On August 7,2025, President Donald Trump signed a landmark executive order that could redefine how Americans approach retirement savings. For the first time, professionally managed 401(k) plans can now consider cryptocurrencies, private equity, and other alternative assets as part of their investment mix. With roughly 90 million Americans participating in these retirement accounts, this move has ignited excitement and debate across the financial landscape.

Crypto in Your 401(k): What Just Changed?

The Trump 401k crypto executive order is more than just a headline – it’s a pivotal shift in retirement investing philosophy. Historically, 401(k) plans have focused on traditional assets like stocks and bonds. Now, plan administrators are being encouraged to broaden their horizons to include digital currencies such as Bitcoin, which currently trades at $118,575.00. This change is not automatic for every plan; it instructs regulatory agencies to update the rules so that professionally managed accounts may offer these new options over time.

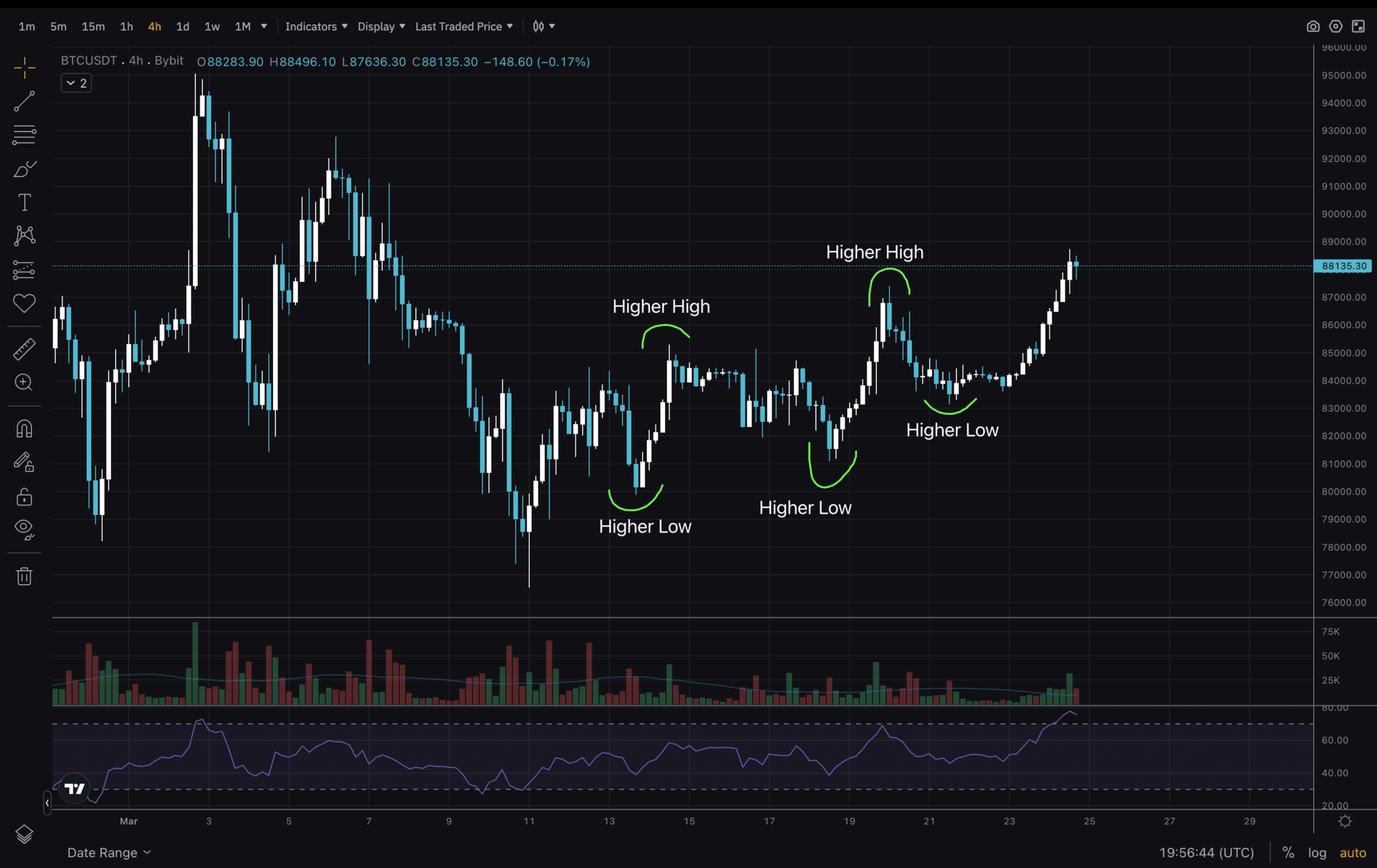

This development comes as Bitcoin maintains its position above $100,000 for the first time in history. The executive order has already sent ripples through the market – not just boosting Bitcoin’s price but also signaling mainstream acceptance of crypto as an asset class suitable for long-term investing.

Potential Benefits: Diversification and Growth

The appeal of adding crypto in retirement accounts lies primarily in diversification. Cryptocurrencies often move independently from stocks and bonds, offering a way to spread risk across different types of assets. Over the past decade, digital currencies like Bitcoin have outperformed most traditional investments during certain periods – providing potential for higher returns.

This diversification could help protect your nest egg from market downturns that affect conventional asset classes. However, with opportunity comes complexity; understanding how these assets behave is crucial before making any decisions.

Key Benefits and Risks of Crypto in Your 401(k)

-

Diversification Potential: Adding cryptocurrencies to your 401(k) can help diversify your retirement portfolio beyond traditional stocks and bonds, potentially reducing overall risk.

-

Potential for Higher Returns: Cryptocurrencies like Bitcoin have posted significant long-term growth, with Bitcoin currently priced at $118,575, offering the possibility of higher returns compared to conventional assets.

-

High Volatility: Crypto assets are known for dramatic price swings, which can cause substantial fluctuations in your retirement account value. For example, Bitcoin’s price recently ranged from $116,482 to $118,919 in a single day.

-

Higher Fees: Investing in cryptocurrencies through 401(k) plans may involve higher management and transaction fees than traditional investments, which can impact your long-term returns.

-

Regulatory Uncertainty: The rules governing cryptocurrencies in retirement accounts are still evolving, and future regulatory changes could affect your investments.

-

