Interactive Brokers’ recent foray into the stablecoin sector marks a pivotal moment for crypto onboarding, especially as regulatory clarity emerges in the United States. With Interactive Brokers Group Inc (IBKR) currently trading at $65.39, the firm’s move to launch its own stablecoin is not just a technical upgrade but a calculated response to shifting market dynamics and evolving client expectations.

Why Interactive Brokers Stablecoin Matters Now

The timing of this initiative is no coincidence. The passage of the GENIUS Act, which mandates full reserve backing and stringent transparency for stablecoins, has set new standards for digital asset issuers. Legacy players like Tether are scrambling to adapt, as evidenced by their recent unveiling of a U. S. -compliant stablecoin (AInvest). Meanwhile, Interactive Brokers is leveraging its reputation for robust risk management and regulatory compliance to enter this highly scrutinized space.

Unlike many crypto-native platforms, Interactive Brokers aims to use its proposed stablecoin to facilitate 24/7 funding for brokerage accounts. This directly addresses one of the most persistent friction points in traditional finance – the limitations imposed by banking hours. By enabling instant deposits and withdrawals, IBKR’s stablecoin could make crypto onboarding as seamless as topping up a brokerage account after hours or during weekends.

Wall Street’s Embrace of Stablecoins: A New Competitive Frontier

This move follows a broader trend among Wall Street firms integrating blockchain infrastructure into their core services. Robinhood’s recent launch of USDG via a consortium including Paxos and Kraken signals that dollar-pegged digital assets are quickly becoming table stakes in mainstream finance (Newsmax). For Interactive Brokers’ 3.87 million clients (as of June 2025), this means access to faster settlements and improved liquidity – features previously reserved for crypto-native exchanges.

The implications extend beyond customer convenience. By supporting both proprietary and third-party stablecoins (contingent on issuer credibility), Interactive Brokers is positioning itself as an on-ramp not only for seasoned traders but also for beginners looking to bridge traditional finance with digital assets. This approach could accelerate mainstream adoption by reducing perceived risks associated with lesser-known or unregulated tokens.

The Regulatory Backdrop: GENIUS Act Reshapes the Playing Field

The GENIUS Act has fundamentally altered the calculus for all U. S. -based stablecoin issuers. It requires 100% reserves held in high-quality liquid assets, regular audits, and licensing – effectively raising the barrier to entry while providing much-needed consumer protection (John Lothian News). Tether’s status as an industry giant is now challenged by regulatory headwinds; meanwhile, trusted financial institutions like Interactive Brokers can leverage their compliance infrastructure as a competitive advantage.

This shift is not just theoretical – it has immediate practical effects on how new users experience crypto onboarding. With transparent reserve backing and regulated issuance, clients can have greater confidence that their digital dollars are safe from hidden risks or opaque accounting practices.

