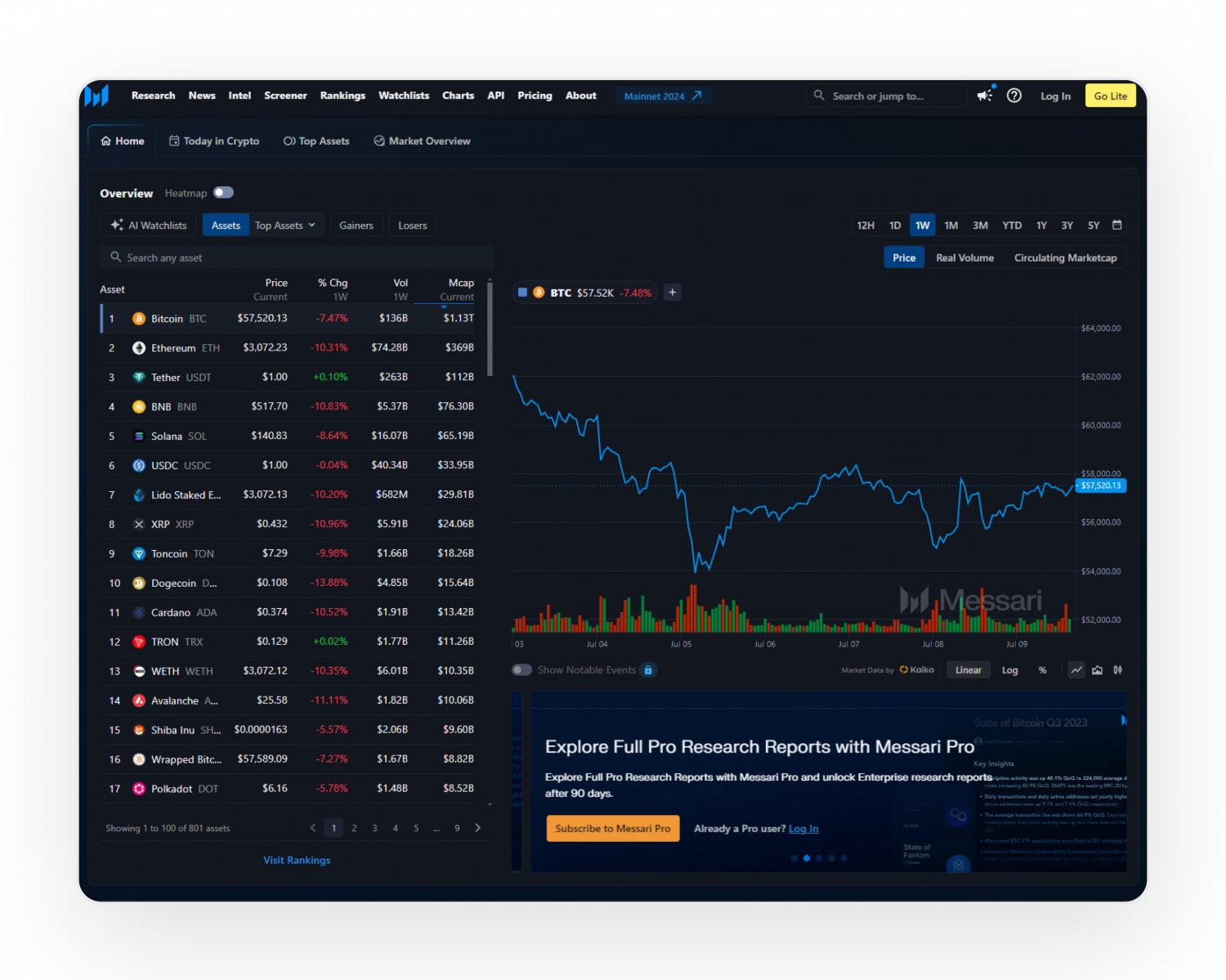

USDT payments are at the center of a seismic shift in global business and freelance transactions. In 2025, Tether (USDT) has firmly established itself as the stablecoin of choice for cross-border settlements, payroll, and digital commerce. With the current market price of Polygon Bridged USDT (Polygon) holding steady at $0.9998, businesses and freelancers are increasingly leveraging its stability and efficiency to bypass traditional banking constraints and currency volatility.

