On August 7,2025, President Donald Trump signed an executive order that could fundamentally reshape how Americans invest for retirement. The Trump 401(k) crypto executive order directs the Department of Labor and Securities and Exchange Commission to update regulations, clearing a path for 401(k) plans to offer access to cryptocurrencies such as Bitcoin, alongside private equity and other alternative assets. This shift is being hailed as a step toward democratizing investment options for everyday savers, but it also introduces new complexities that beginners must understand before diving in.

What Does the Trump 401(k) Crypto Executive Order Actually Change?

Until now, most 401(k) plans were limited to traditional assets: stocks, bonds, and mutual funds. The new executive order expands the menu by allowing plan sponsors to consider digital assets like Bitcoin and Ethereum. This move is not automatic – plan administrators must still review their fiduciary duties and risk management practices before adding these options. However, it signals a significant regulatory shift toward broader access.

The Department of Labor will be tasked with revising its guidelines on what qualifies as an appropriate retirement investment. As a result, you may soon see crypto index funds, ETFs tracking Bitcoin or Ethereum, or even direct crypto exposure available in your employer’s retirement plan.

Why Crypto in Retirement Accounts? Opportunities and Risks at Today’s Prices

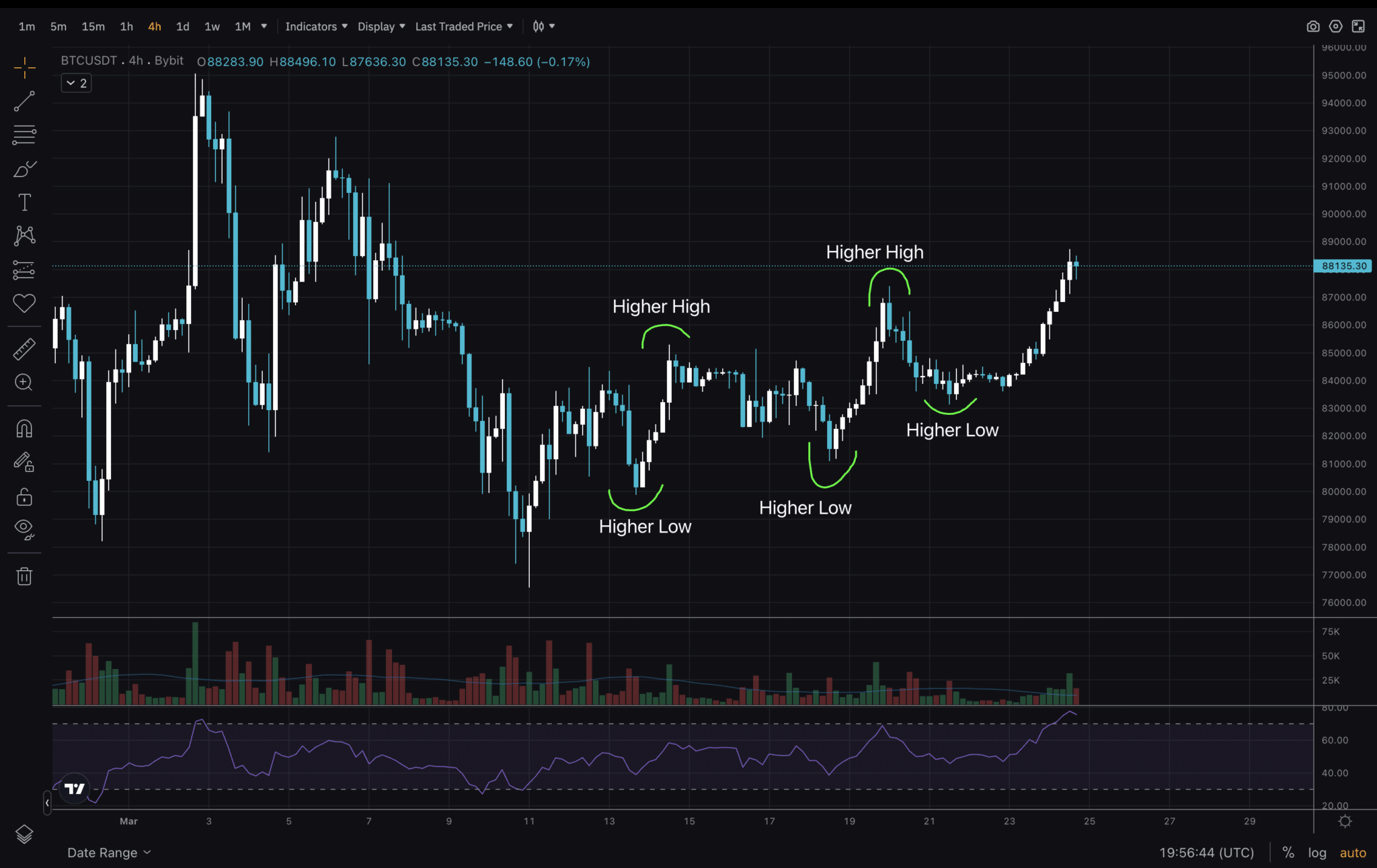

The case for including crypto in retirement portfolios is simple: over the past decade, assets like Bitcoin have delivered outsized returns compared to stocks or bonds. As of August 9,2025, Bitcoin (BTC) trades at $116,643, with an intraday high of $117,796 and a low of $116,367. Ethereum (ETH) is priced at $4,243.49 after reaching highs of $4,243.86 during the day.

This performance has attracted attention from both retail investors and institutional players seeking diversification and potential growth beyond traditional markets.

However – and this cannot be overstated – cryptocurrencies are notoriously volatile. While Bitcoin has surged past $100,000 this year, it has also experienced sharp swings within days or weeks. For retirement savers with long-term horizons but low tolerance for sudden losses near retirement age, this risk profile demands careful consideration.

Navigating Fiduciary Responsibility: What Plan Sponsors Must Weigh

The executive order does not force employers to offer crypto in their plans; instead it requires them to re-evaluate whether these assets can fit within prudent portfolio construction under updated fiduciary standards. Experts caution that factors like liquidity constraints (can you sell easily?), fee structures (are costs transparent?), and overall risk alignment must be scrutinized.

- Liquidity: Unlike stocks or ETFs traded during market hours on major exchanges, some crypto products may have limited trading windows or higher transaction costs.

- Fees: New offerings could carry higher management fees than standard index funds due to custody challenges or regulatory compliance costs.

