Bitcoin’s wild ride in 2025 is putting new investors to the test. After smashing through its all-time high and peaking at $124,480.82 in mid-August, Bitcoin has pulled back sharply, currently trading at $108,487 as of August 31. This correction isn’t just a number on a screen, it’s a wake-up call for anyone jumping into crypto for the first time. If you’re asking what $112,000 means now that we’ve dipped below it, you’re not alone. Let’s cut through the noise and break down what this price action really signals for onboarding into crypto during periods of extreme volatility.

Bitcoin’s $112,000 Milestone: Why It Matters Now

That $112,000 level isn’t just psychological, it’s a battleground. In August 2025, derivatives markets saw aggressive “buy the dip” activity right around this zone with over $30.3B in open interest (source). Traders and institutions piled in as Bitcoin tested support here, some betting on a quick rebound to new highs, others bracing for further downside.

If you’re onboarding now, understand this: support levels like $112,000 are magnets for market drama. When price slices through them on high volume (as it did last week), volatility spikes and emotions run hot. For veterans it’s an opportunity; for newcomers it can be intimidating, or worse, lead to panic decisions.

The Anatomy of a Price Correction: More Than Just Numbers

This isn’t just another dip, this is textbook crypto volatility amplified by macro headlines and regulatory moves. The creation of the U. S. Strategic Bitcoin Reserve earlier this year was supposed to stabilize things (details here). Instead, it added fuel to an already roaring fire by attracting new money and speculation.

What triggered the recent pullback?

- Profit-taking after all-time highs: When BTC surged past $124K, big players locked in gains fast.

- Regulatory uncertainty: Even with pro-crypto policies in place now (see FT coverage), traders know that sentiment can flip on a dime.

- Macro headwinds: Rate hikes and shifting risk appetite globally are making everyone nervous, even those who claim diamond hands.

This is classic market psychology: euphoria at the top turns into fear at the first sign of red candles. But corrections like this are where disciplined traders build their edge, and where new investors need to learn fast or risk getting washed out.

Tactics for New Investors During Volatility

If you’re onboarding into crypto during this stormy period, here’s what matters most:

Key Steps for New Investors Buying Bitcoin in Volatility

-

Assess Your Risk Tolerance: Understand that Bitcoin’s price recently dropped from $124,480.82 to $108,487. Only invest what you can afford to lose, and be honest about your comfort with volatility.

-

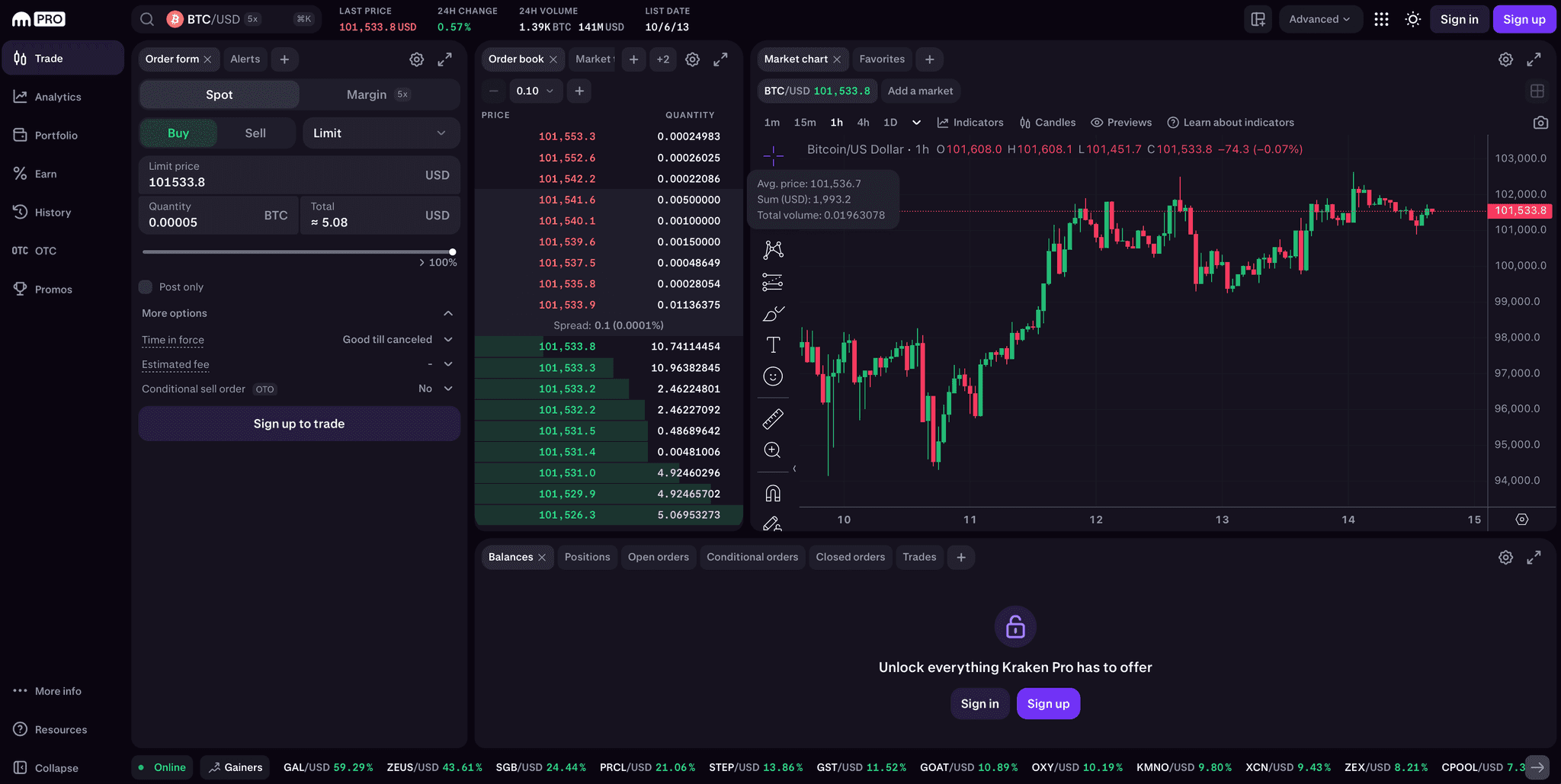

Choose a Reputable Exchange: Use established platforms like Coinbase, Kraken, or Binance for secure transactions and robust user protections.

