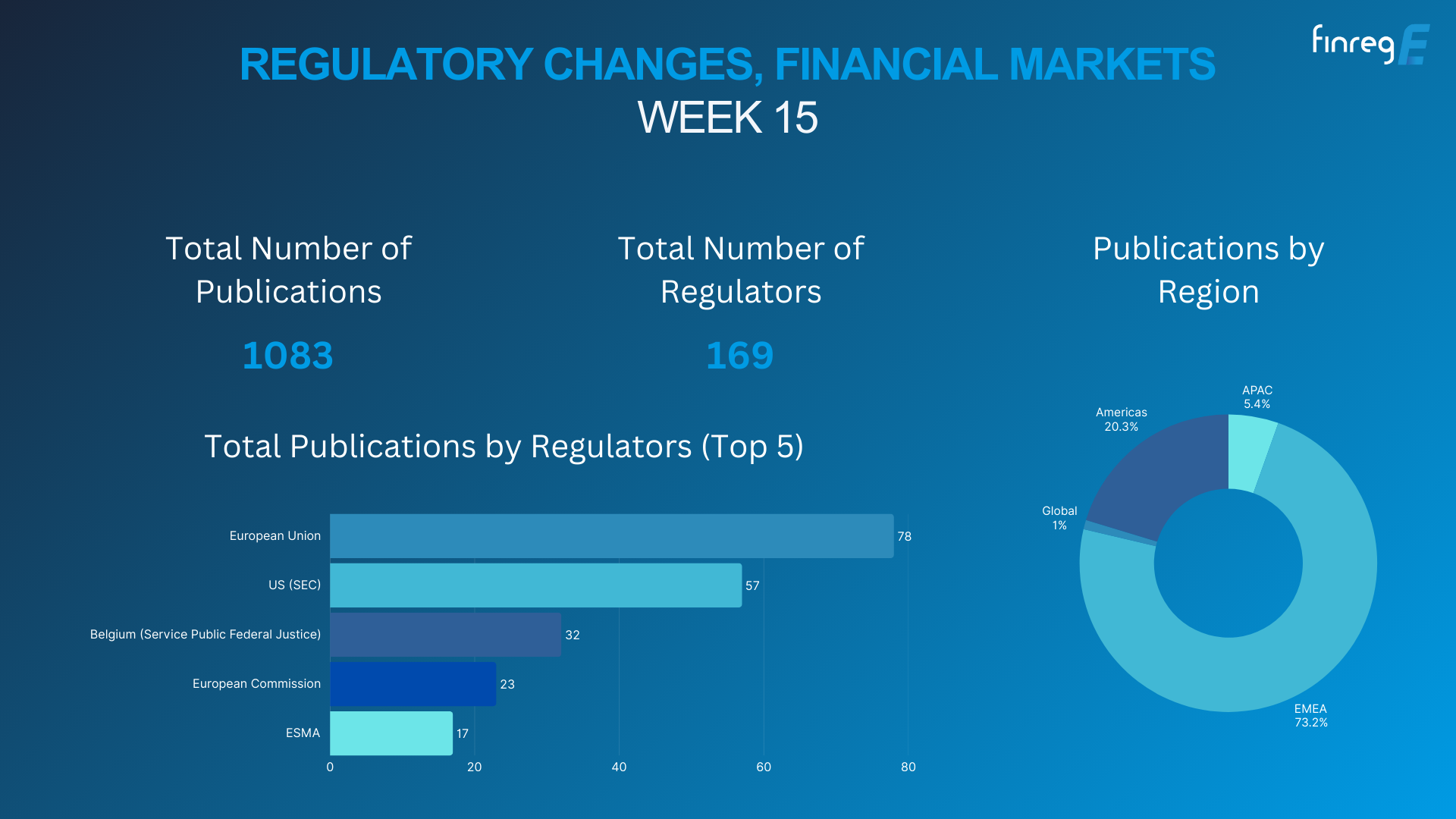

Crypto onboarding in 2025 is no longer the wild west it once was. Across the globe, regulators are raising the bar on transparency, security, and consumer protection, especially in the European Union (EU), United Kingdom (UK), and Asia. For beginners, these changes are both a challenge and an opportunity. Let’s break down how these new rules are reshaping the first steps into crypto, making it safer but also more structured than ever before.

