The landscape of U. S. crypto regulation is shifting, and for the first time in years, the change feels like a tailwind rather than a headwind for investors. In 2025, the Securities and Exchange Commission (SEC) has taken concrete steps toward embracing digital assets, specifically targeting staking regulations. This is a pivotal moment for both seasoned crypto enthusiasts and those just beginning their crypto onboarding journey.

SEC Project Crypto Staking: The New Era of Regulatory Clarity

On May 29,2025, the SEC’s Division of Corporation Finance issued guidance that certain protocol staking activities on proof-of-stake (PoS) blockchains do not constitute securities offerings. Put simply, if you stake native tokens like Ethereum (ETH) to help validate transactions and secure the network, you’re not automatically subject to federal securities laws. This distinction is crucial for new investors who want exposure to staking rewards but were previously deterred by regulatory ambiguity.

This shift is part of a broader initiative known as Project Crypto, which aims to position America as a leader in digital finance innovation. The SEC’s recent hands-off approach to liquid staking – where users can earn rewards while retaining liquidity – further underscores their pro-crypto pivot. For more on this evolution, see CryptoSlate’s coverage.

Why This Matters: Staking Benefits Under SEC Guidance

The implications of this regulatory clarity are profound:

- Institutional Participation: With less regulatory gray area, large investors are more likely to get involved in staking. This could mean greater market stability and liquidity.

- Enhanced Staking Services: Platforms offering “staking-as-a-service” can now operate with more confidence and potentially innovate new features without fear of immediate SEC intervention.

- Staking-Enabled Investment Products: The door is now open for exchange-traded products (ETPs) that incorporate staking rewards – making it easier for everyday investors to access yield through familiar financial instruments.

This new environment democratizes access to crypto yields and may accelerate mainstream adoption. As institutional money flows in and service providers expand their offerings, the average investor gains both opportunity and optionality.

Ethereum at $4,260.15: What Does Price Stability Mean for New Investors?

