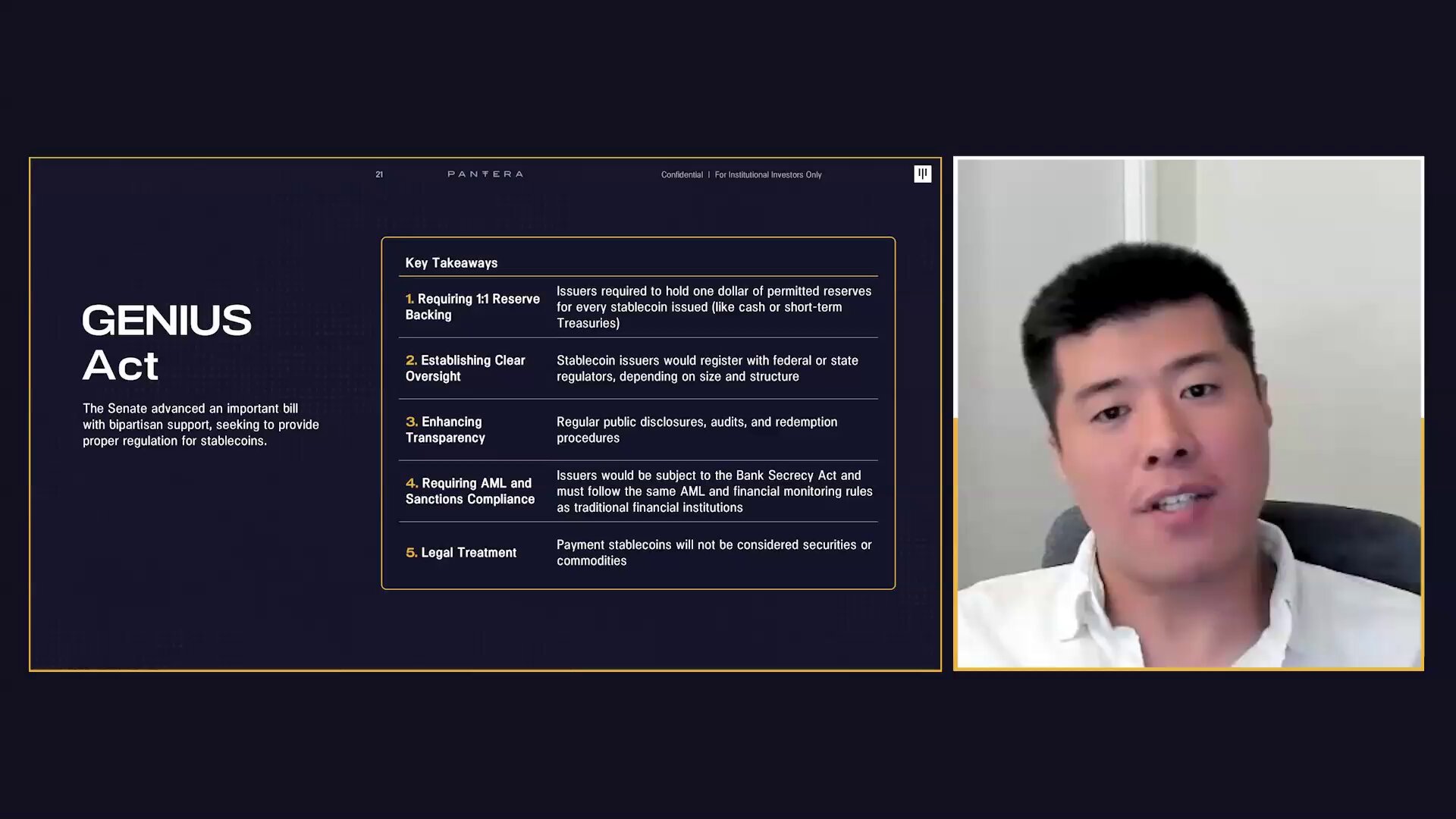

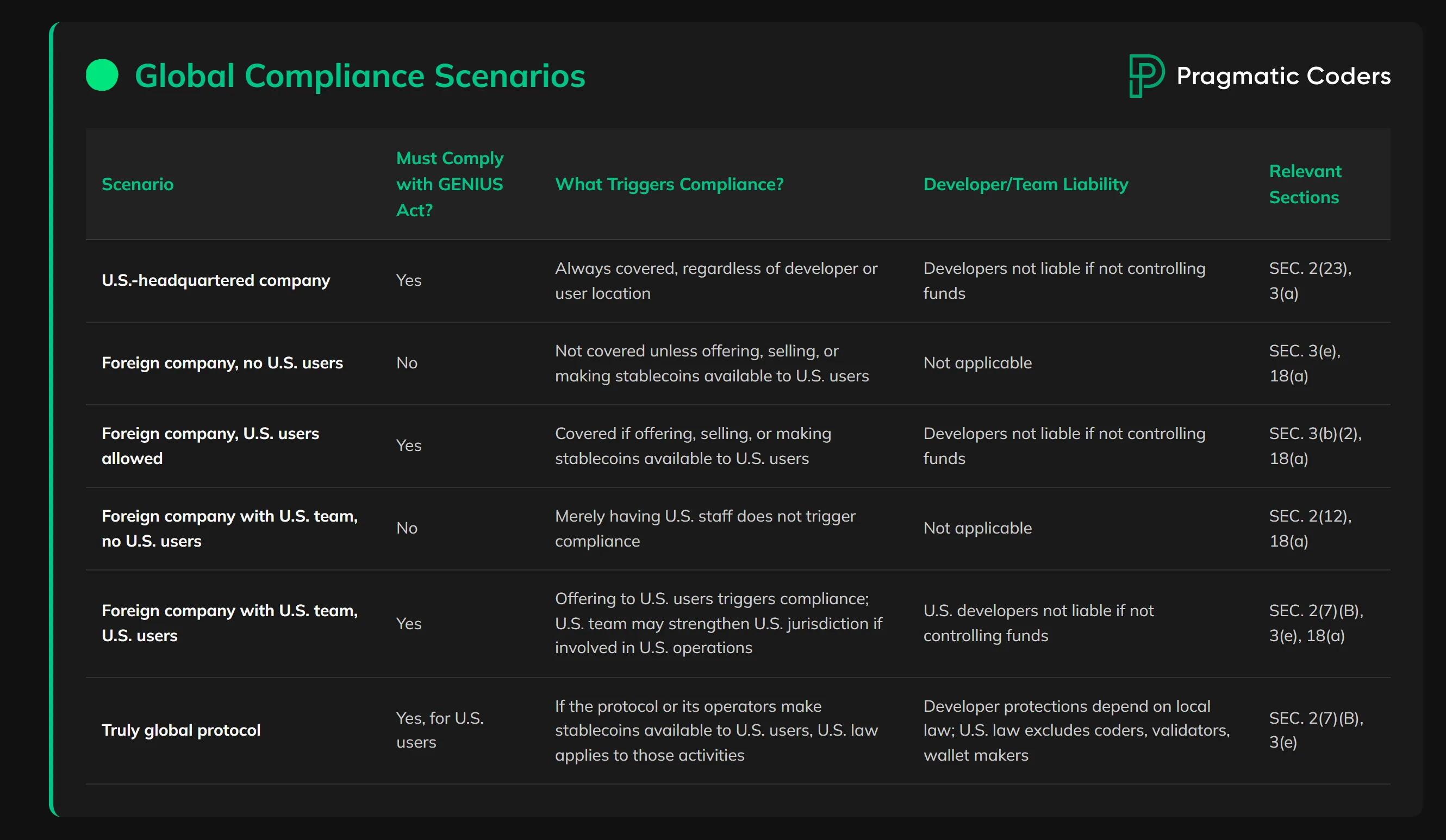

The landscape of crypto onboarding in the United States is undergoing a seismic shift in 2025. With the signing of the Guiding and Establishing National Innovation for U. S. Stablecoins (GENIUS) Act into law on July 18,2025, the federal government has introduced its first comprehensive regulatory framework for payment stablecoins. This move is not just regulatory housekeeping, it fundamentally changes how newcomers, institutions, and established players approach digital asset adoption, especially as stablecoin law in the US finally catches up to market innovation.