Need for Education: Crypto beginners should take time to understand how cryptocurrencies work, their risks, and market dynamics before investing in their 401(k).

-

Professional Guidance Recommended: Consulting a certified financial advisor can help you assess if crypto aligns with your retirement goals and risk tolerance.

Navigating Risks: Volatility and Uncertainty

No discussion about crypto investing for beginners would be complete without addressing risk. Cryptocurrencies are known for their dramatic price swings – just look at how quickly Bitcoin surged to its current price of $118,575.00. While this volatility can create opportunities for outsized gains, it also introduces the possibility of steep losses within short timeframes.

Additionally, alternative investments like crypto usually carry higher management fees compared to standard mutual funds or index funds found in most retirement plans. These costs can eat into your long-term returns if not carefully monitored.

The regulatory landscape remains fluid as well; while Trump’s order sets the stage for broader adoption, specific guidelines on how these assets will be integrated into retirement portfolios are still evolving. Plan sponsors may proceed cautiously until there’s more clarity from regulatory bodies.

Bitcoin Price Prediction 2026-2031 Post-Trump 401(k) Executive Order

Professional outlook reflecting mainstream adoption, regulatory trends, and market cycles after 401(k) crypto inclusion

| Year | Minimum Price | Average Price | Maximum Price | Potential % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $95,000 | $130,000 | $170,000 | +9.7% | Initial 401(k) inflows, continued volatility, regulatory clarification ongoing |

| 2027 | $110,000 | $152,000 | $210,000 | +16.9% | Improved adoption in retirement accounts, potential ETF approvals, moderate bull cycle |

| 2028 | $120,000 | $171,000 | $245,000 | +12.5% | Broader institutional participation, clearer tax guidance, tech upgrades (e.g., scaling) |

| 2029 | $135,000 | $193,000 | $280,000 | +12.9% | Global pension funds consider allocation, halving event after-effects, possible regulatory tightening |

| 2030 | $155,000 | $218,000 | $320,000 | +12.9% | Mainstream adoption, increased use cases, competitive altcoin landscape |

| 2031 | $170,000 | $243,000 | $350,000 | +11.5% | Matured adoption in retirement plans, stable regulatory environment, slower growth phase |

Price Prediction Summary

Bitcoin’s inclusion in 401(k) plans following Trump’s executive order is expected to drive gradual but significant mainstream adoption, especially among long-term U.S. retirement investors. While initial volatility and regulatory uncertainty may persist, the medium- to long-term outlook is bullish, with average prices projected to rise steadily year-over-year. Maximum price scenarios reflect the potential for strong bull markets driven by institutional inflows, while minimums account for possible regulatory or macroeconomic setbacks. Overall, Bitcoin is likely to become a core component of diversified retirement portfolios by 2030, with price appreciation outpacing traditional assets but volatility remaining a key risk.

