After years of anticipation, the first U. S. -listed spot XRP ETF has officially launched, marking a pivotal moment for both crypto enthusiasts and traditional investors. With the SEC’s recent regulatory shift and the debut of the XRPR ETF from REX Shares and Osprey Funds, gaining exposure to XRP is now as simple as buying any stock or ETF from your brokerage account. But how exactly do you buy the XRPR ETF, and what does this mean for crypto onboarding in 2025?

XRP ETF Onboarding: Why This Launch Matters

The approval of the XRPR ETF isn’t just headline news – it’s a game-changer for crypto accessibility. For years, newcomers faced hurdles like complex wallet setups, confusing exchanges, and custody risks when buying XRP directly. Now, anyone with a U. S. brokerage account can add XRP exposure to their portfolio in just a few clicks, without leaving familiar platforms like Fidelity or E*TRADE.

As of September 20,2025, XRP trades at $3.00, with a daily range between $2.98 and $3.05. The XRPR ETF holds actual XRP tokens and allocates part of its assets to other XRP-linked products – all under strict regulatory oversight.

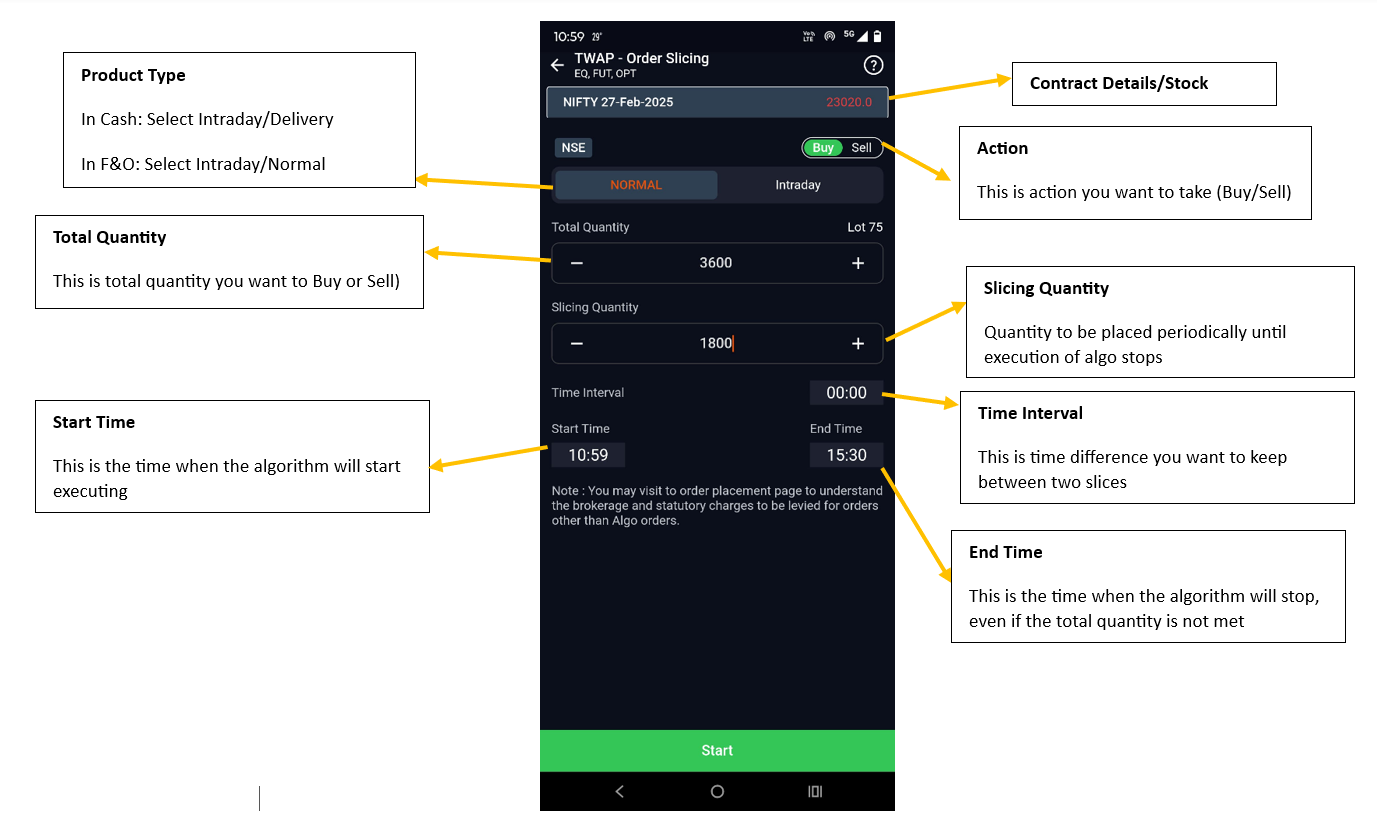

Step-by-Step Guide: How to Buy the First U. S. XRP ETF (XRPR)

If you’re ready to participate in this historic launch – whether you’re a crypto beginner or an experienced investor seeking regulated exposure – follow these exact steps:

- Open a brokerage account with a U. S. platform that lists the XRPR ETF (e. g. , Fidelity, Charles Schwab, E*TRADE, or Robinhood). If you already have an account at one of these brokers with access to Cboe BZX Exchange listings, you’re set.

- Fund your brokerage account by linking your bank account and depositing enough USD to cover your intended investment plus trading fees. Most brokers offer quick ACH transfers or wire options.

- Search for the XRPR ETF by its official ticker symbol (‘XRPR’). Double-check that the issuer is Rex Shares/Osprey Funds before proceeding to avoid confusion with similarly named products.

- Place a buy order for XRPR. For added control during launch-day volatility, use a limit order instead of market order so you set your maximum purchase price.

