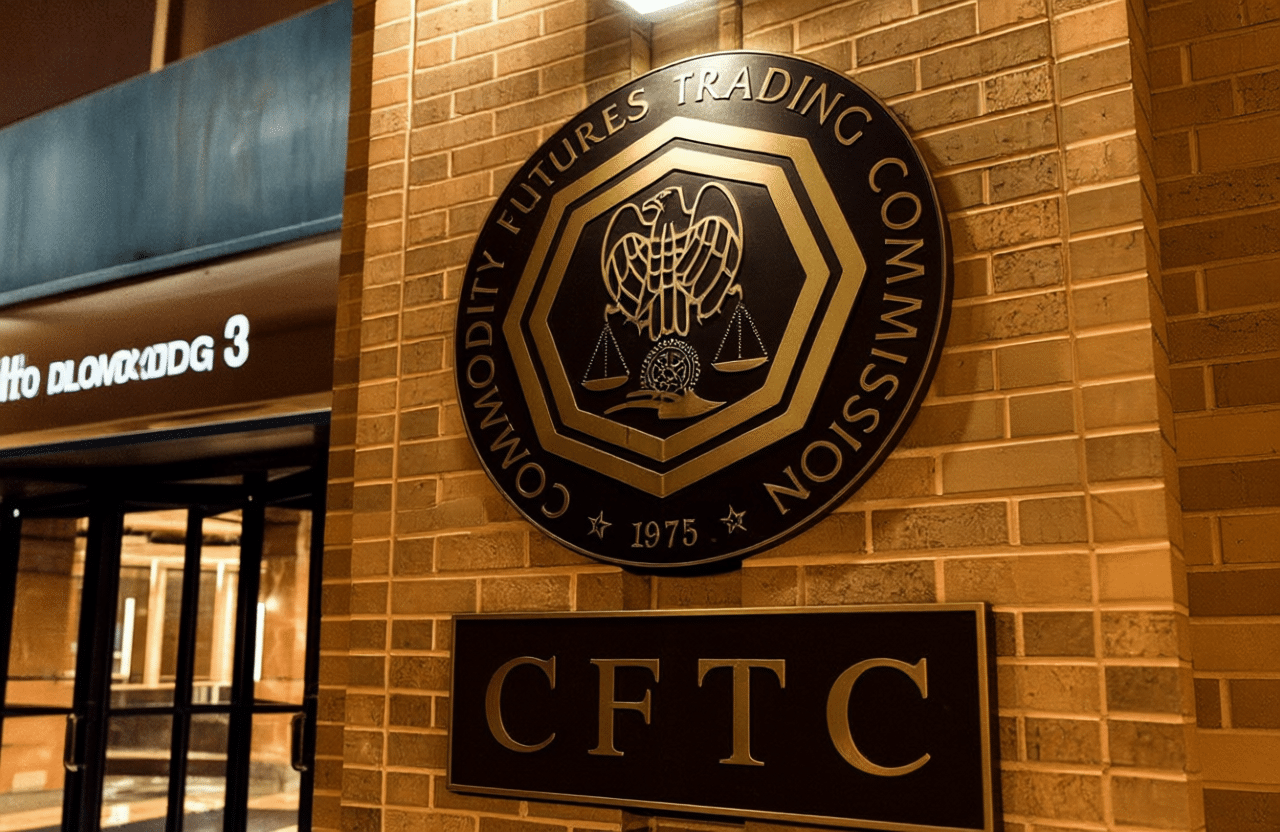

The U. S. Commodity Futures Trading Commission (CFTC) has just rewritten the playbook for American access to offshore crypto exchanges. In August 2025, the CFTC issued a landmark advisory clarifying that non-U. S. platforms can now legally serve U. S. customers by registering as Foreign Boards of Trade (FBOTs). This is a seismic shift for U. S. crypto onboarding, compliance, and the entire landscape of global digital asset trading.

CFTC Crypto Rules 2025: What Changed?

