In July 2025, Tether’s USDT reached a historic milestone with a market capitalization of $162 billion, cementing its dominance as the world’s leading stablecoin. For those new to crypto, this achievement is far more than a headline – it signals a paradigm shift in how digital assets are used, trusted, and onboarded into the mainstream financial system. As stablecoins like USDT become foundational to both decentralized finance (DeFi) and traditional payment rails, it’s essential for newcomers to understand what this means for their first steps into crypto.

USDT’s $162 Billion Market Cap: Why It Matters for New Crypto Users

Stablecoins are digital tokens designed to maintain a steady value, usually pegged to major fiat currencies like the US dollar. Among these, Tether (USDT) stands out not just for its size but also for its universal utility across exchanges, wallets, and payment platforms. As of July 23,2025, USDT’s market cap is $162 billion, according to XT.com. This figure is more than just a number – it represents liquidity, trust, and growing global adoption.

For beginners navigating crypto onboarding with Tether or other stablecoins, this massive adoption means:

- Reliability: Deep liquidity ensures easy entry and exit from crypto markets without wild price swings.

- Access: Most exchanges and DeFi protocols use USDT as their default trading pair or collateral asset.

- Simplicity: With USDT’s value anchored at $1.00 (as per current Polygon Bridged USDT pricing), users can avoid the volatility that often deters newcomers from entering crypto.

The surge in USDT usage also reflects broader trends in stablecoin adoption. The total stablecoin market cap now exceeds $268 billion globally (Reuters). This growth is fueled by new regulations like the U. S. GENIUS Act as well as increased participation from major banks and corporations exploring their own digital dollar initiatives.

The Role of Regulation: GENIUS Act Ushers in Stablecoin Clarity

The regulatory landscape has been one of the biggest hurdles to widespread crypto onboarding. In 2025, however, legislative clarity arrived with the GENIUS Act – a U. S. initiative focused on setting clear rules for stablecoin issuance and use. This act has not only legitimized assets like USDT but also encouraged traditional financial institutions such as Bank of America and Morgan Stanley to explore stablecoin-backed services (Reuters).

This environment benefits newcomers by offering:

- Greater transparency: Issuers must now provide regular audits and disclosures about reserves backing each token.

- Lower risk: Regulatory oversight reduces the chances of fraud or mismanagement that have plagued some earlier projects.

- Easier onboarding: Know Your Customer (KYC) processes are streamlined across compliant platforms using regulated stablecoins like USDT.

How Stablecoins Like USDT Power Everyday Crypto Usage in 2025

The practical impact of USDT’s dominance goes far beyond speculation. Stablecoins now underpin everything from cross-border payments to payroll solutions and decentralized lending protocols. Retail giants such as Walmart and Amazon are reportedly considering launching proprietary stablecoins for internal transactions – a testament to how deeply embedded these assets have become in daily commerce (Reuters).

Top Tips for Safely Using Stablecoins in 2025

-

Choose reputable stablecoins like USDT or USDC. Tether (USDT) remains the most widely used stablecoin, with a market capitalization of $162 billion as of July 2025. Stick to well-established coins supported by major exchanges and wallets for maximum security.

-

Verify platform security before transacting. Only use trusted platforms such as Coinbase, Binance, Kraken, or established DeFi protocols like Aave and Uniswap to buy, store, or transfer stablecoins. Check for up-to-date security audits and user reviews.

-

Understand regulatory requirements in your region. The GENIUS Act and similar regulations are shaping how stablecoins are issued and used in the U.S. and globally. Always ensure your activities comply with local laws and know-your-customer (KYC) rules.

-

Double-check wallet addresses before sending funds. Stablecoin transactions are irreversible. Always copy and paste wallet addresses carefully and confirm the network (e.g., Ethereum, Polygon) matches your recipient’s wallet.

-

Use hardware wallets for large holdings. For significant amounts of stablecoins, store your assets in hardware wallets like Ledger or Trezor to reduce exposure to online threats and hacks.

