The U. S. crypto landscape is experiencing a seismic regulatory shift, with the fast-tracked crypto market structure bill: particularly the CLARITY Act, poised to redefine how new investors enter digital assets. For years, regulatory ambiguity and financial barriers have stifled mainstream adoption. Now, as the U. S. House passes sweeping legislation clarifying oversight and expanding access, onboarding for newcomers is set for its most significant transformation yet.

What Is the Crypto Market Structure Bill and Why Does It Matter?

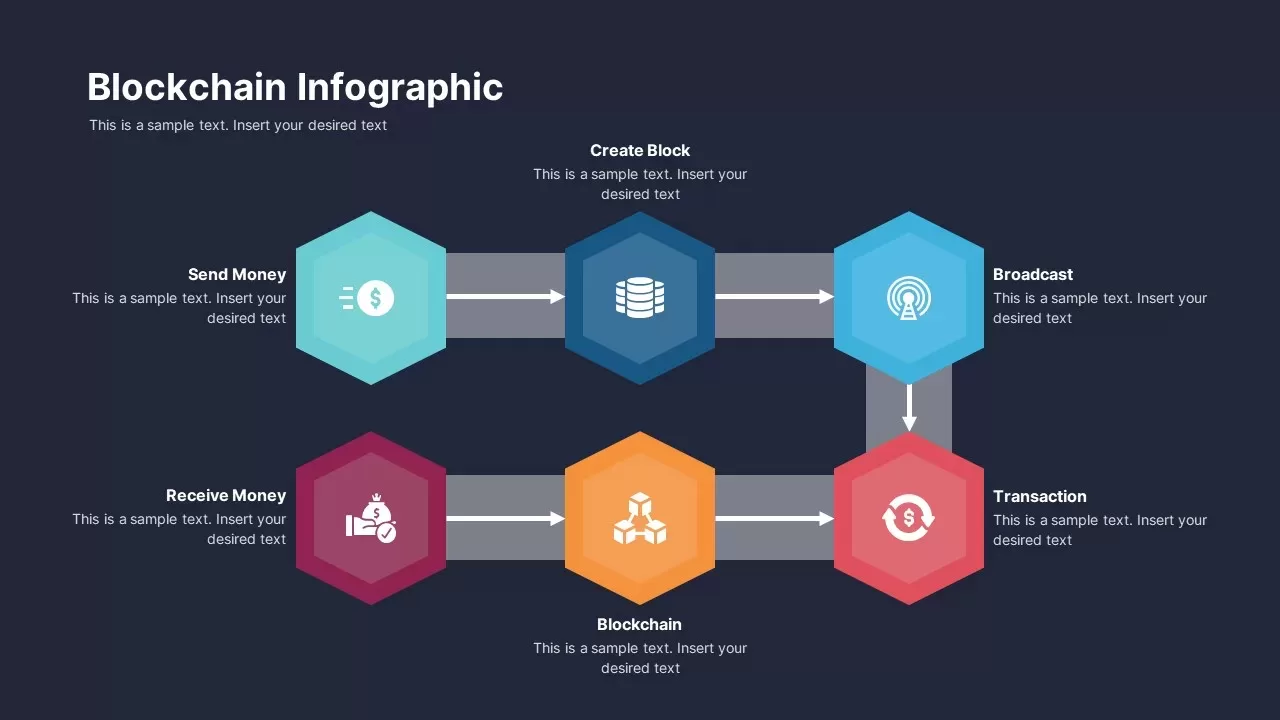

The crypto market structure bill is a comprehensive regulatory framework designed to delineate responsibilities between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). This division of labor addresses a core issue that has long plagued U. S. crypto markets: uncertainty over whether a digital asset is a security or a commodity. The bill also directs the SEC to pursue reciprocal arrangements with foreign regulators, maintaining U. S. leadership in global digital asset regulation (source).

This clarity is not just bureaucratic housekeeping, it’s foundational for investor confidence and industry innovation. By establishing clear rules of engagement, both retail participants and institutions gain confidence to enter or expand within U. S. crypto markets without fear of sudden enforcement or shifting requirements.