-

Enable Two-Factor Authentication: Secure your account with 2FA on your chosen exchange to protect your assets from unauthorized access.

-

Start with Small, Regular Purchases: Consider dollar-cost averaging (DCA) by investing a fixed amount at regular intervals, reducing the impact of short-term price swings.

-

Store Bitcoin Safely: Transfer your Bitcoin to a reputable hardware wallet like Ledger or Trezor for enhanced security against hacks.

-

Stay Informed on Regulations: Follow updates from sources like CoinDesk, Reuters, and FT.com to track regulatory changes that may affect the crypto market.

-

Consult a Financial Advisor: Seek guidance from a certified financial planner with crypto expertise to align your Bitcoin investment with your overall financial goals.

Don’t chase pumps or panic sell dips. The current price action is noisy but offers lessons if you keep your head clear. Diversify your entry points (dollar-cost averaging still works), use secure exchanges only (see our guide on how to buy Bitcoin safely 2025) and always double-check your risk tolerance before deploying capital.

Bitcoin Price Prediction 2026-2031 Post-$112K Correction

Comprehensive outlook based on 2025’s correction, on-chain data, and evolving crypto market fundamentals.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-over-Year Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $83,000 | $115,000 | $155,000 | +6% | Post-correction accumulation, possible regulatory tightening, and global macro uncertainty could create volatility. Base case assumes recovery and moderate growth as adoption continues. |

| 2027 | $102,000 | $138,000 | $185,000 | +20% | ETF inflows and increased institutional adoption drive a new uptrend. Potential for temporary corrections as regulatory clarity improves. |

| 2028 | $118,000 | $160,000 | $225,000 | +16% | Next Bitcoin halving event spurs bullish sentiment. Wider integration in payment systems and ongoing global adoption. Bearish scenario reflects possible tech or regulatory setbacks. |

| 2029 | $130,000 | $182,000 | $270,000 | +14% | Sustained growth as Bitcoin cements its role as a macro asset. Possible competition from new blockchain technologies. Enhanced scalability and privacy features boost average value. |

| 2030 | $150,000 | $210,000 | $320,000 | +15% | Mainstream financial adoption, with Bitcoin offered in more retirement and pension funds. Bullish scenario assumes global regulatory harmonization and mass retail adoption. |

| 2031 | $170,000 | $240,000 | $380,000 | +14% | Long-term institutional holding and reduced volatility. Bitcoin potentially becomes a global digital reserve asset. Bearish case: competition from CBDCs or major tech disruption. |

Price Prediction Summary

Bitcoin’s price trajectory post-2025 correction suggests continued volatility but a generally upward trend, driven by institutional adoption, regulatory developments, and technological progress. While short-term corrections are likely, the long-term outlook remains positive as Bitcoin matures as an asset class.

Key Factors Affecting Bitcoin Price

- Regulatory environment and global policy shifts impacting crypto adoption and flows.

- Institutional adoption and ETF/retirement product inflows.

- Technological upgrades to Bitcoin (e.g., scalability, privacy features).

- Macroeconomic conditions, including inflation and monetary policy.

- Competition from other cryptocurrencies and digital assets, including CBDCs.

- Market sentiment and behavioral cycles (accumulation vs. distribution).

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Staring at the $108,487 price tag after Bitcoin’s recent correction, new investors are asking the right questions: Is this the bottom? Will we snap back above $112,000 or drift lower? Nobody has a crystal ball, but on-chain data and market sentiment offer real clues for those who know where to look.