Why USDT Payments Are Surging in 2025

The data is unequivocal: USDT now accounts for 80% of all stablecoin payments, reflecting both dominant transaction volumes and deep liquidity across networks like Ethereum, Solana, Tron, and even the Bitcoin Lightning Network (source). This dominance is not accidental. Businesses cite three primary drivers:

- Stability: Pegged to the U. S. dollar, USDT shields users from crypto market swings.

- Efficiency: Instant settlement times and low fees outpace legacy payment rails.

- Global Reach: USDT enjoys wide acceptance in Europe (over 90% of stablecoin volume), Asia (43% India, 50% Hong Kong), and emerging markets (source).

This surge is further fueled by institutional adoption. Tether’s acquisition of a majority stake in South America’s Adecoagro signals a new era for commodities trade settlement (source). For freelancers, platforms like XAIGATE have made it possible to work globally without financial borders.

Three Actionable Onboarding Strategies for Businesses and Freelancers

If you’re looking to integrate USDT payments into your workflow or business model this year, focusing on these three strategies will maximize your success while minimizing risk:

Essential USDT Onboarding Tips for 2025

-

Prioritize Reputable USDT Payment Gateways with Low Fees and Fast Settlement: Select established platforms like Bitnob or XAIGATE that offer transparent fee structures, robust compliance, and instant cross-border settlement. These gateways help businesses and freelancers maximize cost savings and efficiency, with USDT settlements often occurring within minutes and fees significantly lower than traditional bank transfers.

-

Implement Stablecoin Risk Management Practices: Regularly convert excess USDT holdings into local currency or diversify into other stablecoins such as USDC or PYUSD. This approach mitigates counterparty and regulatory risks, especially as stablecoin regulations evolve in 2025. Proactive treasury management helps protect against sudden policy changes or platform-specific issues.

-

Educate Teams and Clients on Stablecoin Compliance and Taxation: Stay updated on local and international crypto regulations, ensure proper KYC/AML procedures are followed, and use automated tools like CoinTracking or Koinly to track transactions for accurate income and tax reporting. This reduces legal risks and streamlines compliance in a rapidly changing regulatory environment.

1. Prioritize Reputable USDT Payment Gateways with Low Fees and Fast Settlement

The foundation of effective crypto onboarding is choosing the right payment gateway. Established platforms like Bitnob or XAIGATE stand out for their transparent fee structures and robust compliance frameworks. These gateways offer near-instant cross-border settlements – critical for freelancers invoicing clients worldwide or businesses paying remote teams. In fact, CoinGate processed over 1.68 million crypto payments in 2024 alone, with stablecoins making up more than a third of all transactions (source). By opting for proven providers with clear terms and support for multiple blockchain networks, you can reduce friction while maximizing cost savings.

