Crypto investing in the United States is on the brink of a significant transformation, thanks to the Securities and Exchange Commission’s (SEC) newly adopted shortcut for exchange-traded fund (ETF) approvals. This regulatory shift has already sent ripples through the financial world, with legal experts and market analysts predicting an unprecedented surge in crypto ETF launches as early as Q4 2025. For both seasoned investors and those just beginning their crypto onboarding journey, understanding these changes is crucial for navigating the evolving landscape.

What Is the SEC’s New ETF Approval Shortcut?

Historically, launching a crypto ETF in the US was a marathon. Issuers faced a dual filing process: a 19b-4 rule change request and an S-1 registration statement. This could stretch approval timelines to 240 days or more, creating both uncertainty and frustration for innovators and investors alike. The SEC’s new framework, however, marks a dramatic departure from this practice.

Now, if a cryptocurrency meets certain criteria, such as having active Commodity Futures Trading Commission (CFTC)-regulated futures contracts for at least six months or representing at least 40% of an existing listed ETF, the issuer can bypass the lengthy 19b-4 process. They need only file an S-1 registration and wait out a 75-day period. Unless the SEC objects during this window, the ETF is automatically cleared for listing.

This streamlined approach effectively removes one of the most significant barriers to entry for new crypto ETFs. According to CNBC, this move is expected to accelerate product launches and broaden access for US investors seeking regulated exposure to digital assets.

The Floodgates Open: What Investors Can Expect

With these new rules in place, industry watchers anticipate a “boom time” for crypto ETF issuers in late 2025. The market is preparing for an explosion of offerings across not just Bitcoin but also Ethereum and potentially other major tokens that meet regulatory criteria.

Top Crypto ETFs Poised to Launch Under New SEC Rules

-

Grayscale Ethereum Trust (ETHE) Conversion to ETF: Grayscale, known for its Bitcoin ETF, is widely expected to convert its Ethereum Trust (ETHE) into a spot Ethereum ETF following the SEC’s streamlined approval process. This move would allow investors to gain direct exposure to Ethereum through a regulated exchange-traded product.

-

Fidelity Ethereum Fund: After the success of its Bitcoin ETF, Fidelity has filed for an Ethereum ETF, leveraging the new SEC rules to bring a trusted, institutional-grade product to market. This ETF would offer investors a secure way to access Ethereum’s price movements.

-

BlackRock iShares Ethereum Trust: BlackRock, the world’s largest asset manager, is expected to launch the iShares Ethereum Trust as an ETF. With its established reputation and large client base, BlackRock’s entry into Ethereum ETFs is anticipated to attract significant investor interest.

-

Bitwise Crypto Industry Innovators ETF (BITQ) Expansion: Bitwise, a leader in crypto index funds, is set to expand its ETF lineup with new products tracking a diversified basket of cryptocurrencies, taking advantage of the SEC’s expedited process for multi-asset crypto ETFs.

-

VanEck Solana Trust: VanEck, a prominent ETF issuer, has signaled intent to launch a Solana ETF once regulatory criteria are met. With Solana’s growing ecosystem and active futures market, this ETF could be among the first non-Bitcoin, non-Ethereum crypto ETFs in the U.S.

This wave of innovation promises several key benefits:

- Diversification: Investors will soon have access to a wider array of digital asset ETFs beyond just Bitcoin or Ethereum.

- Simplicity: Buying shares of an ETF through traditional brokerage accounts can be far less intimidating than setting up wallets or managing private keys directly.

- Regulatory Oversight: ETFs remain subject to strict SEC supervision, which may provide greater investor protections compared with unregulated exchanges.

The upshot? Crypto onboarding in the US could become dramatically easier, especially for beginners who are wary of direct token purchases but are comfortable with familiar brokerage platforms.

How Does This Change Crypto Onboarding?

The impact on crypto onboarding cannot be overstated. In recent years, one of the biggest hurdles for newcomers has been navigating complex wallets, exchanges, and security protocols required for direct ownership of cryptocurrencies. By contrast, ETFs offer a bridge between traditional finance and digital assets, allowing exposure without needing deep technical know-how.

This regulatory shortcut doesn’t just benefit large institutions; it democratizes access by making it simpler and faster for retail investors to participate in the growth of digital assets through their existing investment accounts.

While the SEC’s new approval shortcut is a boon for accessibility, it also raises important questions about risk and education. Crypto ETFs, though more approachable than direct token purchases, still carry volatility and regulatory uncertainty. The SEC itself has cautioned that these products may be even riskier than some single-stock ETFs, highlighting the need for investors to conduct thorough due diligence before diving in.

Risks and Realities: What Beginners Should Know

For those new to digital assets, the streamlined path to buying crypto ETFs can feel deceptively simple. However, several key factors should be considered:

- Underlying Volatility: Even with SEC oversight, crypto ETFs track assets known for sharp price swings. A diversified basket does not eliminate this risk.

