The U. S. Securities and Exchange Commission (SEC) is redefining the crypto landscape. With Chair Paul Atkins at the helm, the SEC is now championing crypto super apps: integrated platforms that promise to unify trading, lending, staking, and custody under a single regulatory license. This bold move could mark a watershed moment for crypto onboarding in 2025 and beyond, making digital assets more accessible than ever before.

From Fragmentation to Seamless Experiences: The Super App Vision

Historically, newcomers to crypto have faced a daunting patchwork of platforms and regulatory hurdles. Want to trade? You need one app. Interested in staking or lending? That’s another service entirely, often with its own compliance headaches and learning curve. The result has been confusion, higher costs, and lost opportunities for those trying to engage with digital assets for the first time.

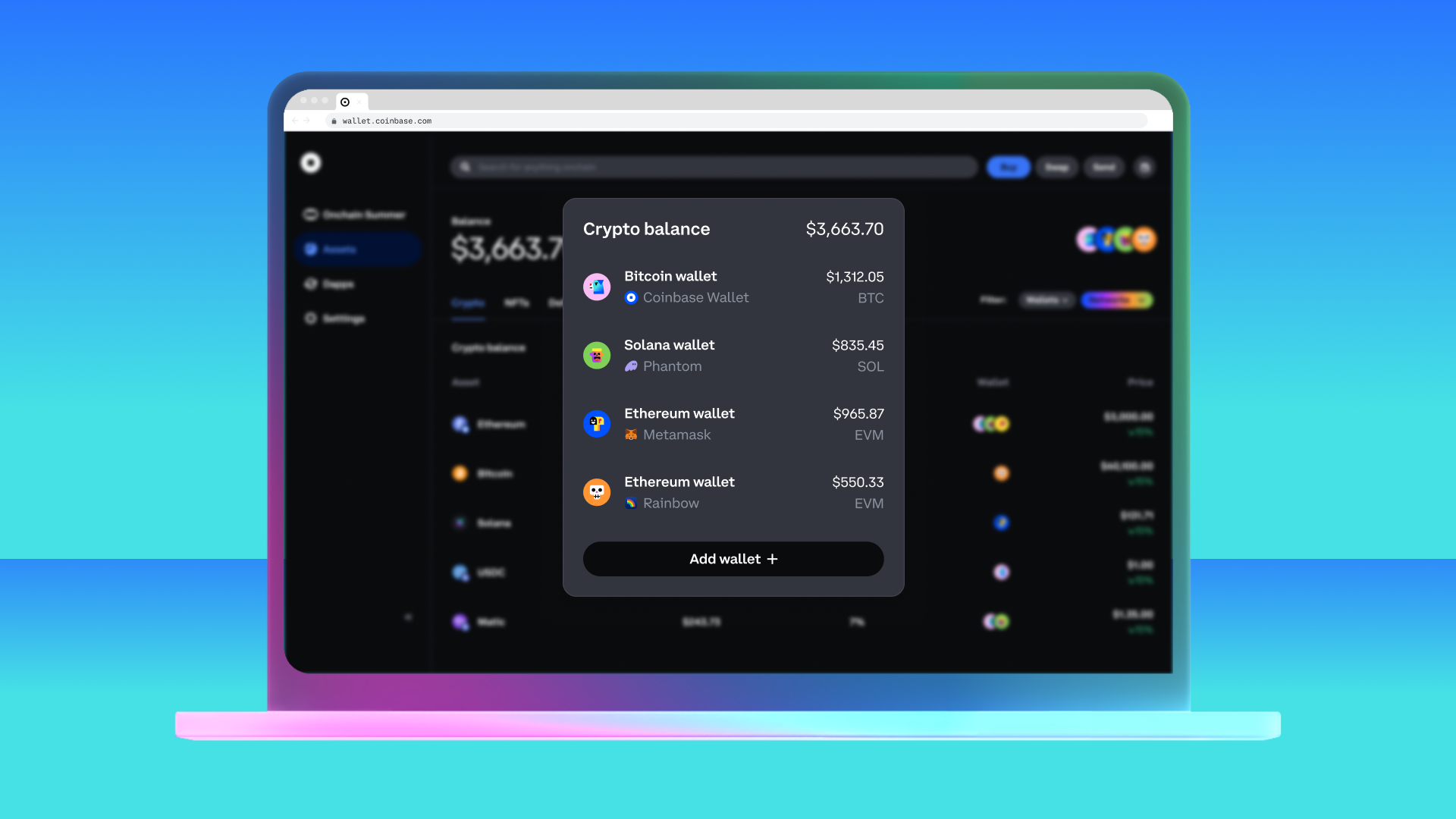

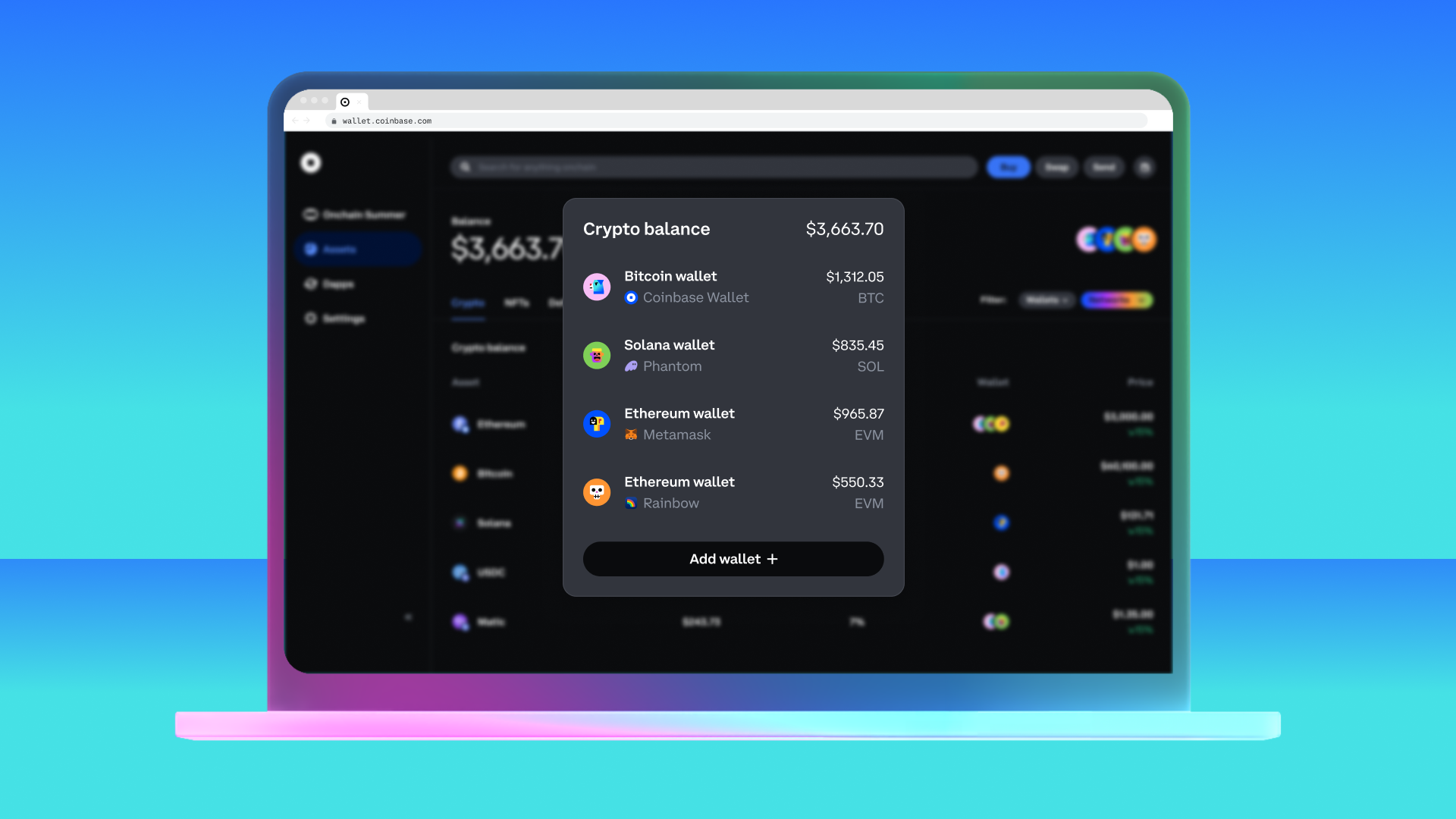

