In July 2025, the U. S. Securities and Exchange Commission (SEC) took a decisive step into the future of finance with the launch of ‘Project Crypto’. This initiative is designed to overhaul outdated securities regulations and facilitate crypto-based trading, with a clear focus on making blockchain technology a core pillar of American financial infrastructure. For anyone interested in crypto onboarding, these regulatory changes are more than bureaucratic adjustments, they represent a new era for digital asset adoption in the United States.

Project Crypto: A Paradigm Shift for Onboarding

The SEC’s Project Crypto is not just another regulatory tweak. According to SEC Chair Paul Atkins, the goal is to “move U. S. financial markets on-chain” and prevent innovative crypto companies from leaving for more favorable jurisdictions. This marks a significant departure from previous years, where regulatory uncertainty and compliance burdens pushed many startups offshore. The official announcement underscores how this initiative aims to streamline onboarding processes for both individuals and institutions.

Key features of Project Crypto include:

Key Elements of SEC’s Project Crypto Impacting Onboarding

-

Modernization of Securities Regulations for Digital Assets: Project Crypto is overhauling outdated securities rules to accommodate blockchain-based trading and digital asset issuance, streamlining the onboarding process for both retail and institutional investors.

-

Permitting In-Kind Creations and Redemptions: The SEC now allows in-kind creations and redemptions for crypto-based funds, enabling smoother onboarding for asset managers and reducing operational friction for new crypto investment products.

-

Clarity on Initial Coin Offerings (ICOs) and Capital Raising: Project Crypto signals a policy shift by embracing ICOs and crypto-based capital formation, providing clear guidelines for compliant onboarding of new digital asset issuers and investors.

-

Integration of Blockchain in U.S. Financial Infrastructure: The initiative aims to transition U.S. financial markets onto blockchain technology, facilitating seamless onboarding through transparent, on-chain processes and reducing reliance on legacy systems.

-

Regulatory Clarity and Reduced Compliance Barriers: Project Crypto, in alignment with the White House’s crypto policy report, focuses on removing compliance obstacles and providing regulatory clarity—key factors for easier and faster onboarding of crypto firms and users.

These reforms directly address long-standing pain points in crypto compliance for beginners, making it easier to understand requirements, register accounts, and access compliant products.

The White House Push: Regulatory Clarity and National Strategy

The timing of Project Crypto aligns with the Trump administration’s sweeping strategy on digital assets. In July 2025, the White House released a comprehensive 160-page report urging agencies like the SEC to remove compliance barriers and provide unambiguous guidance on crypto integration across sectors such as taxation, banking, and retirement planning (source). The report’s message is clear: America must foster innovation while maintaining robust oversight.

“If we want to lead in blockchain innovation, we must make it easy for entrepreneurs to build here, not abroad. “

This policy environment has already led to historic legislation like the GENIUS Act and CLARITY Act, both designed to reduce ambiguity around which digital assets are securities or commodities, further smoothing the path for crypto onboarding guides aimed at U. S. -based users.

In-Kind Creations and ICOs: New Onramps for Capital Formation

The SEC’s decision to permit in-kind creations and redemptions is another headline development (SEC.gov). This means investors can now use cryptocurrencies directly, without first converting them into fiat, to participate in regulated investment vehicles. For startups, the upcoming embrace of initial coin offerings (ICOs) by U. S. regulators signals an unprecedented opportunity; capital formation will become faster, more transparent, and accessible within American borders (source).

How New US Regulations Simplify Crypto Onboarding

-

In-Kind Creations and Redemptions for Crypto ETFs: The SEC’s approval of in-kind creations and redemptions enables platforms like BlackRock’s iShares Bitcoin Trust ETF to offer faster and more efficient onboarding by allowing direct transfer of crypto assets, streamlining investment for both retail and institutional clients.

-

Support for ICOs and Tokenized Capital Raising: The SEC’s new stance on initial coin offerings (ICOs) and tokenized securities, as seen on platforms like Republic, opens legitimate fundraising channels for startups and simplifies onboarding by providing clear, regulated pathways for participation.

