Hong Kong is stepping boldly into the next phase of digital asset regulation, with its new stablecoin licensing regime set to take effect on August 1,2025. This move is already reshaping the landscape for both crypto newcomers and seasoned investors. As Bitcoin (BTC) trades at $117,746 and Ethereum (ETH) at $3,791.05, Hong Kong’s approach could set a global benchmark for stablecoin oversight and investor protection.

Why Stablecoin Regulation Matters for Crypto Onboarding in 2025

Stablecoins have become the backbone of crypto onboarding. They offer a familiar entry point for buyers seeking to avoid volatility while bridging traditional finance and digital assets. However, past scandals and collapses involving unregulated issuers have underscored the need for robust oversight.

The Hong Kong Monetary Authority (HKMA) has responded by requiring all fiat-referenced stablecoin issuers operating in or from Hong Kong to obtain a license. This new framework mandates strict operational standards, including reserve management and redemption procedures. The goal: enhance trust and transparency while making it easier – and safer – for new users to buy stablecoins.

What Are the Key Features of Hong Kong’s Stablecoin Regulations?

The regulatory regime introduces several critical requirements:

- Licensing: Only entities licensed by the HKMA can issue fiat-referenced stablecoins in or from Hong Kong.

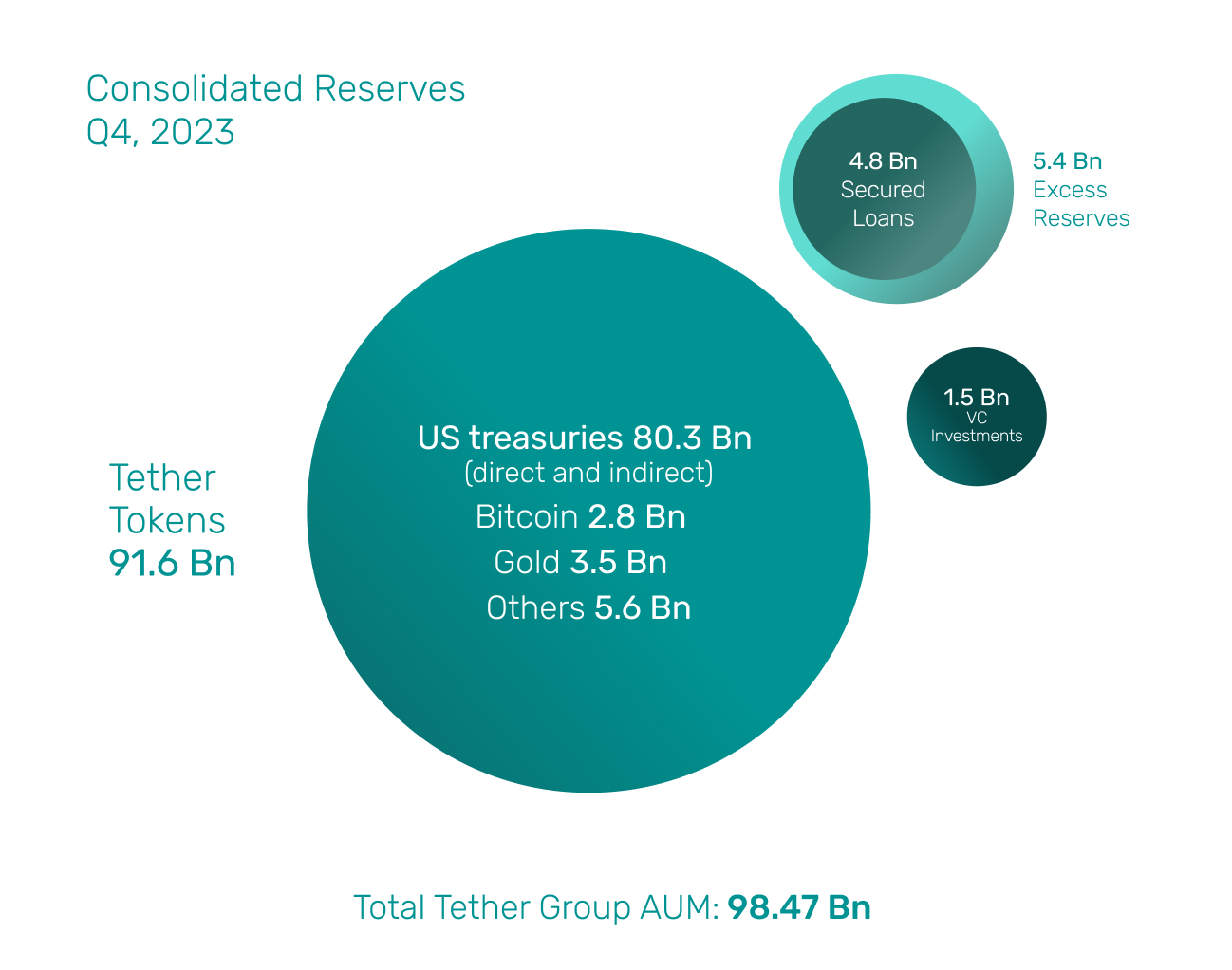

- Reserve Management: Issuers must fully back their coins with high-quality reserve assets and disclose holdings regularly.

- Redemption Rights: Users must be able to redeem stablecoins at par value under clear procedures.

- AML and Risk Controls: Stringent anti-money laundering (AML) rules and risk management frameworks are obligatory.

This means that buyers can expect increased accountability from issuers – a significant shift from earlier days when “buyer beware” was often the only rule in town.

The Rise of Jcoin: Corporate Adoption Signals New Era

The regulatory clarity has already attracted major players. JD. com’s registration of “Jcoin” and “Joycoin” positions it at the forefront of compliant stablecoin innovation in Hong Kong. This signals a potential wave of corporate-backed tokens entering the market under strict supervision – a development that could foster mainstream adoption while giving buyers more choices backed by established brands.