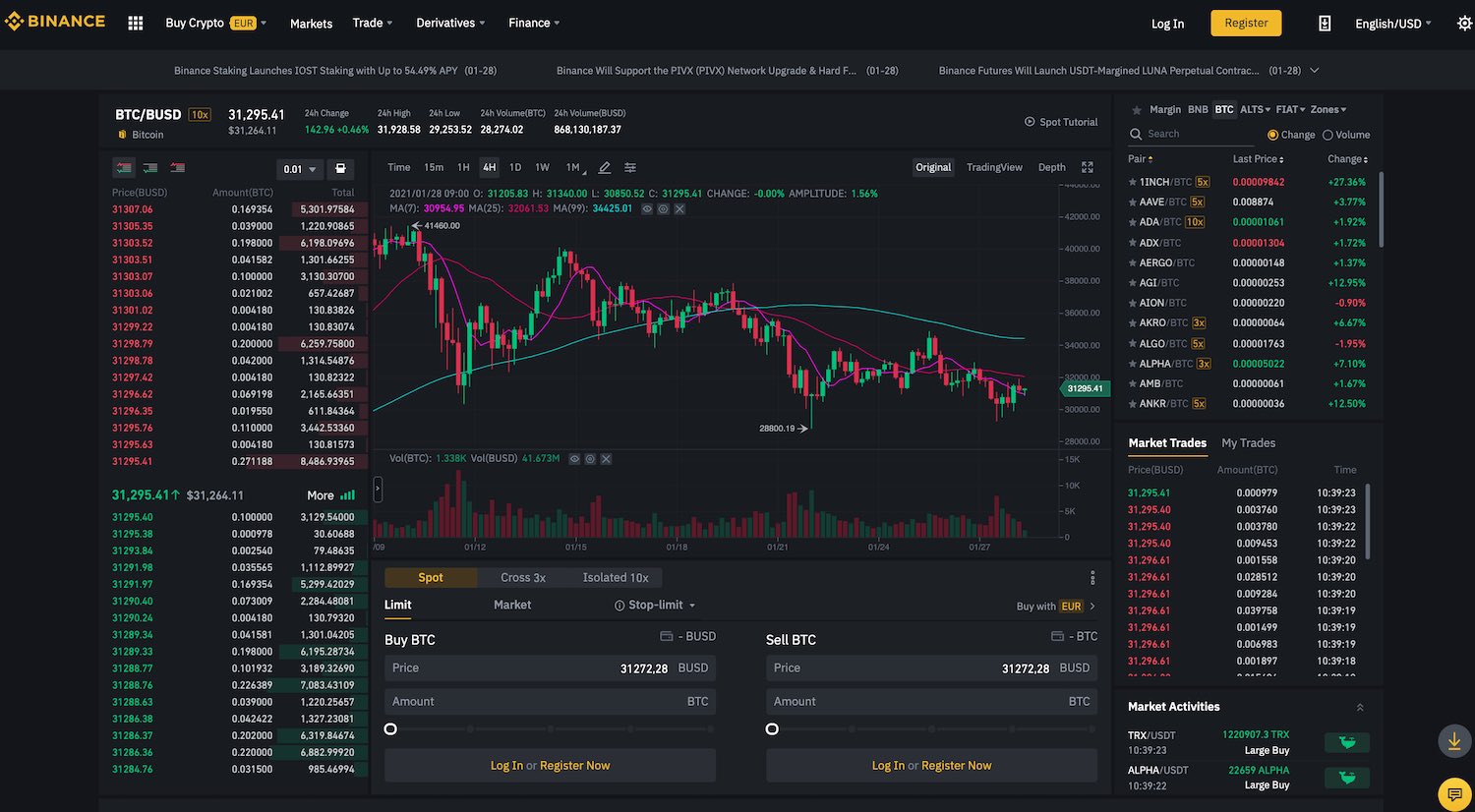

For years, U. S. traders faced a maze of restrictions when trying to access international crypto markets. Many major exchanges, including Binance Holdings Ltd. , had previously barred Americans due to regulatory uncertainty and enforcement risk. The new CFTC rules offer a clear path for these platforms to open their doors again – but only if they meet robust regulatory standards via FBOT registration.

