The landscape for crypto regulation in the United States is undergoing a significant transformation. With the passage of the Bipartisan Crypto Market Structure Bill by the U. S. House of Representatives on July 17,2025, the industry stands at a pivotal juncture. This legislation seeks to address long-standing ambiguities around digital asset oversight and promises to alter how new users approach crypto onboarding. For those entering the space, these changes could mark a new era defined by clarity, security, and standardized processes.

Regulatory Uncertainty: The Biggest Barrier to Crypto Onboarding

Historically, one of the greatest challenges for potential crypto users has been regulatory uncertainty. Without clear definitions distinguishing which assets fall under Commodity Futures Trading Commission (CFTC) oversight versus Securities and Exchange Commission (SEC) jurisdiction, exchanges and platforms have struggled to design compliant onboarding procedures. This lack of clarity has resulted in inconsistent Know Your Customer (KYC) practices and varying degrees of consumer protection across platforms.

The crypto market structure bill directly addresses this issue by establishing a comprehensive framework that delineates regulatory responsibilities. By providing explicit guidelines on asset classification, it aims to remove much of the confusion that has deterred both retail investors and institutions from joining the market.

How Standardized Rules Will Simplify KYC Onboarding in Crypto

KYC onboarding in crypto has often been fragmented due to differing interpretations of existing laws. Some platforms have implemented rigorous verification processes akin to traditional banks, while others have taken a more relaxed approach, sometimes exposing users to higher risks.

With bipartisan crypto regulation now advancing through Congress, new standards are set to emerge. The bill outlines requirements for customer identification, anti-money laundering procedures, and reporting obligations that will apply uniformly across all compliant platforms. This should streamline onboarding for new users by making expectations transparent from the outset.