- Diversification: While adding non-correlated assets can reduce overall portfolio volatility in theory, allocating too much to any single asset class – especially something as volatile as crypto – could backfire if markets turn sharply against you.

Bitcoin (BTC) Price Prediction 2026–2031 (Post-401(k) Executive Order)

Projections based on latest market data ($116,643 as of August 2025), regulatory changes, and adoption trends in retirement investing.

| Year | Minimum Price | Average Price | Maximum Price | Year-on-Year Avg % Change | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $95,000 | $130,000 | $165,000 | +12% | Volatility expected from initial 401(k) adoption, with increased institutional inflows driving higher averages but risk of corrections. |

| 2027 | $110,000 | $150,000 | $200,000 | +15% | Wider integration in retirement portfolios, strong demand, but possible regulatory tightening could dampen bullish extremes. |

| 2028 | $120,000 | $175,000 | $235,000 | +17% | Mainstream adoption in retirement accounts, improved custodial solutions, possible ETF boom, but global macro risks persist. |

| 2029 | $135,000 | $195,000 | $270,000 | +11% | Market matures, volatility moderates, BTC viewed as a digital gold equivalent in pensions, though altcoin competition rises. |

| 2030 | $150,000 | $220,000 | $320,000 | +13% | Steady growth as crypto becomes a standard retirement asset; possible new ATHs if global adoption accelerates. |

| 2031 | $170,000 | $250,000 | $375,000 | +14% | Long-term confidence as regulatory clarity and global pension adoption peak; bullish scenario sees BTC as a reserve asset. |

Price Prediction Summary

Bitcoin’s inclusion in 401(k) plans is a major milestone, likely fueling significant institutional inflows and broader retail adoption over the next six years. Prices are projected to trend upward, with average annual gains in the low double digits. However, volatility will remain, especially during early stages of regulatory implementation. Max price scenarios reflect strong bull cycles, while minimums account for potential market corrections and regulatory challenges. Overall, BTC is positioned as a core digital asset in retirement portfolios, with long-term upside driven by adoption and macro trends.

Key Factors Affecting Bitcoin Price

- Expanding 401(k) access and mainstream adoption of crypto in retirement plans

- Evolving regulatory landscape and fiduciary guidelines for alternative assets

- Institutional inflows and increased portfolio diversification

- Technological improvements (scalability, security, custodial solutions)

- Potential for global economic uncertainty driving demand for alternative stores of value

- Competition from altcoins and other digital assets

- Market sentiment, halving cycles, and macroeconomic trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Beginner Steps: How to Approach Crypto Onboarding for Retirement

If your employer adds digital assets following this order’s implementation – or if you’re considering rolling over into a provider that does – start by assessing your own risk tolerance and time horizon. Younger investors with decades until retirement might allocate a small portion (<10%) of their portfolio to alternatives like crypto; those closer to retirement should tread more carefully.