The FBOT framework isn’t new; it has governed foreign commodity exchanges seeking U. S. access since the 1990s. What’s revolutionary is its application to crypto derivatives marketplaces in 2025, providing legal clarity and compliance benchmarks for both platforms and users.

Why This Matters for U. S. Crypto Onboarding

Let’s break down how this impacts American traders looking to onboard onto offshore crypto exchanges:

Key Benefits for US Users Onboarding Offshore Exchanges

-

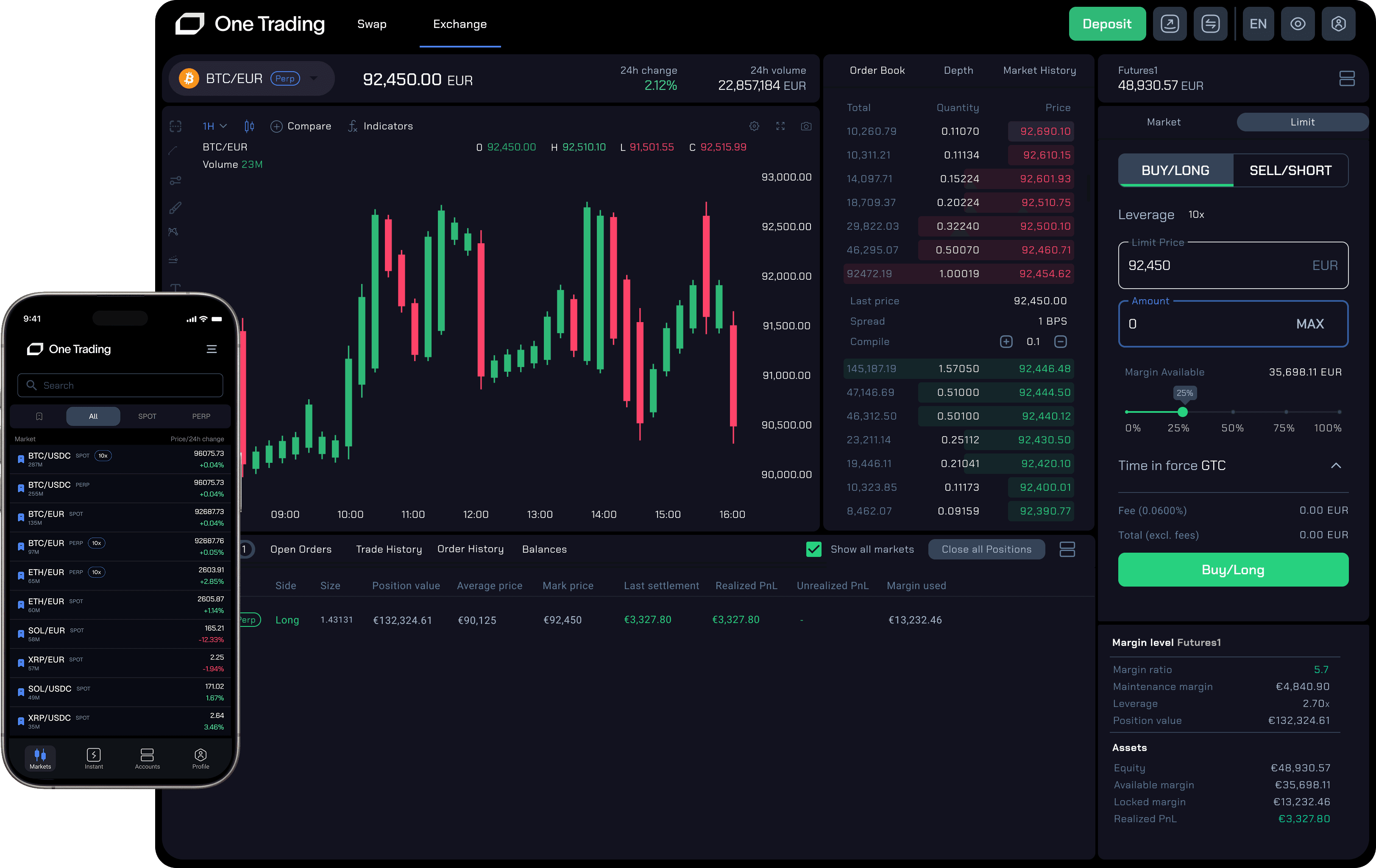

Broader Range of Crypto Derivatives: The new CFTC framework allows Americans to access a wider selection of crypto derivatives and futures products available on foreign exchanges, increasing portfolio diversification opportunities.