Reading On-Chain Data: What Beginners Need to Know

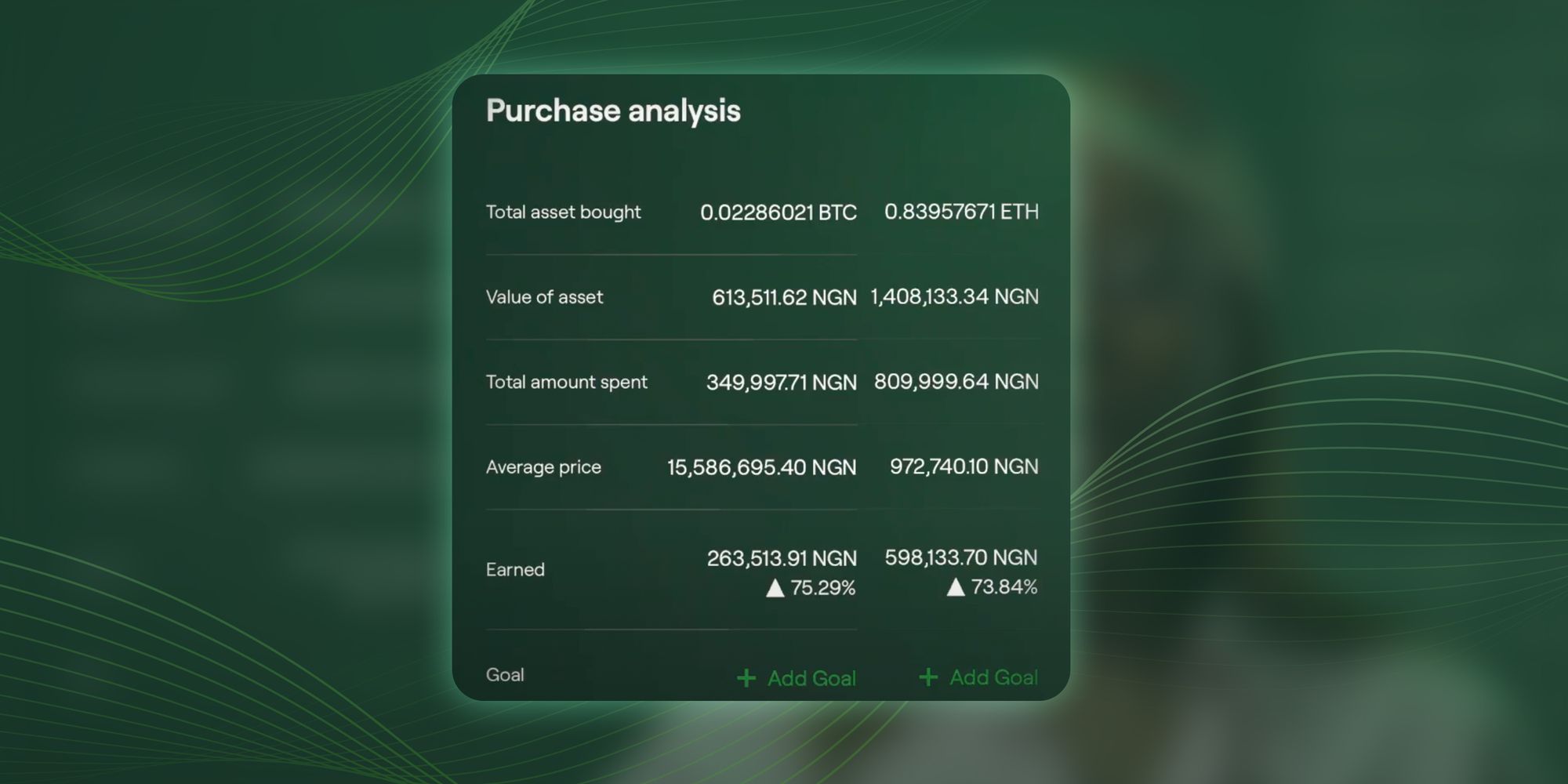

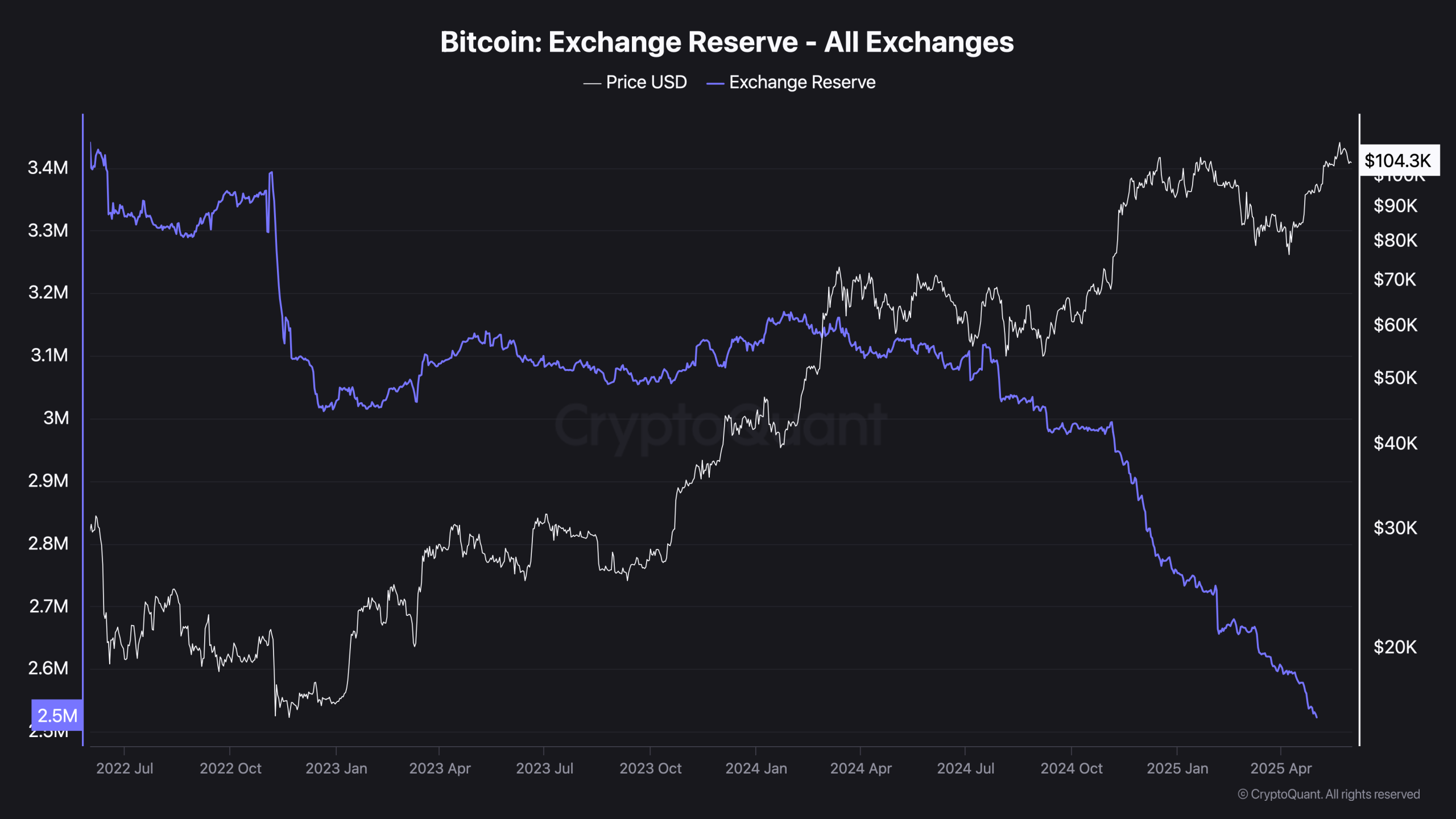

For anyone onboarding during this volatility, understanding on-chain data for beginners is a must. Metrics like exchange inflows, whale wallet movements, and realized price bands can signal when big players are accumulating, or dumping. Right now, data shows a tug-of-war: some large holders are cashing out after the run-up, while others are quietly stacking sats below $112K. This is what creates those wild swings you’re seeing in real time.

If you’re new to crypto, don’t get lost in technical jargon. Focus on these basics:

5 Essential On-Chain Metrics for New Bitcoin Investors

-

1. Exchange Reserves: Tracking the total amount of Bitcoin held on major exchanges (e.g., Glassnode, CryptoQuant) reveals investor sentiment. Decreasing reserves often signal accumulation and reduced selling pressure, while rising reserves may indicate looming sell-offs.

-

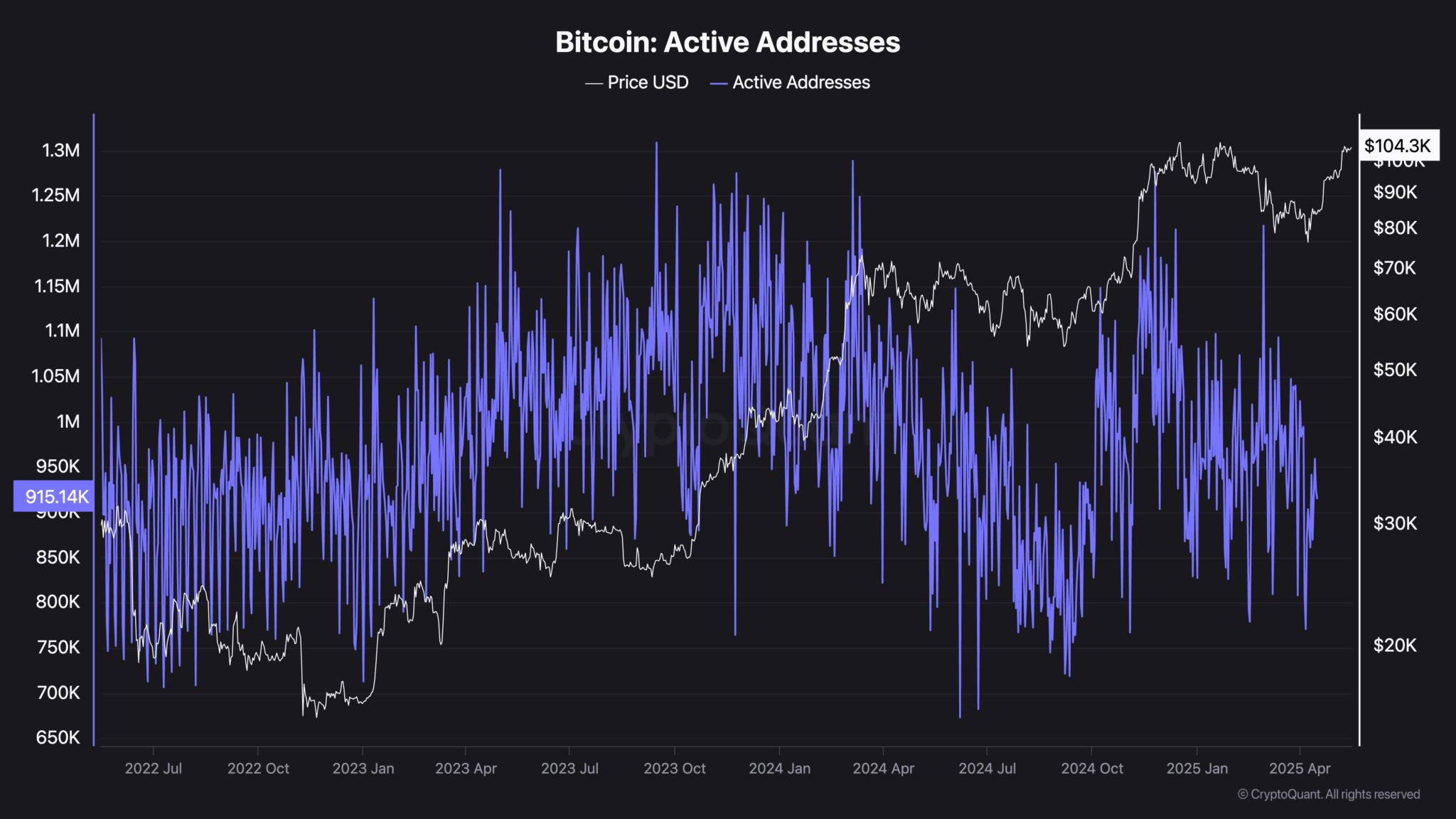

2. Active Addresses: The number of unique active Bitcoin addresses (daily/weekly) can be viewed on Blockchain.com. Rising activity typically suggests growing network usage and adoption, which can support long-term price stability.