Key Factors Affecting Bitcoin Price

- 401(k) and institutional adoption: Accelerated inflows from retirement accounts can provide consistent demand.

- Regulatory clarity: Clearer rules from the SEC and DOL can boost confidence and participation.

- Market cycles: Bitcoin’s halving events and macro cycles will continue to drive periodic bull and bear trends.

- Competition: Growth of alternative layer-1s and tokenized assets may impact Bitcoin’s market share.

- Technological upgrades: Improvements to Bitcoin’s scalability, privacy, and security may enhance its utility and value proposition.

- Global macro factors: Interest rates, inflation, and geopolitical events could influence investor sentiment and capital flows.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

What Crypto Beginners Should Consider Next

If you’re new to digital assets and wondering whether you should allocate part of your retirement savings into crypto via your 401(k), education is your best ally. Understanding blockchain technology, market dynamics, and how cryptocurrencies fit into diversified portfolios will empower you to make informed choices aligned with your risk tolerance and long-term goals.

You don’t have to navigate this alone – many financial advisors are updating their knowledge bases to guide clients through this new era of retirement planning. For an in-depth look at what this means for investors like you, check out our comprehensive guide at BuyingCryptoToday.com.

While the executive order has opened the door, it’s important to recognize that not every employer or plan administrator will immediately offer cryptocurrency options. Implementation will take time, and each 401(k) provider may interpret the new guidelines differently. For now, participants should stay in close contact with their HR departments or plan sponsors to monitor updates on available investment choices.

For those considering their first step into Bitcoin 401k onboarding, patience and preparation are key. Begin by reviewing your current asset allocation and asking yourself how much risk you’re willing to take on for the possibility of higher returns. Remember, even a small allocation to crypto can introduce significant volatility into your portfolio, so starting modestly is wise for most beginners.

Practical Steps: How to Approach Crypto in Your Retirement Plan

Navigating this new landscape requires a thoughtful approach. Here are some actionable tips for those interested in exploring crypto within their retirement accounts:

Actionable Steps for Adding Crypto to Your 401(k)

