August 2025 delivered a harsh wake-up call for crypto investors: a coordinated breach led to a staggering $163 million in stolen digital assets, rattling both newcomers and seasoned traders. As adoption accelerates and prices remain volatile, the sophistication of hacks is rising in lockstep. If you’re just beginning your crypto journey, understanding the specific risks and taking decisive action is no longer optional – it’s essential. The following prioritized security steps are not just best practices; they are your front line of defense against the next big breach.

Why Crypto Security Matters More Than Ever

Unlike traditional banking, cryptocurrency transactions are irreversible and largely anonymous. Once funds leave your wallet due to a hack or scam, they are almost impossible to recover. The August 2025 breach underscored that even major platforms with robust reputations can be compromised. For new buyers, this means you must take personal responsibility for securing your assets from the very start. Crypto onboarding security isn’t just about avoiding loss – it’s about building confidence as you navigate this high-stakes market.

The Five Essential Steps Every New Crypto Buyer Must Take

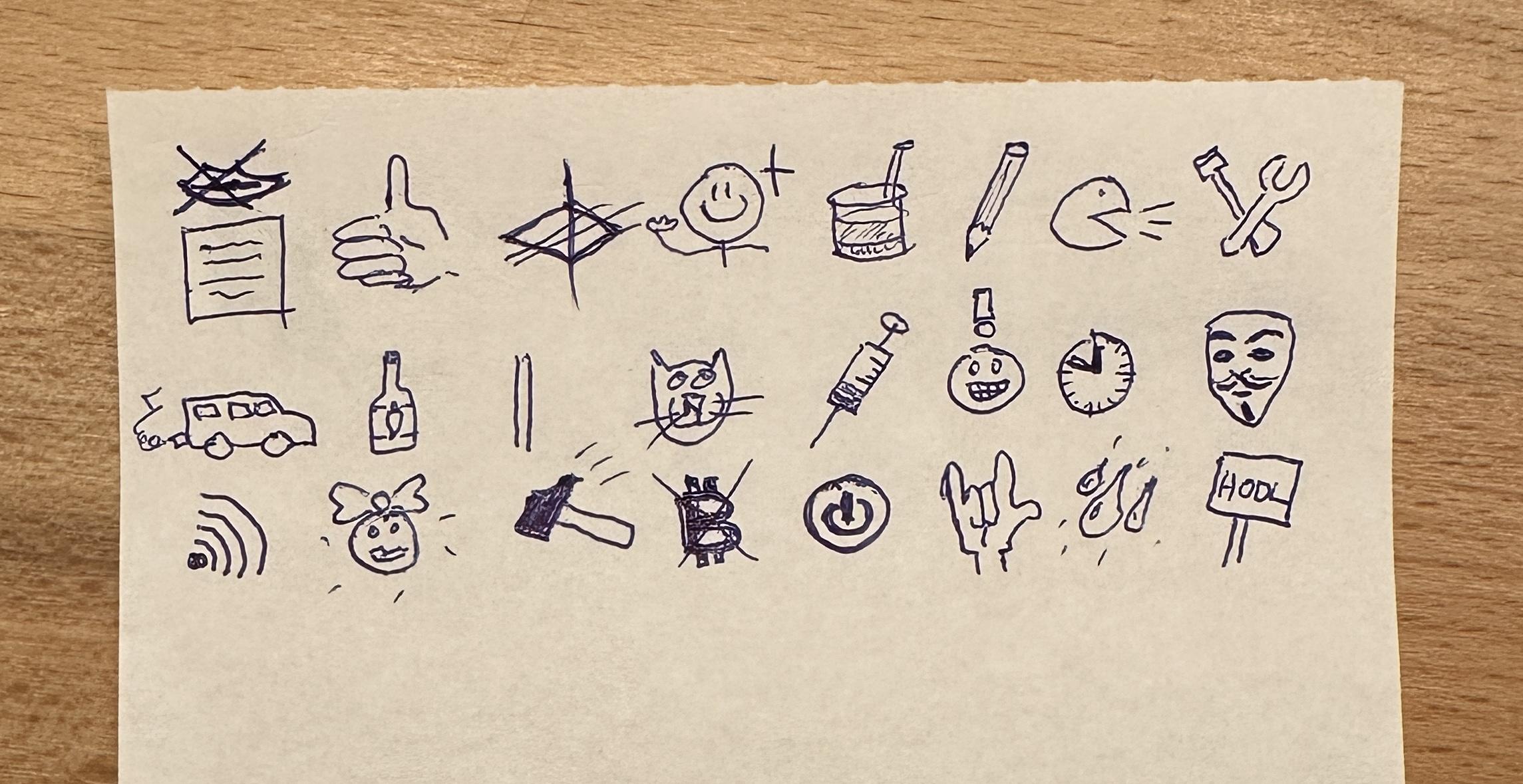

5 Essential Crypto Security Steps After the $163M Breach

-

Enable Two-Factor Authentication (2FA) on All Crypto Accounts: Strengthen your account security by activating 2FA on every cryptocurrency exchange and wallet you use. Prefer authenticator apps like Google Authenticator or Authy over SMS-based 2FA, which is susceptible to SIM swapping attacks.