-

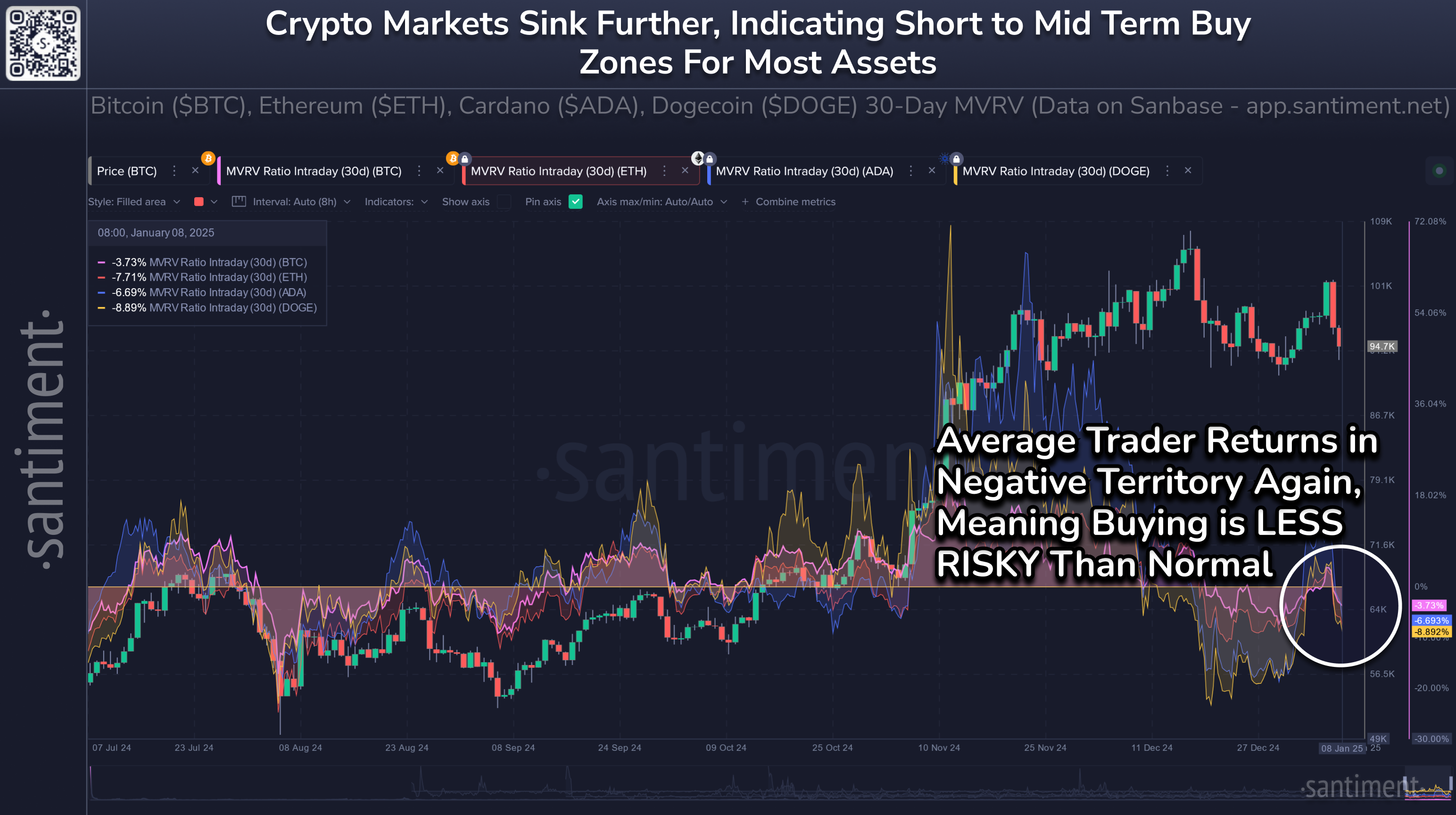

3. MVRV Ratio (Market Value to Realized Value): This metric, available on Glassnode, compares Bitcoin’s current market cap to the value at which coins last moved. MVRV extremes help identify overbought or oversold conditions—crucial for timing entries during corrections like the recent drop from $124,480.82 to $108,487.