-

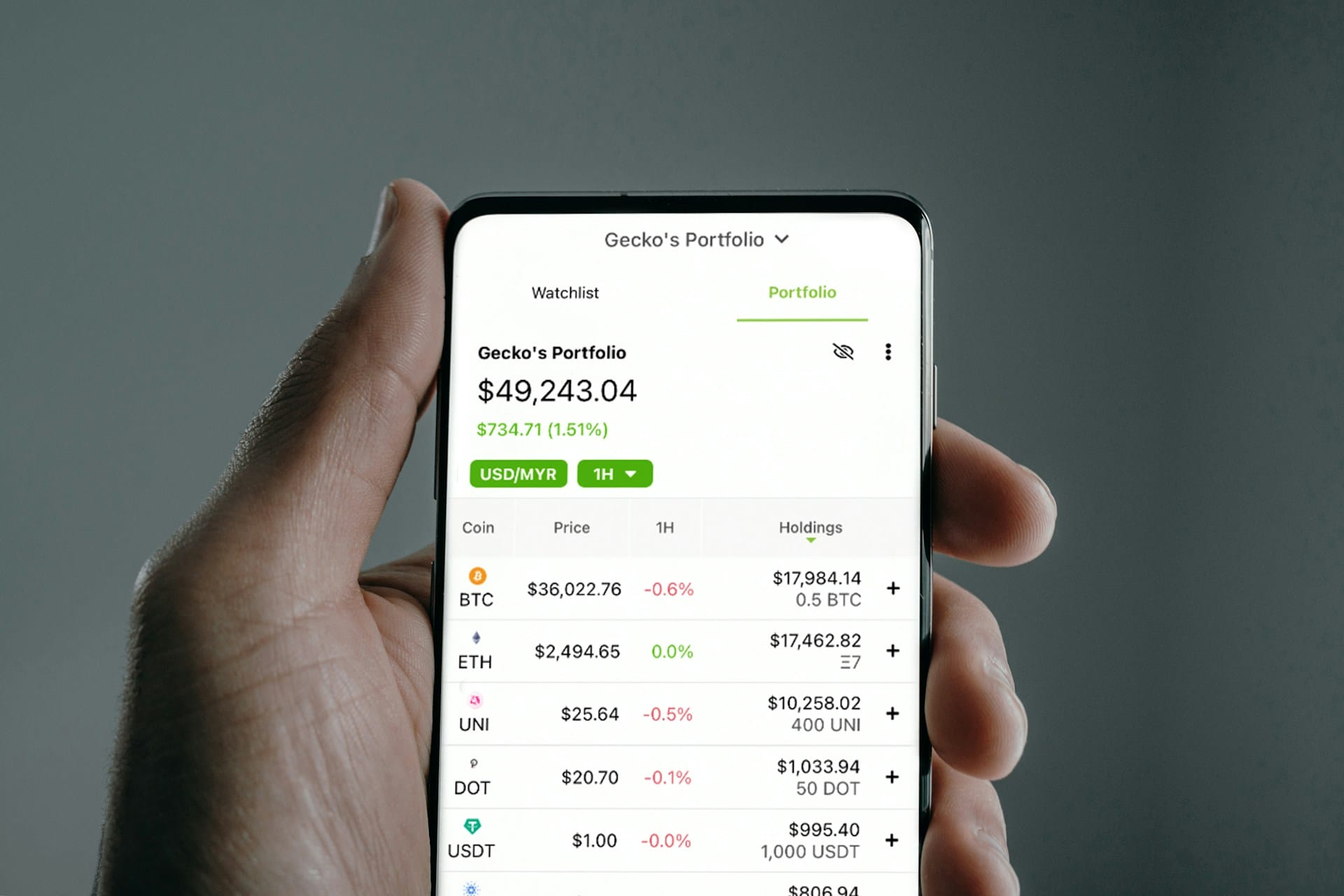

Monitor stablecoin price pegs and market news. While USDT is designed to maintain a $1.00 price, occasional fluctuations can occur. Stay informed through reputable sources like CoinGecko, CoinMarketCap, and official project channels.

