With Binance continuing its aggressive expansion in 2025, the exchange remains a magnet for both institutional and retail crypto investors seeking early access to high-potential tokens. As of August 13,2025, Binance Coin (BNB) is trading at $837.20, reflecting robust market activity and renewed interest in new listings. For those aiming to capitalize on Binance’s latest offerings, like recent additions Aspecta (ASP) and Alliance Games (COA): a systematic onboarding strategy is essential.

Why Early Preparation Matters for Binance Listings in 2025

The landscape of Binance listings in 2025 is more competitive than ever. With up to 16 new coins anticipated for listing this year (according to Cryptonews), including infrastructure-focused projects and community-driven tokens like Pi Network (PI) and Solaxy (SOLX), being an early adopter can lead to outsized gains, but also exposes you to intense volatility. A methodical approach, rooted in data and risk management, is non-negotiable.

1. Set Up Real-Time Alerts for Binance Listing Announcements

The window between a listing announcement and the actual token launch on Binance can be extremely narrow, sometimes less than an hour. Missing this window often means missing the most favorable entry points. To avoid this, set up real-time alerts using both official Binance channels and reputable crypto news aggregators.

- Binance Square: Follow daily updates on Binance Square, where new listings are often teased or announced first.

- Push notifications: Enable alerts from the Binance app, Twitter/X accounts of key executives, and trusted news sources like Coinspeaker’s upcoming listings guide.

- Email subscriptions: Subscribe to official newsletters covering new coin launches.

This proactive information gathering ensures you’re never caught off guard when a high-potential project hits the exchange.

2. Conduct Due Diligence Using Official Binance Research and Community Channels

The hype around new tokens can be overwhelming, especially when influencers or unofficial sources speculate on “the next big thing. ” To separate signal from noise, always conduct due diligence using official resources:

- Binance Research: Review detailed project reports released by the exchange prior to listing. These typically cover tokenomics, team credibility, use cases, and audit results.

- Community discussions: Engage with user feedback on platforms like Reddit, Telegram groups, or dedicated threads under official Binance posts. This helps gauge genuine sentiment versus manufactured hype.

- Ecosystem analysis: Look into how projects fit into broader trends, such as AI-powered tools like Aspecta or Web3 gaming infrastructure represented by Alliance Games.

This approach aligns with the best practices outlined by industry experts: always DYOR (Do Your Own Research) and use strict risk management (source). The goal is not just to chase hype but to identify tokens with sustainable value propositions before they go mainstream.

The Next Steps: Funding and Trade Execution Readiness

Ahead of any major listing event, practical preparation is key, not just information gathering but also ensuring you’re technically ready to act fast when opportunities arise. In the next section we’ll cover how to prepare KYC documents and funding in advance for rapid token purchases, as well as tactical trade execution strategies tailored for post-listing volatility.

Binance Coin (BNB) Price Prediction 2026-2031 After Major Binance Listings

Professional projections considering Binance’s aggressive listing strategy, evolving regulatory landscape, and BNB’s growing utility as of August 2025.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg, YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $790.00 | $1,020.00 | $1,300.00 | +21.8% | New listings boost BNB demand; possible market correction after 2025 rally. |

| 2027 | $900.00 | $1,175.00 | $1,520.00 | +15.2% | Continued adoption; regulatory clarity in US/EU could spur growth. |

| 2028 | $1,050.00 | $1,320.00 | $1,750.00 | +12.3% | DeFi/Web3 integration deepens; BNB key for ecosystem fees. |

| 2029 | $1,200.00 | $1,480.00 | $2,000.00 | +12.1% | Institutional entry accelerates; possible new ATH if macro conditions favorable. |

| 2030 | $1,350.00 | $1,650.00 | $2,300.00 | +11.5% | BNB solidifies as top-3 crypto; competition from new chains intensifies. |

| 2031 | $1,500.00 | $1,820.00 | $2,600.00 | +10.3% | Utility-driven growth; regulatory headwinds or tech breakthroughs could swing prices. |

Price Prediction Summary

BNB is poised for steady growth from 2026 to 2031, underpinned by Binance’s expanding ecosystem, frequent new listings, and rising adoption of BNB for transaction fees and DeFi. While volatility will persist, especially due to regulatory and macroeconomic factors, the overall trajectory remains bullish, with BNB likely to set new all-time highs by 2030 under favorable conditions. Minimum price estimates reflect potential corrections or bear markets, while maximums consider bull run scenarios and major adoption breakthroughs.

Key Factors Affecting Binance Coin Price

- Aggressive Binance listing strategy increases BNB demand and on-chain activity.

