Bitcoin’s price is holding strong at $113,660.00, a milestone that would have seemed extraordinary just a few years ago. But as the crypto market matures, so too do the methods used by scammers to exploit new entrants. For beginners, especially those using Bitcoin ATMs for their first crypto purchase, understanding recent regulatory changes is essential for a safe onboarding experience.

Why Bitcoin ATMs Are Under Scrutiny

Bitcoin ATMs have become a popular entry point into cryptocurrency due to their convenience and accessibility. However, their very strengths – easy cash transactions and relative anonymity – have made them a magnet for fraudsters. According to Senator Cynthia Lummis, who has been vocal in her concern about crypto ATM scams, law enforcement in Cheyenne alone identified over 50 instances of fraud involving these machines, totaling more than $645,000 in unrecovered losses (source).

The National Consumers League notes that the largely unregulated nature of these kiosks has made them favored tools for scammers seeking to exploit their anonymity and the irreversibility of transactions.

The New Safeguards: What’s Changing?

In response to mounting concerns, several states are rolling out new regulations designed to protect users – particularly beginners who may be less familiar with common crypto scams. Here are some of the key changes:

Top 5 New Bitcoin ATM Safeguards for Beginners

-

Mandatory Identity Verification (KYC): Many states now require users to complete Know Your Customer (KYC) checks at Bitcoin ATMs, including presenting a valid photo ID for each transaction. This step helps prevent fraud and ensures compliance with financial regulations.

-

Transaction Limits: To minimize losses from scams, states like Wisconsin and California have introduced $1,000 daily transaction caps on Bitcoin ATM withdrawals and purchases. Beginners should be aware of these limits before transacting.

