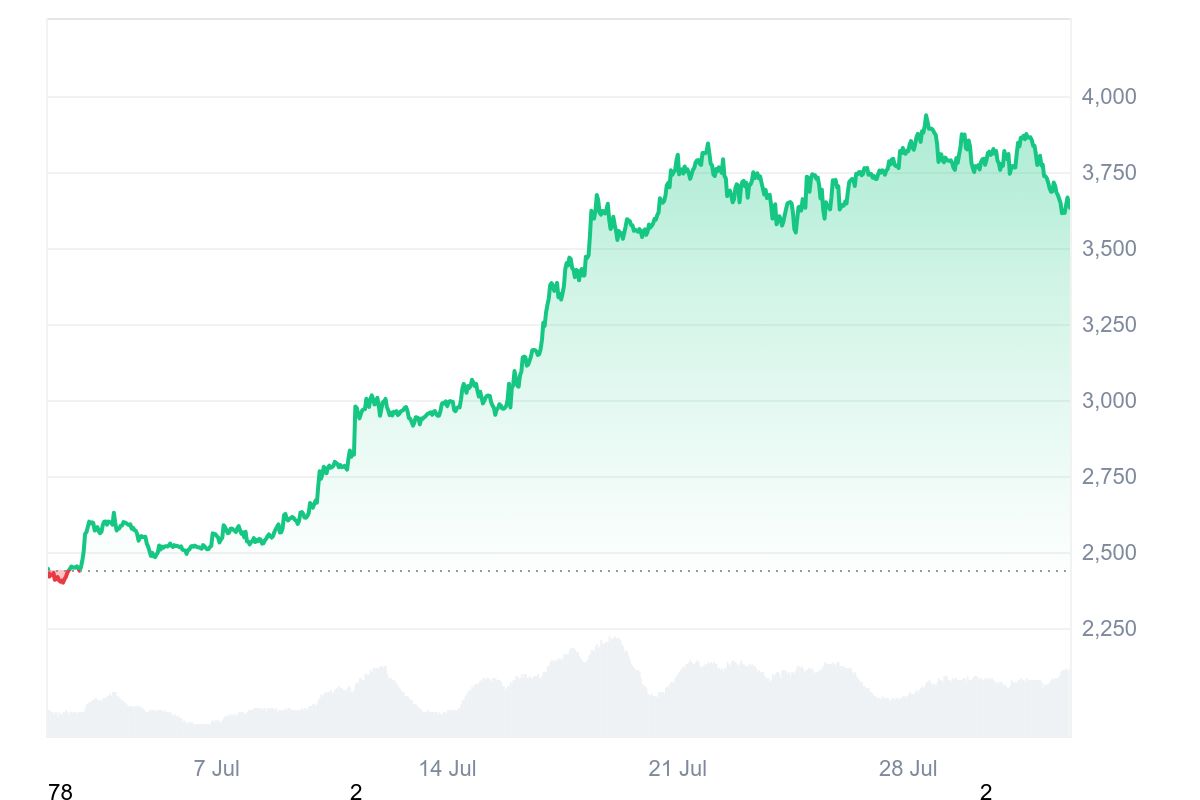

Ethereum just made history. On August 24,2025, Ether soared to an all-time high of $4,945.60, briefly brushing the $5,000 mark before settling at $4,576.09 as of this writing. This milestone didn’t happen in isolation – it arrived on the heels of the United States passing the GENIUS Act, a landmark piece of crypto legislation. The act’s full name, Guiding and Establishing National Innovation for U. S. Stablecoins Act, is a mouthful but its effects are already rippling through both Wall Street and Main Street.

GENIUS Act: The Regulatory Gamechanger for Crypto Onboarding

The GENIUS Act was signed into law by President Donald Trump on July 18,2025, after months of debate and anticipation. This sweeping legislation establishes a dual-licensing regime for fiat-backed stablecoin issuers and sets clear federal standards while preserving some state-level oversight. In practical terms, every stablecoin must now be fully backed one-to-one by U. S. dollars or other low-risk assets – a move designed to protect consumers and ensure market stability.

For newcomers to crypto or those considering their first purchase in 2025, this regulatory clarity is pivotal. The uncertainty that once surrounded stablecoins – from Tether’s reserves controversy to questions over USDC’s backing – has been replaced with enforceable rules. This doesn’t just help big institutions; it also means individuals can enter the crypto space with more confidence that their dollars won’t vanish overnight due to regulatory crackdowns or insolvencies.

Ethereum’s Surge: Not Just Hype, But Institutional Momentum

Ethereum’s price movement isn’t simply retail FOMO or speculative mania this time around. The surge to $4,945.60 was powered by record ETF inflows (over $727 million in a single day) and increasing adoption by digital asset treasury firms and traditional financial players. According to Axios, Ethereum’s programmability as a smart contract platform is drawing not just developers but also institutional investors who see it as critical infrastructure for the next phase of finance.