- Global regulatory developments, especially in the US and EU, could impact exchange operations and token valuation.

- BNB’s expanding utility in DeFi, Web3, and as a core fee token for Binance Smart Chain.

- Competitive pressure from emerging layer-1 and layer-2 blockchains.

- Potential for new partnerships or ecosystem incentives (e.g., Launchpool/Launchpad).

- Macro market cycles and investor sentiment swings.

- Possible technology upgrades or tokenomics changes (e.g., burns, staking).

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Once you’ve established a reliable information flow and completed your due diligence, the next critical step is operational readiness. The difference between catching a listing at launch and missing out often comes down to minutes. Binance’s infrastructure-focused listings in 2025, such as the anticipated Pi Network (PI) and Solaxy (SOLX), are expected to attract massive attention, so efficiency is non-negotiable.

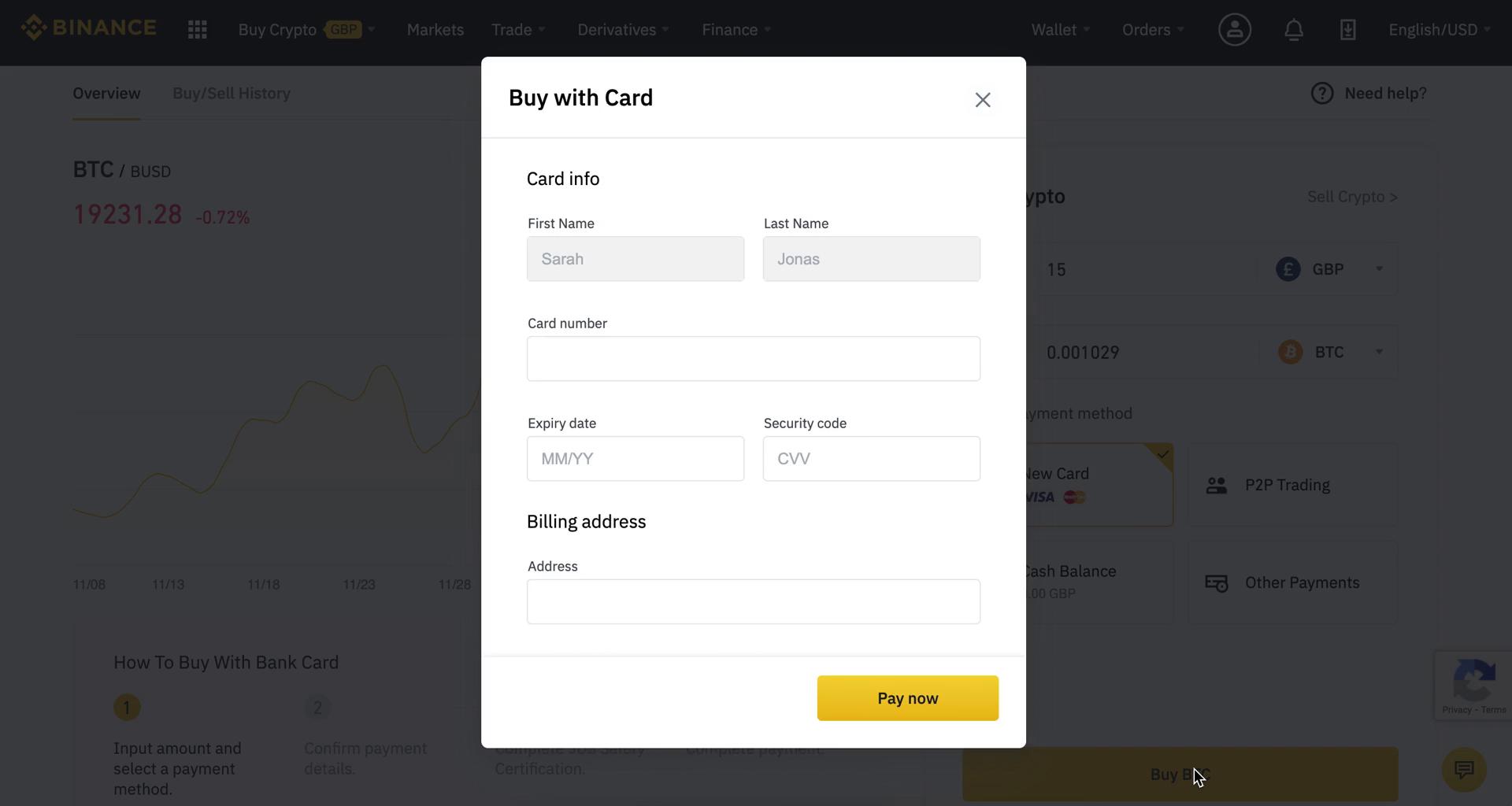

3. Prepare KYC and Funding in Advance for Fast Token Purchases

Binance enforces strict Know Your Customer (KYC) protocols for new users and high-volume traders. If your KYC isn’t up to date, expect delays that could cost you prime entry positions on new tokens. Ensure your identity verification is completed well before any major listing window.