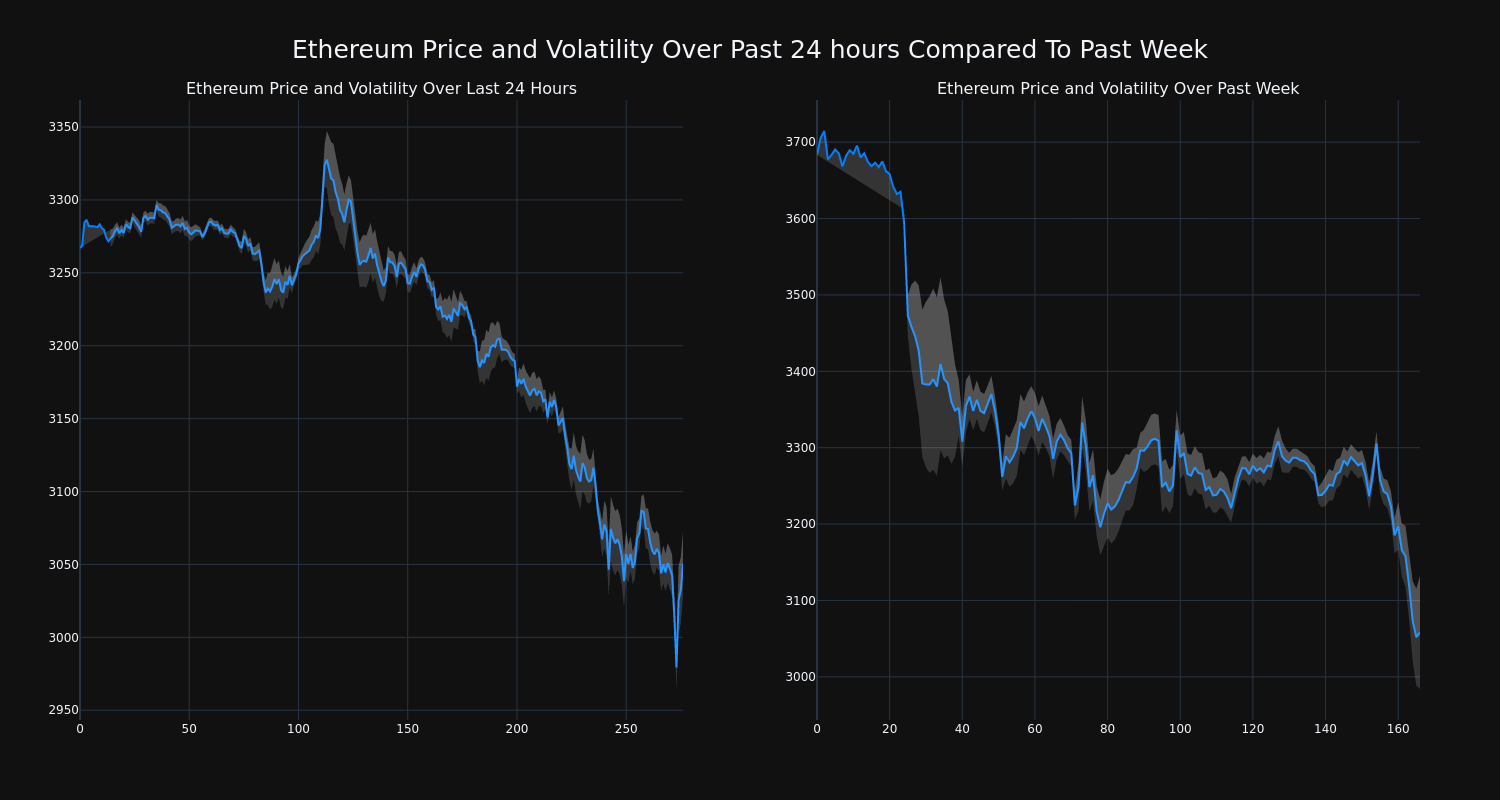

The timing couldn’t be better for newcomers exploring staking opportunities. As of August 12,2025, Ethereum (ETH) trades at $4,260.15, holding steady despite market volatility with only a slight decrease of 0.00174% from its previous close. Price stability at these levels gives new investors breathing room to explore staking without the whiplash often associated with early-stage crypto assets.

This steadiness also reflects growing institutional confidence following the SEC’s updated stance – a trend observed across several proof-of-stake networks beyond just Ethereum.

Ethereum (ETH) Price Prediction 2026-2031: Impact of SEC Pro-Staking Guidance

Professional price forecasts considering the SEC’s pro-crypto regulatory shift, increased staking adoption, and evolving market dynamics. Prices are based on August 2025 ETH baseline ($4,260.15).

| Year | Minimum Price | Average Price | Maximum Price | Potential % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,950 | $4,700 | $5,800 | +10% | Initial boost from institutional staking, minor volatility as market adjusts to new products. |

| 2027 | $4,200 | $5,300 | $6,600 | +13% | Growth in staking ETPs and super-apps; increased mainstream adoption. |

| 2028 | $4,600 | $6,100 | $7,800 | +15% | Continued regulatory clarity, ETH upgrades (scalability), and DeFi expansion. |

| 2029 | $5,000 | $7,150 | $9,400 | +17% | Bullish cycle peak possible; ETH gains as staking rewards attract new capital. |

| 2030 | $5,500 | $8,000 | $10,900 | +12% | Mature staking market, ETH as core asset in digital finance, moderate growth. |

| 2031 | $5,300 | $8,500 | $12,000 | +6% | Market stabilizes, ETH faces competition but benefits from established network effects. |

Price Prediction Summary

Ethereum’s price outlook is positive over the next six years, given the SEC’s favorable stance on staking and increasing institutional participation. Progressive adoption of staking-enabled investment products, ongoing technical upgrades, and broader acceptance of ETH as a digital asset are expected to drive average annual price growth between 6% and 17%. The forecast incorporates both bullish and bearish scenarios, reflecting potential market volatility and regulatory nuances.

Key Factors Affecting Ethereum Price

- SEC’s pro-staking regulatory clarity attracting institutional investors and enabling new investment products.

- Growth of staking-as-a-service and super-apps making ETH more accessible to mainstream users.

- Continued technical upgrades to Ethereum (scalability, security, and DeFi integrations).

- Evolving competition from alternative blockchains and potential shifts in market share.

- Macroeconomic factors, including global financial policy and digital asset adoption rates.

- Possible future changes in U.S. or international regulatory stance.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating Staking Regulations for Beginners

If you’re just starting your crypto onboarding 2025, understanding what qualifies as compliant staking is essential:

- Direct Protocol Staking: Participating directly in PoS consensus mechanisms generally falls outside securities law per current guidance.

- Liquid Staking Solutions: These allow you to earn rewards while keeping your assets flexible – now officially not considered securities by the SEC in many cases (source).

