The landscape of crypto onboarding in the United States has shifted dramatically in 2025, reshaping what it means to be a beginner in the world of digital assets. With new regulations targeting everything from privacy to compliance, anyone looking to buy their first crypto is now greeted by a maze of rules and documentation. If you’re just starting out, understanding these changes isn’t optional, it’s essential for protecting your funds and your privacy.

Why 2025 Is a Turning Point for US Crypto Regulations

Let’s set the stage: In April 2025, the U. S. Justice Department disbanded its National Cryptocurrency Enforcement Team, signaling a narrower focus on criminal activity rather than blanket enforcement. Meanwhile, the SEC has stepped in with plans for clear guidelines around which tokens count as securities, giving both projects and investors more certainty but also introducing new hoops for beginners to jump through (Reuters, Reuters).

On top of that, Congress formed a bipartisan working group dedicated to digital asset policy, aiming to balance innovation with risk management. The result? A rapidly evolving rulebook that directly impacts how you sign up for exchanges or wallets, and what information you’ll need to provide.

KYC and AML: The New Gatekeepers of Crypto Onboarding

The most immediate change beginners will feel is at the onboarding stage. In 2025, KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements have become much stricter. FinCEN now requires any crypto wallet holding over $10,000 to report user identities directly to the IRS (GrowEasyFinance). This means that even if you’re using decentralized platforms or self-custody wallets, your privacy expectations need an update.