![]()

EU’s MiCA Regulation: Making Crypto Onboarding Smoother and Safer

The EU’s Markets in Crypto-Assets (MiCA) regulation is a game changer for anyone new to digital assets. Fully operational since December 2024, MiCA sets clear standards for everything from token whitepapers to licensing requirements for exchanges. For beginners, this means:

- Unified onboarding processes: No matter which of the 27 EU countries you’re in, crypto exchanges must follow the same strict rules.

- Transparent token information: Whitepapers must clearly explain what you’re buying, no more mysterious coins with hidden risks.

- Enhanced risk management: Platforms are required to protect your funds with robust internal controls.

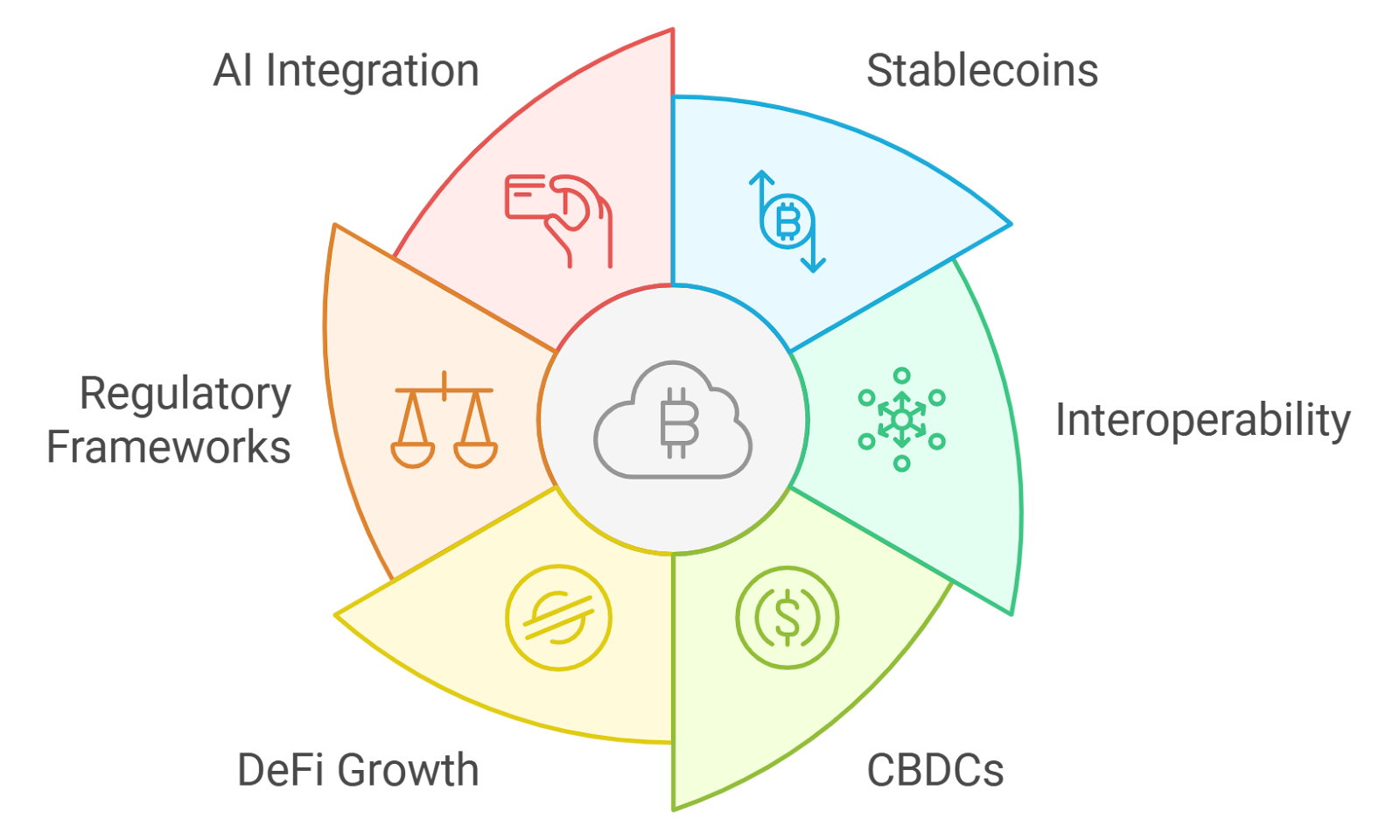

This regulatory clarity is especially important as stablecoins like USDT and PYUSD expand their reach across Europe. The result? Beginners can now explore cross-border payments and digital assets with more confidence than ever before. For a detailed breakdown of what MiCA means for you, check out this essential guide from InnReg: EU Crypto Regulation Explained: An Essential Guide (2025).