This isn’t lost on everyday investors either. The GENIUS Act’s passage has coincided with growing optimism that U. S. -regulated crypto products are safer bets than ever before – particularly as spot ETH ETFs attract mainstream capital at unprecedented rates.

How Regulation Shapes Your First Crypto Purchase in 2025

If you’re new to buying crypto or helping someone get started this year, you’ll notice some big differences compared to previous cycles:

- Stablecoins are now federally regulated: Every dollar-pegged token must be fully collateralized under strict federal guidelines.

- Banks can issue digital dollars: Traditional banks can launch their own stablecoins but face restrictions on offering interest-bearing products (unlike some crypto exchanges).

- KYC and compliance are clearer: Onboarding processes have become more standardized across platforms thanks to federal oversight.

- User protections are stronger: Clearer recourse exists if something goes wrong with your funds held in regulated stablecoins.

This environment supports cautious optimism for both retail buyers and institutions looking for exposure to digital assets without navigating legal gray zones.

Ethereum (ETH) Price Prediction 2026-2031 Post-GENIUS Act

Professional outlook based on current market context, regulatory evolution, and institutional adoption trends

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,800 | $5,150 | $7,200 | +12.5% | Potential consolidation as market digests GENIUS Act effects; volatility likely as institutions adjust strategies. |

| 2027 | $4,200 | $5,900 | $8,800 | +14.6% | Broader adoption of stablecoins on Ethereum, continued ETF inflows, and evolving competition with traditional finance. |

| 2028 | $4,700 | $6,800 | $10,200 | +15.3% | Network upgrades (e.g., scaling, privacy) and increasing DeFi/NFT activity drive demand and price. |

| 2029 | $5,200 | $7,700 | $12,400 | +13.2% | Further regulatory clarity globally, Ethereum cements role as leading smart contract platform; possible new all-time highs. |

| 2030 | $5,800 | $8,600 | $14,000 | +11.7% | Mainstream institutional adoption, new use cases (e.g., RWA tokenization), and robust Layer-2 ecosystem. |

| 2031 | $6,400 | $9,400 | $16,000 | +9.3% | ETH matures as digital asset, faces competition from next-gen chains but benefits from network effects and regulatory tailwinds. |

Price Prediction Summary

Ethereum’s price outlook post-GENIUS Act is bullish, with regulatory clarity, institutional inflows, and expanding use cases driving growth. While volatility and competitive pressures remain, the overall trend is upward, with ETH expected to solidify its position as a core digital asset through 2031.

Key Factors Affecting Ethereum Price

- GENIUS Act’s regulatory clarity spurring institutional adoption and stablecoin growth.

- Spot ETH ETF inflows increasing demand from traditional investors.

- Ongoing Ethereum network upgrades improving scalability and usability.

- Competition from other smart contract platforms and Layer-1/L2 chains.

- Potential global regulatory harmonization or fragmentation.

- Macroeconomic trends impacting risk appetite and capital flows.

- Adoption of new use cases (DeFi, NFTs, RWA tokenization) expanding Ethereum’s addressable market.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Competitive Landscape: Banks vs Crypto Exchanges

The GENIUS Act hasn’t pleased everyone equally. U. S. banks warn that allowing exchanges to offer rewards on third-party stablecoins while prohibiting banks from doing so on their own creates an uneven playing field (FT. com). There’s concern that deposit outflows could threaten credit creation and raise borrowing costs across the economy.

This tension is likely to shape how new users approach onboarding in 2025: Will they trust established banks’ digital offerings or migrate directly onto crypto-native platforms promising higher yields? Either way, competition should drive innovation across both sectors – ultimately benefiting end users seeking secure yet flexible entry points into digital assets.

For anyone considering their first crypto purchase, the impact of this regulatory shift is already being felt at the ground level. The onboarding process, once a patchwork of inconsistent checks and unpredictable wait times, has become more uniform. Know Your Customer (KYC) requirements are now clearer and more standardized, meaning that both retail investors and institutions can expect a smoother experience when opening accounts or transferring funds into digital assets.

But the GENIUS Act’s influence extends beyond onboarding mechanics. It’s fundamentally altering how newcomers weigh their options between banks and crypto exchanges. With federally regulated stablecoins, users can now move value between traditional finance and the blockchain economy with fewer worries about sudden regulatory interventions or frozen funds.

What to Watch: Risks, Rewards, and User Protections

As with any period of rapid change, there are new risks to navigate. While the GENIUS Act brings much-needed clarity, it also introduces fresh challenges for both legacy banks and crypto-native firms:

Pros and Cons of US Crypto Regulation for New Buyers

-

Pro: Enhanced Consumer Protections — The GENIUS Act requires stablecoins to be fully backed by U.S. dollars or other low-risk assets, reducing the risk of sudden losses for first-time buyers and increasing trust in digital assets.

-

Pro: Regulatory Clarity Boosts Market Confidence — Clear federal rules under the GENIUS Act have encouraged institutional investment, helping Ethereum reach a new high of $4,945.60 and making the crypto market more attractive for newcomers.