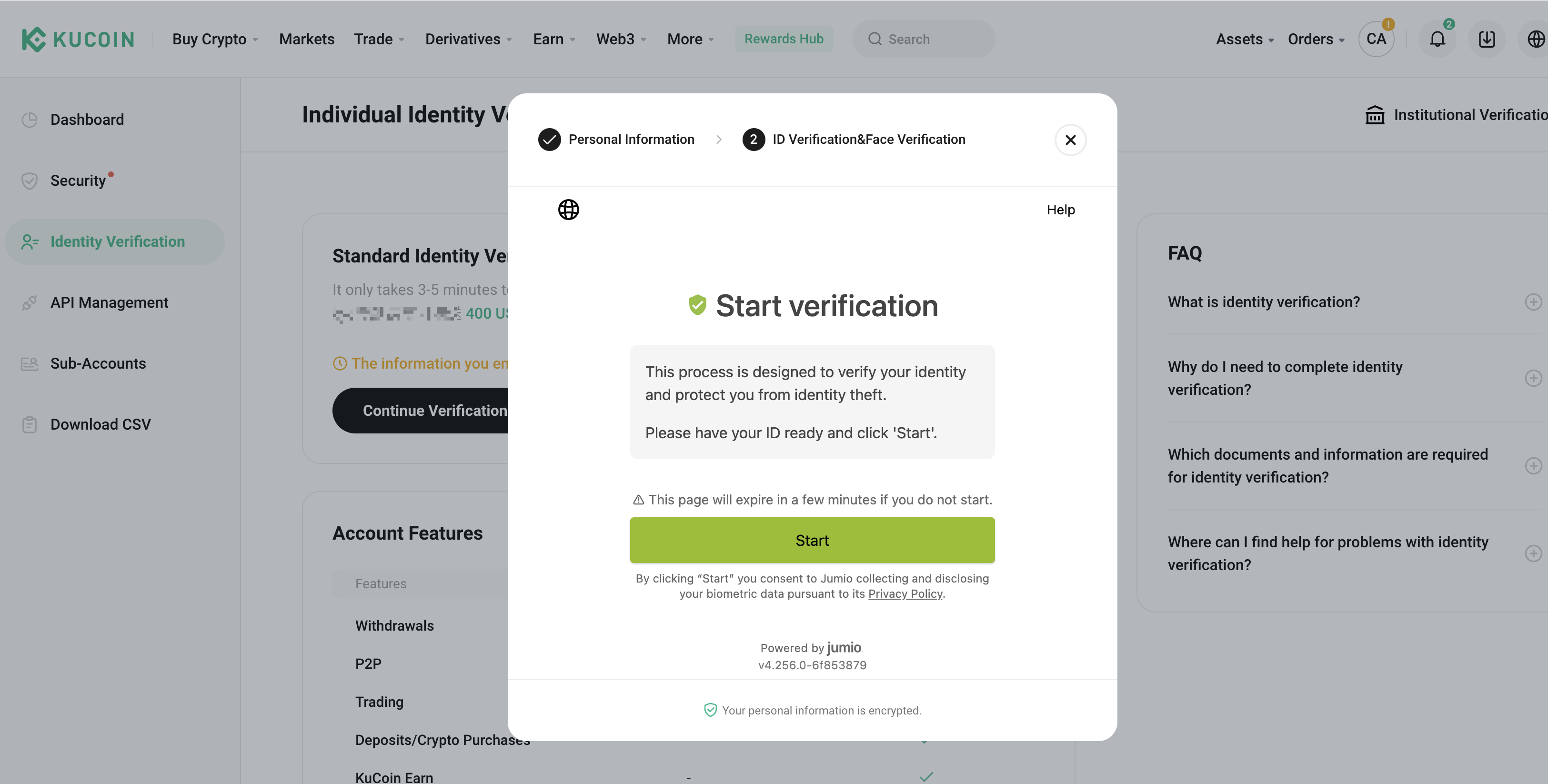

If you’re opening an account on a major exchange or connecting your wallet to DeFi protocols, expect additional verification steps:

Essential KYC/AML Checks for US Crypto Onboarding (2025)

-

Social Security Number (SSN) Submission: Platforms such as Gemini and Binance.US require users to provide their SSN for tax reporting and compliance with FinCEN regulations.

-

Biometric Verification: Increasingly, exchanges such as Coinbase use facial recognition or selfie verification to match users with their submitted IDs, enhancing security and compliance.

-

Enhanced Due Diligence for High-Value Wallets: As of 2025, wallets holding over $10,000 in crypto (including those on MetaMask) require users to undergo additional checks and report identities to the IRS, per updated FinCEN guidelines.

-

Sanctions and Watchlist Screening: All major US platforms screen new users against OFAC and global sanctions lists to prevent onboarding of restricted individuals or entities.

This shift is designed to curb illicit activity but also adds friction for legitimate users, especially those new to crypto who may not be accustomed to sharing sensitive documents online.

Privacy Trade-Offs: What Beginners Need To Know

The trade-off between privacy and compliance is front and center. Enhanced KYC rules mean more personal data collected at every step. For some, this feels like a necessary evolution; for others, it’s a step back from crypto’s original ethos of pseudonymity. Here’s what’s changed:

- ID Verification Is Now Standard: Expect government-issued ID checks even on some non-custodial wallets.

- Larger Transactions Flagged: Any wallet holding over $10,000 triggers mandatory reporting.

- Travel Rule Expansion: When sending funds between platforms or across borders, details about both sender and receiver may be logged and shared with authorities.

This environment can feel intimidating, but it’s not all bad news. Regulatory clarity could make mainstream adoption easier by reducing legal uncertainties for exchanges and users alike (KYC Hub). Still, beginners should weigh their comfort with data sharing before diving in.

Navigating Your First Steps: Compliance Checklist for New Users

If you’re just getting started with digital assets under these new rules, preparation is key. Here are some crucial steps every beginner should follow:

The days of anonymous trading are fading fast, at least within regulated US platforms. For those who value privacy above all else, these developments might prompt deeper research into self-custody solutions or alternative jurisdictions (though those routes come with their own risks).

For most beginners, the best approach is to embrace the new normal and focus on compliance-first onboarding. The upside? Exchanges and wallet providers are racing to streamline the KYC/AML process, making it less painful than in years past. Expect more intuitive interfaces, faster verification times, and clear guidance at every step.

Practical Tips: How to Onboard Smoothly in 2025

Getting started in crypto under the 2025 regulatory regime doesn’t have to be overwhelming. Here are a few actionable strategies for a frictionless experience:

5 Essential Tips for US Crypto Beginners in 2025

-

2. Prepare for Enhanced KYC Verification: Be ready to provide detailed identity documents, especially if your crypto wallet exceeds $10,000, due to FinCEN’s stricter KYC requirements.

-

3. Understand New SEC Token Classifications: Check if the crypto assets you want to buy are classified as securities under the SEC’s 2025 guidelines to ensure you’re trading compliant tokens.

-

4. Monitor Tax Reporting Obligations: Use tools like CoinTracker or Koinly to track transactions and simplify IRS digital asset tax reporting, especially for wallets over $10,000.

-

5. Stay Updated on Regulatory Changes: Follow sources like Latham & Watkins’ US Crypto Policy Tracker and PwC Global Crypto Regulation Report for the latest compliance updates.

Staying organized with your documentation and understanding what’s expected will help you avoid delays or account freezes. It’s also smart to regularly review your exchange’s compliance updates, regulations are still evolving, and platforms may adjust their requirements on short notice.