-

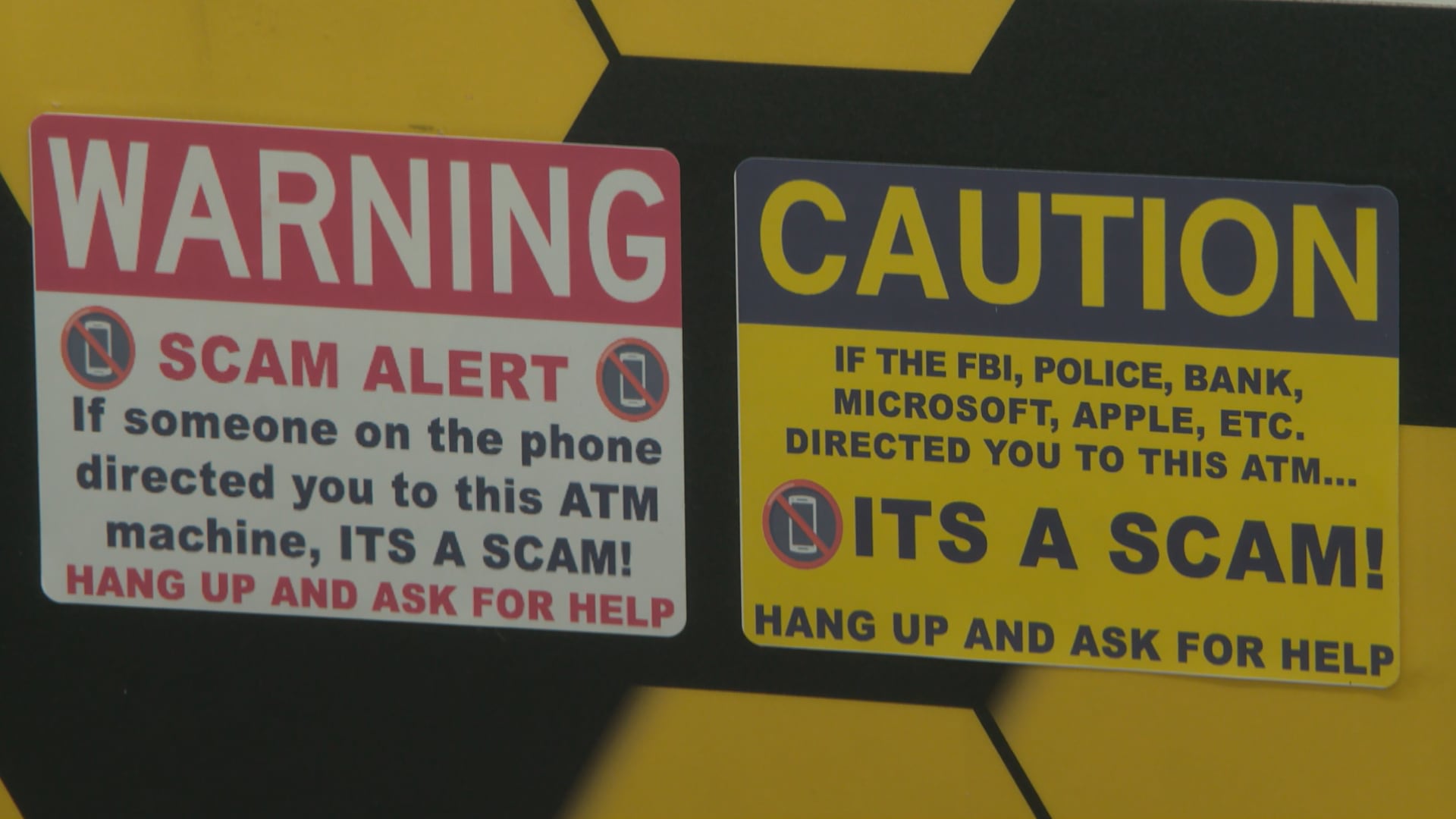

Enhanced Consumer Scam Warnings: New regulations require Bitcoin ATMs to display clear, multilingual warnings about potential scams. For example, Arizona mandates that operators post visible warnings and offer refunds to scam victims who report incidents within 30 days.

-

Refund Policies for Scam Victims: In some states, Bitcoin ATM operators are now required to provide refunds to users who fall victim to fraud and report it promptly, increasing consumer protection for beginners.

-

Operator Accountability and Regulation: Recent legislation, such as the Crypto ATM Fraud Prevention Act (S.710), is pushing for stricter oversight of Bitcoin ATM operators, including registration requirements and anti-fraud measures to ensure safer onboarding for new users.

Mandatory Identity Verification (KYC): States like Wisconsin are proposing laws requiring all Bitcoin ATM users to present photo identification for each transaction. This Know Your Customer (KYC) process is intended to deter criminal activity by ensuring every transaction can be traced back to an individual.

Transaction Limits: To reduce potential losses from scams or impulsive mistakes, several states are implementing daily caps on how much can be transacted via crypto ATMs. For example, Wisconsin’s proposed bill sets a $1,000-per-transaction cap while California has introduced a $1,000 daily withdrawal limit (source).

Enhanced Consumer Warnings: Operators must now display clear warnings about potential scams directly on ATM screens. Arizona goes even further by requiring multilingual alerts and mandating refunds for scam victims who report incidents within 30 days (source).

Navigating Crypto Onboarding Safety as a Beginner

If you’re new to buying cryptocurrency at an ATM, these changes will affect your experience in several ways:

- You’ll need valid photo ID for every transaction.

- You may face daily or per-transaction limits, so plan accordingly if you intend to buy larger amounts of Bitcoin.

- You’ll see prominent warnings about common scams.

This shift puts more responsibility on both operators and users but ultimately aims to make onboarding safer for everyone entering the world of digital assets at today’s prices – with Bitcoin currently at $113,660.00.

For those just starting out, these new Bitcoin ATM safeguards are not just bureaucratic hurdles, they’re designed to help protect your funds and personal information at a time when scams are becoming more sophisticated. The hope is that with better consumer education and clear warnings, fewer newcomers will fall victim to the types of fraud that have plagued the space in recent years.

How to Avoid Common Bitcoin ATM Scams

While regulations are tightening, vigilance remains your best defense. Scammers often use social engineering tactics, posing as government officials, tech support, or even family members, to convince victims to deposit cash into a Bitcoin ATM and send funds to a wallet controlled by the scammer. If an offer sounds too good to be true or if someone is pressuring you to act quickly, step back and verify before proceeding.

Here’s a practical checklist for beginners looking to use Bitcoin ATMs safely:

What These Changes Mean for Crypto’s Future

The introduction of mandatory KYC checks and transaction limits at ATMs reflects a broader shift toward mainstream adoption, and regulation, of digital assets. As prices like $113,660.00 for Bitcoin capture headlines, lawmakers such as Senator Cynthia Lummis are pushing for frameworks that balance innovation with consumer protection (source). This regulatory clarity could ultimately bring more legitimacy and stability to the space.

For beginners, this means onboarding into crypto in 2025 will likely be safer but also more structured than ever before. You’ll need to plan ahead, bring ID, understand your limits, and read all on-screen warnings carefully. While some may see these steps as obstacles, they’re actually important guardrails as you learn the ropes of digital asset investing.

Staying Informed: Your Best Crypto Onboarding Tool

The landscape around crypto legislation for beginners is changing rapidly. Staying up-to-date with local regulations and best practices is key, not just for compliance but for your own peace of mind. As always in investing: patience pays dividends, especially when working with emerging technologies at price points like $113,660.00.

Ultimately, these changes are about building trust in an industry where transparency has sometimes lagged behind innovation. For those willing to take the time to understand both the risks and rewards of using Bitcoin ATMs under this new regulatory regime, cryptocurrency can remain an accessible, and secure, gateway into the future of finance.