-

Be aware of transaction fees and network congestion. Fees can vary depending on the blockchain used (e.g., Ethereum gas fees vs. Polygon). Check current rates before making transfers to avoid unexpected costs.

This integration means that even first-time users can leverage stablecoins to send money globally at low cost, earn yield through DeFi platforms, or seamlessly convert between fiat and digital currencies without worrying about sudden price drops.

Tether (USDT) Price & Stability Outlook: 2026-2031

Forecasting USDT’s price stability and adoption in a rapidly evolving stablecoin market

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Key Market Insights |

|---|---|---|---|---|

| 2026 | $0.98 | $1.00 | $1.02 | GENIUS Act fully implemented, regulatory clarity boosts institutional use; minor volatility possible during transition. |

| 2027 | $0.98 | $1.00 | $1.03 | Major US banks and global fintechs integrate stablecoins; competitive launches by big tech (Amazon, Walmart) increase sector scrutiny. |

| 2028 | $0.97 | $1.00 | $1.03 | Emerging markets adoption accelerates; minor price deviations possible during macroeconomic shocks or regulatory updates. |

| 2029 | $0.97 | $1.00 | $1.04 | Cross-border payments and DeFi integration deepen; USDT’s market share challenged by CBDCs and new asset-backed stablecoins. |

| 2030 | $0.96 | $1.00 | $1.05 | Broader digitization of money; volatility risk from regulatory divergence (e.g., EU vs. US frameworks). USDT maintains leading role. |

| 2031 | $0.95 | $1.00 | $1.05 | USDT remains global settlement layer, but increased competition and technological shifts (e.g., programmable money) test its peg resilience. |

Price Prediction Summary

USDT is expected to maintain a tight trading range around its $1.00 peg from 2026 to 2031, with limited downside risk due to strong regulatory backing and institutional adoption. However, as the stablecoin sector matures and competition intensifies—especially from CBDCs and corporate-backed coins—minor deviations from the peg may occur during periods of market stress or regulatory change. USDT’s dominance is likely to persist, but its resilience will be tested by evolving technology and new entrants.