-

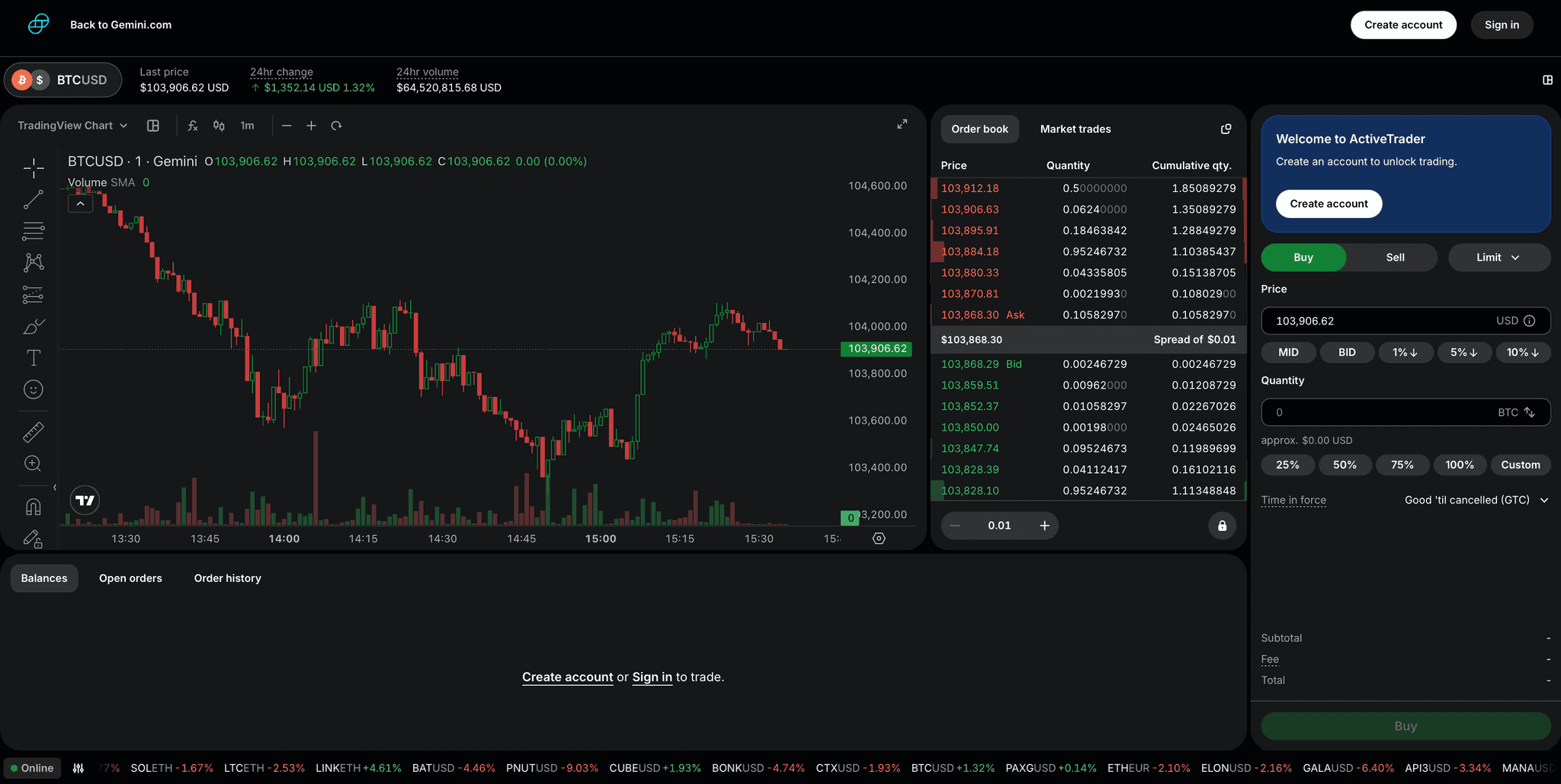

Enhanced Consumer Protections and Disclosures: New SEC rules require standardized disclosures and risk warnings on major platforms, such as Gemini, improving transparency and building trust among first-time crypto investors.

What Does This Mean for Users?

If you’re new to cryptocurrency or considering your first investment in 2025, these regulatory shifts mean simpler KYC processes, better consumer protections, and more product choices, all within a compliant framework. The days of navigating vague rules or worrying about sudden regulatory crackdowns are fading fast as U. S. agencies embrace transparency and innovation.

