The crypto world is buzzing with a new kind of threat – quantum computing. It’s not science fiction anymore, and if you’re holding Bitcoin or Ethereum, it’s time to pay attention. With Bitcoin (BTC) currently trading at $109,036.00, the stakes have never been higher for keeping your digital assets secure.

Quantum Computing: The Next Big Crypto Security Risk

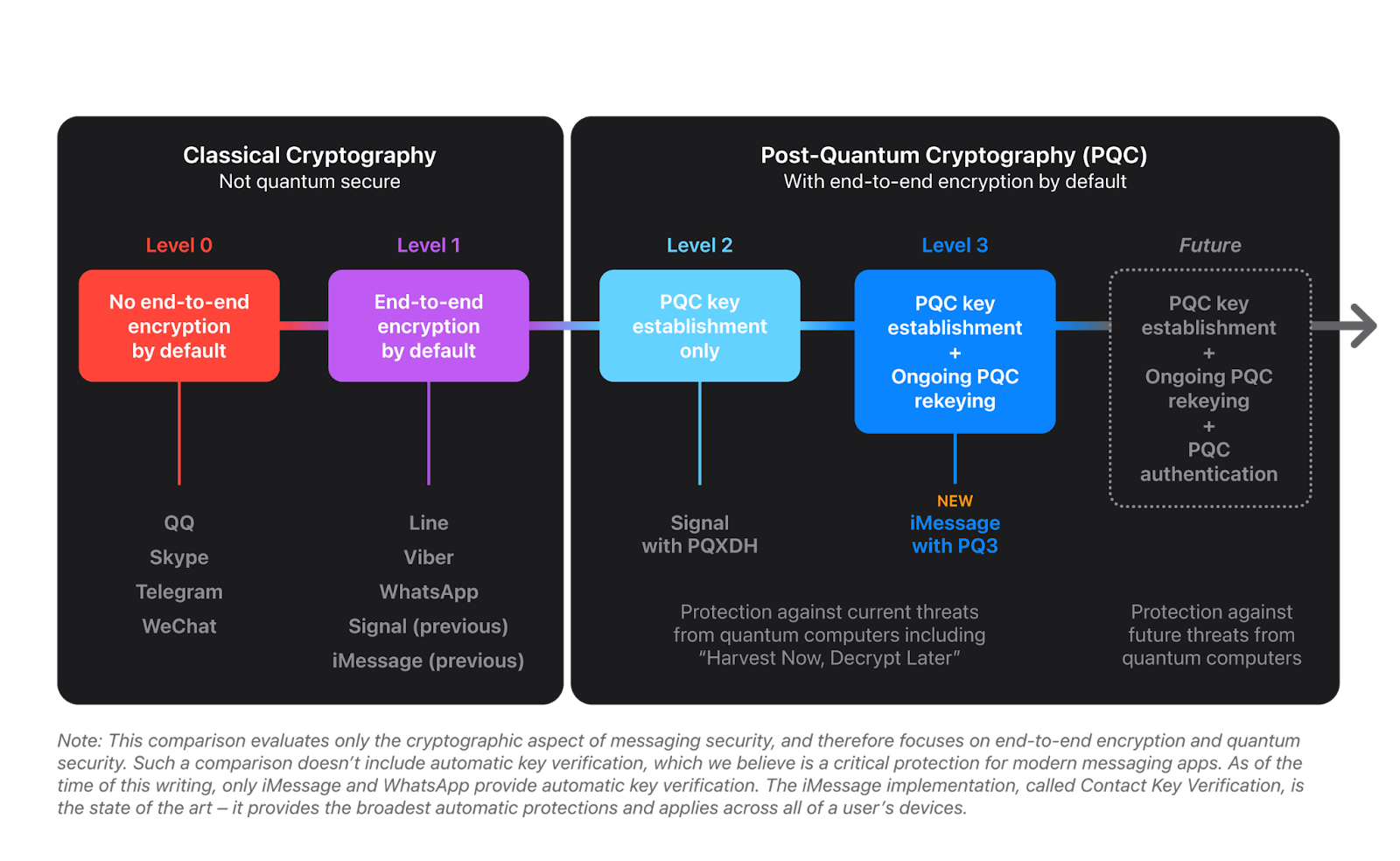

Let’s cut through the hype. Quantum computers use principles of quantum mechanics to solve complex problems much faster than traditional computers. That sounds great for science, but it’s a nightmare for crypto security. Most cryptocurrencies, including Bitcoin and Ethereum, rely on elliptic curve cryptography (ECC) to keep your private keys safe. Quantum computers could theoretically crack ECC in a fraction of the time it would take today’s machines.