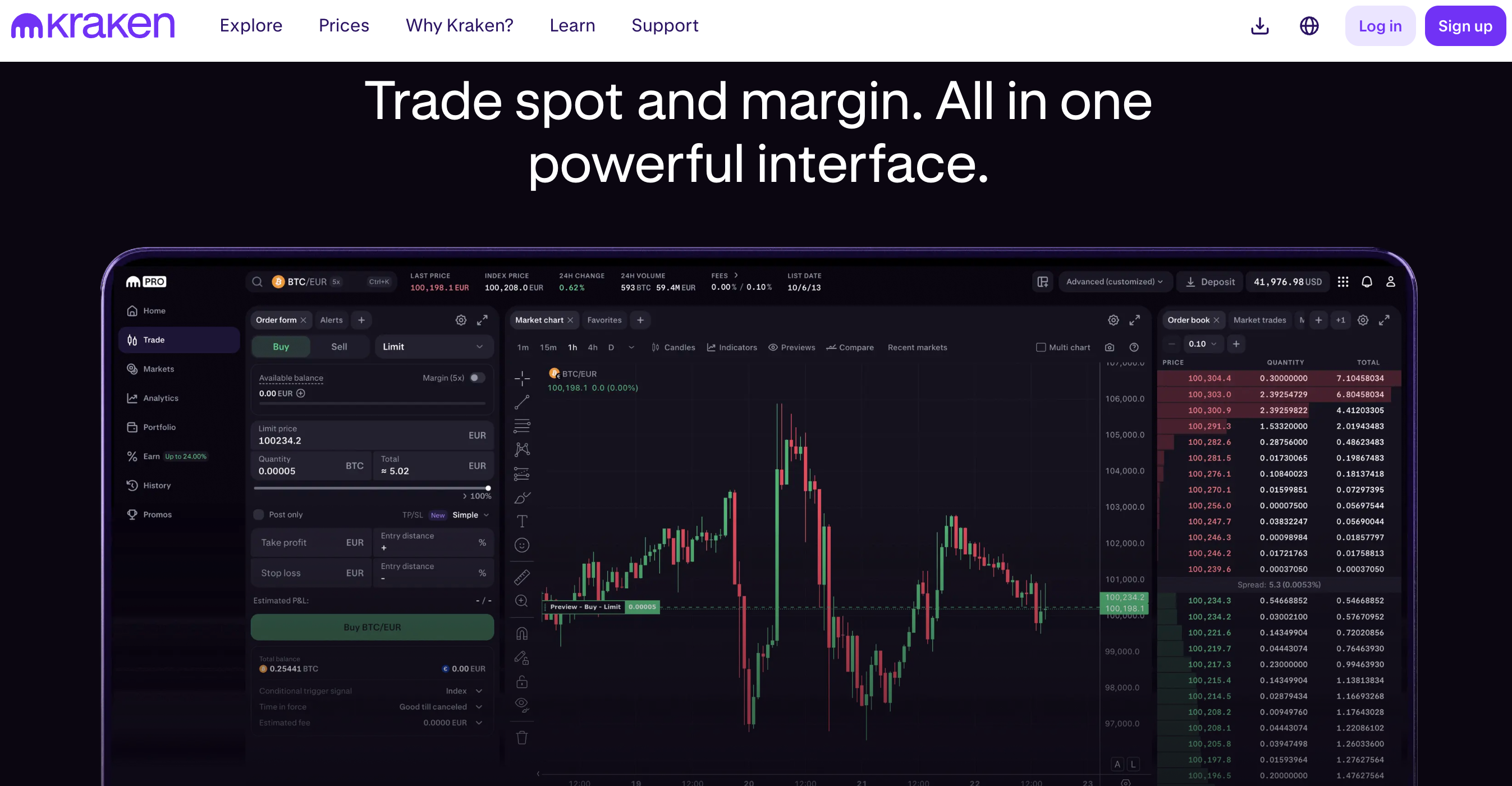

The SEC’s new approach seeks to streamline this journey. By supporting super apps that operate under a unified license, the agency aims to eliminate redundant registrations and outdated custody rules. In practice, this means users could soon access everything, from buying tokens to earning yield, within a single interface. Coinbase’s recent launch of their “Base App” is an early example of this trend (see more here).