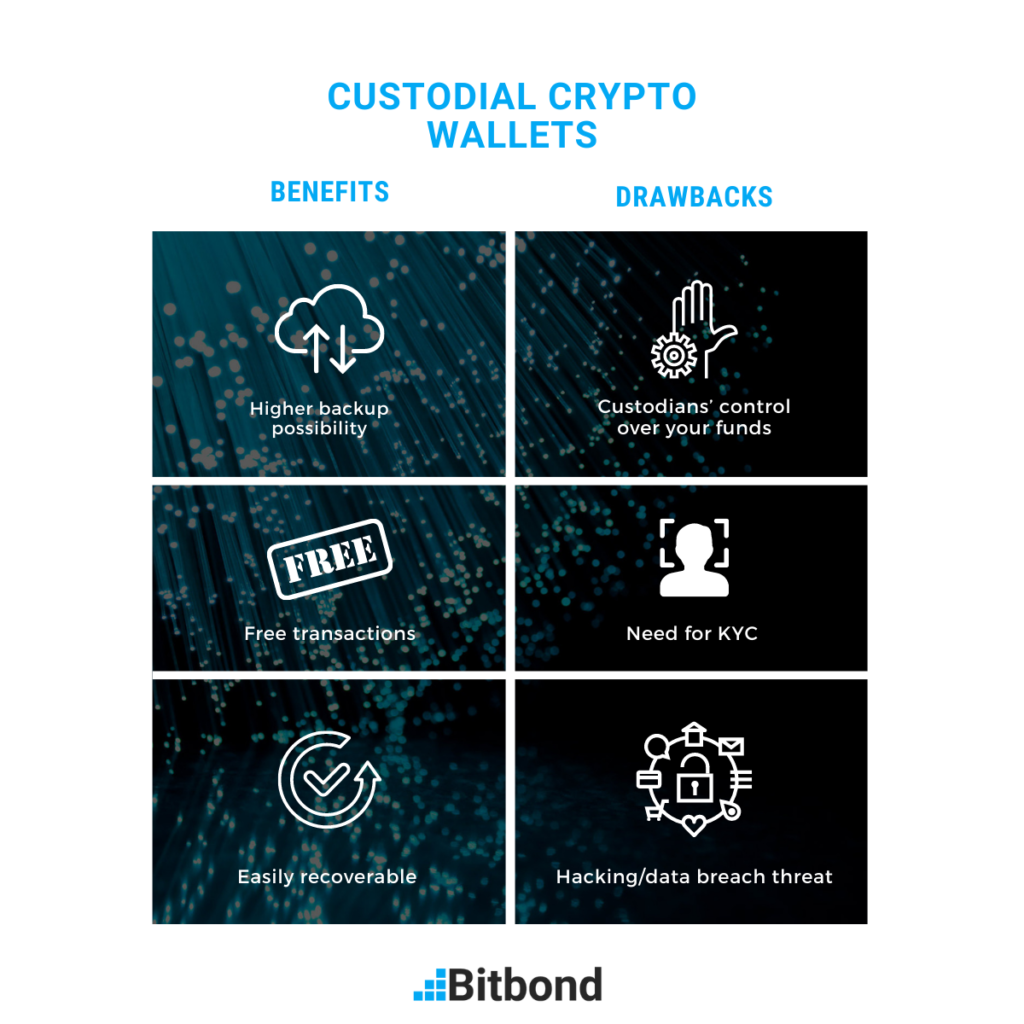

- Custody and Redemption: Unlike holding tokens directly, ETF shareholders do not own the underlying crypto. This distinction matters for those seeking true self-custody or on-chain participation.

- Fees and Tracking Error: Management fees and potential tracking discrepancies can erode returns compared to direct holdings.

The bottom line: while ETFs lower operational barriers, they are not a risk-free gateway. Investors should weigh their comfort with both market volatility and product structure when considering crypto onboarding via ETFs.

Crypto ETFs vs. Direct Token Ownership: A Beginner’s Guide

-

Accessibility: Crypto ETFs can be bought and sold through traditional brokerage accounts like Fidelity or Charles Schwab, making them familiar for stock investors. Direct token ownership requires setting up a crypto wallet and using exchanges such as Coinbase or Kraken.

-

Security & Custody: ETFs are managed by regulated custodians (e.g., BlackRock for iShares Bitcoin Trust), reducing risks of losing private keys. Direct ownership means you control your crypto, but you’re responsible for safeguarding private keys and recovery phrases.

-

Regulation & Oversight: Crypto ETFs are SEC-regulated investment products with investor protections and disclosures. Direct tokens are largely unregulated, exposing investors to more counterparty and platform risk.

-

Fees & Costs: ETFs typically charge an annual management fee (e.g., iShares Bitcoin Trust’s 0.25%), but don’t require network transaction fees. Direct ownership may have lower ongoing costs but includes network fees for transfers and potential exchange withdrawal fees.

-

Trading Hours & Liquidity: ETFs trade during regular stock market hours, so you can’t buy or sell overnight or on weekends. Direct crypto trades 24/7 on global exchanges, offering continuous access but with variable liquidity.

-

Tax Treatment: ETFs are taxed like stocks, with capital gains realized on sale. Direct token sales can trigger taxable events with each trade or use, and may require more complex reporting.

-

Ownership & Utility: Direct tokens allow participation in blockchain activities like staking, governance, or DeFi. ETFs only provide price exposure—no direct blockchain interaction or utility.

Market Impact: What’s Next for Crypto ETF Innovation?

The flood of new products expected in late 2025 could reshape both retail and institutional participation in digital assets. With approval timelines now cut from 240 days to just 75 days, issuers are racing to bring novel strategies to market, ranging from multi-asset baskets to sector-specific plays within the blockchain ecosystem.

This innovation is likely to intensify competition among asset managers, potentially driving down costs and improving investor choice. At the same time, it may accelerate mainstream adoption by removing psychological barriers that have long kept traditional investors on the sidelines.

A New Era of Crypto Onboarding in the US

The SEC’s shortcut marks a pivotal moment in US financial history, one where digital assets move closer to parity with traditional securities in terms of access and legitimacy. For investors at all levels, staying informed about regulatory changes is essential as the landscape evolves rapidly.

If you’re considering your first step into crypto or weighing whether an ETF fits your strategy better than direct ownership, focus on your risk tolerance and investment goals. The coming wave of SEC-approved products will offer unprecedented choice, but also demands a thoughtful approach as innovation outpaces regulation.