- Pre-fund your account: Maintain a balance of stablecoins (like USDT or BUSD) or BNB in your Binance wallet. This allows you to execute trades instantly when a new coin goes live, avoiding the bottleneck of last-minute deposits.

- Monitor fiat on-ramps: Be aware of local banking cut-off times or potential delays with fiat transfers, especially if you’re onboarding from regions with tighter capital controls.

Early funding also lets you participate in Binance’s Launchpool or Launchpad events, which sometimes provide allocation advantages for early adopters (see official announcements).

Checklist: KYC & Funding Prep for Binance Listings

-

Set Up Real-Time Alerts for Binance Listing AnnouncementsEnable notifications on Binance’s official announcement page and follow their verified social media channels. Use tools like CoinMarketCap and CoinGecko to receive instant updates on new listings, ensuring you never miss a high-potential opportunity.

-

Conduct Due Diligence Using Official Binance Research and Community ChannelsReview project details on Binance Research and participate in discussions on Binance Square and official Telegram groups. Cross-reference with reputable sources like CryptoRank and Coinspeaker for added insights.

-

Prepare KYC and Funding in Advance for Fast Token PurchasesComplete Binance KYC verification ahead of time to avoid delays. Pre-fund your account with stablecoins (e.g., USDT, BUSD) or BNB—currently priced at $837.20—to ensure immediate buying power when a new token lists.