- Caveat Emptor: Not all staking services are created equal; some arrangements may still fall under different regulations depending on structure or custodianship.

The bottom line? Investors should remain alert as regulatory interpretations can evolve – but today’s environment offers more certainty than ever before.

For those considering their first move into staking, the landscape has never been more accessible. The SEC’s pro-crypto shift, especially under Project Crypto, gives both individuals and institutions a green light to participate in network security and earn rewards, provided they understand the nuances of compliance. This opens the door to new forms of passive income in crypto that were previously reserved for technical insiders or risk-tolerant early adopters.

How to Start Staking: A Simple Guide for New Investors

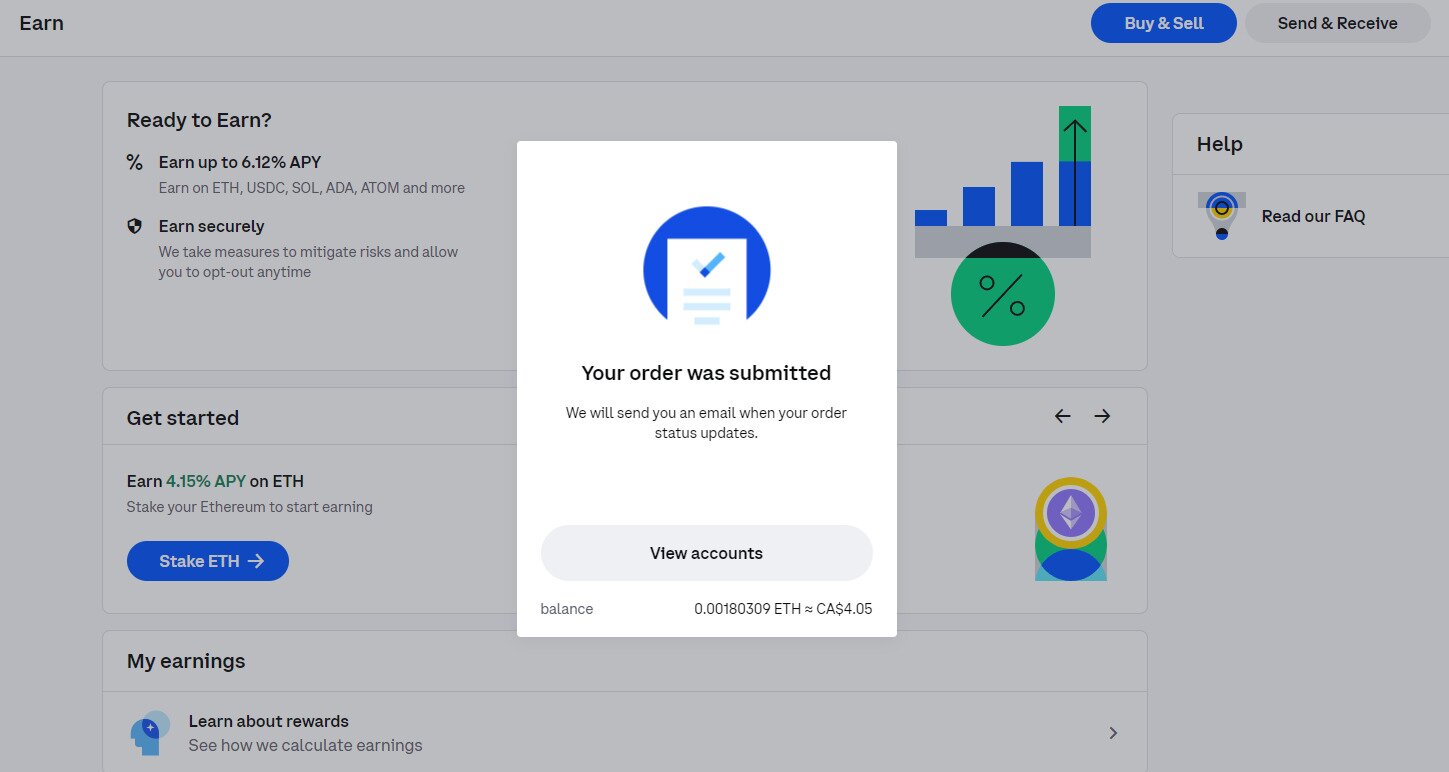

Getting started with staking doesn’t require deep technical expertise. Here’s a streamlined approach for beginners looking to take advantage of the current regulatory clarity:

With platforms now able to openly offer staking-as-a-service, newcomers can choose between direct protocol staking or reputable liquid staking providers. The latter often appeals to those who want flexibility and access to their funds while still earning yield. Always review platform security, fee structures, and user reviews before committing assets.