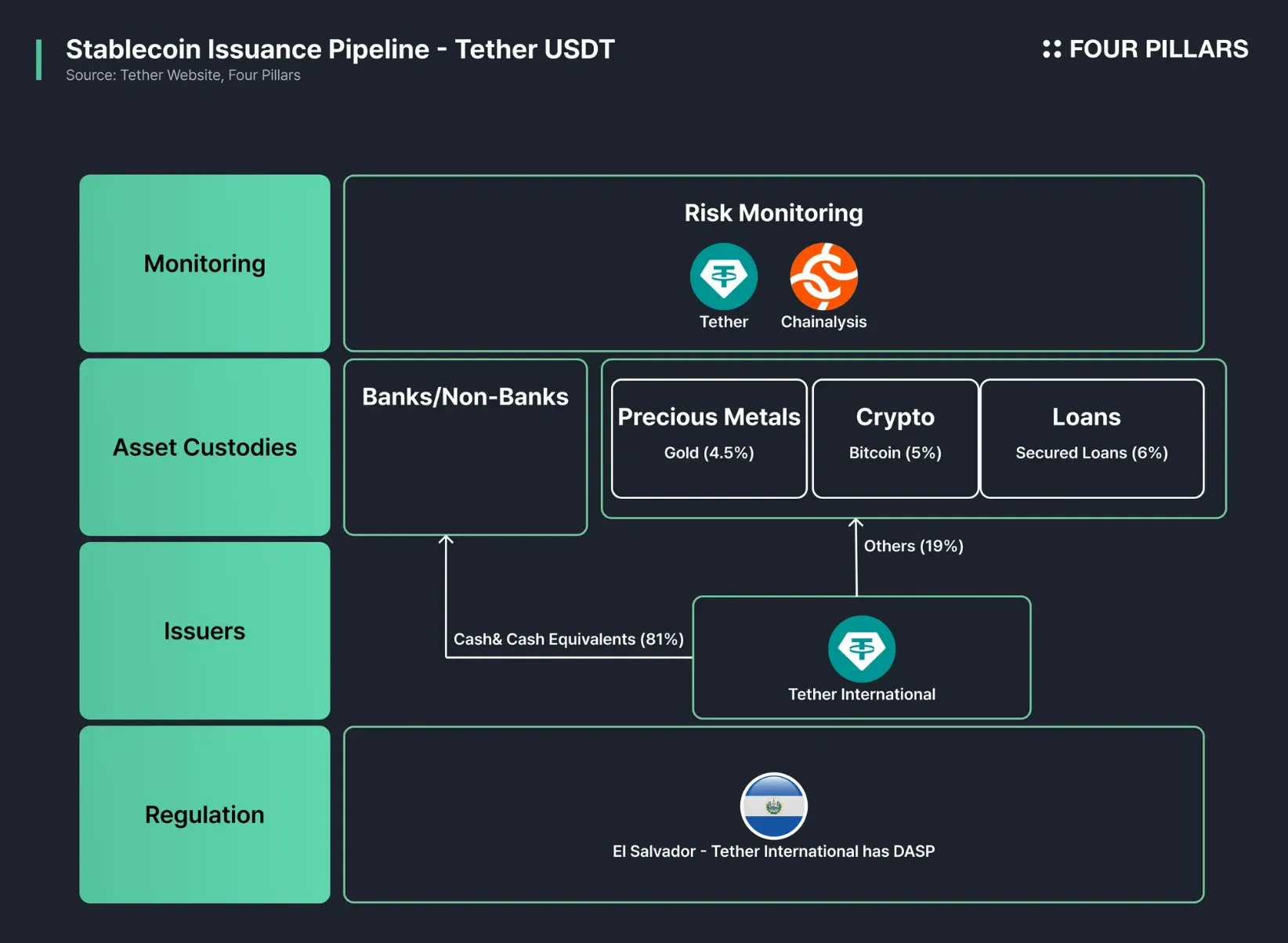

2. Implement Stablecoin Risk Management Practices

The regulatory landscape around stablecoins is evolving rapidly in 2025 – what works today may change tomorrow. To mitigate counterparty risk (for example, exposure to a single issuer or chain) as well as potential regulatory changes impacting Tether specifically, it’s best practice to regularly convert excess USDT into your local fiat currency or diversify into other regulated stablecoins such as USDC or PYUSD when appropriate. This approach not only preserves capital but also ensures operational flexibility if new rules are enacted.

Tether (USDT) Price Stability & Outlook: 2026–2031

Professional Price Prediction Table Reflecting USDT’s Market Dominance and Stability as a Global Payment Solution

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Percentage Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.9950 | $1.00 | $1.0050 | 0% | Continued regulatory clarity and high adoption sustain peg stability; minor depegs possible during market stress. |

| 2027 | $0.9940 | $1.00 | $1.0060 | 0% | Wider institutional integration and growth in cross-border payments; slight volatility during global economic events. |

| 2028 | $0.9930 | $1.00 | $1.0070 | 0% | Competing stablecoins (USDC, PYUSD) increase market share but USDT maintains dominance; technology upgrades improve efficiency. |

| 2029 | $0.9920 | $1.00 | $1.0080 | 0% | Potential regulatory shifts in US/EU test peg resilience; robust reserves and transparency keep price stable. |

| 2030 | $0.9910 | $1.00 | $1.0090 | 0% | Global stablecoin regulation harmonized, ensuring trust; minor depegs possible during black swan events. |

| 2031 | $0.9900 | $1.00 | $1.0100 | 0% | USDT remains primary settlement asset in crypto; increasing competition but Tether adapts with new partnerships and multi-chain support. |

Price Prediction Summary

USDT is projected to maintain its dollar peg with extraordinary stability through 2031, supported by robust adoption, institutional integration, and regulatory adaptation. Occasional minor depegs are possible during periods of extreme market stress or regulatory uncertainty, but the average price is expected to remain at or very near $1.00. Maximum and minimum ranges reflect rare, short-term deviations observed in historical data and anticipated during future market events.