-

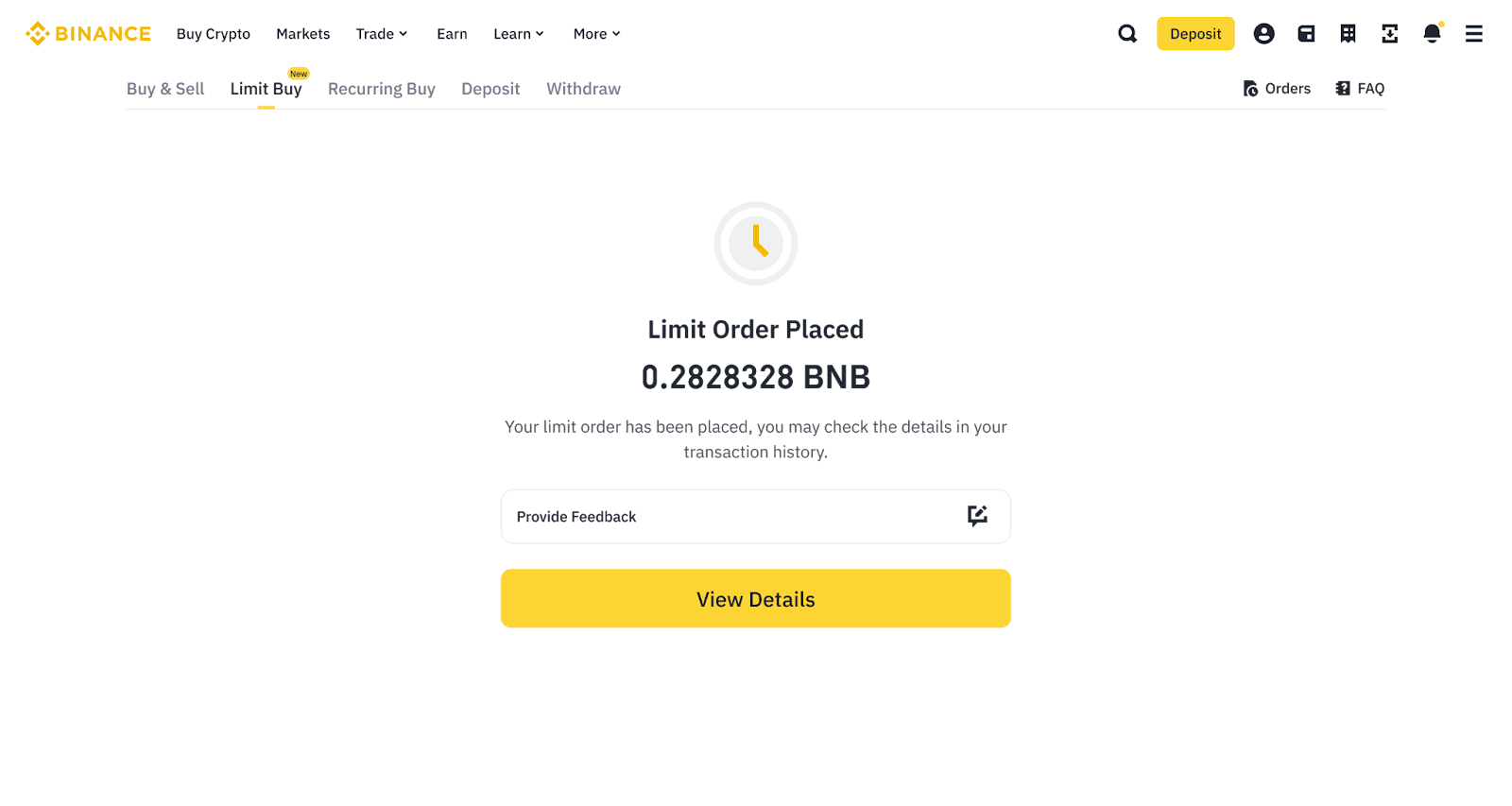

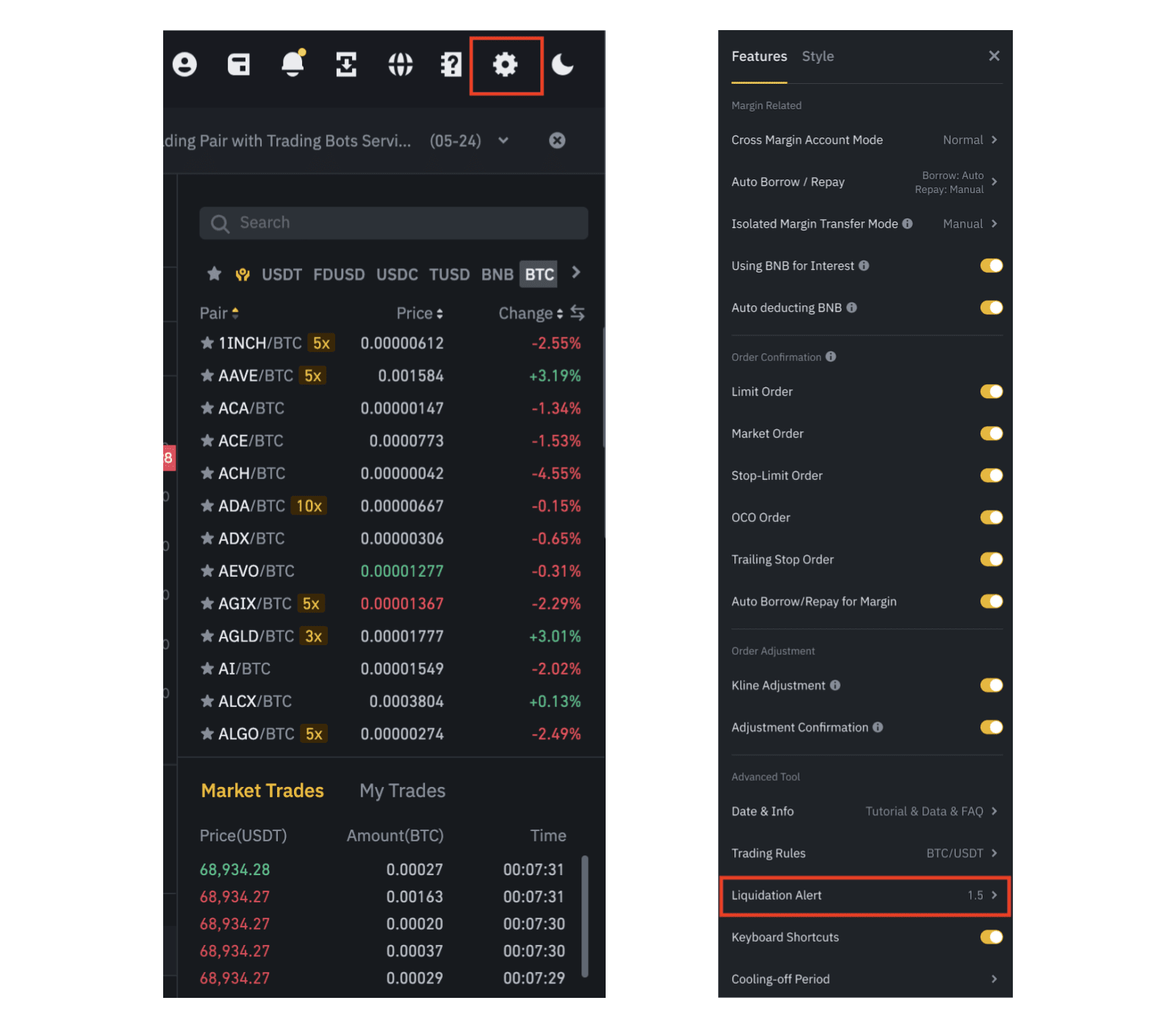

Utilize Limit Orders and Staggered Entry Points to Manage VolatilitySet limit orders for target prices and consider dollar-cost averaging to minimize risk during volatile initial trading. Use Binance’s advanced trading interface for precise execution and risk management.

-

Monitor Post-Listing Performance and Set Exit Strategies EarlyTrack token price action and volume using Binance Spot Trading and TradingView integrations. Define profit targets and stop-losses in advance to lock in gains or limit losses as the market reacts to the new listing.

4. Utilize Limit Orders and Staggered Entry Points to Manage Volatility

The first hours after a new token goes live are notoriously volatile. Market orders can expose you to wild price swings and slippage, especially when initial liquidity is thin. Instead, use limit orders to control your entry price, setting buy orders at logical support levels based on recent trading patterns or technical indicators.

- Staggered entries: Rather than going all-in at once, break up your buy orders across several price points. This dollar-cost averaging approach smooths out volatility risk and helps avoid emotional decision-making during rapid market moves.

- Automate where possible: Use Binance’s advanced order types, such as OCO (One Cancels the Other): to automate both entries and stop-losses during high-traffic listing windows.

This disciplined execution strategy is particularly important in 2025’s hyper-competitive environment where bots and high-frequency traders are active participants in every major listing event.

5. Monitor Post-Listing Performance and Set Exit Strategies Early

The period immediately after listing can see explosive gains, but also sharp reversals as early buyers take profits or whales rotate positions. Monitoring post-listing performance is not just about chasing green candles; it’s about protecting capital and locking in gains according to a pre-defined plan.

- Set exit targets: Before entering any trade, define your profit-taking levels as well as stop-loss thresholds based on technical analysis or percentage moves from your entry point.

- Avoid FOMO traps: Resist the urge to chase parabolic moves after initial pumps; statistically, most newly listed coins experience significant retracements within days of launch (Coinspeaker research).