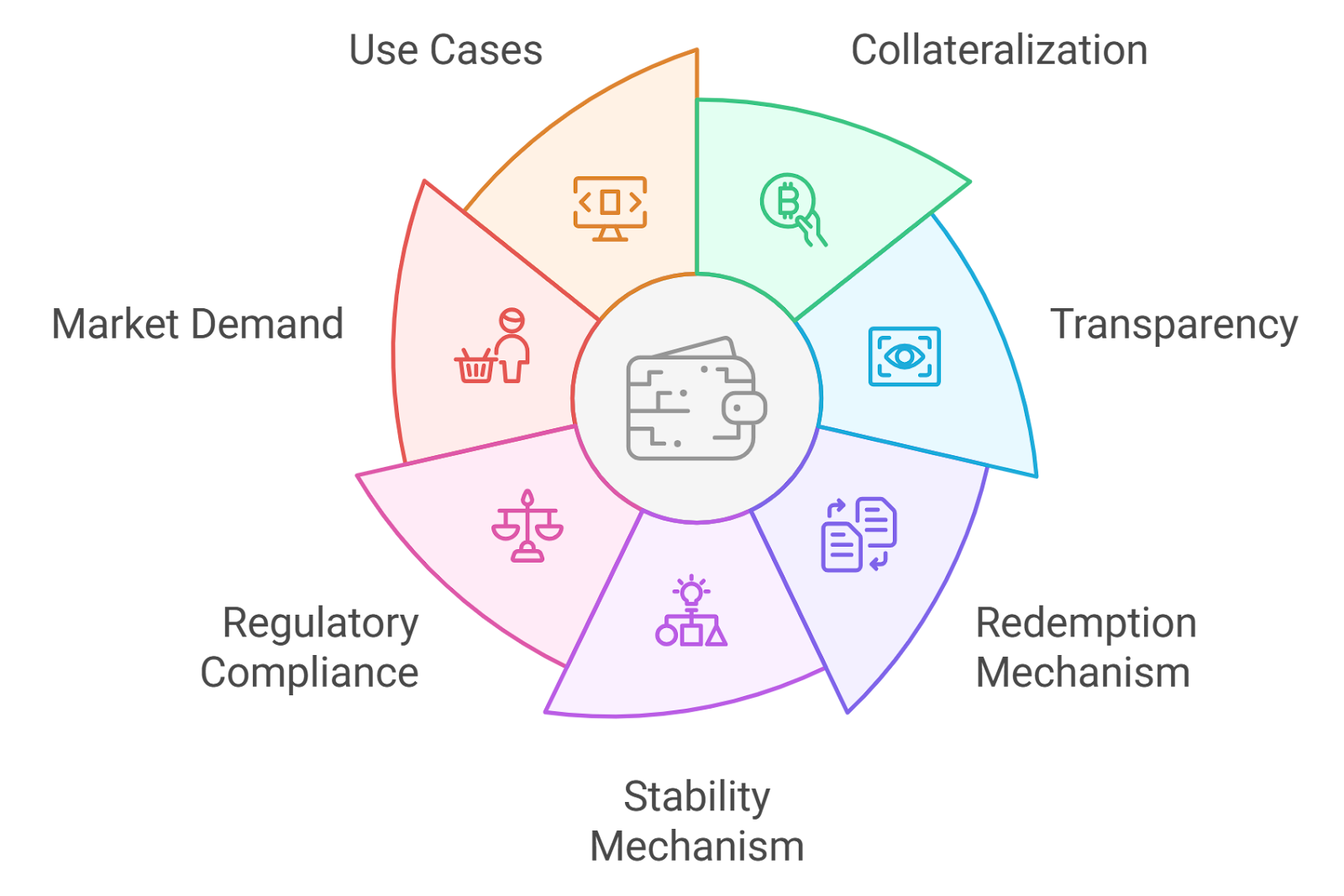

Key Factors Affecting Tether Price

- Regulatory clarity (e.g., GENIUS Act) fostering institutional and retail adoption

- Integration with traditional finance (banks, retail, payments)

- Emergence of competing stablecoins from tech giants and central banks

- Continued expansion in DeFi and cross-border payments

- Potential for market stress events causing brief peg deviations

- Technological advancements (e.g., blockchain scalability, programmability) impacting utility and adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As stablecoins like USDT become the backbone of digital finance, understanding how to use them safely is essential for anyone starting their crypto journey. The days of stablecoins being a niche tool for traders are over. In 2025, they serve as the entry point for millions into the Web3 economy, powering everything from microtransactions to enterprise payrolls.