-

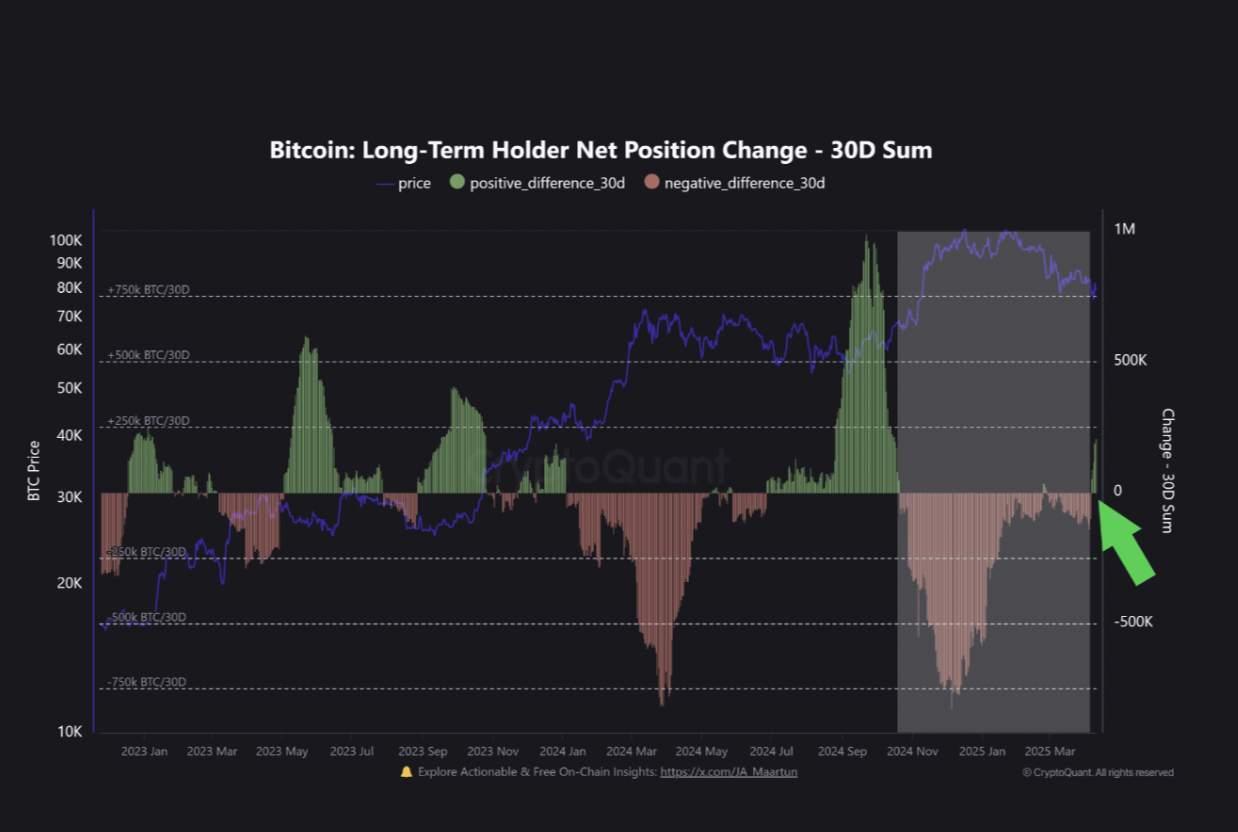

4. Long-Term Holder Supply: Platforms like CryptoQuant and Glassnode track the amount of Bitcoin held by long-term holders (typically >155 days). Rising long-term holder supply signals strong conviction and can provide a buffer during volatile corrections.

-

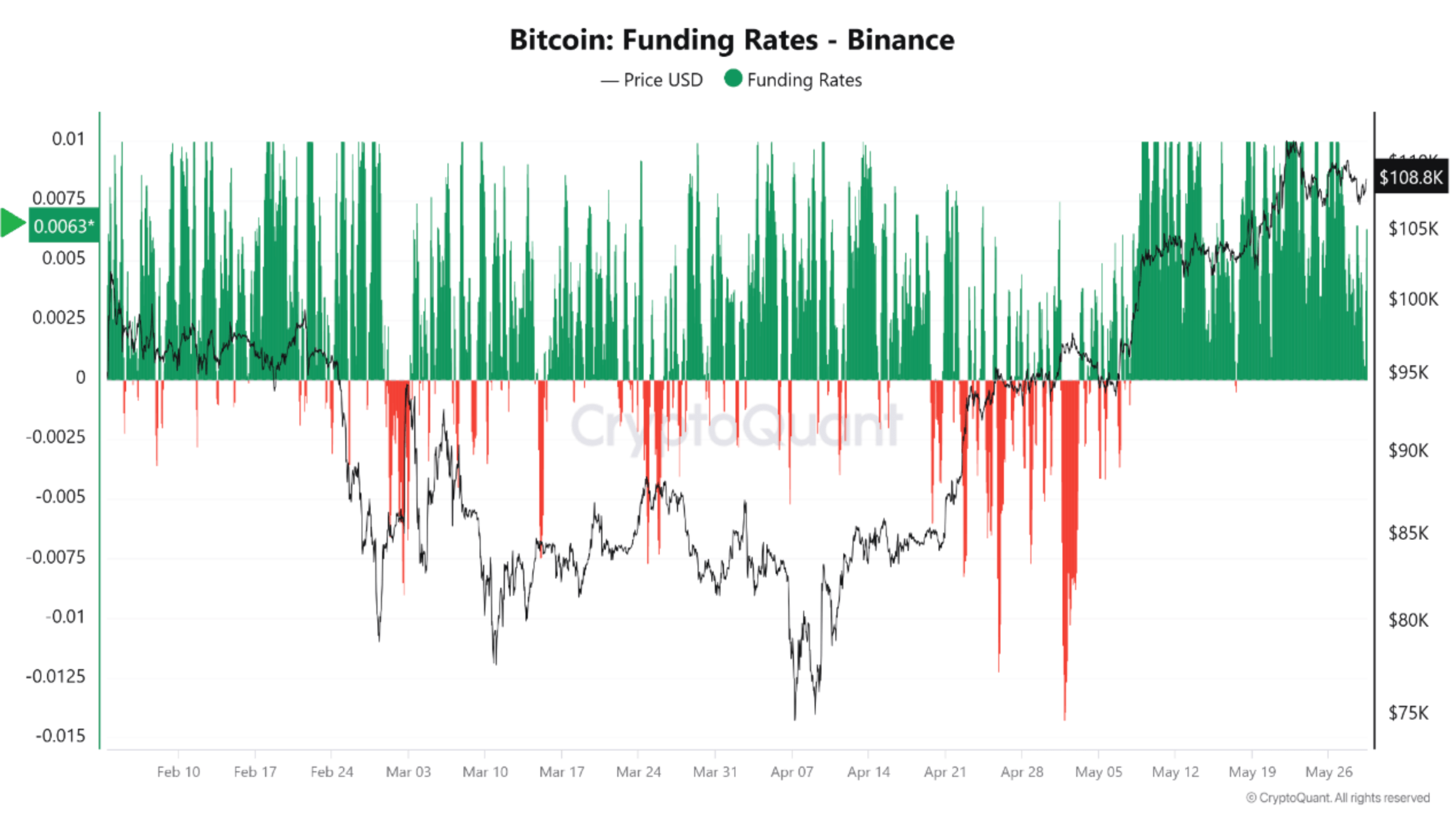

5. Funding Rates: Funding rates on major derivatives exchanges (e.g., Binance, Bybit) reflect the cost of holding leveraged positions. Extremely positive or negative rates can indicate overheated markets or panic, helping investors gauge whether the current correction is likely to continue or reverse.

