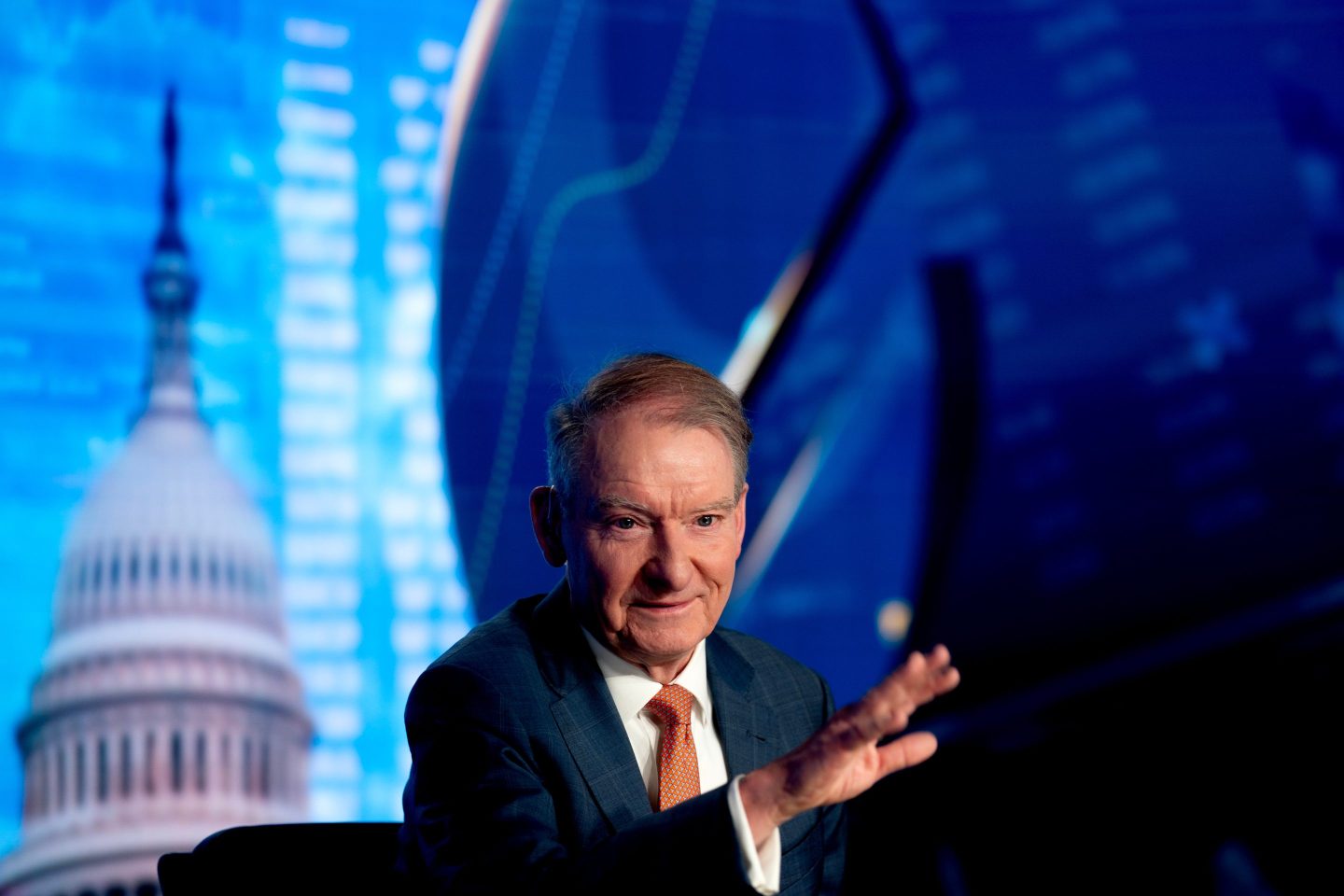

On July 31,2025, the U. S. Securities and Exchange Commission (SEC) made its boldest move yet to reshape the landscape for crypto investors. By launching Project Crypto, SEC Chair Paul Atkins signaled a new era of regulatory clarity and innovation for digital assets. For anyone onboarding into crypto or managing a portfolio today, these changes are not just bureaucratic tweaks, they could fundamentally alter how you buy, hold, and interact with cryptocurrencies in the U. S.