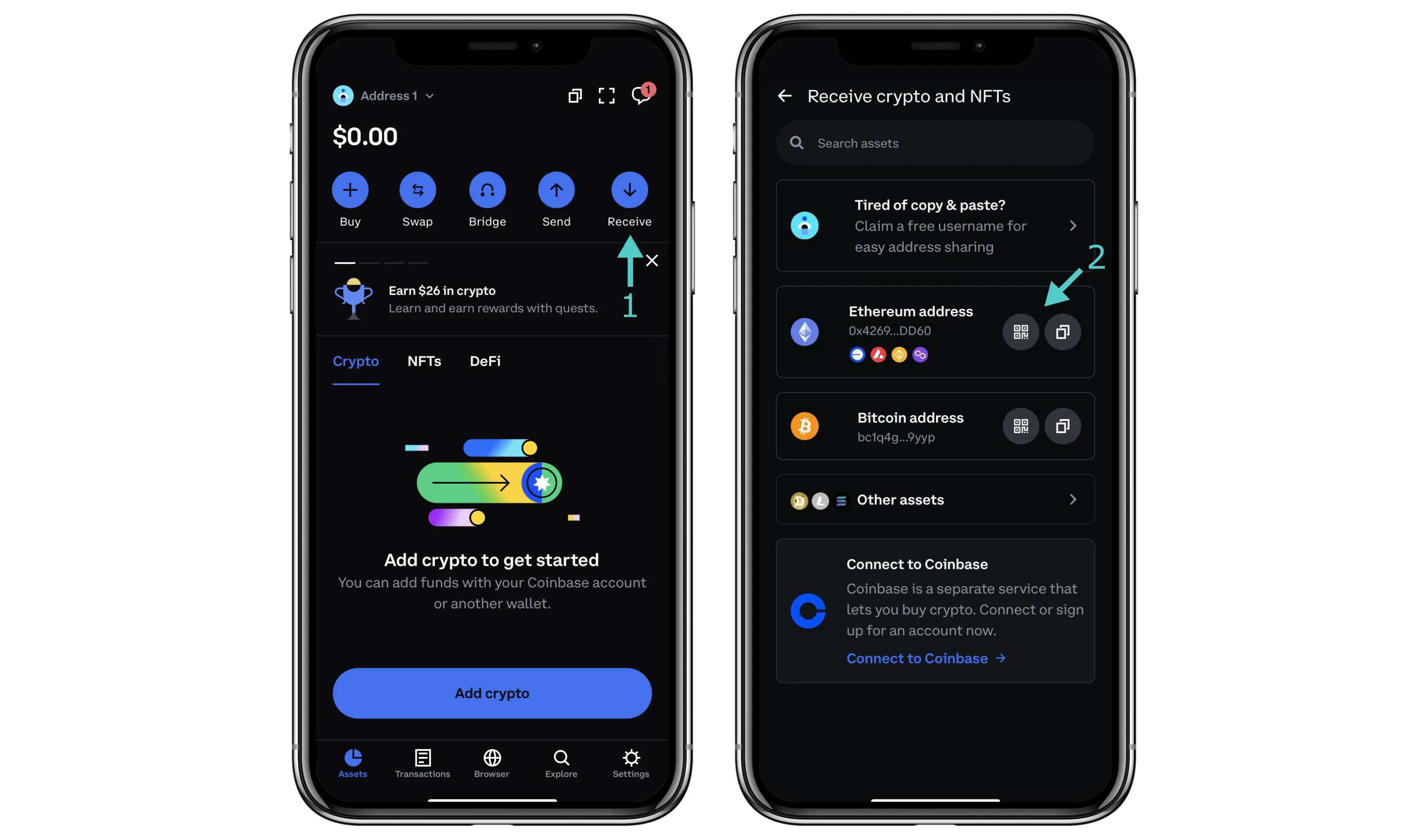

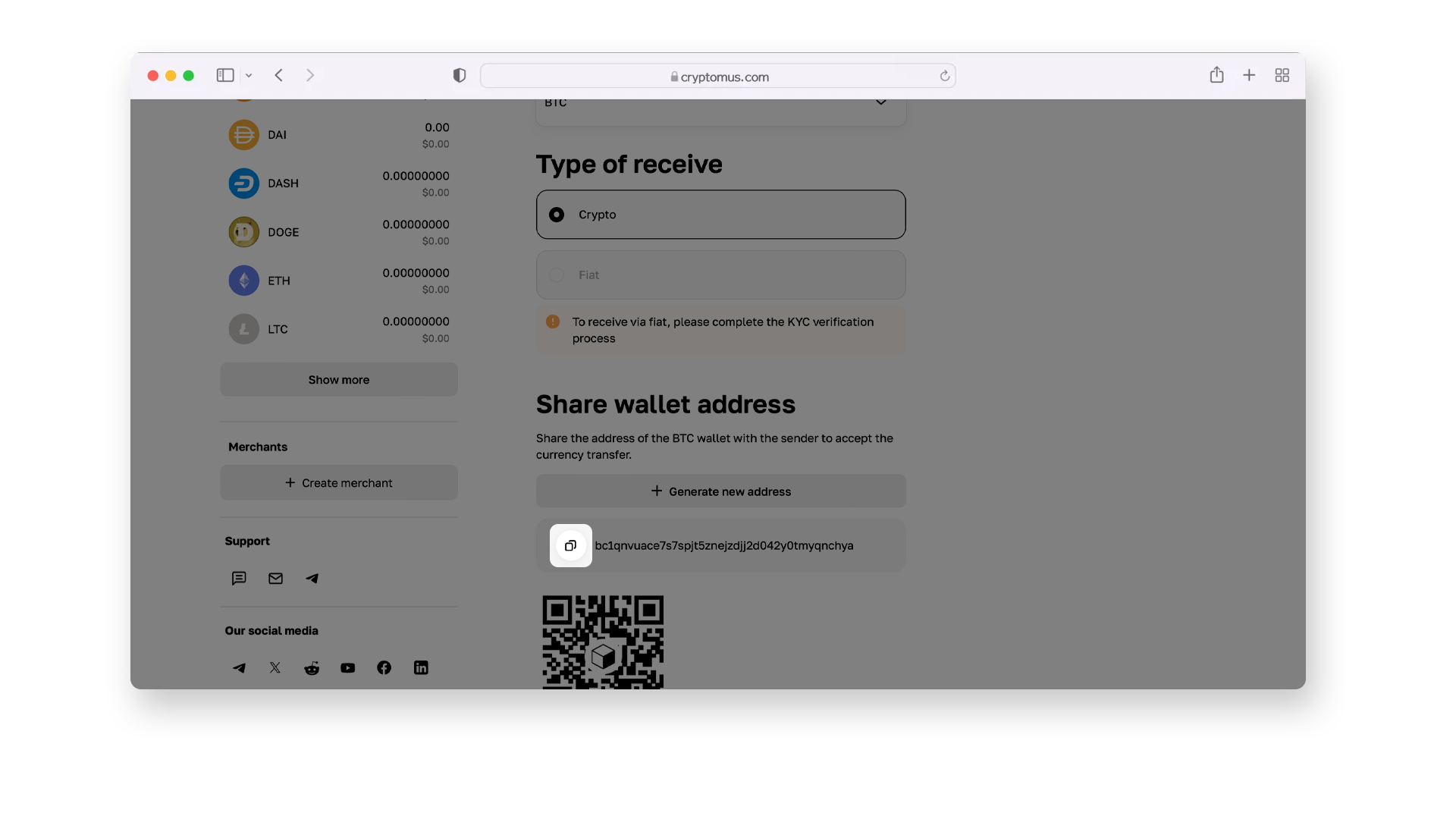

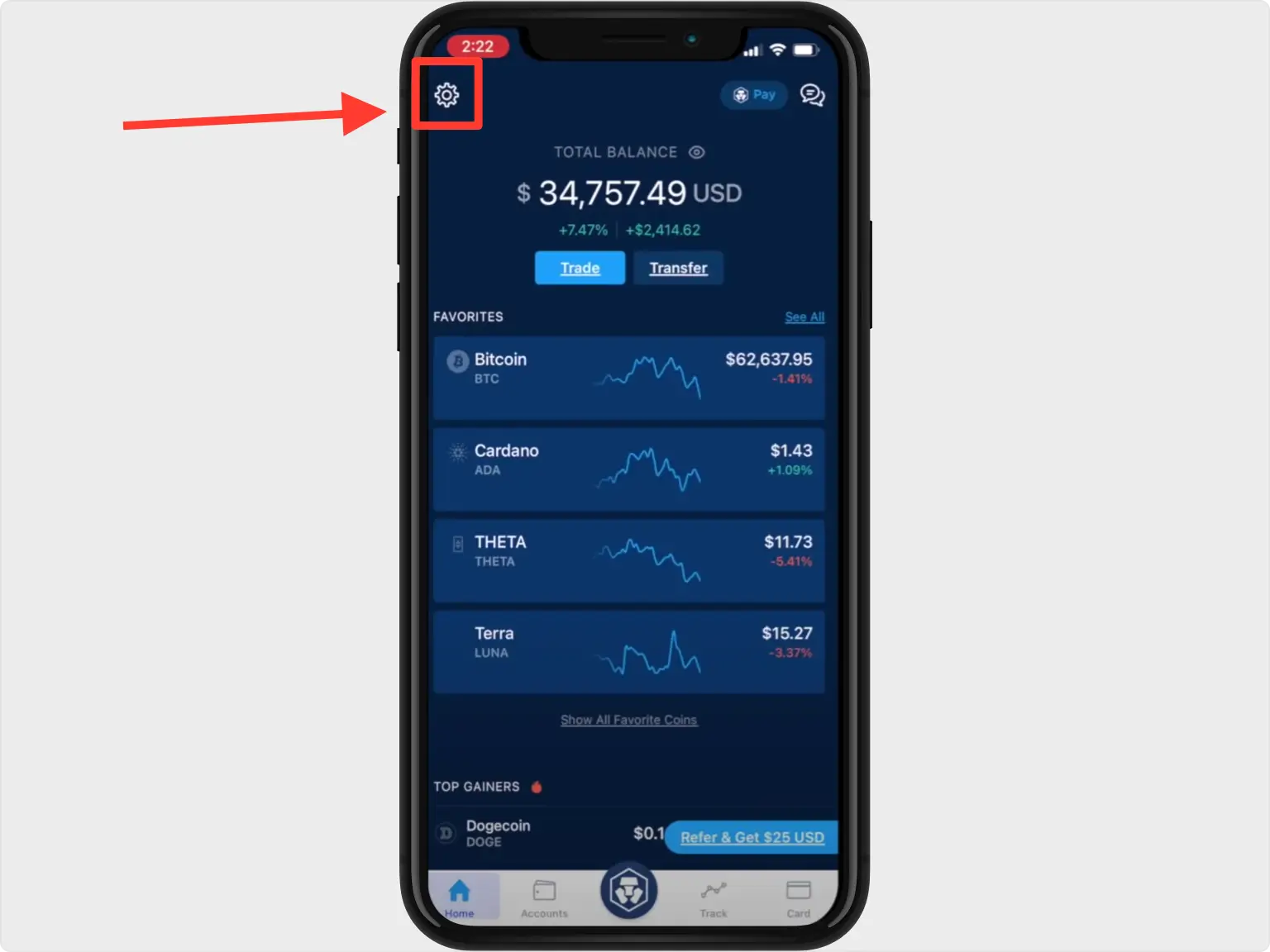

Practical Steps: Getting Started with USDT and Stablecoins

For new users, onboarding with Tether (USDT) or similar stablecoins can be straightforward if you follow best practices. Start by choosing a reputable exchange or wallet that supports robust security features and complies with local regulations. Always enable two-factor authentication and familiarize yourself with withdrawal limits, fees, and network options, Polygon, Ethereum, and Tron are the most common chains for USDT transactions in 2025.

With USDT’s value anchored at $1.00, it’s easy to track your portfolio’s worth without worrying about wild price fluctuations. This makes budgeting for investments or everyday spending far simpler than using volatile assets like Bitcoin or Ethereum.