- Monitor your investment post-purchase. Stay updated on regulatory developments and performance metrics within your brokerage dashboard so you can make informed decisions over time.

Navigating Your First Crypto ETF Purchase Like a Pro

The process above mirrors what seasoned traders do when entering new ETFs on launch day – but it’s designed so even first-timers can follow along confidently:

- Why use limit orders? Launch days are notorious for volatile swings as liquidity builds up; limit orders protect you from paying more than planned if prices spike temporarily.

- Why verify the ticker? With multiple products launching across various platforms, always confirm “XRPR” is issued by Rex Shares/Osprey Funds on Cboe BZX before clicking buy.

- How much should I invest? Start small if this is your first crypto allocation; monitor performance and adjust as your comfort grows.

XRP (XRP) Price Prediction 2026-2031

Comprehensive XRP price projections following the launch of the first U.S. spot XRP ETF (XRPR) and evolving market dynamics.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $2.60 | $3.80 | $5.20 | +26.7% | ETF inflows stabilize; regulatory clarity continues; moderate adoption growth |

| 2027 | $2.40 | $4.20 | $6.50 | +10.5% | Potential market correction; increased competition from other altcoins; steady institutional interest |

| 2028 | $2.80 | $5.00 | $8.00 | +19.0% | Renewed bull cycle; broader crypto ETF adoption; expanding use cases in cross-border payments |

| 2029 | $3.50 | $6.20 | $10.00 | +24.0% | Mainstream financial integration; significant enterprise partnerships; speculative momentum builds |

| 2030 | $4.20 | $7.50 | $13.00 | +21.0% | Peak market cycle; possible regulatory tightening; XRP gains traction as settlement layer |

| 2031 | $3.50 | $6.80 | $12.00 | -9.3% | Market consolidation phase; profit-taking; maturing utility and network effects |

Price Prediction Summary

Following the approval and launch of the first U.S. spot XRP ETF, XRP is poised for increased institutional adoption and liquidity. While price appreciation is expected as regulatory clarity and mainstream acceptance grow, volatility will remain high, with both bullish surges and potential corrections. The average price is projected to steadily rise through 2030, peaking with broader market cycles, before a likely consolidation in 2031.