-

Improved Market Liquidity and Price Discovery: Onboarding to offshore exchanges connects US traders to deeper global liquidity pools, potentially resulting in tighter spreads and more efficient price discovery for assets like XRP.

-

Enhanced Regulatory Clarity and Consumer Protections: With the FBOT framework, US users benefit from exchanges that meet CFTC oversight standards, providing greater transparency and regulatory protections compared to unregulated offshore options.

-

Competitive Fees and Innovative Features: Offshore exchanges often offer lower trading fees and advanced features such as copy trading, automated trading bots, and a broader selection of tokens, giving US users more choices and value.

Market competition is about to heat up. With more global venues allowed to serve Americans, expect better pricing, deeper liquidity pools, and innovative products previously out of reach in the domestic market.

This also marks a major win for transparency and consumer protection. The CFTC now requires that registered FBOTs maintain compliance standards comparable to those in the U. S. , meaning American users can expect higher levels of oversight than ever before when accessing international platforms.

Onboarding Compliance: What Users Need to Know

The days of using VPNs or questionable workarounds are numbered – legal access means onboarding processes will be thorough but standardized across compliant platforms. Here’s what you can expect as you start your journey:

- KYC/AML Checks: All FBOT-registered exchanges must enforce strict Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

- Regulatory Disclosures: Users will receive clear information on risks, fees, and dispute resolution procedures as part of onboarding.

- Smoother Fiat Onramps: Expect improved options for funding accounts directly from U. S. bank accounts or stablecoins.

This framework doesn’t just protect users; it also levels the playing field between domestic and international players by holding everyone to similar standards.

A Shift Toward Global Liquidity and Choice

CFTC Acting Chair Caroline Pham summed it up: these changes are about “legally onshoring trading activity” that was previously driven abroad due to unclear rules (source). For U. S. -based traders, this opens up a world of opportunity – literally – with access to global order books, tighter spreads, and potentially more advanced products like perpetual swaps or exotic options.

Still, this expanded access comes with real responsibilities. U. S. users must now navigate a more formal onboarding process, likely involving multi-step verification and ongoing compliance checks. The upside is that these measures help weed out bad actors and foster a safer environment for all participants.

For platforms, the cost of compliance is significant, but so is the reward: direct entry into one of the world’s most lucrative retail crypto markets. Expect to see global giants like Binance and Bybit ramping up their U. S. -facing offerings as they pursue FBOT registration. Meanwhile, smaller offshore venues may struggle to meet the CFTC’s bar, which could ultimately concentrate liquidity among well-capitalized players.

How to Onboard to Offshore Crypto Exchanges in 2025

Onboarding in this new era will look different than in years past. Here’s what American users should prepare for when signing up with an FBOT-registered exchange:

As you move through these steps, keep documentation handy, government-issued ID, proof of address, and sometimes even source-of-funds details may be required. The process is less about hurdles and more about building trust on both sides of the platform.

Potential Risks and What to Watch

Even with enhanced oversight, risks remain when trading on global platforms. Currency conversion fees, cross-border withdrawal delays, and regulatory changes in other jurisdictions can all impact your experience. It’s wise to stay informed about evolving rules both at home and abroad.

The broader impact? This move by the CFTC signals a shift from defensive regulation to proactive engagement with global crypto markets, a stance that could inspire similar reforms worldwide. For everyday traders and institutions alike, it means more options but also a higher bar for due diligence.

What Comes Next?

The months ahead will be telling as major offshore exchanges begin rolling out FBOT-compliant services for Americans. Watch for announcements from industry leaders, and expect an influx of educational resources aimed at helping users navigate this new landscape safely.

Ultimately, these regulatory updates represent a turning point for U. S. crypto onboarding: more choice, greater transparency, but also more accountability for platforms and users alike.