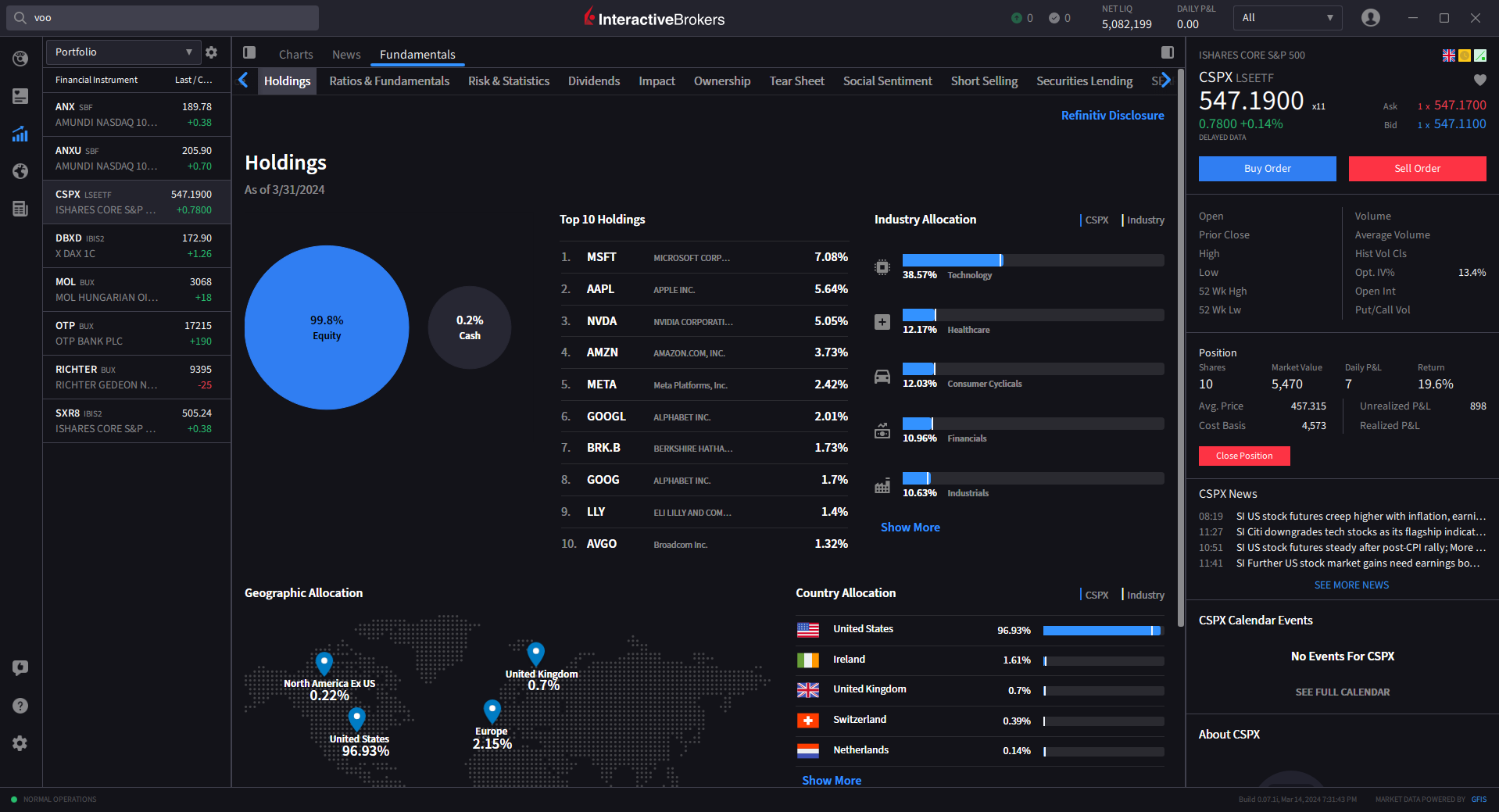

Interactive Brokers Group Inc. (IBKR) Stock Price Prediction 2026-2031

Forecasts reflect current market context, stablecoin integration, and evolving digital asset regulations.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change (Avg. vs. Current) | Key Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $59.00 | $68.00 | $77.00 | +4% | Stablecoin launch drives new accounts, but regulatory adaptation costs weigh on margins. |

| 2027 | $61.00 | $72.00 | $83.00 | +10% | Ongoing digital asset adoption and 24/7 funding boost client activity; market volatility persists. |

| 2028 | $64.00 | $77.00 | $90.00 | +18% | Full regulatory clarity on stablecoins; IBKR stablecoin widely adopted, improving client retention. |

| 2029 | $67.00 | $83.00 | $98.00 | +27% | IBKR benefits from leading digital asset infrastructure; increased competition from fintechs. |

| 2030 | $70.00 | $89.00 | $106.00 | +36% | Broader institutional adoption of crypto services; stablecoin revenue becomes material. |

| 2031 | $73.00 | $95.00 | $115.00 | +45% | IBKR emerges as a top global crypto-onboarding platform; strong earnings growth despite new entrants. |

Price Prediction Summary

IBKR’s stock price outlook is moderately bullish, reflecting the company’s strategic push into stablecoins and digital assets. While regulatory adaptation introduces near-term uncertainty and costs, Interactive Brokers’ expanding user base and leadership in integrated crypto services provide strong growth potential. The upside scenario is driven by successful stablecoin adoption and broader digital asset integration, while downside risks include regulatory setbacks or technological disruption.

Key Factors Affecting Interactive Brokers Group Inc. Stock Price

- Successful launch and adoption of IBKR’s stablecoin for 24/7 funding.

- Growth in client accounts and trading volumes due to digital asset offerings.

- Impact and adaptation to stablecoin regulation (GENIUS Act and similar).

- Competition from fintechs and other brokers entering crypto markets.

- Broader trends in institutional and retail adoption of digital assets.

- Macroeconomic conditions, interest rates, and overall equity market performance.

- Operational execution, cost control, and ability to monetize new services.