Project Crypto: A Regulatory Turning Point for Digital Assets

The SEC’s Project Crypto initiative is designed to modernize outdated securities rules that have long struggled to keep pace with blockchain technology. The headline? The SEC is finally moving toward clearer classifications for crypto assets, distinguishing between what counts as a security and what does not. This is huge for investors who have faced years of uncertainty about whether their favorite tokens might suddenly fall under stricter regulation.

Notably, Project Crypto will also introduce tailored disclosure requirements for tokenized securities, meaning projects that tokenize real-world assets or equities will have specific guidelines to follow. This should help weed out scams while making it easier for legitimate projects to comply.

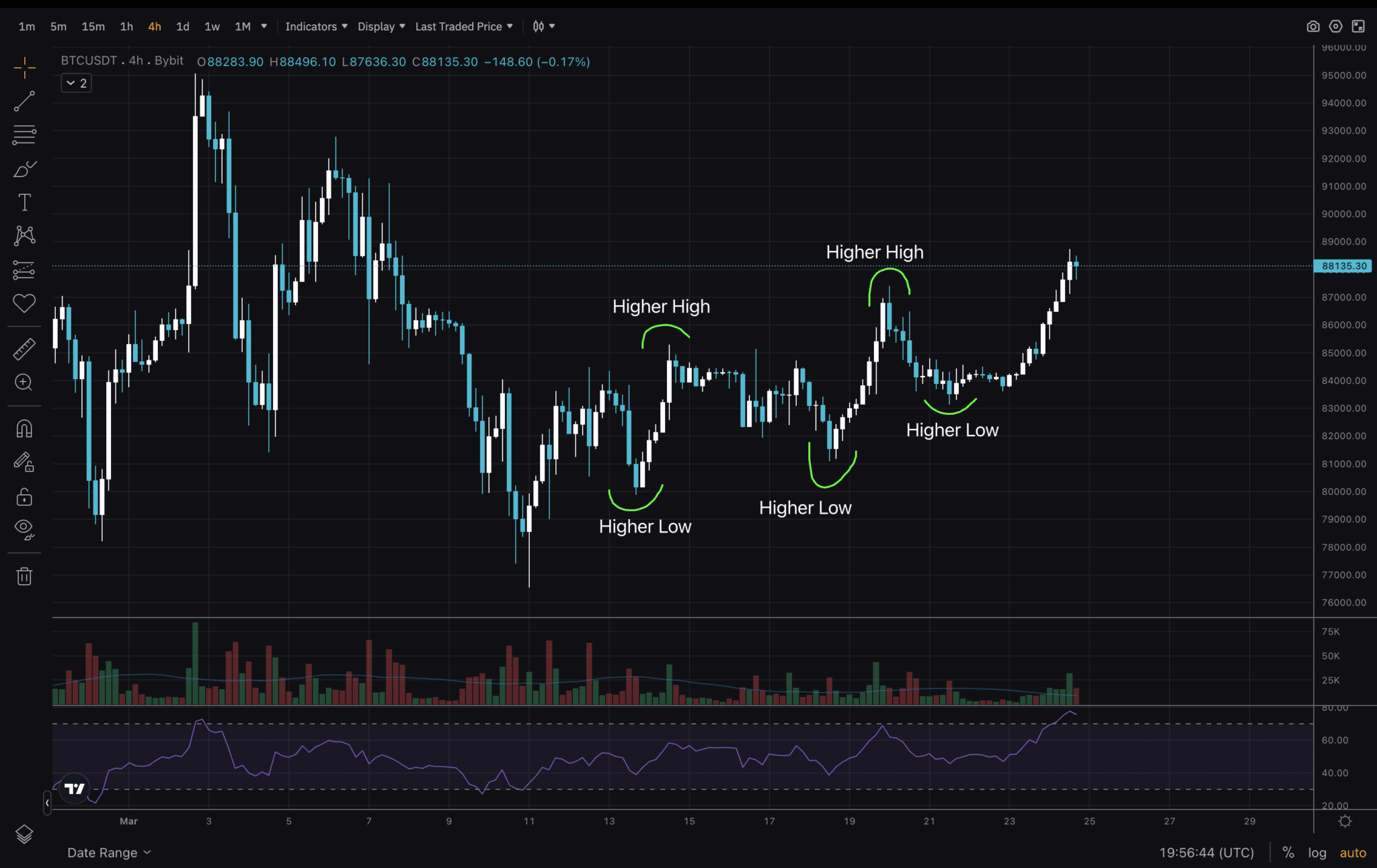

The market has responded with cautious optimism. As of August 1,2025, Bitcoin (BTC) is trading at $113,010.00, reflecting both anticipation and volatility as investors digest what these changes might mean for the future of digital finance.

The Rise of Super-Apps: One License, Many Services

Perhaps the most transformative piece of Project Crypto is its embrace of so-called super-apps. Under this framework, broker-dealers can offer everything from trading security tokens and non-security crypto assets to staking and lending, all under a single federal license. No more juggling dozens of state applications or worrying about patchwork compliance headaches.

This centralization could make onboarding dramatically simpler for new investors while helping established players streamline their offerings. Imagine opening one app where you can buy Bitcoin, stake Ethereum, lend stablecoins, and track your entire portfolio, without worrying if you’re violating some obscure state rule.

- Simplified onboarding: Fewer regulatory hurdles mean faster access for retail investors.

- Integrated services: Trading, staking, lending, all in one place.

- Improved compliance: Standardized rules reduce legal ambiguity for both platforms and users.

This approach not only promises efficiency but could also help position the U. S. as a global leader in blockchain finance, a goal highlighted by multiple sources including Reuters.

The New Era of Self-Custody and Modernized Safekeeping Rules