Removing Barriers: How Onboarding Will Change for New Investors

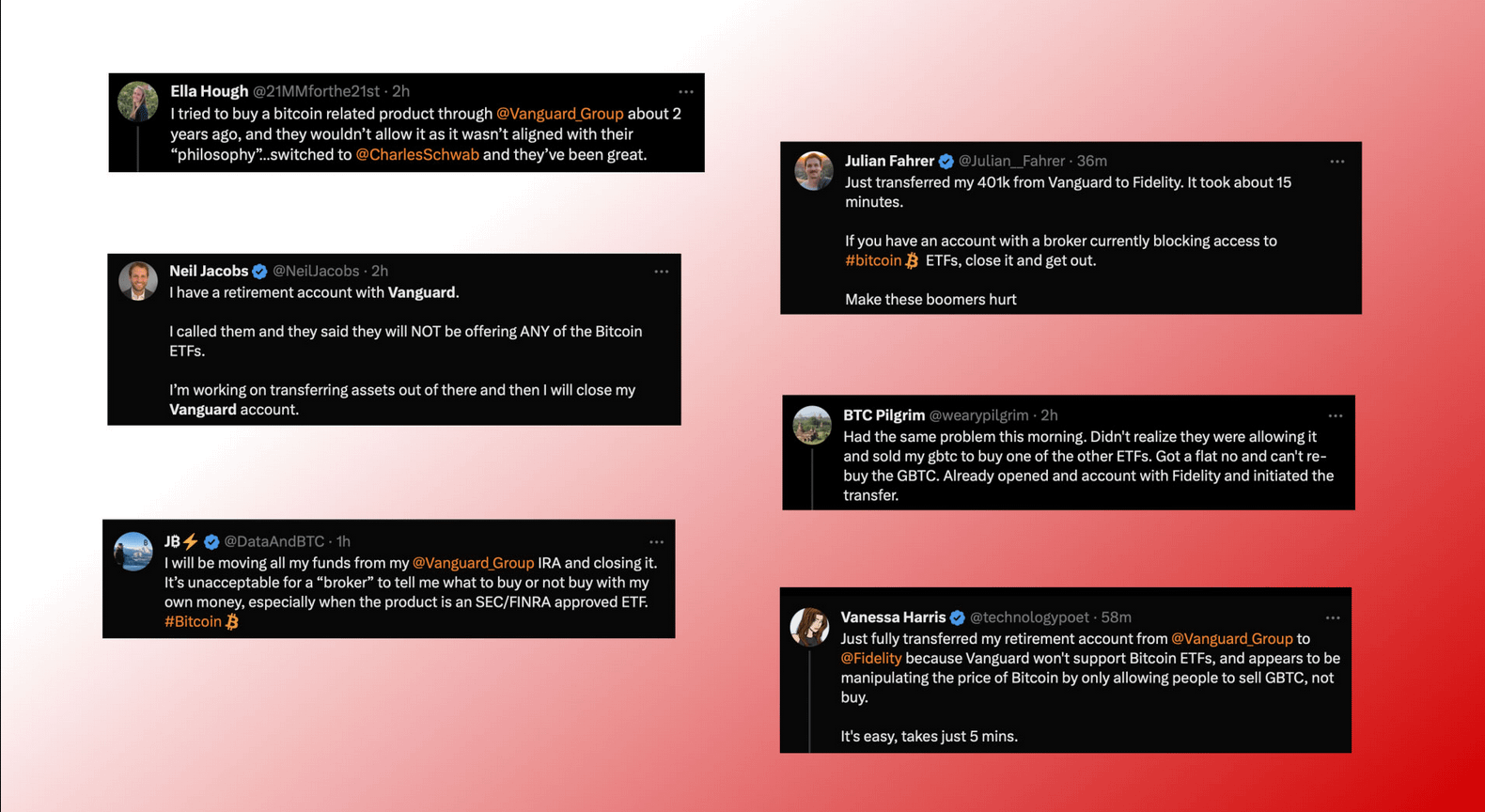

Historically, investing in certain digital assets required meeting stringent income or wealth thresholds, excluding many retail investors from early participation. The CLARITY Act eliminates these restrictions, allowing a more diverse group of Americans to access cryptocurrency markets directly (source). This democratization mirrors trends seen in traditional finance but with an even broader scope given crypto’s borderless nature and innovative DeFi protocols.

Key onboarding changes include:

3 Ways the New US Crypto Bill Eases Onboarding

-

Broader Access for Retail Investors: The CLARITY Act removes previous income and wealth restrictions, enabling all retail investors to participate in cryptocurrency markets without meeting high financial thresholds. This democratizes access and allows a more diverse group of beginners to invest in digital assets.