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

Expanding Crypto Onboarding: From Trading Pairs to Seamless Funding

Since 2021, Interactive Brokers has methodically expanded its cryptocurrency offerings, supporting an array of assets from Bitcoin (BTC) and Ethereum (ETH) to Solana (SOL), Cardano (ADA), Ripple (XRP), and Dogecoin (DOGE). The introduction of a native or supported stablecoin completes this ecosystem by solving one of crypto’s biggest pain points: frictionless fiat-to-crypto transitions at any hour (Interactive Brokers official announcement).

For both retail and institutional clients, this means funding brokerage accounts, executing trades, and moving capital between crypto and traditional assets can all happen in real time. No more waiting for ACH transfers to clear or being limited by bank holidays. This is a watershed moment for crypto onboarding, especially for those who have hesitated due to operational bottlenecks.

Risk mitigation remains central to Interactive Brokers’ approach. By considering support only for third-party stablecoins that meet high standards of credibility and compliance, the firm reduces exposure to counterparty risks that have plagued less regulated platforms. This dual-track strategy, offering both a proprietary stablecoin and carefully vetted external tokens, could make IBKR a preferred gateway for conservative investors seeking exposure to digital assets without compromising on safety.

What It Means for Crypto Beginners

The onboarding process has historically been one of the most intimidating hurdles for newcomers. Complex wallet setups, opaque fee structures, and concerns about unregulated actors have all contributed to a steep learning curve. Interactive Brokers’ entry into the stablecoin space promises to lower these barriers in several ways:

How Interactive Brokers’ Stablecoin Could Simplify Crypto Onboarding

-

24/7 Instant Account Funding: Interactive Brokers’ stablecoin initiative aims to enable round-the-clock deposits and withdrawals, eliminating delays caused by traditional banking hours. This allows beginners to move funds instantly, aligning with the continuous nature of crypto markets.

-

Reduced Reliance on Traditional Banks: By facilitating direct stablecoin transfers, Interactive Brokers could reduce dependence on conventional bank transfers, which are often slow and can be intimidating for newcomers.

-

Seamless Integration with Existing Brokerage Accounts: The stablecoin would be natively supported within Interactive Brokers’ platform, letting users manage both traditional and crypto assets in one place—simplifying the onboarding process for those new to digital currencies.

-

Enhanced Security and Compliance: As a regulated U.S. brokerage, Interactive Brokers is expected to adhere to strict compliance and transparency standards, addressing common concerns about stablecoin safety and regulatory oversight for beginners.

-

Support for Credible Third-Party Stablecoins: In addition to its own token, Interactive Brokers is considering offering support for reputable third-party stablecoins, giving users more trusted options for funding and withdrawals.

First, existing clients can leverage familiar interfaces and customer support channels while gaining access to 24/7 funding. Second, transparent regulatory compliance provides peace of mind often lacking in decentralized alternatives. Finally, by integrating digital dollars directly into their brokerage ecosystem, IBKR enables users to experiment with crypto markets without leaving their trusted financial institution.

“The GENIUS Act has changed the game, now it’s about trust as much as technology. “

Market Impact: Pricing Power and Competitive Pressures

Interactive Brokers Group Inc (IBKR) is currently priced at $65.39. While this figure reflects broader market sentiment, the firm’s pivot toward blockchain-based settlement could influence its valuation trajectory in the quarters ahead. As more institutions follow suit, either launching their own stablecoins or partnering with established issuers, the competitive landscape will shift toward those who can offer seamless onboarding without sacrificing regulatory safeguards.

The GENIUS Act’s requirements also mean that only entities with robust financial controls will be able to compete effectively in the U. S. stablecoin arena. This creates new opportunities for regulated brokers but raises existential questions for offshore or under-collateralized issuers such as Tether, whose market dominance is now under scrutiny (Wall Street Journal coverage).

Looking Ahead: The Future of Crypto Onboarding on Wall Street

The convergence of regulatory clarity, technological innovation, and evolving client expectations is setting the stage for a new era in digital asset adoption. Interactive Brokers’ potential rollout of a native stablecoin, and its willingness to embrace credible third-party tokens, signals that mainstream finance is not just experimenting with blockchain but actively reshaping how individuals access global markets.

If successful, this initiative could become the blueprint for other brokerages looking to bridge traditional finance with digital assets securely and efficiently. For investors at every level, from cautious beginners to seasoned professionals, the result is greater choice, faster access, and enhanced peace of mind as crypto becomes an integrated part of everyday portfolio management.