- Track on-chain activity: Use tools that monitor large wallet movements or sudden shifts in trading volume, these often precede major price reversals post-listing.

Key Takeaways for Crypto Onboarding Success in 2025

The influx of new tokens onto Binance this year, spanning AI utilities like Aspecta (ASP), Web3 gaming infrastructure such as Alliance Games (COA), and community-driven projects like Pi Network, demands more than just enthusiasm from early adopters. It requires a systematic approach anchored by five core strategies: real-time alerts, sound research practices, proactive account setup, tactical trade execution, and disciplined exit planning.

If you master these steps while respecting current market dynamics, such as BNB’s position at $837.20, reflecting both bullish sentiment and heightened competition, you’ll be far better positioned to convert opportunity into sustained success rather than fleeting hype cycles.

5 Actionable Strategies for Binance Listing Success in 2025

-

Set Up Real-Time Alerts for Binance Listing Announcements: Enable notifications on Binance’s official announcement page and follow Binance Square for instant updates on new listings. This ensures you never miss timely opportunities as soon as they are revealed.

-

Conduct Due Diligence Using Official Binance Research and Community Channels: Leverage Binance Research for in-depth project reports and join Binance’s Telegram and X (Twitter) communities to gauge sentiment and gather insights before making investment decisions.

-

Prepare KYC and Funding in Advance for Fast Token Purchases: Complete Binance’s Know Your Customer (KYC) verification and ensure your account is funded (e.g., with USDT or BNB at $837.20 as of August 13, 2025) to act quickly when new tokens become available.

-

Utilize Limit Orders and Staggered Entry Points to Manage Volatility: Use Binance’s advanced trading features to set limit orders and plan staggered entries, helping you avoid price spikes and manage risk during the high volatility of new listings.

-

Monitor Post-Listing Performance and Set Exit Strategies Early: Track price action and trading volume after listing. Establish clear profit targets and stop-losses to protect gains and minimize downside, using Binance’s portfolio and price alert tools.