-

Clear Regulatory Guidance: The bill establishes definitive roles for the SEC and CFTC and provides clear criteria for when a blockchain network is considered decentralized. This reduces confusion for new investors about which assets are regulated and how, making it easier to understand compliance requirements.

-

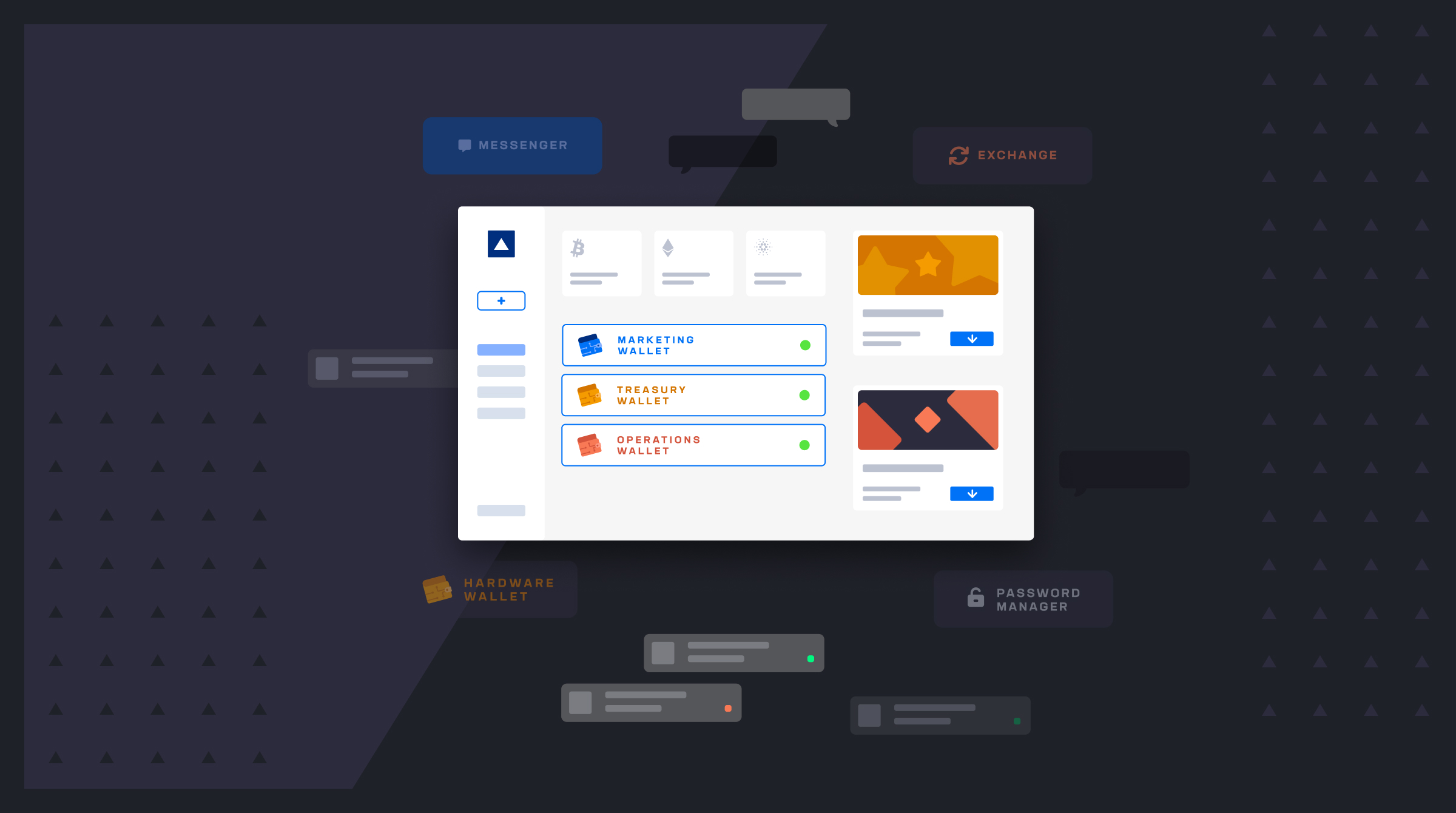

Support for Non-Custodial DeFi Platforms: By exempting non-custodial DeFi protocols from certain regulations, the act encourages innovation and gives beginners safer, more transparent options to engage with decentralized finance without relying on intermediaries.