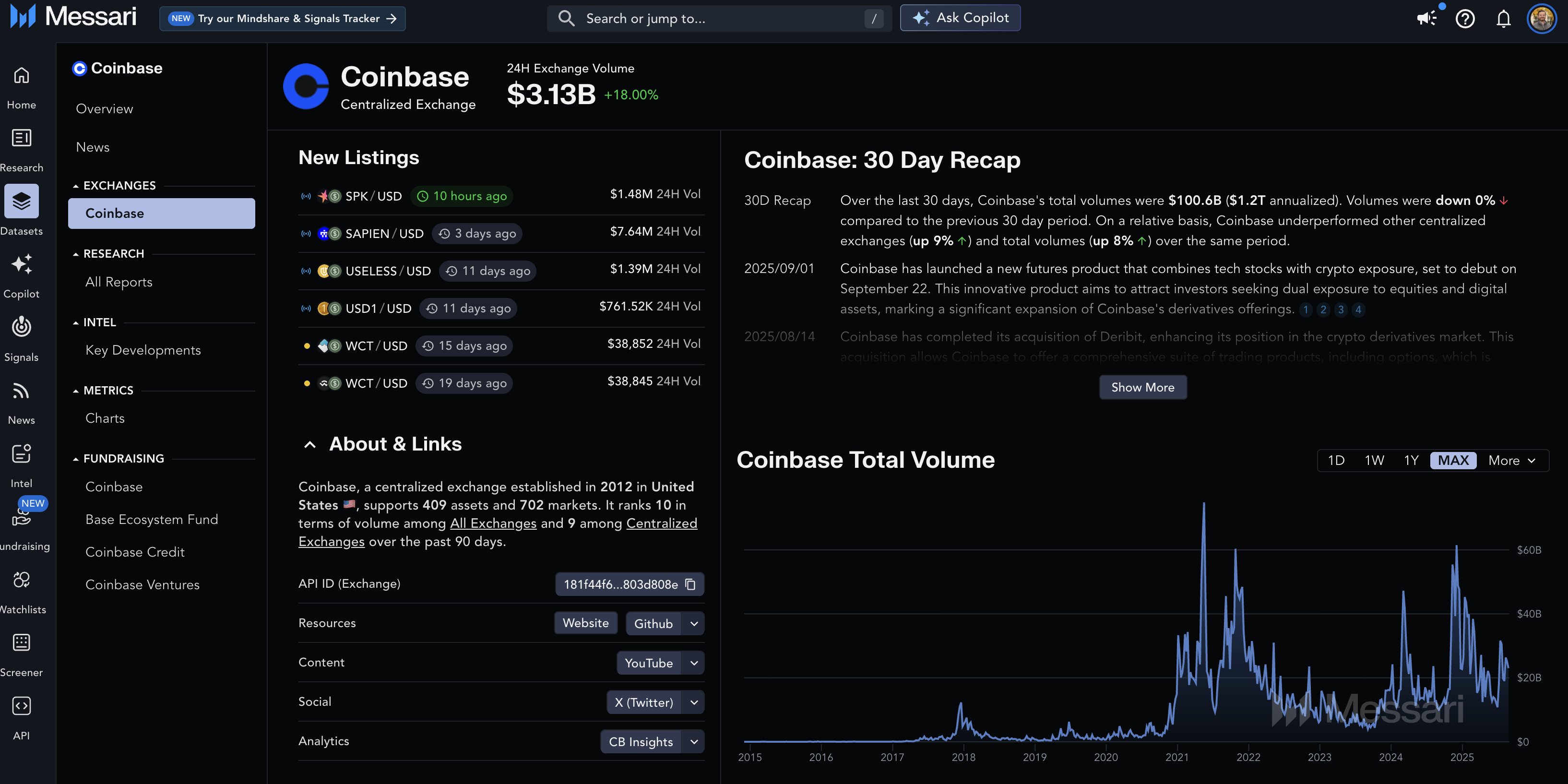

Beyond Borders: Comparing US Crypto Onboarding Globally

The US isn’t alone in tightening crypto onboarding rules. In fact, some regions, like parts of Asia and the UAE, are experimenting with different balances between privacy, compliance, and innovation. For example, while US users now face stricter IRS reporting for wallets over $10,000, other countries focus more on real-time transaction monitoring or stablecoin-specific regulation.

This global patchwork means that if you’re planning to use international exchanges or travel frequently, you’ll need to keep tabs on local laws too. For deeper dives into regional differences or emerging global standards, check out resources like the KYC Hub guide or Global Legal Insights.

What Does This Mean for the Future?

Regulatory clarity is a double-edged sword for beginners. On one hand, it can make crypto safer and more accessible by rooting out bad actors. On the other hand, it raises new questions about surveillance and personal freedom within blockchain ecosystems.

The bottom line: if you’re onboarding into crypto in 2025, expect transparency, not just from yourself but from every platform you interact with. Keep your privacy expectations realistic and stay informed as laws continue to evolve.

Let the charts tell the story: Regulatory moves are shaping not just how we trade but how we enter this market in the first place. Stay compliant, and stay curious.