, proof of address, maybe even a selfie video or biometric check depending on which exchange you choose. While this might feel like extra hassle at first glance, it’s all about building trust and keeping bad actors out of the system.

Transparency and Trust: Stablecoins Get Serious

The days of wondering whether your stablecoin is truly backed by dollars are over – at least for those issued under this new regime. The GENIUS Act requires all permitted issuers to back their coins 1: 1 with real assets and undergo regular audits. For users, that means more confidence when holding or transacting with these digital dollars.

This move is expected to drive broader adoption by making stablecoins less risky and more appealing as an entry point into crypto – especially if you’re coming from traditional banking.

Algorithmic Stablecoins Out; Fiat-Backed Coins In

If you’ve dabbled in algorithmic stablecoins before (think coins that maintain their value via code rather than actual dollar reserves), those options are now off-limits through regulated platforms in the US. The focus has shifted entirely toward fiat-backed coins like USDC or Tether USD (as long as they comply). This might mean fewer choices but greater peace of mind.

The Big Picture: Why This Matters Now

If you’ve been watching US crypto regulation 2025, it’s clear we’re entering an era where transparency isn’t optional – it’s required by law. For newcomers asking about crypto compliance for beginners, this means onboarding will be more standardized across platforms but also safer than ever before.

Let’s be real: the days of breezing through a crypto signup with just an email are over. But is that such a bad thing? Not really. These new onboarding hoops are designed to protect you, your assets, and the entire ecosystem. If you’ve been burned by shady platforms or worried about rug pulls, this shift toward compliance and oversight is actually a huge win for regular users.

One major upside is the standardized redemption process now required by law. You can convert your stablecoins to U. S. dollars on demand, with clear protections if an issuer ever faces insolvency or delays. That’s a level of consumer security we’ve honestly needed for years.

How State Laws and Federal Rules Work Together

The GENIUS Act sets the baseline, but don’t forget about state-level rules like New York’s BitLicense. Depending on where you live, onboarding could still vary, certain exchanges or coins might not be available in your state due to extra licensing requirements (see more here). It pays to check which platforms operate legally in your area before diving in.

Tax Time: Reporting Gets Real

Another big update is around tax reporting. The IRS now wants every transaction over $600 reported, and exchanges must help automate this process (details here). That means keeping track of every buy, sell, or swap is no longer optional. For some, it’ll feel like extra homework; for others, it’s a relief knowing those records are handled automatically.

How to Prepare for New US Crypto Onboarding Rules

-

Update Your Personal Identification DocumentsEnsure your government-issued ID (like a driver’s license or passport) is valid and up to date. Platforms such as Coinbase and Kraken will require clear, current documents for enhanced KYC checks.

-

Gather Proof of AddressHave recent utility bills or bank statements ready, as exchanges including Gemini and Binance.US may request these during onboarding to verify your residency.

-

Prepare for More In-Depth Identity VerificationBe ready to provide a selfie or video verification, as platforms will use advanced tools to comply with new AML rules under the GENIUS Act.

-

Review Your Stablecoin HoldingsCheck that your stablecoins are fiat-backed (like USDC or USDP), since algorithmic stablecoins are now excluded from US platforms. Move funds if needed to remain compliant.

-

Organize Your Crypto Transaction RecordsDownload your transaction history from exchanges such as Coinbase or Kraken. This will help you meet new IRS tax reporting requirements for crypto transactions over $600.

-

Check Platform Compliance in Your StateIf you live in states with strict rules (like New York), confirm that your chosen exchange is licensed (e.g., holds a BitLicense) to avoid onboarding issues.

-

Understand Stablecoin Redemption PoliciesFamiliarize yourself with how to redeem stablecoins for US dollars on platforms like Coinbase and Circle, as new laws guarantee transparent and prompt redemptions.

Banks and Crypto: A New Relationship?

It’s worth noting that while the GENIUS Act covers payment stablecoins, it leaves room for banks to issue tokenized deposits outside its scope (source). This could open doors for even more mainstream financial institutions to enter the crypto space, potentially making onboarding as easy as opening a checking account in the future.

For anyone asking how to start with crypto in the US, here’s my honest take: Yes, it’ll take a bit more paperwork and patience up front. But what you get in return, safer platforms, clearer rules, better protection, is absolutely worth it.

The GENIUS Act isn’t just about compliance; it’s about building a bridge between traditional finance and digital assets that everyone can walk across confidently. Whether you’re brand new or a seasoned trader looking for peace of mind, these changes set up American users for smarter (and safer) crypto journeys ahead.