The UK’s Balanced Approach: Innovation Meets Accountability

The UK isn’t sitting still either. In April 2025, draft legislation landed that requires all crypto exchanges and dealers operating in Britain to register with regulators and meet tough new standards. Here’s what stands out for newcomers:

- KYC requirements: You’ll need to prove your identity, no more anonymous accounts.

- Consumer protection: Platforms must have clear complaint procedures and keep customer funds segregated from company assets.

- Operational resilience: Exchanges must show they can withstand cyberattacks or technical failures.

This approach aims to curb misconduct without stifling legitimate innovation, a balancing act that has seen UK crypto adoption soar from just 4% in 2021 to about 12% of adults today (Reuters). If you’re a beginner looking for practical onboarding tips or need guidance on FCA registration, check resources like The Sumsuber’s compliance guide: UK Crypto Regulations 2025 or The Sumsuber.

Essential Onboarding Tips for Crypto Beginners (2025)

-

Choose Regulated Exchanges: Always start with platforms licensed under local regulations—like Coinbase (EU, UK), Binance (EU, Asia), or Kraken (EU, UK). These exchanges comply with the latest MiCA, FCA, and Asian rules, offering enhanced consumer protection and transparency.

-

Verify KYC & AML Requirements: Be prepared to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. In the EU, UK, Japan, and Singapore, regulated platforms require identity verification for all new users.

-

Understand Stablecoin Regulations: If using stablecoins like USDT, USDC, or PYUSD, check their regulatory status. For example, PYUSD is now approved for use in the EU, UK, and Canada, while Hong Kong and Singapore have strict licensing for fiat-referenced stablecoins.

-

Read Platform Whitepapers & Disclosures: Under MiCA and new UK rules, exchanges must provide clear whitepapers and risk disclosures. Always review these documents to understand the assets and risks before investing.

-

Prioritize Security Practices: Use strong, unique passwords and enable two-factor authentication (2FA). Consider hardware wallets like Ledger or Trezor for storing assets securely, especially as regulations emphasize user protection.

-

Check for Local Licensing: In Asia, platforms like HashKey Exchange (Hong Kong) and bitFlyer (Japan) are licensed under new 2025 regulations. Always confirm your chosen platform’s regulatory status with local authorities.

-

Stay Informed on Regulatory Updates: Follow official sources like the European Securities and Markets Authority (ESMA), UK Financial Conduct Authority (FCA), and Monetary Authority of Singapore (MAS) for the latest crypto compliance news.

-

Be Aware of Cross-Border Payment Rules: If sending or receiving crypto internationally, understand new cross-border regulations—especially for stablecoins and large transfers. The EU and Asia have introduced stricter reporting and compliance measures in 2025.

Asia Leads With Stablecoin Clarity and Strong KYC Rules

If you want a glimpse into the future of global crypto onboarding, look east. Asia’s leading financial hubs, Hong Kong, Japan, Singapore, are rolling out targeted regulations that directly impact how first-timers enter the market.

- Hong Kong: The Stablecoins Bill passed in May 2025 sets up a strict licensing regime for fiat-referenced stablecoins. This means any stablecoin tied to the Hong Kong dollar, even those issued offshore, must comply with reserve management rules and AML checks. Beginners benefit from greater stability and legal recourse if things go wrong (LinkedIn analysis).

- Japan: Amendments to the Payment Services Act in 2025 tightened KYC/AML requirements for exchanges while encouraging innovation through sandbox programs.

- Singapore: The MAS Stablecoin Regulatory Framework forces issuers to keep reserves matching their stablecoin pegs. Over 30 Major Payment Institution licenses have already been issued by August 2025, a sign Singapore is betting big on regulated stability (Crypto.com University).

Together these changes mean fewer scams, more reliable platforms, and a much clearer path for anyone starting their crypto journey in Asia.

For those just stepping into crypto, the impact of these regulatory shifts is already being felt at every turn. From the moment you open an account, expect far more robust identity checks, clearer disclosures about what you’re buying, and a support structure that simply didn’t exist five years ago. Where once onboarding could feel like navigating a maze of jargon and risk, now there’s a marked shift toward transparency and user education.