The HKMA’s public registry will allow buyers to verify which coins are officially licensed, reducing risks associated with unregulated projects. For those just starting their crypto journey in 2025, this registry is an essential tool for buying stablecoins safely and avoiding scams or fly-by-night operators.

Cryptocurrency Price Predictions Post-Hong Kong Stablecoin Regulations (2026-2031)

Projected Price Ranges for Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) in a Regulated Hong Kong Market Environment

| Year | BTC Minimum Price | BTC Average Price | BTC Maximum Price | ETH Minimum Price | ETH Average Price | ETH Maximum Price | USDT Minimum Price | USDT Average Price | USDT Maximum Price | Key Scenario/Insight |

|---|---|---|---|---|---|---|---|---|---|---|

| 2026 | $97,000 | $123,000 | $145,000 | $3,200 | $4,250 | $5,100 | $0.98 | $1.00 | $1.02 | Market digests new HKMA regulations; stablecoins remain tightly pegged, BTC/ETH volatility persists |

| 2027 | $110,000 | $132,000 | $160,000 | $3,600 | $4,600 | $5,800 | $0.98 | $1.00 | $1.02 | Increased institutional adoption and new stablecoin entrants (e.g., Jcoin); continued regulatory clarity |

| 2028 | $125,000 | $145,000 | $175,000 | $4,000 | $5,200 | $6,500 | $0.98 | $1.00 | $1.02 | Broader use of stablecoins in Asia; ETH benefits from scaling upgrades; possible BTC consolidation |

| 2029 | $118,000 | $138,000 | $170,000 | $3,800 | $4,900 | $6,000 | $0.98 | $1.00 | $1.02 | Potential market correction; HKMA regime matures, stablecoin trust at all-time high |

| 2030 | $135,000 | $155,000 | $190,000 | $4,400 | $5,700 | $7,400 | $0.98 | $1.00 | $1.02 | Bullish scenario for digital assets; stablecoin competition increases, but USDT maintains dominance |

| 2031 | $140,000 | $166,000 | $210,000 | $4,900 | $6,200 | $8,300 | $0.98 | $1.00 | $1.02 | Global stablecoin adoption peaks; regulatory harmonization supports robust crypto markets |

Price Prediction Summary

The introduction of Hong Kong’s stablecoin regulatory regime is expected to enhance market security and stability, encouraging greater institutional adoption and innovation. Bitcoin and Ethereum are likely to experience both growth and periods of consolidation, reflecting broader market cycles and the impact of regulatory clarity. Tether (USDT) is projected to maintain its USD peg with minimal volatility, benefiting from strengthened operational standards and increased user confidence. The competitive landscape may shift with new entrants like Jcoin, but USDT is expected to remain the leading stablecoin in the region.