Flexible Custody: Empowering Users With Choice

A cornerstone of the SEC’s vision is flexible custody. Traditionally, many exchanges have required users to surrender control of their assets, a model at odds with the ethos of decentralization. Now, under Project Crypto, self-custody is being recognized as a fundamental right (source). This shift not only protects investors but also paves the way for safer onboarding experiences.

Imagine opening an account on a super app where you can choose between holding your own keys or delegating custody, all while enjoying robust security standards and regulatory clarity. Such flexibility lowers barriers for new users who may be wary of managing wallets themselves but want the option as they become more comfortable.

Key Benefits of SEC-Backed Crypto Super Apps for New Users

-

Unified Access to Multiple Services: Super apps like Coinbase Base App combine trading, lending, staking, and wallet management in one platform, eliminating the need for multiple accounts and simplifying the crypto journey for newcomers.

-

Streamlined Onboarding Process: With a single license and integrated compliance checks, SEC-backed super apps reduce paperwork and regulatory hurdles, making it easier and faster for new users to start using digital assets.

-

Enhanced User Protection and Self-Custody: The SEC’s focus on flexible custody—including self-custody—empowers users to safely manage their own assets, addressing key security and trust concerns for beginners.

-

Lower Costs and Fewer Redundancies: By consolidating services and compliance under one regulatory framework, super apps help cut duplicate fees and administrative costs, making crypto more affordable for new entrants.

-

Clearer Regulatory Environment: SEC Chair Paul Atkins’ stance that most crypto tokens are not securities, combined with rule-based regulations, reduces uncertainty and inspires confidence among first-time users.

The Power of Unified Crypto Licenses

Perhaps most revolutionary is the introduction of unified crypto licenses. Rather than juggling multiple registrations across fragmented agencies, platforms will soon be able to operate under a single regime tailored for blockchain-based markets (details here). For users, this translates into simpler onboarding flows and lower compliance costs passed on as savings or incentives.

This regulatory clarity also sends an important signal: The U. S. , long seen as lagging in digital asset innovation, is ready to compete globally by fostering safe but accessible markets. As more companies embrace these super app frameworks, with features like real-time price tracking and social tools, crypto could move from niche to mainstream faster than anyone expected.