Essential Stablecoin Safety Tips for Beginners (2025)

-

Choose reputable stablecoins like USDT, USDC, or DAI. Stick to widely adopted options with strong track records. As of July 2025, USDT leads the market with a capitalization of $162 billion and is supported by major exchanges and wallets.

-

Use trusted platforms and wallets for transactions. Only buy, sell, or store stablecoins through established exchanges (e.g., Coinbase, Binance, Kraken) or secure wallets like Ledger and MetaMask to reduce the risk of hacks or scams.

-

Verify regulatory compliance and transparency. Check if the stablecoin issuer follows regulations such as the GENIUS Act in the U.S. and regularly publishes reserve audits. USDC and USDT both provide transparency reports to increase user trust.

-

Double-check wallet addresses before sending funds. Crypto transactions are irreversible. Always copy and paste wallet addresses carefully, and consider sending a small test amount first to avoid costly mistakes.

-

Enable two-factor authentication (2FA) on all accounts. Protect your exchange and wallet accounts with 2FA to add an extra layer of security against unauthorized access.

-

Stay alert for phishing scams and fake websites. Only access stablecoin platforms via official URLs. Beware of unsolicited emails or messages asking for your private keys or login details.

-

Understand stablecoin risks and limitations. Even leading stablecoins can face regulatory, technical, or market risks. Stay updated on news, especially regarding USDT and USDC, and never invest more than you can afford to lose.