How Standardized Crypto Regulations Improve Onboarding

-

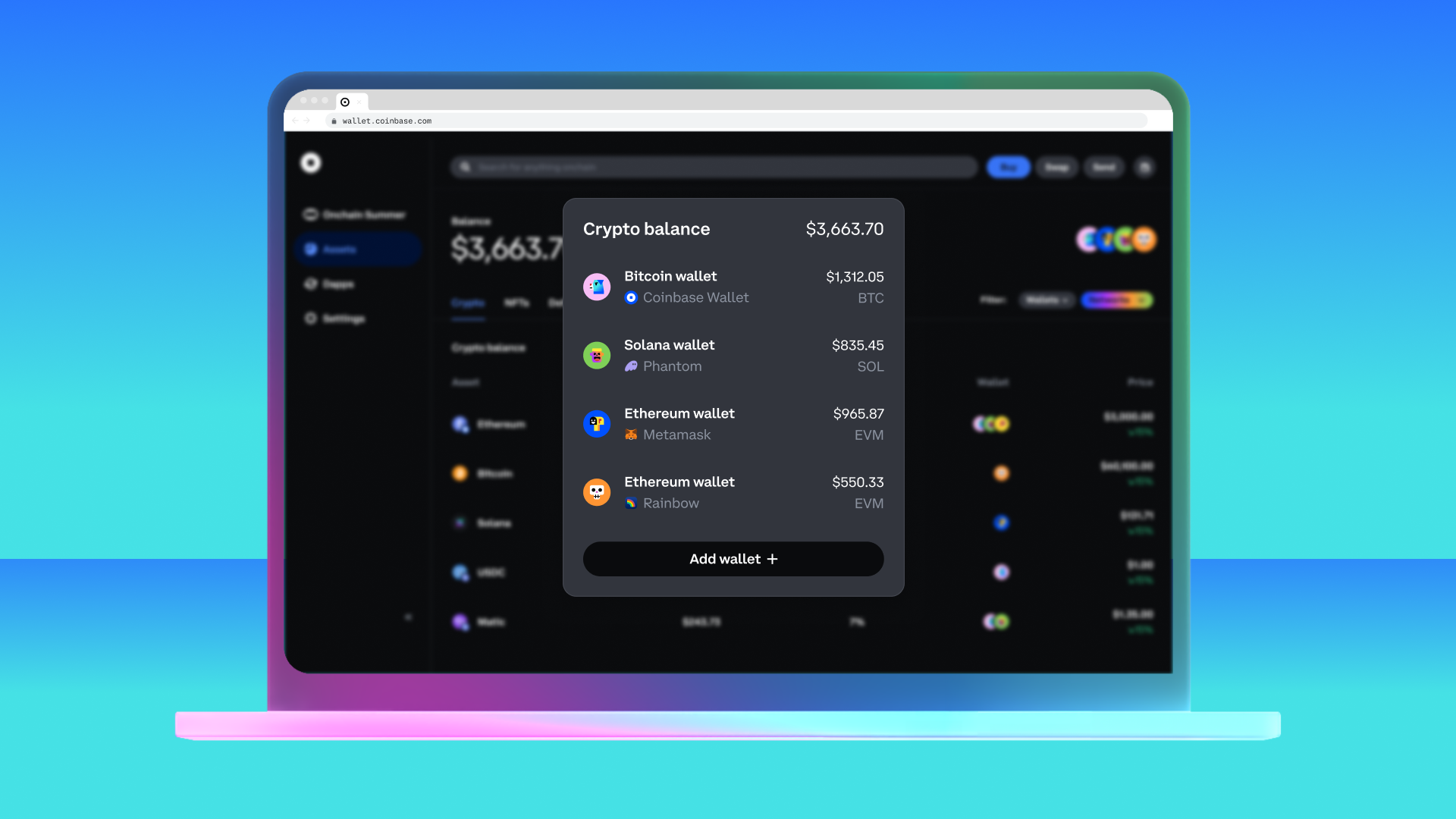

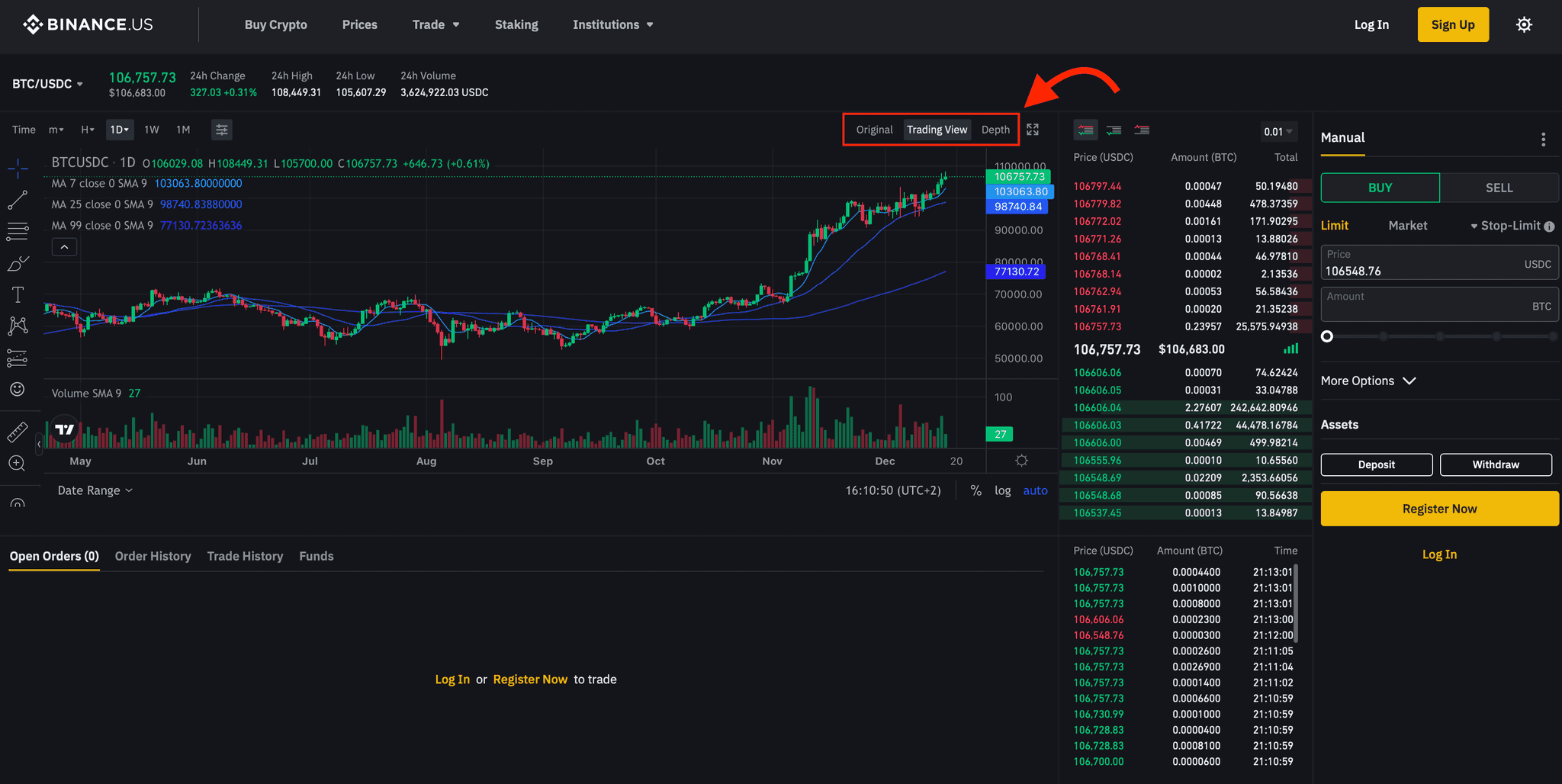

Enhanced Consumer Protections: The bill introduces robust consumer safeguards, such as mandatory disclosures and anti-fraud measures, giving new users greater confidence in platforms like Binance.US and Gemini.