GENIUS Act: The Regulatory Milestone Crypto Needed

The GENIUS Act addresses a longstanding gap in U. S. financial regulation by setting out clear rules for who can issue payment stablecoins and under what conditions. Only entities recognized as “permitted payment stablecoin issuers”: including subsidiaries of insured depository institutions, certain nonbanks, federal branches of foreign banks, and uninsured national banks, are allowed to issue these tokens. This limitation is designed to weed out fly-by-night operators and give consumers confidence that their stablecoins are fully backed and professionally managed.

Reserve requirements are at the heart of this law. Every dollar’s worth of stablecoin must be matched by reserves held in U. S. currency, bank deposits, short-term Treasury securities, or select money market funds. This one-to-one backing aims to eliminate the risk of runs or insolvency that have plagued some past projects. Read more about the GENIUS Act’s regulatory framework.

Transparency and Trust: Monthly Reporting Mandates

Transparency isn’t optional under the new regime. Issuers must publish detailed monthly reports outlining both their outstanding token supply and reserve composition. These disclosures are subject to independent public accounting review, and crucially, they require attestation from both the CEO and CFO of each issuer. This level of scrutiny is rare in crypto markets but will be familiar to anyone with experience in regulated finance.

For users just starting their crypto journey, these measures mean less guesswork about whether a given stablecoin is truly safe or liquid. For institutional players, who have often sat on the sidelines due to legal uncertainty, this clarity could finally open the doors to broader participation.

How New Laws Will Change Crypto Onboarding for Beginners

How the GENIUS Act Will Affect First-Time Crypto Users

-

Greater Consumer Protection and Trust: The GENIUS Act requires stablecoin issuers to maintain full (1:1) reserves and undergo independent audits, giving first-time users increased confidence that their digital assets are securely backed and transparently managed.

-

Clearer Legal Framework for Onboarding: By establishing federal licensing for permitted payment stablecoin issuers, the Act eliminates much of the previous regulatory uncertainty, making it easier and safer for newcomers to enter the crypto market.

-

Improved Transparency Through Regular Reporting: Issuers must publish monthly reserve reports, verified by independent auditors and attested by top executives, ensuring first-time users have access to reliable information about the assets backing their stablecoins.

-

Broader Institutional Participation: The Act’s regulatory clarity is expected to encourage more banks and financial institutions to offer crypto-related services, providing first-time users with familiar, reputable entry points into digital assets.

-

Enhanced Safety from Anti-Money Laundering (AML) Protections: The GENIUS Act strengthens AML compliance for stablecoin issuers, reducing risks of fraud and illicit activity for new users joining the crypto ecosystem.

The onboarding process for crypto beginners has historically been fraught with confusion over which assets are safe or compliant, and what risks lurk beneath the surface. The GENIUS Act changes this calculus by:

- Providing legal clarity: Consumers know which issuers are federally authorized.

- Enhancing consumer protection: Reserve requirements reduce counterparty risk.

- Simplifying due diligence: Monthly disclosures make it easier to evaluate different stablecoins’ safety.

- Paving the way for mainstream adoption: Institutional players can now participate with confidence.

This new environment means that onboarding guides and tips must evolve as well, crypto regulation onboarding tips should now emphasize checking issuer status and reviewing monthly reserve attestations before choosing a stablecoin platform.

The Institutional Domino Effect

The ripple effects of this legislation extend beyond retail users. With well-defined compliance obligations, including licensing, capital standards, risk management protocols, and anti-money laundering controls, the barrier to entry rises for fly-by-night projects but lowers for established financial institutions looking to enter crypto safely.

Expect more banks and fintechs to launch their own compliant stablecoins or integrate them into customer offerings, a shift likely to accelerate mainstream adoption throughout 2025.

For up-to-date analysis on institutional participation trends sparked by these laws, see Arnold and Porter’s guide.