Key Factors Affecting Tether Price

- Implementation and enforcement of HKMA’s stablecoin regulations

- Entry of new stablecoin competitors (e.g., Jcoin) and market response

- Institutional adoption and mainstream use of digital assets in Asia

- Global macroeconomic conditions and crypto market cycles

- Technological improvements in blockchain scalability and security

- Evolution of regulatory harmonization across regions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating Compliance: What Every Crypto Buyer Must Know

If you’re considering your first purchase or looking to move funds into digital assets, understanding these compliance changes is crucial. Not only do they provide greater peace of mind around asset safety, but they also level the playing field between retail buyers and institutional investors.

The market’s stability is reflected in current prices: Bitcoin holds steady at $117,746, while Tether (USDT) and USD Coin (USDC) continue trading close to their peg values. Such price consistency underscores how regulatory measures can help dampen volatility – especially important for onboarding users who value predictability over speculation.

However, the benefits of Hong Kong’s stablecoin regulations extend beyond just investor protection. By fostering a transparent and compliant environment, the city is actively inviting financial innovation while setting clear expectations for all market participants. This is especially significant for those new to crypto onboarding in 2025, as it reduces the learning curve and helps build confidence in digital asset transactions.

How to Safely Buy Stablecoins Under the New Regime

Navigating the new landscape is straightforward if you follow a few essential steps. Here’s how buyers can approach stablecoins safely under Hong Kong’s updated rules:

Safe Stablecoin Buying Checklist in Hong Kong (2025)

-

Verify the Issuer’s License on the HKMA Register: Before purchasing, confirm that the stablecoin issuer is listed on the Hong Kong Monetary Authority’s (HKMA) Register of Licensed Stablecoin Issuers. Only licensed issuers are legally permitted to operate under the new regime. Check the HKMA Register here.

-

Choose Reputable Platforms for Transactions: Use well-established crypto exchanges and platforms such as HashKey Exchange or OSL, both licensed in Hong Kong, to buy, sell, or store stablecoins. These platforms comply with local regulations and offer enhanced consumer protections.

-

Check Stablecoin Reserve Transparency: Review the reserve asset disclosures of the stablecoin you intend to buy (e.g., Tether (USDT), USD Coin (USDC)). Licensed issuers must publish clear, up-to-date information on their reserves to ensure 1:1 backing and redemption capability.

-

Review AML and KYC Requirements: Be prepared to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) checks when onboarding with licensed platforms or issuers. This is now mandatory under Hong Kong’s new regulations to enhance market integrity.

-

Monitor Stablecoin Peg and Market Price: Confirm that the stablecoin is trading close to its pegged value (e.g., USDT and USDC near $1) on major platforms. As of July 30, 2025, Bitcoin (BTC) is $117,746 and Ethereum (ETH) is $3,791.05, reflecting a stable market environment.

-

Stay Informed About Regulatory Updates: Regularly check the HKMA website and reputable news sources (e.g., Reuters) for updates on stablecoin regulations, new licensed issuers, and market developments such as JD.com’s Jcoin registration.

First, always check the HKMA’s public register of licensed stablecoin issuers. Only purchase from entities listed there. Next, review issuer disclosures about reserve assets and redemption processes. Reputable issuers will provide transparent information about how your funds are backed and how you can redeem your coins.

For beginners, understanding compliance requirements can seem daunting. Yet, with robust AML protocols now mandatory, buyers are better shielded from illicit activity risks that have plagued unregulated markets in the past. The HKMA’s guidelines also require issuers to implement ongoing risk management, another layer of security for new entrants.

What to Watch: Market Trends and Corporate Influence

The entry of major corporations like JD. com into Hong Kong’s regulated stablecoin market could transform how digital money is used day-to-day. With “Jcoin” and “Joycoin” poised to launch under strict oversight, we may see broader integration with e-commerce platforms and payment systems, making crypto onboarding even more seamless for everyday users.

It’s also worth noting that other tech giants are eyeing similar moves. As more established firms seek licenses, buyers should expect a growing selection of trustworthy options, potentially driving further innovation in both product offerings and user experience.

Staying Informed: Resources for Crypto Compliance in 2025

With regulatory frameworks evolving rapidly, staying informed is crucial. Regularly consult official HKMA releases and industry news to monitor updates on licensed issuers or any changes in operational standards. For those onboarding into crypto for the first time, or helping others do so, educational resources will be invaluable as compliance norms mature.

Ultimately, Hong Kong’s new regime marks a turning point for digital asset adoption across Asia. By prioritizing transparency and security without stifling innovation, these regulations offer a blueprint that other jurisdictions may soon follow. For crypto buyers in 2025, this means greater confidence when entering the market, and a smoother path toward financial participation in the digital age.