Crypto scams in 2025 are more sophisticated than ever, blending technical exploits with psychological manipulation to deceive even experienced investors. Recent high-profile attacks, such as the WLFI token heist leveraging Ethereum’s EIP-7702 upgrade, highlight how phishing schemes and malicious smart contracts can drain wallets in minutes. To outsmart these evolving threats, a data-driven approach is essential, one that goes beyond basic caution and implements actionable security strategies tailored to today’s threat landscape.

Phishing Attacks Are Evolving: Why Vigilance Is Non-Negotiable

This year has seen an explosion of phishing attacks in crypto, targeting both new and seasoned users. Hackers now exploit trusted platforms, such as Google Forms, to trick users into revealing wallet credentials or signing malicious transactions. The recent WLFI token hack is a textbook example: attackers used fake wallet interfaces and pre-planted malicious contracts to siphon assets from unsuspecting holders. As deepfake technology and AI-generated communications proliferate, distinguishing legitimate messages from scams is increasingly difficult (TechRadar).

Five Actionable Strategies to Outsmart Crypto Scams in 2025

5 Proven Strategies to Outsmart Crypto Scams in 2025

-

Always Verify Wallet and DApp URLs Before Connecting: Double-check the website address and ensure it matches the official project site, especially when interacting with new token launches like WLFI. Use browser bookmarks for trusted sites and avoid clicking links from emails or social media. This helps protect against phishing attacks exploiting lookalike domains and malicious links.