-

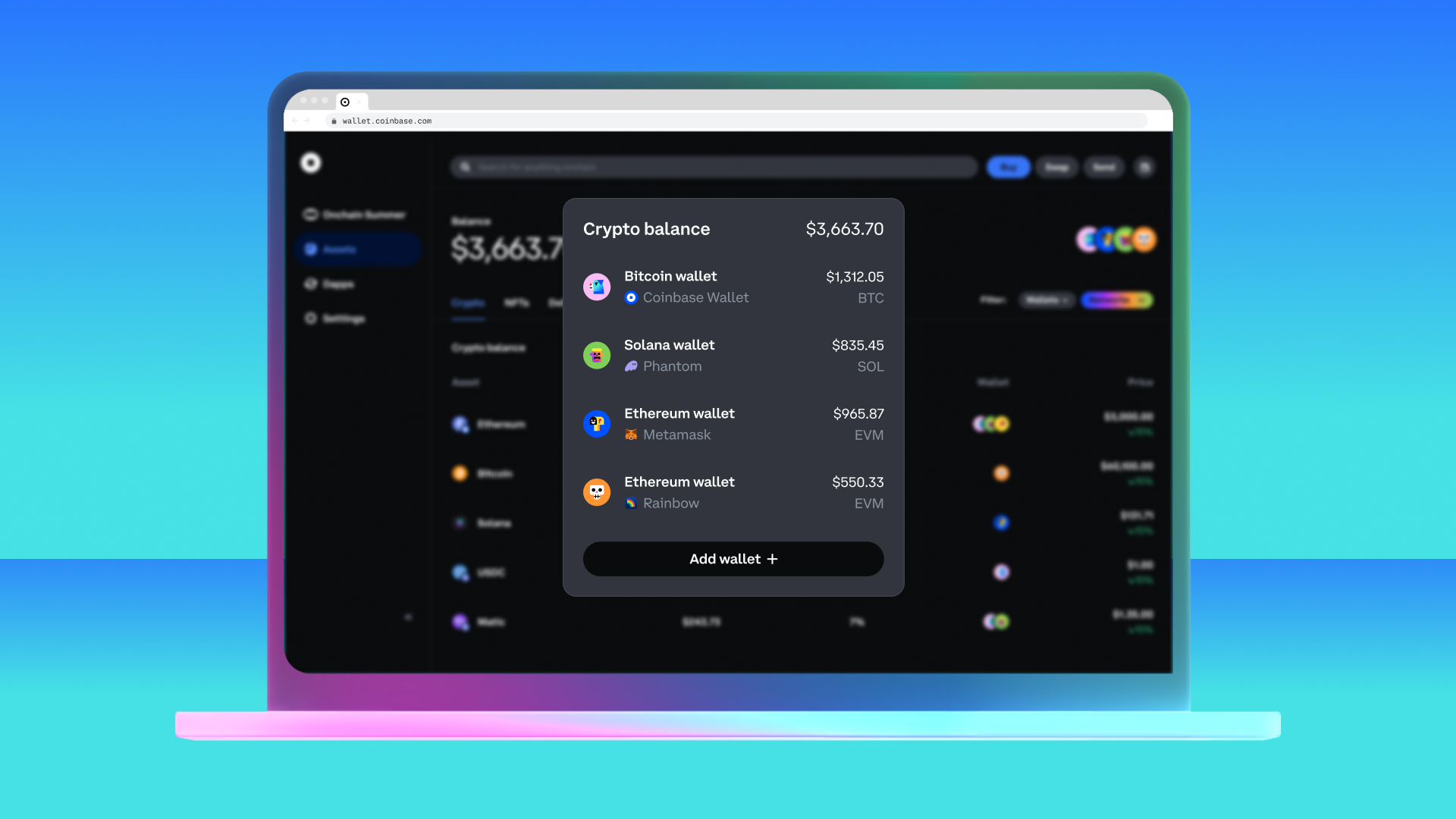

Educate Yourself on Cryptocurrency BasicsTake introductory courses from reputable platforms like Coinbase Learn or Khan Academy to understand how cryptocurrencies like Bitcoin work, their risks, and their role in a diversified portfolio.

-

Assess Your Risk Tolerance and Investment GoalsUse tools provided by your 401(k) provider or consult with a certified financial planner (find one via CFP Board) to determine if crypto aligns with your retirement objectives and comfort with volatility.

-

Start Small with a Reputable Crypto Fund or TrustConsider allocating a small percentage of your portfolio to established crypto funds like the Grayscale Bitcoin Trust (GBTC) if available through your plan. This provides exposure to Bitcoin (currently priced at $118,575.00) without needing to manage coins directly.

-

Monitor Fees and Regulatory UpdatesCarefully review the fee structure for crypto investments in your 401(k) and stay informed about evolving regulations by following updates from the U.S. Department of Labor and reputable financial news sources.

As with any investment decision, diversification remains crucial. Consider how crypto fits alongside your other holdings like stocks, bonds, and real estate. Resist the temptation to chase recent performance, while Bitcoin’s surge to $118,575.00 is headline-worthy, future returns are never guaranteed.

Staying informed is more important than ever as regulations continue to evolve and new products emerge. Seek out reputable sources of information and remain skeptical of hype-driven narratives or promises of quick wealth.

What Could Happen Next?

The executive order has already prompted a wave of interest from both Wall Street firms and everyday savers, but it’s also raised questions about retirement crypto risks that deserve careful attention. Will other cryptocurrencies besides Bitcoin become available? How will fiduciary standards adapt? And how might increased exposure to digital assets reshape Americans’ financial futures?

Ultimately, this moment marks a turning point for retirement investing in the United States. The inclusion of crypto in 401(k)s could help democratize access to emerging asset classes while challenging investors to think more critically about risk management and long-term planning.

The future belongs to those who prepare for it today. Whether you’re eager or cautious about this change, staying engaged and informed ensures your retirement strategy reflects both opportunity and security.