An equally important shift under Project Crypto is the SEC’s explicit recognition of self-custody rights. Investors will have greater freedom, and responsibility, to hold their own crypto using personal wallets rather than relying solely on exchanges or custodians. At the same time, registered intermediaries will see custody rules updated to better fit digital asset realities (AInvest). This dual-track approach empowers individuals while providing more robust protections at the institutional level.

Bitcoin (BTC) Price Prediction Post-SEC ‘Project Crypto’ Implementation (2026-2031)

Forecasts reflect the impact of SEC regulatory modernization, evolving adoption, and market cycles. All prices are in USD.

| Year | Minimum Price | Average Price | Maximum Price | Year-on-Year Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $92,000 | $128,000 | $165,000 | +13% | Regulatory clarity spurs institutional inflows, but volatility remains as the market digests new rules. |

| 2027 | $110,000 | $145,000 | $190,000 | +13% | Wider adoption of super-apps and clearer custody guidelines increase mainstream usage and trading volume. |

| 2028 | $125,000 | $165,000 | $220,000 | +14% | Bitcoin integration into traditional finance accelerates; global macroeconomic uncertainties drive safe-haven appeal. |

| 2029 | $140,000 | $185,000 | $250,000 | +12% | Greater retail and institutional participation; competition from other digital assets intensifies, but BTC retains lead. |

| 2030 | $155,000 | $205,000 | $280,000 | +11% | Sustained growth as regulatory frameworks stabilize and on-chain finance becomes standard. |

| 2031 | $170,000 | $225,000 | $320,000 | +10% | Matured regulatory environment and mass adoption position Bitcoin as a core digital asset globally. |

Price Prediction Summary

Bitcoin is poised for steady growth through 2031, fueled by regulatory clarity, innovation in digital asset services, and broader integration into traditional financial systems. While volatility will persist, especially as new rules are implemented, BTC’s status as a digital store of value and its increasing role in global finance support a bullish long-term outlook. Minimum and maximum price ranges reflect both potential bearish scenarios (regulatory setbacks, macro shocks) and bullish outcomes (rapid adoption, financialization).

Key Factors Affecting Bitcoin Price

- SEC’s Project Crypto brings regulatory clarity and encourages institutional participation.