Key Factors Affecting XRP Price

- ETF-driven institutional inflows and increased liquidity

- Ongoing global and U.S. regulatory developments impacting crypto

- Adoption of XRP for cross-border payments and institutional transfers

- Competition from other payment-focused cryptocurrencies (e.g., Stellar, stablecoins)

- Macro market cycles and investor sentiment

- Technological improvements to XRP Ledger and ecosystem expansion

- Potential for further cryptocurrency ETF approvals (ETH, SOL, etc.)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

XRP Price Today: What Does It Mean For Your Investment?

XRP’s current price sits at $3.00, down slightly (-1.32%) over the last day but holding steady within its recent range ($2.98–$3.05). The introduction of spot ETFs often increases liquidity and stabilizes prices over time by attracting institutional flows previously sidelined by regulatory uncertainty.

If you’re tracking market sentiment or considering dollar-cost averaging into XRPR shares over several weeks rather than going all-in at once – this approach helps manage risk as trading volumes normalize post-launch.

As the XRPR ETF gains traction, expect more mainstream investors to dip their toes into crypto markets without the technical hurdles of wallets or private keys. This shift is especially important for onboarding a new wave of users who have watched from the sidelines, wary of security risks and regulatory ambiguity.

Best Practices: Tips for Smooth Crypto ETF Onboarding

Whether you’re a first-timer or a seasoned investor, these tips will help you navigate your initial XRPR purchase and ongoing portfolio management:

Step-by-Step Guide to Buying the First U.S. XRP ETF

-

Open a brokerage account with a U.S. platform that lists the XRPR ETF (e.g., Fidelity, Charles Schwab, E*TRADE, or Robinhood). Make sure the broker offers access to the Cboe BZX Exchange, where XRPR is listed.

-

Fund your brokerage account by linking your bank account and depositing sufficient USD to cover your intended investment plus fees. Most platforms support ACH transfers, wire transfers, and sometimes debit card funding.

-

Search for the XRPR ETF by its official ticker symbol (e.g., ‘XRPR‘) and verify the issuer is Rex Shares/Osprey to avoid confusion with other products. Double-check the ticker and issuer before proceeding.

-

Place a buy order for the XRPR ETF, preferably using a limit order to control your purchase price, especially during launch volatility. Limit orders help you avoid unexpected price swings and ensure you only buy at your chosen price.

-

Monitor your investment post-purchase and stay updated on regulatory news and ETF performance to make informed future decisions. Keep an eye on XRP’s latest price (currently $3.00) and watch for any SEC or ETF issuer announcements.

- Stick to limit orders on launch day to avoid price spikes from early volatility.

- Check extended hours trading rules if you want to buy pre-market or after-hours, some brokers allow this, but liquidity may be thinner.

- Double-check the ticker symbol (XRPR) and issuer (Rex Shares/Osprey Funds) before purchasing. With new products popping up, accuracy matters.

- Monitor your investment regularly using your broker’s dashboard. Set up alerts for major price swings or news affecting XRP or crypto ETFs in general.

- Stay informed about regulatory updates. The landscape is evolving quickly, what’s true today may change in months ahead as more ETFs launch and SEC guidance shifts.

Why This Matters: The Ripple Effect on Crypto Adoption

The launch of America’s first spot XRP ETF is more than just a headline, it represents a watershed moment for how everyday investors access digital assets. By following the five critical steps above, opening a brokerage account, funding it with USD, searching for XRPR by its official ticker, placing a limit order, and monitoring your investment, you’re gaining exposure to XRP with institutional-grade security and compliance baked in from day one.

This model could soon extend to other digital assets as regulators warm up to crypto ETFs. For now, the XRPR ETF stands as proof that crypto can coexist with traditional finance, making onboarding safer and easier than ever before. If you’ve been waiting for a sign that it’s time to get started with crypto ETFs in the U. S. , this is it.