What Do These Changes Mean for Your First Crypto Experience?

Let’s visualize how onboarding flows have changed under these new rules:

Step-by-Step Onboarding Journey for Crypto Beginners (2025)

-

1. Choose a Regulated Exchange or PlatformStart by selecting a licensed crypto exchange or wallet provider. In the EU, look for platforms authorized under MiCA (e.g., Binance, Kraken); in the UK, ensure the provider is FCA-registered; in Asia, check for licensing by local authorities like the HKMA (Hong Kong), FSA (Japan), or MAS (Singapore).

-

2. Complete Enhanced Identity Verification (KYC/AML)Submit personal identification and proof of address to meet KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements. This step is now mandatory under MiCA, the UK’s draft crypto law, and Asian regulations (e.g., Japan’s Payment Services Act, Singapore’s MPI licensing).

-

3. Review Key Disclosures and Risk WarningsCarefully read the token whitepapers, platform terms, and risk disclosures provided during onboarding. MiCA and the UK’s draft rules require clear information about crypto-asset risks, fees, and consumer rights before you can proceed.

-

4. Set Up Secure Wallets and Enable Two-Factor AuthenticationEstablish a secure digital wallet (custodial or non-custodial) and activate two-factor authentication (2FA) for enhanced account protection. Many regulated platforms now require 2FA as part of their operational resilience obligations.

-

5. Fund Your Account Using Approved Payment MethodsAdd funds via bank transfer, credit/debit card, or approved stablecoins (e.g., USDT, USDC, PYUSD). Platforms in the EU, UK, and Asia must comply with strict rules on fiat and stablecoin transactions, including reserve and redemption requirements for stablecoins.

-

6. Start with Beginner-Friendly Crypto ProductsExplore regulated, beginner-focused products such as spot trading, regulated stablecoins, or educational demo accounts. Many platforms now offer risk-limited trading modes and educational resources to help newcomers navigate safely.

-

7. Monitor Transactions and Stay InformedTrack your transactions and holdings via the platform dashboard. Subscribe to regulatory updates and security alerts from your provider to stay compliant and protected as rules evolve across the EU, UK, and Asia.

Regulated platforms now often guide users through interactive KYC tutorials, offer real-time help desks, and even require acknowledgment of key risks before you can deposit funds. For example, in the EU under MiCA or in Singapore with MAS licensing, you’ll see pop-up reminders about stablecoin reserves or withdrawal rights before your first purchase.

But it’s not just about compliance. The best exchanges are leaning into education, think video walkthroughs, sandbox demo accounts, and community Q and amp;A sessions, making crypto less intimidating for all ages. In fact, many platforms are now required to provide educational resources as part of their onboarding process.

Stablecoins: The New Frontline for Beginner Safety

Stablecoins like USDT, USDC, and PYUSD are at the heart of this regulatory evolution. In 2025 alone, we’ve seen PayPal expand PYUSD into the UK and EU after securing approvals (XAIGATE). This means beginners can access digital dollars with greater confidence that their funds are fully backed and protected by law, a huge leap from the wild volatility of early altcoins.

The focus on reserve management isn’t just legalese; it’s a safety net. Hong Kong’s Stablecoins Bill and Singapore’s MAS framework both require issuers to hold assets matching their stablecoin liabilities, no more empty promises or rug pulls. For anyone using stablecoins for cross-border payments or first-time investments, this is a direct line to peace of mind.

Key Takeaways: How to Navigate Onboarding in 2025

- Be prepared for thorough identity verification: Have your documents ready, passport or ID card scans are standard worldwide now.

- Read platform disclosures carefully: Regulatory regimes require clear info on token risks, don’t skip those pop-ups!

- Choose regulated platforms: Look for EU MiCA compliance badges or check if your exchange is FCA-registered in the UK or licensed in Singapore/HK.

- Diversify learning sources: Use free educational content from major exchanges and trusted compliance guides (like those from InnReg or Crypto. com University).

The upshot? While onboarding is more structured, and yes, sometimes slower, the tradeoff is a safer environment where beginners have recourse if things go wrong. Regulation isn’t killing innovation; it’s giving newcomers a fairer shot at understanding what they’re getting into before taking that first leap.

If you’re starting your crypto journey today in Europe or Asia, you’re walking into an ecosystem that’s finally putting users first, not just tech hype or speculation.