- Super-apps and improved custody rules expand access and usability for retail and institutional users.

- Potential for global macroeconomic instability may drive increased demand for Bitcoin as a hedge.

- Ongoing technological improvements (scalability, security) enhance BTC’s utility.

- Competition from other digital assets and potential regulatory setbacks could cap upside or increase volatility.

- Market cycles (halving events, liquidity shifts) will continue to influence price swings.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The upshot? If you’re onboarding into crypto now, or advising clients on how to do so, the regulatory environment promises to be far less ambiguous than in previous years. But it also means keeping up-to-date with compliance requirements as they evolve through 2025 and beyond.

For long-term investors, the SEC’s pivot could mark a watershed moment. The clarity around what constitutes a security will finally make it easier to assess risks and opportunities in both established coins and emerging tokens. With Bitcoin holding steady at $113,010.00 despite recent volatility, the market seems to be weighing the potential for streamlined access and institutional adoption against short-term regulatory uncertainty.

What Crypto Investors Should Do Now

With Project Crypto’s rollout, it’s crucial for both new and seasoned investors to adapt their onboarding strategies. Here are some actionable steps to consider as the regulatory landscape shifts:

Tips for U.S. Crypto Investors Navigating Project Crypto

-

Stay Updated on SEC Guidance: Regularly review official updates from the U.S. Securities and Exchange Commission regarding Project Crypto to ensure compliance with evolving regulations.

-

Review Asset Classifications: Monitor how the SEC distinguishes between security and non-security crypto assets to understand which of your holdings may be subject to new disclosure or registration requirements.

-

Evaluate Your Custody Solutions: Consider using reputable self-custody wallets like Ledger or Trezor, as the SEC is emphasizing the right to self-custody and updating rules for intermediaries.

-

Explore Regulated Super-Apps: Look for established broker-dealers or platforms—such as Robinhood or Coinbase—that may integrate new ‘super-app’ features under SEC-compliant frameworks.

-

Track Market Volatility: Pay attention to current prices and fluctuations, such as Bitcoin’s price at $113,010.00 (24h change: -$3,096.00), to make informed investment decisions as regulations evolve.

-

Consult a Licensed Financial Advisor: Seek guidance from professionals with experience in digital assets and U.S. securities law to adapt your strategy as Project Crypto rules are implemented.

Review your custody strategy: If you currently rely on exchanges for storage, now is a good time to explore self-custody options or hybrid solutions. The SEC’s new stance makes personal wallets more attractive but also places more responsibility on you for asset security.

Stay updated on compliance requirements: As rules evolve, especially regarding tokenized securities and super-app licensing, make sure your platforms of choice are proactively updating their compliance measures. This will help you avoid unexpected disruptions or legal exposure.

Diversify with confidence: Clearer asset classifications mean you can expand your portfolio into new digital assets with greater certainty about their regulatory status. But always balance growth with risk management, regulatory clarity does not eliminate market volatility.

The Bigger Picture: U. S. Leadership and Global Implications

The SEC’s modernization push is not happening in a vacuum. By positioning the U. S. as a leader in digital finance regulation, Project Crypto could set benchmarks that influence global standards. If successful, American investors may benefit from earlier access to innovative products and more robust protections than peers abroad.

This initiative also signals that Washington is taking crypto seriously, not just as a speculative asset class but as an integral part of the future financial system. For those who have waited on the sidelines due to regulatory fog, this could be the green light they’ve been waiting for.

Looking Ahead: Navigating 2025’s Regulatory Shifts

The next year will be pivotal as Project Crypto moves from announcement to implementation. Investors should expect ongoing updates as the SEC finalizes disclosure requirements, super-app frameworks, and custody rules throughout 2025 (CNBC). Proactive education, whether through official sources or community discussions, will be key to staying compliant while seizing new opportunities.

If you’re building your first crypto portfolio or advising others through onboarding, now is the time to embrace both caution and curiosity. Regulatory clarity does not mean risk-free investing, but it does mean fewer unknowns for those willing to learn and adapt.