Risks Remain: What New Investors Should Watch For

While regulatory risk has receded, other factors remain:

Key Risks to Consider When Staking Crypto in 2025

-

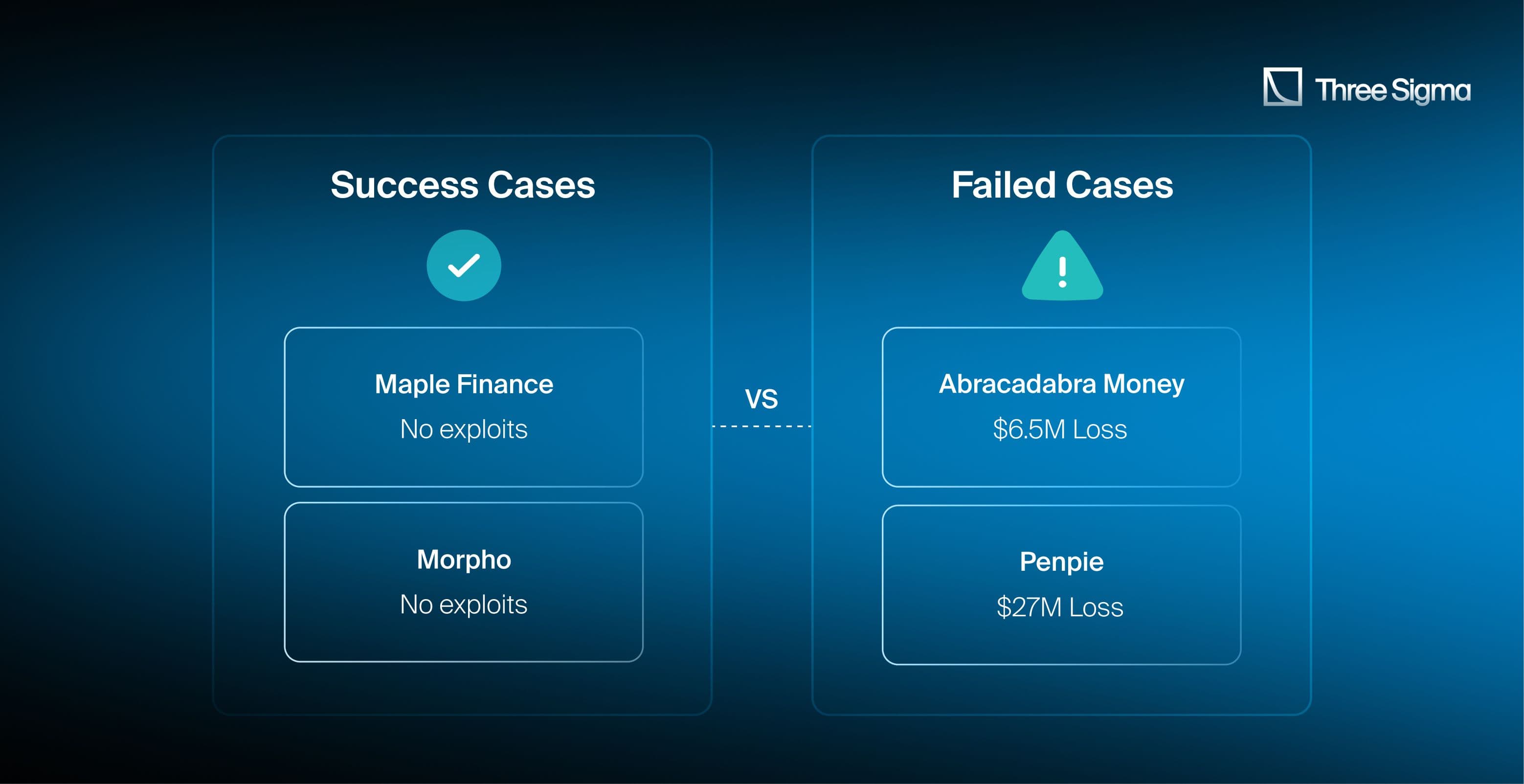

Smart Contract Vulnerabilities: Even on major networks like Ethereum, bugs or exploits in staking smart contracts can lead to loss of funds. Always review audits and use reputable platforms.