Right now, experts say current quantum technology isn’t there yet – but that window might be closing fast. Some developers warn that in the absolute worst-case scenario, we could have as little as three years before quantum computers become a real danger to crypto wallets everywhere.

El Salvador’s High-Stakes Quantum Defense: What It Means for You

El Salvador isn’t waiting around to see what happens. In a bold move, the country recently split its entire Bitcoin reserve – 6,274 BTC worth about $678 million – across 14 new wallet addresses. Each address now holds up to 500 BTC instead of keeping all their eggs in one basket (source). This strategy isn’t just about decentralization; it’s about minimizing exposure if a quantum attack ever hits.

The risk comes when you spend from an address and expose its public key on-chain. Quantum computers could theoretically use that information to reverse-engineer your private key and drain your funds. By spreading out holdings and using fresh addresses, El Salvador is reducing its attack surface dramatically.

How El Salvador Shields Bitcoin from Quantum Threats

-

Splitting Reserves Across Multiple Wallets: El Salvador redistributed its entire 6,274 BTC (worth about $678 million at the current price of $109,036.00 per Bitcoin) into 14 new wallet addresses. Each address holds a maximum of 500 BTC, reducing single-point vulnerability and exposure to quantum attacks.

-

Using Unused Addresses for Maximum Security: The new wallet addresses are unused, meaning their public keys have never been revealed on the blockchain. This practice helps prevent quantum computers from targeting exposed public keys, which are most vulnerable after funds are spent.

-

Limiting Exposure of Public Keys: By only using new addresses for storage and avoiding repeated use, El Salvador minimizes the risk that quantum computers could exploit previously revealed public keys to steal funds.

-

Adhering to Best Practices in Crypto Management: The strategy of distributing holdings and using fresh addresses aligns with industry best practices for institutional-grade crypto security, reflecting a proactive stance against emerging technological threats.

-

Publicly Announcing Quantum-Resilient Measures: El Salvador’s National Bitcoin Office openly communicated these steps, signaling transparency and encouraging other institutions to adopt similar quantum-resilient strategies.

Vitalik Buterin Sounds the Alarm on Ethereum

Ethereum co-founder Vitalik Buterin isn’t mincing words either. He’s publicly warned that the rapid pace of both blockchain innovation and quantum computing means we can’t afford complacency (source). If you’re thinking this is only a problem for governments or whales with massive reserves, think again – anyone holding assets on-chain could be vulnerable if post-quantum upgrades aren’t implemented in time.

Buterin has pushed for proactive research into post-quantum cryptography so that networks like Ethereum can pivot quickly when the threat becomes real. The message is clear: don’t assume today’s security will protect tomorrow’s wealth.

Bitcoin (BTC) Price Prediction Table: Quantum Threats, Adoption, and Security (2026-2031)

Forecasts incorporate quantum risk scenarios, market adoption, regulatory trends, and El Salvador’s quantum-resilient strategy.

| Year | Minimum Price | Average Price | Maximum Price | Year-on-Year % Change (Avg) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $92,500 | $118,000 | $145,000 | +8.3% | Volatility persists as quantum risk headlines spur caution, but ongoing institutional adoption supports price. |

| 2027 | $81,000 | $110,000 | $160,000 | -6.8% | Quantum computing breakthroughs cause market jitters; short-term dip amid global discussions on post-quantum upgrades. |

| 2028 | $105,000 | $137,000 | $185,000 | +24.5% | Major networks roll out quantum-resistant upgrades; renewed confidence and institutional inflows drive prices higher. |

| 2029 | $120,000 | $155,000 | $210,000 | +13.1% | Improved security and increased regulatory clarity boost adoption; bullish sentiment returns. |

| 2030 | $100,000 | $140,000 | $225,000 | -9.7% | Market correction as quantum-capable hardware becomes more accessible, causing brief uncertainty. |

| 2031 | $130,000 | $175,000 | $260,000 | +25.0% | Full quantum-resistant protocols widely adopted; new cycle of growth as security concerns ease and adoption accelerates. |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 is shaped by the evolving quantum computing threat, proactive security measures (such as El Salvador’s quantum-resilient strategy), and the broader adoption of quantum-resistant technologies. While quantum risk introduces periods of volatility and short-term corrections, the long-term trajectory remains positive as the ecosystem adapts. Price ranges reflect both bearish (delayed response to quantum risk) and bullish (rapid adoption of post-quantum cryptography) scenarios.