As the GENIUS Act’s provisions take hold, the onboarding experience for both individuals and institutions is poised to become more streamlined and less risky. For beginners, the days of navigating a patchwork of opaque stablecoin projects are ending. Instead, onboarding will increasingly involve choosing from a vetted set of federally authorized issuers, each with transparent reporting and robust backing. This not only reduces the risk of loss but also fosters a culture of accountability among stablecoin providers.

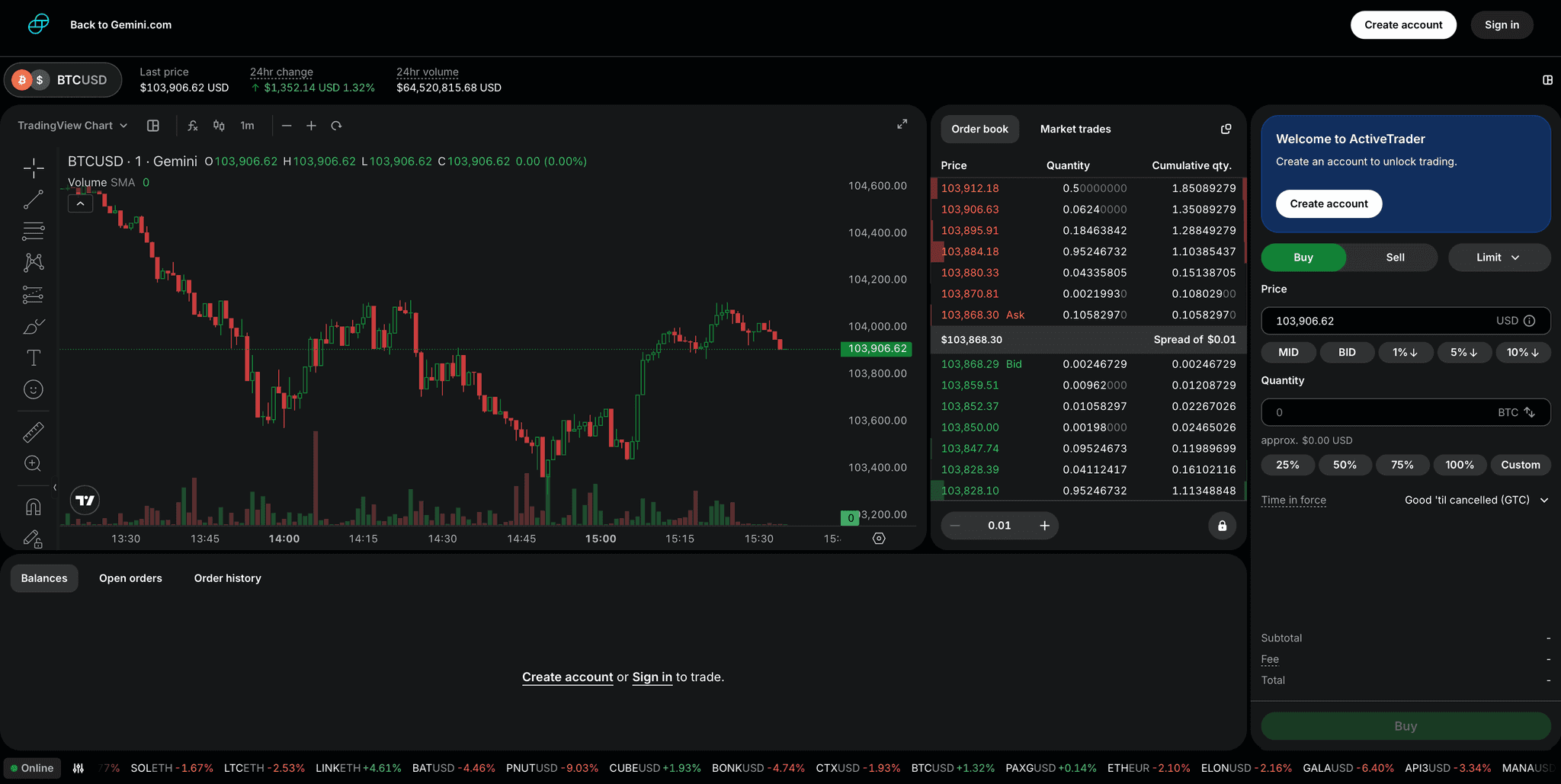

Practical Steps for Secure Crypto Onboarding in 2025

With the regulatory landscape transformed, newcomers must update their approach to getting started in crypto. Here are actionable steps that reflect the new reality under US stablecoin law 2025:

2025 Checklist for Safe Crypto Onboarding Post-GENIUS Act

-

Verify Stablecoin Issuer Licensing: Ensure the stablecoin is issued by a federally recognized Permitted Payment Stablecoin Issuer as defined by the GENIUS Act. This includes subsidiaries of insured depository institutions, nonbank entities, federal branches of foreign banks, and uninsured national banks.

-

Check Reserve Backing and Composition: Confirm that the stablecoin maintains 1:1 reserve backing with approved assets such as U.S. currency, bank deposits, short-term U.S. Treasuries, or eligible money market funds, as mandated by the new law.

-

Review Monthly Transparency Reports: Access the latest independently audited monthly reports from the issuer, detailing outstanding stablecoins and reserve composition, with CEO/CFO attestations as required by the Act.

-

Confirm AML and KYC Compliance: Use platforms that implement robust anti-money laundering (AML) and know your customer (KYC) procedures in line with GENIUS Act and federal requirements.

-

Monitor Regulatory Updates and Consumer Alerts: Stay informed through official channels like the Federal Reserve, OCC, and SEC for the latest guidance and alerts on stablecoin issuers and crypto onboarding.

For those new to digital assets, it’s now essential to verify whether a stablecoin issuer is listed as a permitted payment stablecoin issuer under federal guidelines. Monthly reserve reports, now mandatory, offer an accessible way to assess whether an asset is fully backed and well-managed. This transparency helps demystify what was once a black box for most users.

Opportunities and Challenges Ahead

The GENIUS Act’s impact isn’t universally positive for every player in the market. Smaller, non-compliant projects may find it difficult or impossible to compete with federally regulated issuers due to increased compliance costs and reporting burdens. However, this culling effect is precisely what many industry veterans have called for, a shift toward quality over quantity that strengthens the overall ecosystem.

Meanwhile, larger financial institutions can leverage their compliance infrastructure and capital reserves to quickly enter the market or expand existing offerings. As more banks and fintechs launch their own stablecoins or custody solutions, consumers will benefit from greater choice and competitive innovation, all within a framework that prioritizes safety and reliability.

What Should Crypto Beginners Watch For?

Crypto onboarding in 2025 will look very different than in previous years:

- Regulatory status: Always confirm if your chosen platform’s stablecoins are issued by federally recognized entities.

- Reserve transparency: Review monthly public attestations before holding significant balances.

- Fee structures: New compliance costs may affect transaction fees or spreads, compare across platforms.

- Onboarding support: Look for platforms offering clear guidance on regulatory compliance and consumer rights under new laws.

The GENIUS Act has also clarified what falls outside its scope, tokenized deposits by banks remain untouched, leaving room for further innovation in digital banking products without crowding out regulated payment stablecoins (source). This dual-track approach could drive even more experimentation as banks explore tokenization alongside compliant stablecoins.

Long-Term Implications: A More Mature Crypto Ecosystem

The GENIUS Act represents a turning point where regulatory clarity meets technological innovation, ushering in an era where trust is built into the system rather than assumed or improvised by users. The likely result? Increased adoption among mainstream consumers, deeper institutional engagement, and fewer high-profile failures due to mismanagement or insufficient reserves.

If you’re considering entering crypto this year, remember: robust regulation doesn’t eliminate all risk, but it does raise the bar for safety and transparency across the board. By following updated onboarding best practices tailored to this new environment, and monitoring issuer disclosures, you’ll be positioned to benefit from both innovation and protection as digital assets continue their march into everyday finance.