-

Streamlined Asset Classification: By clarifying whether digital assets are overseen by the CFTC or SEC, the bill reduces confusion for new users about which assets are regulated and how, simplifying the onboarding process across major platforms.

-

Improved Access to Educational Resources: Regulatory clarity encourages platforms to provide accurate, up-to-date onboarding materials, such as those found in Coinbase Learn and Gemini Cryptopedia, helping new users make informed decisions.

As a result, individuals can expect faster account approvals and fewer surprises during registration. Moreover, platforms adhering to these rules are likely to benefit from increased trust among prospective customers, a crucial factor in driving mainstream adoption.

Building Trust Through Enhanced Consumer Protections

The bill’s consumer protection provisions are particularly noteworthy for anyone considering their first steps into digital assets. By mandating robust safeguards against fraud and market manipulation, lawmakers hope to foster an environment where new entrants feel secure navigating the ecosystem.

This is not just theoretical: recent high-profile incidents involving lost funds or exchange collapses have underscored why clear legal recourse and oversight matter so much for user confidence. The legislation’s focus on transparency, requiring disclosures about risks, fees, and platform solvency, will empower users with information previously hard to come by.

The Broader Impact: Fostering Mainstream Adoption

For years, advocates have argued that comprehensive crypto legislation 2025 could unlock broader participation in digital finance. By removing legal grey areas and holding service providers accountable under unified standards, this bill lays the groundwork for responsible growth.

The industry is closely watching ongoing negotiations as Senate Democrats push for further input before final markup expected after October 20 (Politico). However, even as details evolve, it is clear that future onboarding experiences will look markedly different from today’s patchwork system.

Standardized onboarding processes are only one piece of the puzzle. The Bipartisan Crypto Market Structure Bill also signals a shift in how new users perceive risk and opportunity within the digital asset space. By embedding clear, enforceable standards into law, the bill is likely to reduce the “wild west” reputation that has deterred cautious investors and everyday consumers alike. This regulatory clarity could drive a new wave of adoption among individuals who were previously on the sidelines, wary of ambiguous rules and inconsistent protections.

What New Users Can Expect: A Step-by-Step Onboarding Experience

With uniform KYC and anti-money laundering protocols mandated across platforms, newcomers will encounter a more predictable onboarding journey. Instead of navigating a maze of different verification requirements, users can expect:

This consistency not only streamlines access but also minimizes friction for those moving between platforms or exploring multiple digital assets. For service providers, it levels the playing field by holding all participants to the same compliance standards, reducing regulatory arbitrage and enhancing market integrity.

Potential Challenges in Implementation

No legislative overhaul is without its growing pains. While the bill aims to simplify onboarding and boost confidence, some challenges are inevitable during its rollout. Smaller exchanges may face higher compliance costs as they adapt to stringent reporting and KYC requirements. There could be temporary delays as platforms upgrade systems and train staff on new procedures.

Furthermore, as Senate negotiations continue into late October (Politico), final details around asset classification and cross-agency coordination remain in flux. Users should stay informed about which aspects of the bill have been enacted versus those still under discussion.

Looking Forward: What This Means for Everyday Investors

The broader implications of bipartisan crypto regulation extend well beyond initial account setup. As trust builds through enhanced user protection and transparent platform practices, digital assets are poised to become more accessible to mainstream investors, potentially accelerating integration with traditional financial services.

For those considering entering the market now or in coming months, it is an opportune moment to assess how evolving laws will shape your experience. Platforms that embrace these changes early may offer smoother onboarding and stronger safeguards against common risks like fraud or insolvency.

Do recent crypto regulations make you feel more confident about entering the crypto market?

With the Bipartisan Crypto Market Structure Bill aiming to clarify rules and protect consumers, new users may find it easier and safer to get started with crypto. Has this increased your confidence in joining the crypto space?

The passage of the Bipartisan Crypto Market Structure Bill marks a turning point for both seasoned participants and newcomers alike. As regulatory frameworks solidify around user protection, transparency, and standardized processes, onboarding into crypto stands to become not just simpler, but safer and more trustworthy than ever before.