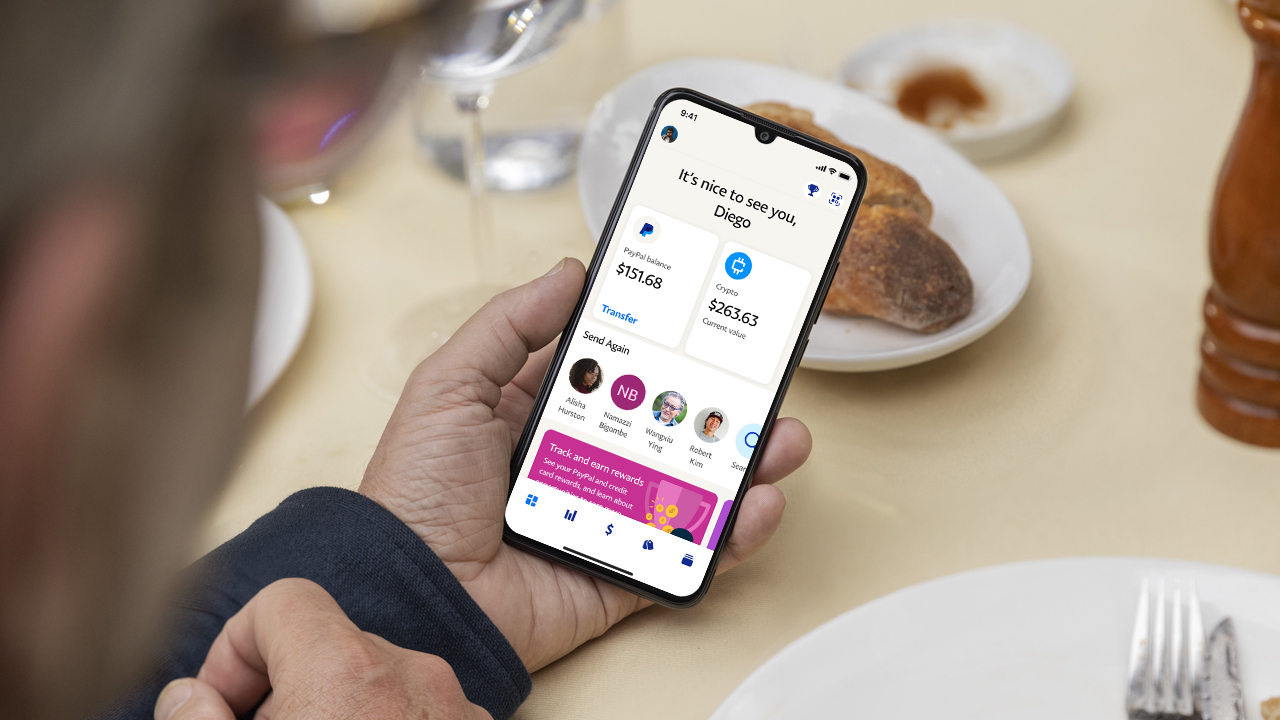

What does this mean for the everyday user? Instead of navigating a maze of signups, KYC processes, and confusing interfaces, onboarding to crypto in 2025 could look as simple as downloading one app and customizing your experience. Whether you’re interested in trading, earning passive income through staking, or exploring DeFi opportunities, it’s all there, intuitive and regulated under a single roof.

Unified crypto licenses also foster trust. When platforms operate transparently within SEC guidelines, new users can feel more secure about compliance and asset safety. This is especially critical as digital assets become part of mainstream portfolios. The ability to toggle between self-custody and trusted third-party custody is not just a technical upgrade, it’s an invitation for users with varying risk appetites to participate confidently in the crypto economy.

How Super Apps Could Redefine Crypto Onboarding in 2025

The potential impact on crypto onboarding 2025 is profound. Here’s how SEC-backed super apps are set to transform the landscape:

How SEC Crypto Super Apps Streamline User Onboarding

-

Unified Access to Multiple Services: SEC-backed super apps like Coinbase Base App offer trading, lending, staking, and custody under one platform, eliminating the need for new users to juggle multiple accounts or apps.

-

Single Regulatory Framework: With the SEC’s single license regime, super apps simplify compliance checks and KYC, making onboarding faster and less confusing for newcomers.

-

Seamless Self-Custody Options: The SEC’s emphasis on self-custody as a fundamental right means users can easily manage their own digital assets within super apps, reducing barriers for those concerned about security.

-

Integrated Educational Resources: Leading platforms like Coinbase Learn embed tutorials and guides, helping new users understand crypto basics directly within the onboarding flow.

-

Lower Costs and Fewer Redundancies: By consolidating services and compliance processes, super apps reduce fees and paperwork, making it less intimidating and more affordable for first-time users to get started.

This evolution isn’t happening in isolation. Other jurisdictions are watching closely, and industry leaders are already racing to build compliant super app experiences. The result? A more competitive marketplace that ultimately benefits consumers through lower fees, better features, and enhanced security.

Of course, questions remain about implementation details, how will these unified licenses adapt to fast-evolving DeFi protocols? What standards must platforms meet to ensure both flexibility and investor protection? Yet the momentum is clear: By prioritizing accessibility without sacrificing safety or innovation, the SEC is laying groundwork for a new era of digital finance.

“Regulation should be an enabler, not a barrier, to financial inclusion, ” said Chair Atkins at a recent summit. This philosophy is now shaping real policy that could bring millions into the crypto fold with confidence.

The Road Ahead: Opportunities and Challenges

The journey toward seamless onboarding isn’t over. As super apps roll out new features, from integrated fiat ramps to interactive social tools, the need for ongoing education grows. Platforms must invest not only in UX but also in transparent communication about risks and rights around flexible custody crypto solutions.

If successful, these reforms could serve as a global template for responsible innovation, balancing user empowerment with robust oversight. For now, all eyes are on the U. S. , where regulatory clarity might finally unlock mass adoption by making digital assets as approachable as any traditional bank account or investment platform.