Key Factors Affecting Bitcoin Price

- Pace of quantum computing advancements and timeline for breaking current cryptography.

- Speed and effectiveness of Bitcoin and broader crypto adoption of quantum-resistant protocols.

- Institutional and government strategies (e.g., El Salvador’s multi-wallet approach) for mitigating quantum risk.

- Regulatory clarity and global coordination on crypto security standards.

- Market cycles, macroeconomic conditions, and capital inflows/outflows.

- Competition from other digital assets, especially those with built-in post-quantum security.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Urgency for Retail Investors: Don’t Wait Until It’s Too Late

If you’re onboarding into crypto or already managing your own keys, El Salvador’s playbook is worth copying at scale:

- Use fresh addresses whenever possible

- Avoid reusing wallets after spending from them

- Stay updated on post-quantum security developments

- Diversify storage solutions (cold wallets, multisig setups)

This isn’t just theory anymore – institutional investors are already allocating capital with these risks in mind (source). If you want to stay ahead of the curve (and keep your stack safe), now is the time to act.

Quantum computing isn’t just a distant threat for tech geeks to debate. With Bitcoin sitting at $109,036.00, the risk is real for anyone with skin in the game. As post-quantum cryptography research ramps up, it’s clear that the crypto community must move fast and decisively. If you’re waiting for a universal fix, you’re already behind.

Proactive Steps: How You Can Protect Your Crypto Right Now

Here’s where theory meets action. The best defense against quantum threats is to adopt habits that minimize your exposure and maximize your flexibility as new security tools emerge. Waiting for protocol-level upgrades is risky, by then, attackers may have already exploited old vulnerabilities.

Top 5 Personal Crypto Security Tips vs. Quantum Risks

-

Use new wallet addresses for each transaction. Following El Salvador’s lead, generate a fresh, unused Bitcoin or Ethereum address every time you receive funds. This minimizes the exposure of your public key, reducing vulnerability to future quantum attacks.

-

Split large holdings across multiple wallets. Just as El Salvador distributed its $678 million in Bitcoin across 14 wallets, spreading your crypto reduces the risk of a single point of failure if one address is compromised.

-

Regularly monitor official security advisories from trusted sources such as Bitcoin.org and Coinbase Blog. Early warnings about quantum threats or new best practices can help you act before vulnerabilities are exploited.

Don’t overlook the basics: Stick to wallets that let you generate new addresses easily. Avoid leaving large sums in hot wallets or on exchanges, these are prime targets if quantum attacks become feasible. Hardware wallets and multisignature arrangements remain the gold standard for now, but keep an eye out for updates from wallet providers about post-quantum support.

Staying informed is half the battle. Vitalik Buterin’s warnings aren’t just theoretical musings, they’re calls to action for developers and users alike to push for rapid innovation in post-quantum cryptography (source). Ethereum’s research teams are already exploring solutions, but broad adoption will take time and pressure from users.

The Institutional Shift: Quantum Security as a New Standard

El Salvador’s high-profile wallet shuffle is just the tip of the iceberg. Institutional investors are now treating quantum risk as a core part of their digital asset strategy, not just an edge case scenario (source). Expect more funds and custodians to follow suit by distributing holdings across multiple secure addresses and demanding quantum-resilient features from wallet providers.

The takeaway? Quantum computing could shatter today’s crypto security assumptions faster than most expect. Whether you’re holding $1,000 or $1 million, it pays to be paranoid, and proactive, about your setup.

The next few years will separate those who react fast from those who get left behind. If you want to keep your stack safe while Bitcoin trades above $109,000, start thinking like El Salvador, and don’t wait until quantum risk moves from theory to reality.