-

Use a Hardware Wallet for Long-Term Storage of Crypto Assets: Store significant or long-term holdings in reputable hardware wallets such as Ledger Nano X or Trezor Model T. These devices keep your private keys offline, protecting your assets from online hacks and malware.

-

Never Share or Store Private Keys and Recovery Phrases Online: Your private keys and recovery phrases grant full access to your crypto. Write them down on paper and store them in a secure, offline location—never upload or save them digitally to prevent unauthorized access.

-

Verify Exchange Security Features and Withdraw Unused Funds Regularly: Choose exchanges with robust security measures like cold storage, insurance policies, and regular security audits. Routinely withdraw unused funds to your personal wallet to minimize exposure to potential exchange breaches.

-

Update Device Software and Use Dedicated Anti-Phishing Tools: Keep your computer and mobile device software up to date to patch vulnerabilities. Install trusted anti-phishing tools such as MetaMask’s built-in phishing detector or Bitdefender to guard against malicious websites and scams.

Let’s break down each step, explaining why it matters and how to implement it effectively.

1. Enable Two-Factor Authentication (2FA) on All Crypto Accounts

Password-only protection is no longer sufficient. Enabling 2FA adds an extra layer of defense by requiring a second verification method whenever you log into an exchange or wallet. This could be a code from an authenticator app like Google Authenticator or Authy – never rely on SMS-based 2FA alone, as SIM-swapping attacks are increasingly common. Even if your password is compromised through a data leak or phishing scam, 2FA can block unauthorized access to your funds.

2. Use a Hardware Wallet for Long-Term Storage of Crypto Assets

If you plan to hold significant amounts of crypto over time, storing assets in an online exchange wallet is risky. Hardware wallets, such as Ledger or Trezor devices, keep your private keys offline and out of reach from hackers targeting internet-connected systems. Always purchase these devices directly from the manufacturer to avoid tampered products and follow setup instructions carefully. Treat your hardware wallet as you would a physical vault – secure it in a safe location and never share access codes.

3. Never Share or Store Private Keys and Recovery Phrases Online

Your private keys and recovery phrases are the master keys to your digital fortune. If someone gains access to them, they can empty your wallets instantly – no questions asked, no recourse available. Never store these credentials in cloud storage services, email drafts, screenshots, or messaging apps. Instead, write them down on paper (preferably multiple copies) and keep them in physically secure locations like safes or safety deposit boxes. For more guidance on why this matters, see advice from industry leaders at Blockchain Council.

4. Verify Exchange Security Features and Withdraw Unused Funds Regularly

Not all crypto exchanges offer the same level of security, and even the largest names have proven vulnerable, as the August 2025 breach demonstrated. Before depositing funds, research your chosen platform’s security features: Do they offer insurance on custodial assets? Is withdrawal whitelisting available? What about anti-phishing codes and withdrawal confirmation emails? Regularly withdraw any funds you are not actively trading to your personal wallet. Keeping only what you need on exchanges reduces your exposure if an exchange is hacked or suddenly freezes withdrawals. This simple habit can mean the difference between a minor inconvenience and total loss.

5. Update Device Software and Use Dedicated Anti-Phishing Tools

Many successful hacks start with compromised devices or clever phishing attacks, malware, fake websites, and malicious browser extensions are constantly evolving. Always keep your operating system, browsers, and crypto apps up to date. Enable automatic updates when possible to patch vulnerabilities quickly. Additionally, install dedicated anti-phishing browser extensions (such as MetaMask’s built-in warning system) and consider using a separate device solely for crypto transactions. This creates a strong barrier between your digital assets and everyday internet threats.

“The best defense is layered: combine strong device hygiene with specialized tools designed for crypto users. ”

Staying Ahead: Proactive Habits for Ongoing Crypto Safety

The threat landscape will continue to evolve as prices rise and more capital flows into digital assets. Don’t treat security as a one-time setup, make it an ongoing process:

- Review your exchange accounts every month.

- Rotate passwords regularly.

- Monitor official sources for alerts about new scams or vulnerabilities.

- Educate yourself on emerging threats such as clipboard hijackers or deepfake phishing attempts.

If you ever feel uncertain about a transaction or receive an unexpected request for sensitive information, pause and verify before proceeding. The most common way investors lose funds isn’t through sophisticated code exploits, it’s simple human error or misplaced trust.

Frequently Asked Questions About Protecting Crypto in 2025

The August $163 million breach was a stark reminder that crypto security is personal responsibility, there are no bailouts or do-overs in this world. By following these five essential steps, enabling two-factor authentication, using hardware wallets for long-term storage, safeguarding private keys offline, verifying exchange security (and withdrawing unused funds), and maintaining strong device hygiene, you put yourself far ahead of most new buyers entering this space.

The payoff? Confidence in your ability to participate in the future of finance without fear that one careless click could erase everything you’ve built. As always: knowledge is the best hedge.