-

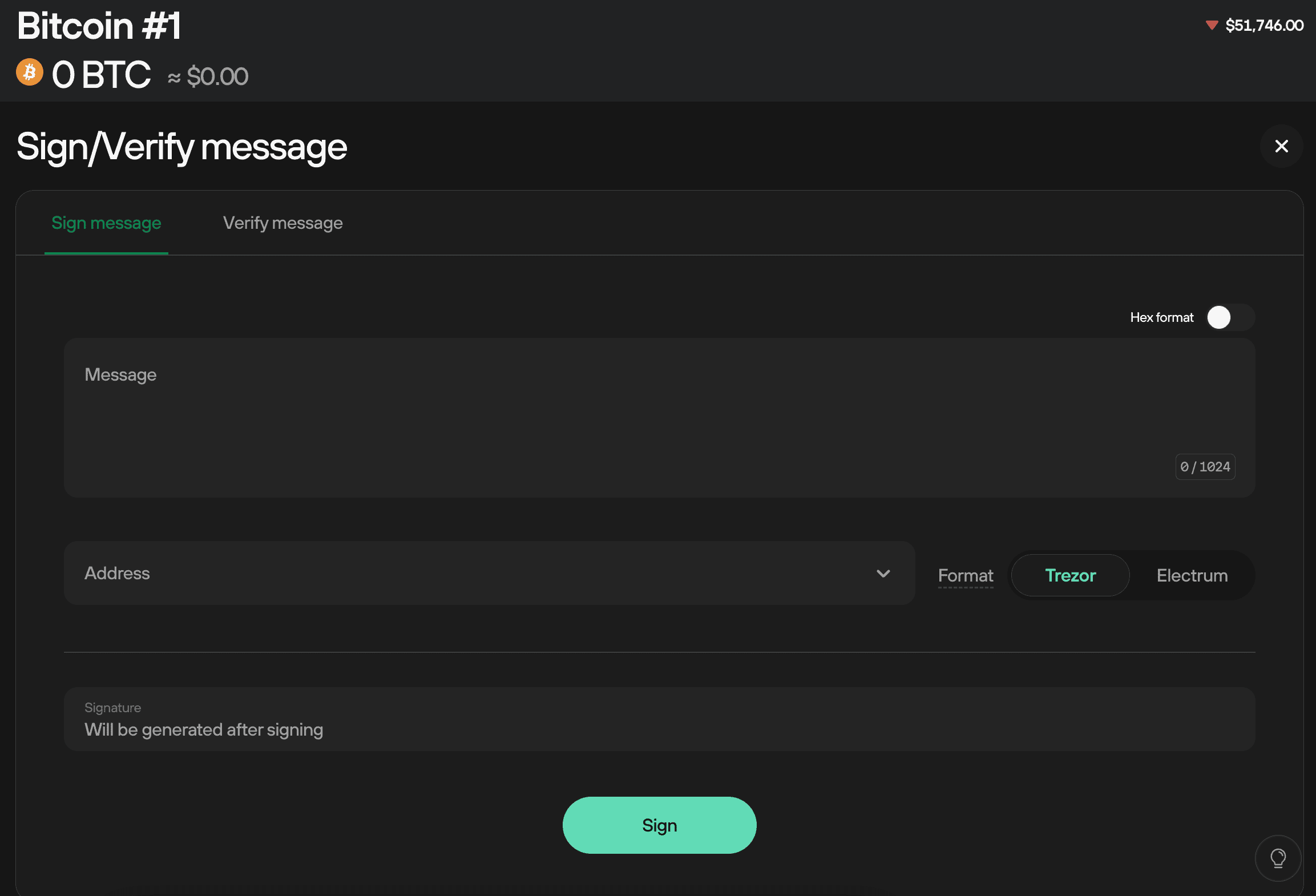

Enable Multi-Factor Authentication (MFA) and Hardware Wallets: Secure your wallets and exchange accounts with MFA, and store significant assets in hardware wallets (e.g., Ledger, Trezor) to reduce exposure to phishing exploits such as those targeting EIP-7702 vulnerabilities.

-

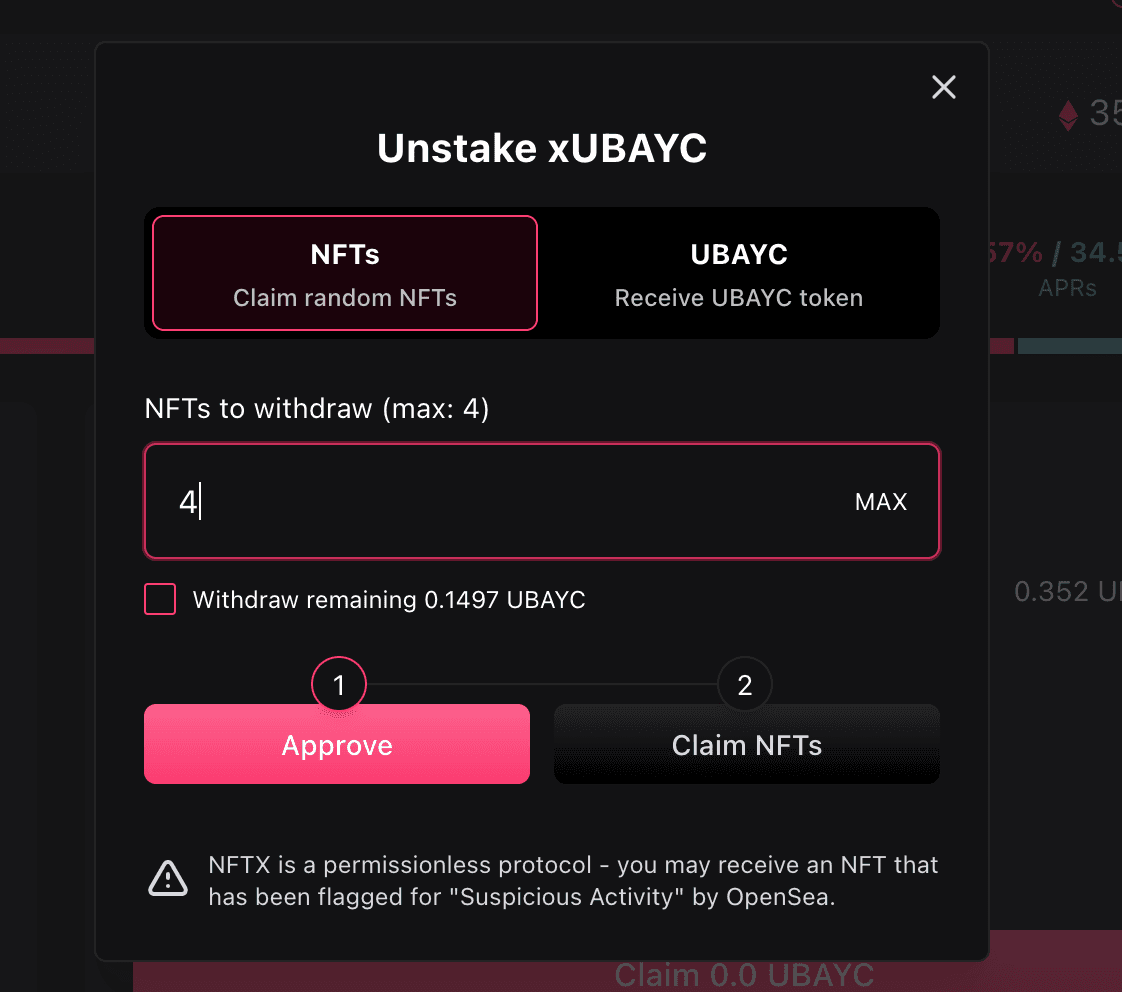

Scrutinize Token Approval Requests and Smart Contract Permissions: Before confirming any transaction, carefully review what permissions you are granting. Avoid approving unlimited spending or unknown smart contracts, as these are common vectors in recent phishing attacks.