-

Pro: Easier Access Through Traditional Banks — The act allows U.S. banks to issue their own digital currencies, potentially making it simpler for first-time buyers to purchase crypto through familiar financial institutions.

-

Con: Uneven Playing Field for Interest Earnings — Crypto exchanges can offer rewards on third-party stablecoins, but banks are prohibited from paying interest on their own stablecoins, which may limit earning options for new users choosing traditional banks.

-

Con: Potential for Higher Borrowing Costs — Banks warn that deposit outflows to crypto platforms could reduce credit availability and increase borrowing costs, indirectly affecting new buyers who rely on traditional banking services.

-

Con: Increased Complexity in Platform Choices — With both banks and crypto-native platforms offering digital assets under different rules, first-time buyers may face confusion when selecting where and how to onboard into crypto.

For retail users, stronger consumer protections mean less risk of losing funds due to platform insolvency or poorly managed reserves. However, some may find yield opportunities more limited if they stick solely with bank-issued stablecoins, which cannot pay interest under current rules.

The flip side is that exchanges offering third-party stablecoins may offer higher rewards but could face stricter scrutiny as regulators monitor compliance and capital adequacy. This competitive push is likely to drive further innovation in user experience, asset security, and educational resources for those just getting started.

“Regulatory clarity doesn’t eliminate risk, but it does make it easier for new users to understand what they’re signing up for. “

Onboarding in 2025: What Does Success Look Like?

The ideal onboarding journey in this post-GENIUS Act era is transparent, efficient, and accessible regardless of whether you choose a bank-backed digital dollar or a decentralized finance (DeFi) protocol on Ethereum. Here’s what successful onboarding should offer:

- Straightforward KYC: No confusing paperwork or opaque requirements, just clear steps to verify your identity.

- Real-time transparency: Access to up-to-the-minute pricing data (like Ethereum’s current price of $4,576.09) so you can make informed decisions.

- Consumer recourse: If something goes wrong with your stablecoin provider or exchange, federal rules backstop your rights.

- Educational support: Platforms are investing in better guides and onboarding tools as competition heats up.

Looking Forward: The Road Ahead for US Crypto Regulation

The GENIUS Act has set a precedent other nations may follow, especially as Ethereum continues to capture institutional capital at scale. As spot ETH ETFs draw record inflows and digital asset treasuries allocate more balances on-chain, America’s approach will be closely watched by global markets seeking similar regulatory blueprints.

If you’re planning your first crypto buy this year, or advising someone who is, keep an eye not just on prices but on evolving compliance standards and incentives offered by different platforms. The landscape will keep shifting as banks lobby for changes and exchanges race to attract new customers with innovative features.

Ethereum (ETH) Price Prediction Table: 2026-2031 (Post-GENIUS Act Era)

Forecasts consider the impact of the GENIUS Act, institutional inflows, and evolving U.S. crypto regulation. Prices are based on current ETH market data ($4,576.09 as of August 2025) and account for bullish and bearish scenarios.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,900 | $5,250 | $7,200 | +14.7% | Volatility after regulatory clarity; ETF inflows continue |

| 2027 | $4,200 | $6,100 | $8,900 | +16.2% | Institutional adoption accelerates; stablecoin use grows |

| 2028 | $4,600 | $7,350 | $11,600 | +20.5% | Mainstream use of on-chain finance and RWAs |

| 2029 | $5,200 | $8,800 | $14,300 | +19.7% | Global expansion; Layer 2 scaling boosts usability |

| 2030 | $5,700 | $10,200 | $17,800 | +15.9% | DeFi and enterprise blockchain integration mature |

| 2031 | $6,300 | $11,600 | $21,400 | +13.7% | Ethereum 3.0 upgrades, new use cases, global adoption |

Price Prediction Summary

Ethereum is poised for continued growth following the GENIUS Act, which provides regulatory clarity and unlocks new institutional capital. While short-term volatility is expected as the market digests new rules and competitive pressures, ETH’s strong position as a programmable blockchain and its integration into mainstream finance drive progressively higher price targets through 2031. Bullish scenarios see ETH approaching $21,400 by 2031, while bearish outcomes maintain support above $6,300. Average annual price growth is expected to range from 13% to 20% in the coming years, with key risks including regulatory shifts, competition, and macroeconomic headwinds.

Key Factors Affecting Ethereum Price

- GENIUS Act regulatory clarity attracting U.S. and global institutions

- Spot ETH ETF inflows and digital asset treasury adoption

- Stablecoin market growth and related competition with banks

- Ethereum’s ongoing technical upgrades (scalability, security, programmability)

- Mainstream adoption of DeFi, NFTs, and tokenization of real-world assets (RWAs)

- Potential competition from other smart contract blockchains

- Macroeconomic conditions and global regulatory developments

- Market cycles and investor sentiment swings

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Ultimately, the winners in this new era will be those who balance security with accessibility, and who help onboard the next wave of users without sacrificing trust along the way.