You’ll want to stay informed about regulatory changes as plan menus evolve over the coming months. For more details on how this policy shift might impact your future nest egg – including practical steps for onboarding into crypto investments through your workplace plan – see our full breakdown here.

Education is the cornerstone of successful retirement investing, especially when navigating new territory like digital assets. The Trump 401(k) crypto executive order may bring fresh opportunities, but it also puts the onus on individuals to understand what they’re getting into. Crypto onboarding for retirement is not just about clicking “buy” on Bitcoin; it’s about grasping how these assets behave, what drives their value, and how they fit with your broader financial goals.

Key Questions Beginners Should Ask Before Allocating to Crypto

Before you allocate even a small portion of your 401(k) to crypto, take time to reflect on the following:

Essential Questions Before Adding Crypto to Your 401(k)

-

What is my risk tolerance for volatile assets like Bitcoin? Cryptocurrency prices can swing dramatically. For example, Bitcoin (BTC) is currently priced at $116,643, but its value can change rapidly. Assess whether you are comfortable with such fluctuations in your retirement portfolio.

-

Does my 401(k) plan offer regulated crypto investment options? Not all plans will immediately support crypto. Check if your provider offers SEC-registered crypto funds or ETFs and review their track records.

-

How will adding crypto affect my portfolio diversification? Experts recommend balancing alternative assets with traditional investments. Consider how crypto fits into your overall asset allocation strategy.

-

What are the fees and expenses associated with crypto investments? Crypto funds may have higher management fees and trading costs than traditional mutual funds. Review all fee disclosures before investing.

-

What are the tax implications of holding crypto in a 401(k)? While 401(k)s offer tax advantages, crypto transactions may have unique tax considerations. Consult a financial advisor or tax professional for guidance.

-

Is my retirement plan provider equipped to handle crypto securely? Security is critical. Ask about the custody solutions and insurance policies in place to protect your crypto assets.

-

How will I stay informed about regulatory changes and market developments? The regulatory landscape for crypto is evolving. Use trusted sources like SEC and Department of Labor updates to monitor changes affecting your retirement investments.

Plan sponsors are likely to roll out educational sessions or resources as part of this transition. Take advantage of these offerings. Brush up on concepts like private keys, cold storage, and the difference between spot crypto exposure versus ETFs or trusts that track digital asset prices. Remember: not all crypto products give you direct ownership; some are structured more like traditional funds.

What Does This Mean for Retirement Planning?

The ability to add Bitcoin (currently at $116,643) or Ethereum ($4,243.49) to your retirement portfolio in 2025 is historic, but it’s not a guaranteed ticket to outsized wealth. Volatility can be both friend and foe. If you’re comfortable with short-term swings in exchange for long-term potential growth, a modest allocation may make sense as part of a diversified approach.

For those new to alternative assets, consider starting with index-style crypto funds or ETFs when available within your plan, these can offer broad exposure while reducing single-asset risk. Always compare fees and liquidity terms against traditional mutual funds before making changes.

Staying Informed: How Regulation and Markets Will Shape Your Choices

Regulatory guidance will continue evolving throughout 2025 as the Department of Labor clarifies fiduciary standards and plan sponsors respond accordingly. Expect ongoing updates regarding which types of crypto products are permitted in qualified plans, and under what conditions.

Meanwhile, keep an eye on market developments. As seen with today’s prices, Bitcoin holding at $116,643, Ethereum near $4,243.49: crypto remains dynamic and subject to rapid change based on macroeconomic factors and investor sentiment alike.

Would you allocate a portion of your 401(k) to cryptocurrency now that it’s allowed?

With President Trump’s recent executive order, 401(k) plans can now include cryptocurrencies like Bitcoin, currently priced at $116,643. Considering both the potential for high returns and the risks involved, would you invest some of your retirement savings in crypto at today’s prices?

Final Thoughts: Patience Pays Dividends

This policy shift marks an inflection point in American retirement planning history: access is expanding beyond Wall Street’s traditional menu. However, with great opportunity comes great responsibility, for plan sponsors and individuals alike.

If you’re new to this space, take small steps. Start with education, ask questions about product structure and risk management, monitor regulatory updates closely, and remember that diversification, not speculation, is key for lasting wealth accumulation.

For further details, including actionable tips for onboarding into digital assets through your workplace plan, read our extended analysis here. As always: patience pays dividends.