-

Stay Informed on Latest Scam Tactics and Security Updates: Follow reputable crypto security sources (e.g., Ledger, OneKey, official project channels) to keep up-to-date on emerging threats like deepfake scams and wallet exploits targeting new tokens.

-

Report Suspected Scams Immediately and Share Warnings: If you encounter a phishing attempt or scam (e.g., fake WLFI wallet), report it to relevant authorities (FTC, project teams) and alert the community to help prevent further losses.

Let’s break down these strategies for practical application:

1. Always Verify Wallet and DApp URLs Before Connecting

Double-check every URL before you connect your wallet or sign transactions. This is non-negotiable, especially during new token launches like WLFI where scammers quickly spin up convincing fake sites. Bookmark official project URLs and avoid clicking links from emails or social media, even if they appear to come from reputable sources. According to Fraudswatch.com, slight misspellings or extra characters are common red flags for phishing domains.

2. Enable Multi-Factor Authentication (MFA) and Use Hardware Wallets

MFA adds an essential layer of protection against unauthorized access. Even if your login credentials are compromised through a phishing attack, MFA can prevent hackers from draining your account. For significant holdings, hardware wallets provide physical isolation from online threats, making it nearly impossible for remote attackers to steal your funds via exploits like those targeting EIP-7702 vulnerabilities (IPST Education). If you’re still relying solely on hot wallets or SMS-based authentication, now is the time to upgrade your security stack.

3. Scrutinize Token Approval Requests and Smart Contract Permissions

Nobody should approve unlimited spending permissions without understanding the risks. Many recent hacks, including the WLFI incident, involved users unknowingly granting broad permissions to malicious smart contracts embedded in fake DApps or wallet prompts. Always review what you’re authorizing before confirming any transaction; if unsure, reject the request and seek clarification through official project channels (CoinCentral). This step is critical in preventing backdoor access that could empty your wallet at any time.

4. Stay Informed on Latest Scam Tactics and Security Updates

Continuous learning is your best defense. The crypto scam landscape is dynamic, with fraudsters rapidly adapting to new security measures and exploiting emerging vulnerabilities. For example, the EIP-7702 exploit that targeted WLFI token holders was not widely anticipated, catching many off guard. To minimize your risk exposure, follow official project channels and subscribe to updates from reputable security sources like Ledger and OneKey. These platforms routinely publish alerts about new phishing vectors, deepfake scams, and wallet exploits, empowering you to act before becoming a victim. Community-driven platforms also share real-time intelligence, making it easier to spot patterns as they develop. Ledger remains a top resource for scam awareness in 2025.

5. Report Suspected Scams Immediately and Share Warnings

Fast reporting can save others from falling into the same trap. If you encounter a suspicious DApp, phishing attempt, or fraudulent token approval request (such as those seen in the WLFI token hack), report it promptly to authorities like the FTC or directly to project teams via their official channels. Sharing your experience on social media or within crypto communities helps amplify warnings and disrupts scammers’ operations by alerting potential victims early. The Federal Trade Commission provides practical steps for reporting cryptocurrency fraud (FTC). Remember: timely action multiplies community resilience against coordinated attacks.

The Bottom Line: Proactive Security is Non-Negotiable

The sophistication of crypto scams in 2025 demands a methodical approach anchored in vigilance, technical literacy, and community engagement. Phishing attacks are no longer crude email attempts, they now leverage AI-generated communications, compromised smart contracts, and even trusted tools like Google Forms to deceive users at scale (TechRadar). By implementing these five actionable strategies, verifying URLs, enabling MFA and hardware wallets, scrutinizing approvals, staying informed on threats, and reporting scams, you significantly reduce your risk profile.

The era of passive crypto onboarding is over; active participation in your own security is now an industry standard. Bookmark trusted resources, participate in community discussions about emerging threats, and never underestimate the value of skepticism when something seems too good to be true.