Remember, on-chain activity doesn’t guarantee price direction, but it gives you an edge over blindly following headlines or hype.

How to Buy Bitcoin Safely in 2025

The temptation to “buy the dip” is everywhere right now. But safety comes first. Use regulated exchanges with strong track records and always enable two-factor authentication. Transfer your coins to self-custody wallets if possible, don’t leave large amounts on exchanges long-term. Scams spike during volatile markets; double-check URLs and never trust random DMs offering investment advice.

If you’re dollar-cost averaging into Bitcoin at $108,487, stick to your plan regardless of daily swings. Don’t let FOMO or panic drive your decisions; consistency beats emotion every time.

What Comes Next? Pro Moves and Pitfalls

The next few weeks will be a masterclass in market psychology as traders debate whether $108,487 is a launchpad or just another stop before further downside. Derivatives markets remain red-hot with open interest still near record highs, meaning volatility isn’t going away anytime soon (see Reuters coverage). If you’re new here, keep your risk tight and avoid leverage until you truly understand how fast things can move against you.

Bitcoin Price Prediction 2026-2031

Expert Forecasts Based on 2025 Market Correction and Current Adoption Trends

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $89,000 | $118,000 | $135,000 | +9% | Potential consolidation as market digests 2025 highs; regulatory clarity may drive renewed interest. |

| 2027 | $98,000 | $130,000 | $154,000 | +10% | Renewed institutional adoption and possible global ETF approvals could fuel bullish sentiment. |

| 2028 | $112,000 | $144,000 | $176,000 | +11% | Halving effect expected; increased scarcity and growing real-world use cases boost price. |

| 2029 | $125,000 | $160,000 | $205,000 | +11% | Macro environment and further adoption by sovereign wealth funds can amplify upward momentum. |

| 2030 | $138,000 | $178,000 | $240,000 | +11% | Mainstream financial integration and improved scaling solutions drive growth; volatility persists. |

| 2031 | $150,000 | $195,000 | $270,000 | +10% | Mature market phase; Bitcoin competes with gold as a global store of value, though regulatory risks remain. |

Price Prediction Summary

Bitcoin is expected to recover from its 2025 correction and gradually establish new all-time highs through 2031, with average prices moving from $118,000 in 2026 to $195,000 by 2031. Minimum and maximum price ranges reflect ongoing market volatility and the influence of external factors such as regulation and macroeconomic conditions. While Bitcoin’s growth trajectory remains positive, investors should be prepared for significant price swings and evolving market dynamics.

Key Factors Affecting Bitcoin Price

- Regulatory clarity in major markets (U.S., EU, Asia) impacting institutional investment.

- Adoption trends among corporations, asset managers, and sovereign entities.

- Technological upgrades (e.g., scaling, privacy, interoperability) enhancing Bitcoin’s utility.

- Market cycles driven by halving events and macroeconomic shifts (inflation, interest rates).

- Competition from alternative cryptocurrencies and digital assets.

- Potential black swan events or systemic risks affecting the broader financial system.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Want actionable steps? Here’s what seasoned traders do, and what newcomers should copy:

Key Steps for Buying Bitcoin in Volatile Markets

-

Assess Your Risk Tolerance: Before investing, honestly evaluate how much price fluctuation you can handle. Bitcoin’s recent correction from $124,480.82 to $108,487 highlights its volatility. Use tools like risk tolerance calculators to guide your decision.

-

Choose a Reputable Exchange: Use established platforms such as Coinbase, Kraken, or Binance for secure and user-friendly Bitcoin purchases. These exchanges offer robust security features and educational resources for new investors.

-

Enable Two-Factor Authentication (2FA): Protect your account by activating 2FA on your exchange. This extra security step is essential during volatile periods when hacking attempts may increase. Platforms like Google Authenticator or Authy are widely used for this purpose.

-

Start with Small, Regular Purchases (Dollar-Cost Averaging): Instead of investing a lump sum at once, consider buying smaller amounts of Bitcoin at set intervals. Services like Coinbase Recurring Buys or Gemini Auto-Buy automate this process and help reduce the impact of short-term price swings.

-

Store Bitcoin Securely in a Wallet: After buying, transfer your Bitcoin to a secure wallet. Hardware wallets like Ledger Nano X or Trezor Model T are industry standards for safely storing crypto assets offline.

-

Stay Informed on Market and Regulatory News: Monitor trusted sources such as CoinDesk and Reuters Crypto for updates on price movements, new regulations, and macroeconomic factors affecting Bitcoin.

-

Consult a Financial Advisor Familiar with Crypto: Seek guidance from professionals who understand cryptocurrency markets. Advisors like Ric Edelman and firms such as Bitwise Asset Management have experience helping clients build balanced crypto portfolios.

This isn’t about guessing tops or bottoms; it’s about building habits that survive any market cycle. If you manage risk aggressively now while others lose their heads, you’ll be miles ahead when the next bull run kicks off.