For crypto companies, the United States is rapidly transforming from a regulatory minefield into a global magnet for digital asset innovation. The SEC’s stated goal is to ensure that the next generation of blockchain startups can launch, fundraise, and scale without leaving U. S. soil. This shift is not just about retaining talent; it signals a deliberate move to capture global market share in crypto infrastructure and services.

From a compliance perspective, the new rules are designed with both user protection and operational efficiency in mind. Streamlined onboarding standards, like unified digital ID verification and standardized disclosures, are reducing friction for retail investors while giving institutions confidence to expand their crypto offerings. As a result, onboarding flows are faster, more intuitive, and less prone to errors or delays.

Mainstream Integration: What Onboarding Looks Like in 2025

Project Crypto’s framework means that opening a regulated crypto account now resembles opening a brokerage or savings account, with clear disclosures, robust consumer protections, and seamless fiat-crypto bridges. Many leading exchanges have already integrated real-time compliance checks and automated risk assessments at sign-up. This helps prevent fraud while keeping the user experience quick and accessible.

Step-by-Step Crypto Onboarding Under Project Crypto (2025)

-

1. Select a SEC-Registered Crypto PlatformBegin by choosing a SEC-registered digital asset platform such as Coinbase, Kraken, or Gemini. These platforms are compliant with the new regulatory requirements set by Project Crypto.

-

2. Complete Enhanced KYC/AML VerificationUnder Project Crypto, users must undergo enhanced Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. This includes biometric verification and cross-referencing with federal databases.

-

3. Link Verified U.S. Bank Account or Stablecoin WalletConnect a U.S. bank account or a regulated stablecoin wallet (e.g., USDC on Circle) to enable in-kind creations, redemptions, and fiat on/off ramps as permitted by the SEC.

-

4. Review SEC-Approved Asset ListingsBrowse and select from SEC-approved digital assets, which are clearly labeled on compliant platforms. These may include major cryptocurrencies like Bitcoin and Ethereum, as well as new tokens launched via regulated ICOs.

-

5. Complete Digital Asset Purchase or ICO ParticipationPurchase digital assets or participate in SEC-sanctioned ICOs directly through the platform, benefiting from new investor protections and transparent disclosures mandated by Project Crypto.

-

6. Secure Assets with On-Chain Custody SolutionsTransfer assets to on-chain custody solutions provided by regulated custodians like Anchorage Digital or BitGo, ensuring compliance and security under the new rules.

-

7. Monitor Tax and Compliance ReportsAccess integrated tax reporting and compliance tools within your platform dashboard, reflecting the latest IRS and SEC requirements for digital asset holdings and transactions.

These improvements are particularly significant for first-time investors who may have been deterred by complex onboarding or unclear legal status in previous years. With new guidance on asset classification (security vs commodity), tax reporting tools built into platforms, and transparent fee structures mandated by regulators, the barriers to entry have never been lower.

For institutional players, banks, pensions, asset managers, the regulatory clarity around custody solutions and capital formation (via compliant ICOs) removes much of the legal uncertainty that previously limited large-scale crypto adoption. This could unlock billions in new investment flows as digital assets become an accepted allocation within traditional portfolios.

Risks Remain: But Smart Onboarding Mitigates Them

No regulatory overhaul is without growing pains. The SEC continues to warn about risks such as market manipulation, security vulnerabilities in smart contracts, and volatility inherent to digital assets. However, by embedding risk management best practices directly into onboarding flows, such as mandatory educational modules for new investors, the likelihood of costly mistakes is reduced.

For those seeking guidance on navigating these changes, reputable crypto onboarding guides are now easier to find than ever before, and they’re tailored specifically for U. S. -based users under the 2025 ruleset.

“The U. S. is finally embracing digital assets with open arms, and clear rules. “

The upshot? Whether you’re an individual investor or an entrepreneur launching your first tokenized project, 2025’s regulatory environment offers unprecedented support without sacrificing transparency or consumer safety. If you’ve been waiting for a sign that it’s time to get started with crypto in America, the SEC’s Project Crypto is it.