-

Platform Solvency Risk: Staking through third-party providers (e.g., Coinbase, Lido, Kraken) exposes you to their financial health. If a provider faces insolvency, your staked assets could be at risk.

-

Market Volatility: The value of staked assets like Ethereum (ETH) can fluctuate. As of August 12, 2025, ETH trades at $4,260.15, but prices can swing rapidly, impacting your returns.

-

Regulatory Uncertainty: While the SEC has clarified that certain staking activities are not securities, future regulatory changes or differing interpretations could affect your staking strategy.

-

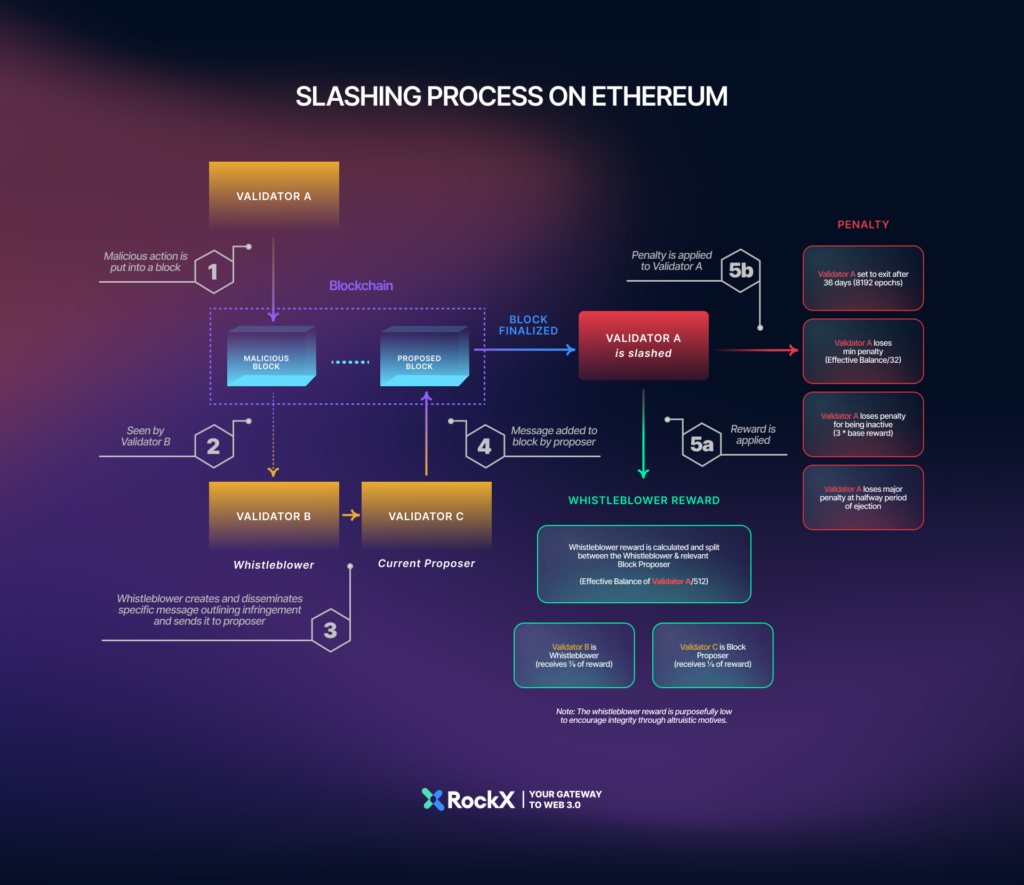

Slashing and Penalties: On proof-of-stake networks, validators (or those delegating to them) can lose a portion of their staked assets due to misbehavior or downtime. Review each network’s slashing rules before staking.