The act also introduces objective criteria for determining when a blockchain network is considered decentralized, a crucial factor influencing which regulator oversees specific tokens or platforms (source). For new investors, this means greater transparency about what they’re buying and who’s responsible for oversight.

The Expanding Role of Stablecoins and DeFi Protocols

Alongside regulatory clarity for tokens, stablecoin oversight is being reimagined. The current draft treats virtual currency transmission similarly to traditional finance, an important step toward integrating stablecoins into mainstream payment systems while ensuring robust anti-money laundering (AML) compliance.

Decentralized finance (DeFi) protocols also receive significant attention: non-custodial DeFi platforms are granted exemptions from some requirements provided they meet certain transparency standards. This balance between innovation and consumer protection may encourage more developers to build accessible tools for first-time users without fear of being swept up in enforcement actions.

By redefining the regulatory environment, the U. S. crypto market structure bill is also likely to catalyze a wave of new products and services tailored for retail investors. With the removal of income and wealth restrictions, onboarding platforms are expected to redesign their user experiences to be more inclusive, intuitive, and compliant. This will particularly benefit those who may have previously felt intimidated by complex verification processes or opaque compliance requirements.

Furthermore, as the roles of the SEC and CFTC become more defined, exchanges and wallet providers can streamline their Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. This means fewer redundancies for users during onboarding, one of the biggest pain points for beginners entering crypto markets.

Implications for Financial Advisors and Traditional Institutions

The ramifications extend beyond individual investors. Financial advisors and traditional institutions now have a clearer framework for integrating digital assets into client portfolios. President Trump’s executive order permitting retirement plans like 401(k)s to invest in cryptocurrencies opens new channels for mainstream capital inflow (source). This could drive further innovation in custodial solutions, risk assessment tools, and educational resources specifically designed for first-time crypto investors.

Crucially, these changes will require ongoing education and transparent communication from both service providers and regulators. As decentralized finance protocols gain exemptions under certain conditions, new investors must understand both the opportunities and risks associated with non-custodial platforms.

Key Takeaways: What New Investors Should Watch For

- Broader Access: Elimination of wealth/income requirements means more Americans can participate in digital asset markets.

- Regulatory Clarity: Clear guidelines on which assets are securities vs. commodities reduces confusion during onboarding.

- Stablecoin Integration: New rules treat stablecoins more like traditional financial instruments, potentially increasing their utility for payments and savings.

- DeFi Innovation: Exemptions for non-custodial DeFi protocols may accelerate user-friendly product development while maintaining consumer protection standards.

The next phase will depend on how quickly industry players adapt to these regulatory shifts, and how effectively they communicate changes to prospective investors. Early signals suggest that both large exchanges and fintech startups are already updating onboarding flows to reflect new compliance standards while simplifying account creation steps for beginners.

Top Tips for Safe Crypto Onboarding Under New US Rules

-

Understand Asset Classification: The new law clearly distinguishes between digital commodities and securities. Check whether the crypto asset you are considering is regulated by the SEC or CFTC, as this impacts investor rights and disclosures.

-

Use Non-Custodial Wallets for DeFi: The CLARITY Act exempts non-custodial DeFi protocols from certain regulations. For greater control and security, consider using reputable non-custodial wallets like MetaMask or Coinbase Wallet when interacting with DeFi platforms.

-

Monitor Decentralization Status: The CLARITY Act defines criteria for when a blockchain network is considered decentralized. Before investing, check if the asset meets these criteria, as this affects its regulatory treatment and risk profile.

-

Take Advantage of Broadened Access: With the removal of income and wealth restrictions, a wider range of investors can now participate. However, start with small amounts and diversify your holdings to manage risk effectively.

A More Inclusive Crypto Future

The fast-tracked U. S. crypto market structure bill represents a pivotal step toward an open yet secure digital asset ecosystem. By removing outdated barriers, clarifying regulatory responsibilities, and incentivizing innovation in both centralized and decentralized finance sectors, it sets the stage for a broader influx of first-time investors, and perhaps a more resilient market overall.

This legislative momentum is not just about compliance; it’s about building trust at scale. As onboarding becomes easier and safer across major platforms, expect participation rates among everyday Americans to rise, fueling further growth in both usage cases and market capitalization.