Key Factors Affecting Tether Price

- Dominance in global crypto payments and cross-border settlements.

- Continued expansion across multiple blockchain networks increases utility and liquidity.

- Institutional adoption and integration into real-world commerce and payroll systems.

- Growing regulatory clarity and compliance among stablecoin issuers.

- Potential competition from other regulated stablecoins (e.g., USDC, PYUSD).

- Resilience of Tether’s reserves and transparency improvements.

- Macroeconomic shocks or regulatory interventions causing short-term peg volatility.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

3. Educate Teams and Clients on Stablecoin Compliance and Taxation

The final pillar is education – both internally with your team and externally with clients or vendors. Make sure everyone understands KYC/AML requirements relevant to your jurisdiction; use automated tools to track all crypto transactions for accurate income reporting; stay up-to-date on evolving tax guidance around digital assets. Proactive compliance will help avoid legal headaches as authorities step up oversight of crypto-based payrolls and B2B settlements this year.

These onboarding strategies are not just theoretical, they are being applied daily by businesses and freelancers who want to future-proof their operations. The growing reliance on USDT, currently priced at $0.9998 on Polygon, reflects more than just a search for efficiency; it is a strategic move to stay ahead in an increasingly digital economy.

Gateway selection remains the most immediate concern for those entering the USDT payments ecosystem. Platforms like Bitnob and XAIGATE have distinguished themselves by offering real-time settlement and transparent, competitive fees, features that are invaluable for freelancers working across borders or companies managing distributed teams. Their compliance support also reduces onboarding friction, allowing even crypto beginners to start accepting payments quickly and securely.

Risk management is no less critical. As stablecoin regulation tightens worldwide, holding large balances in a single asset like USDT may expose you to unforeseen counterparty or regulatory risk. Regularly converting surplus USDT into local currency or splitting holdings between alternatives such as USDC or PYUSD can limit exposure. This diversification strategy is particularly relevant as governments introduce new reporting requirements and reserve audits for stablecoin issuers.

Compliance and taxation are often overlooked but can make or break your crypto integration efforts. Automated transaction tracking tools now make it easier to maintain detailed records, while ongoing education ensures your team understands both the letter and spirit of evolving regulations. Businesses that invest in training see smoother audits and fewer disputes, an edge as authorities increase scrutiny of crypto payrolls and cross-border settlements.

“We shifted 70% of our cross-border payments to USDT last quarter. The difference in speed and cost was immediate, and our finance team appreciates the clarity on compliance. ”

– CFO, EU-based SaaS company

Positioning for Growth with USDT Payments

The data points to a tipping point: with stablecoin payroll adoption now reaching one in four companies globally (source), the momentum behind business crypto payments is undeniable. The key is not just adopting USDT but doing so with a clear plan, selecting reliable gateways, actively managing risk, and prioritizing regulatory awareness at every level.

Essential USDT Onboarding Tips for 2025

-

Prioritize Reputable USDT Payment Gateways with Low Fees and Fast Settlement: Select established platforms like Bitnob or XAIGATE that offer transparent fee structures, robust compliance, and instant cross-border settlement. These gateways are trusted by businesses and freelancers for maximizing cost savings and operational efficiency in global USDT transactions.

-

Implement Stablecoin Risk Management Practices: Regularly convert excess USDT holdings into local currency or diversify into other established stablecoins like USDC or PYUSD. This approach helps mitigate counterparty and regulatory risks, especially as stablecoin regulations continue to evolve in 2025.

-

Educate Teams and Clients on Stablecoin Compliance and Taxation: Stay updated on local and international crypto regulations, ensure proper KYC/AML procedures are followed, and leverage automated tools (such as CoinTracker or Koinly) to track transactions for accurate income reporting and tax obligations.

If you’re ready to join the growing wave of businesses and freelancers embracing stablecoins, remember these fundamentals:

- Select reputable gateways like Bitnob or XAIGATE for transparency and efficiency.

- Diversify your stablecoin holdings as part of your regular treasury management process.

- Invest in compliance education, leveraging automated tools wherever possible.

The surge in USDT adoption shows no signs of slowing down as we approach Q4 2025. With current prices holding steady at $0.9998, now is the time to refine your crypto onboarding strategy, not just to keep pace but to lead in the digital payment revolution.