-

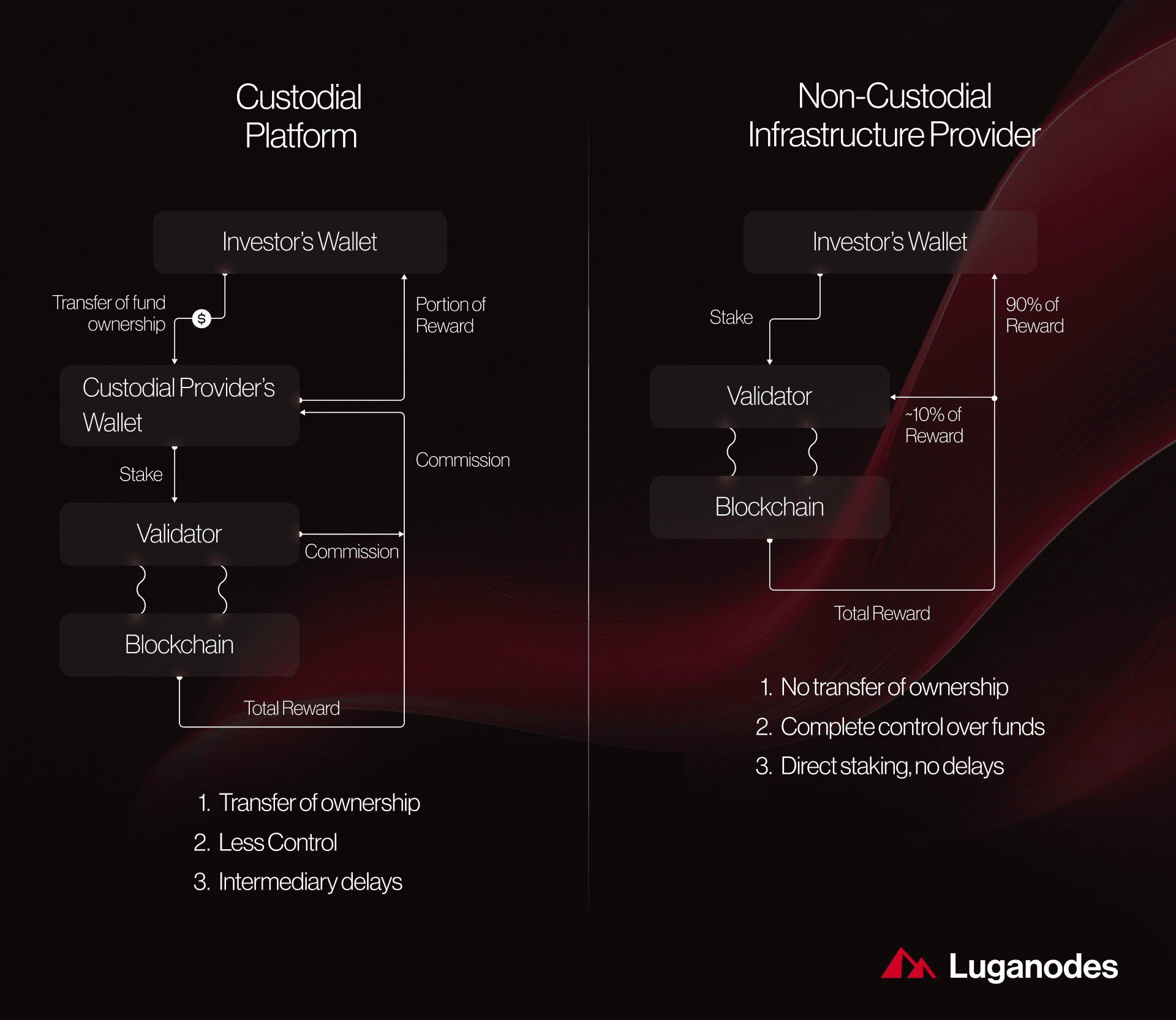

Custodial vs. Non-Custodial Risks: Using custodial services (e.g., centralized exchanges) means you do not control your private keys, increasing counterparty risk. Non-custodial platforms require more technical knowledge but offer greater control.

Even as the SEC clarifies its stance, crypto remains an evolving space where smart contract bugs or poorly managed platforms can put capital at risk. Diversification and due diligence are critical, never stake more than you can afford to lose.

Looking Ahead: The Future of Staking Benefits Under SEC Guidance

The market is already seeing a proliferation of new investment products incorporating staking rewards, particularly ETPs that allow traditional investors exposure without direct wallet management. As these products mature and gain regulatory acceptance, expect yields from proof-of-stake networks like Ethereum to become a standard feature in diversified portfolios.

The SEC’s ongoing Project Crypto initiatives signal that further innovation is not only possible but encouraged within clear boundaries (see official statement). For investors willing to stay informed and adapt as regulations evolve, the opportunity set is expanding rapidly.

Ultimately, this moment marks a turning point for U. S. -based crypto investors. With Ethereum trading at $4,260.15, steady prices plus regulatory clarity combine for a rare window of opportunity. By learning the basics of compliant staking now, and keeping an eye on future guidance, newcomers can participate confidently in this next chapter of digital finance.