Bitcoin Price Prediction 2026-2031: Post-Correction Outlook for New Investors

Price projections incorporate market volatility, on-chain data, and macroeconomic/regulatory factors following the 2025 correction.

| Year | Minimum Price | Average Price | Maximum Price | Potential % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $92,000 | $119,000 | $148,000 | +9.7% | Recovery year: Market stabilizes after 2025 correction, regulatory clarity encourages cautious optimism. |

| 2027 | $102,000 | $132,000 | $168,000 | +10.9% | Renewed institutional interest, further ETF adoption, but volatility remains due to global macro shifts. |

| 2028 | $115,000 | $145,000 | $185,000 | +9.8% | Bullish halving cycle, increased use-case adoption; price appreciation accelerates, but sharp pullbacks possible. |

| 2029 | $125,000 | $159,000 | $210,000 | +9.7% | Broader adoption and tech improvements (e.g., scalability, privacy), but competition from new assets intensifies. |

| 2030 | $139,000 | $175,000 | $238,000 | +10.1% | Mainstream integration into finance, regulatory frameworks mature, but global economic headwinds may cause corrections. |

| 2031 | $154,000 | $191,000 | $265,000 | +9.1% | Long-term holders dominate, price discovery driven by global digital asset adoption and sovereign strategies. |

Price Prediction Summary

Bitcoin is projected to recover from its 2025 correction with a steady upward trajectory through 2031. The average price is expected to increase by approximately 9–11% per year, reflecting both growing adoption and recurring volatility. Minimum prices provide a conservative outlook accounting for potential bear markets, while maximum prices reflect bullish scenarios driven by institutional inflows and technological progress.

Key Factors Affecting Bitcoin Price

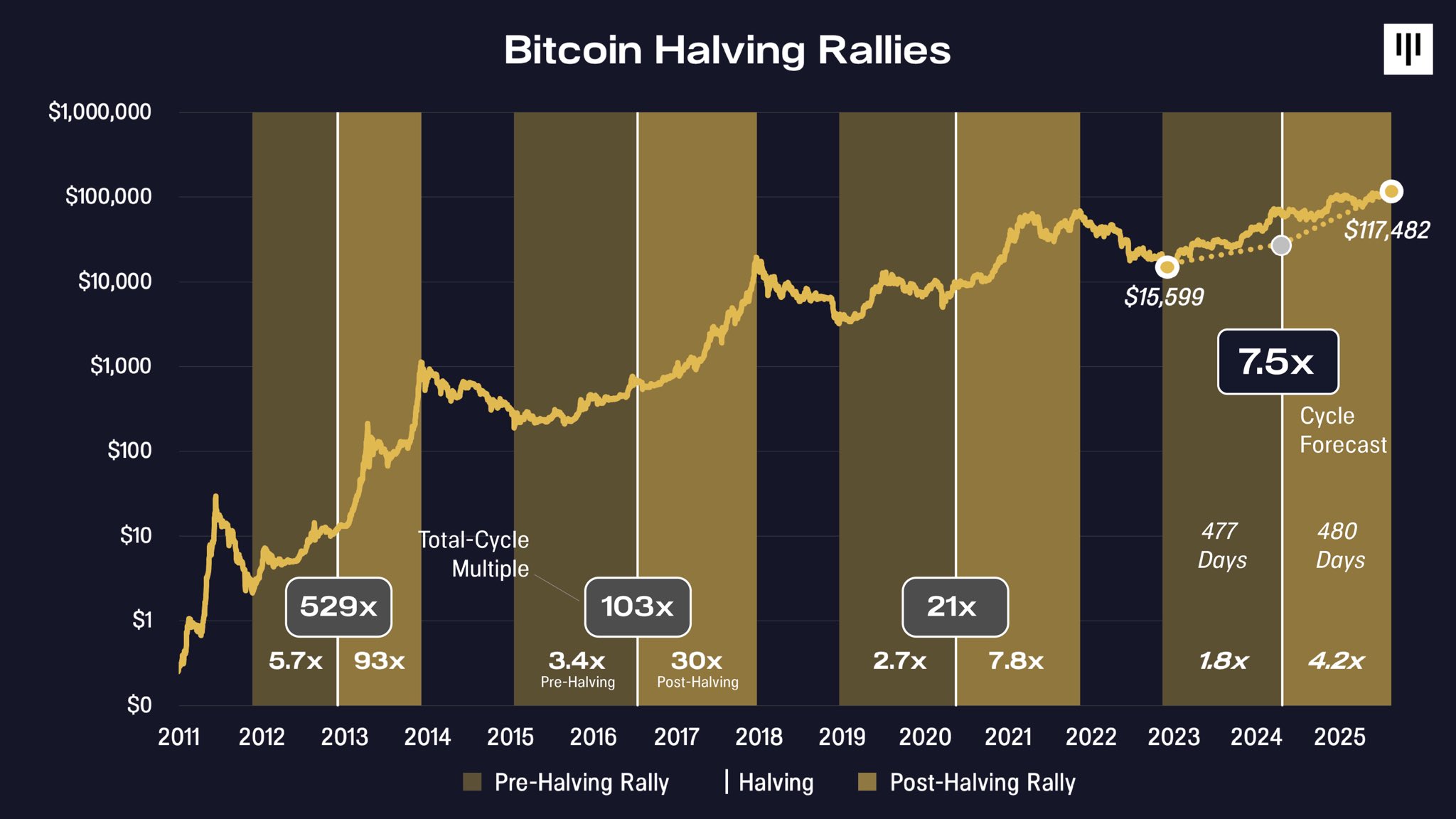

- Market cycles and post-halving effects (notably in 2028)

- Global regulatory clarity and enforcement

- Macroeconomic conditions, including inflation and monetary policy

- Institutional adoption and ETF inflows/outflows

- Technological upgrades (e.g., scalability, security, integration with DeFi)

- Geopolitical events and sovereign digital asset strategies

- Competition from alternative cryptocurrencies and blockchain platforms

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.