USDT also acts as a gateway to decentralized finance (DeFi) services. From earning interest on lending protocols to participating in liquidity pools or using stablecoins as collateral for loans, the possibilities are expanding rapidly. However, always verify that any platform you use is audited and compliant with relevant regulations, especially important as DeFi matures and attracts more mainstream users.

Beyond Trading: Stablecoin Adoption Trends Shaping 2025

The significance of USDT’s $162 billion market cap extends beyond its trading utility. We are witnessing the rise of programmable money, digital dollars that can be sent globally in seconds, embedded into smart contracts, or used seamlessly across different blockchains. This has profound implications for remittances, business-to-business settlements, and even government aid distribution.

What sets this era apart is not just the technology but also the institutional embrace of stablecoins. The GENIUS Act has catalyzed partnerships between crypto firms and major banks; meanwhile, countries like El Salvador are positioning themselves as hubs for digital asset innovation (Reuters). For newcomers, this means more trusted onramps and a broader range of real-world use cases than ever before.

Looking Ahead: The Future of Stablecoin Onboarding

Will stablecoin adoption continue its meteoric rise? Professional forecasts suggest that by late 2026, the total stablecoin market cap could surpass $350 billion, driven by both retail demand and enterprise integration. As regulatory frameworks mature worldwide and technical standards evolve, such as interoperability between chains, the barriers to entry will shrink further.

Tether (USDT) Price & Adoption Scenario Forecast: 2026-2031

Professional outlook on USDT’s price stability and adoption trends in the evolving stablecoin market (2026-2031)

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change (Avg) vs. $1.00 Peg | Market Insights/Scenarios |

|---|---|---|---|---|---|

| 2026 | $0.98 | $1.00 | $1.02 | 0% | Continued regulatory clarity; USDT maintains $1 peg with minor volatility. Market cap could reach $190B as adoption in payments and DeFi increases. |

| 2027 | $0.97 | $1.00 | $1.03 | 0% | Rising competition from CBDCs and other stablecoins; USDT retains dominance, but periodic depegs possible during market stress. |

| 2028 | $0.96 | $1.00 | $1.04 | 0% | Global expansion, especially in emerging markets. Regulatory headwinds may cause brief volatility, but peg remains stable. |

| 2029 | $0.95 | $1.00 | $1.05 | 0% | Technological improvements (interoperability, transparency). Potential for brief depegs if major regulatory or banking shocks occur. |

| 2030 | $0.94 | $1.00 | $1.06 | 0% | USDT faces increasing pressure from new stablecoins and stricter global regulations. Peg generally holds; rare outlier volatility possible. |

| 2031 | $0.93 | $1.00 | $1.07 | 0% | Mature stablecoin market. USDT’s market cap growth slows but remains a key player. Rare, short-lived deviations from $1 peg in extreme events. |

Price Prediction Summary

USDT is projected to maintain its $1.00 peg through 2031, reflecting its robust market position and regulatory adaptation. While minor volatility and rare, temporary deviations below or above $1.00 are possible during periods of market or regulatory stress, the average price is expected to remain at the $1.00 peg each year. USDT’s role as a primary on/off-ramp and settlement layer in crypto and traditional finance is anticipated to persist, even as competition and compliance pressures intensify.

Key Factors Affecting Tether Price

- Regulatory clarity and global stablecoin legislation (e.g., GENIUS Act)

- Institutional and retail adoption, including integration by major banks and retailers

- Technological enhancements (blockchain interoperability, transparency, and audits)

- Competition from CBDCs and new asset-backed stablecoins

- Market shocks, liquidity events, or regulatory crackdowns causing brief depegs

- Tether’s geographic strategy (e.g., El Salvador HQ) and resilience to policy changes

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The bottom line: For anyone new to crypto in 2025, onboarding with Tether (USDT) offers an accessible blend of stability, liquidity, and utility backed by deep market confidence. With careful attention to security best practices and a willingness to explore new financial tools built atop stablecoins, you can participate confidently in this next chapter of digital finance.