The stablecoin market is experiencing a period of explosive growth, with forecasts suggesting it could reach $500 billion by 2026. This surge is not just a headline for crypto insiders – it’s reshaping the financial landscape and introducing both opportunities and new risks for those just starting their crypto journey. If you’re exploring stablecoins for the first time, understanding what’s fueling this boom, what could go wrong, and where the real-world use cases are emerging is essential to making informed decisions.

Stablecoin Market 2026: Why $500B Is Now in Sight

Just a few years ago, stablecoins were mostly seen as digital dollars for traders moving between cryptocurrencies. Now, thanks to institutional adoption and regulatory momentum, the sector is on track to hit $500B in market cap by 2026 according to multiple forecasts. Tether’s own ambitions mirror this, with its potential valuation targeting the same milestone (Mitrade, Yahoo Finance).

This growth isn’t happening in a vacuum:

- Institutional players are ramping up digital asset plans and integrating stablecoins into traditional finance.

- Emerging markets are adopting stablecoins as alternatives to unstable local currencies.

- User-friendly platforms are making onboarding with stablecoins easier than ever.

- Regulatory developments, such as the GENIUS Act in some jurisdictions, offer hope for more resilient frameworks (Coinbase.com).

The result? Stablecoins are quickly moving beyond crypto trading pairs into payments, remittances, savings products, and even everyday purchases.

Tether’s $500B Valuation Bid: What It Means for Crypto Beginners

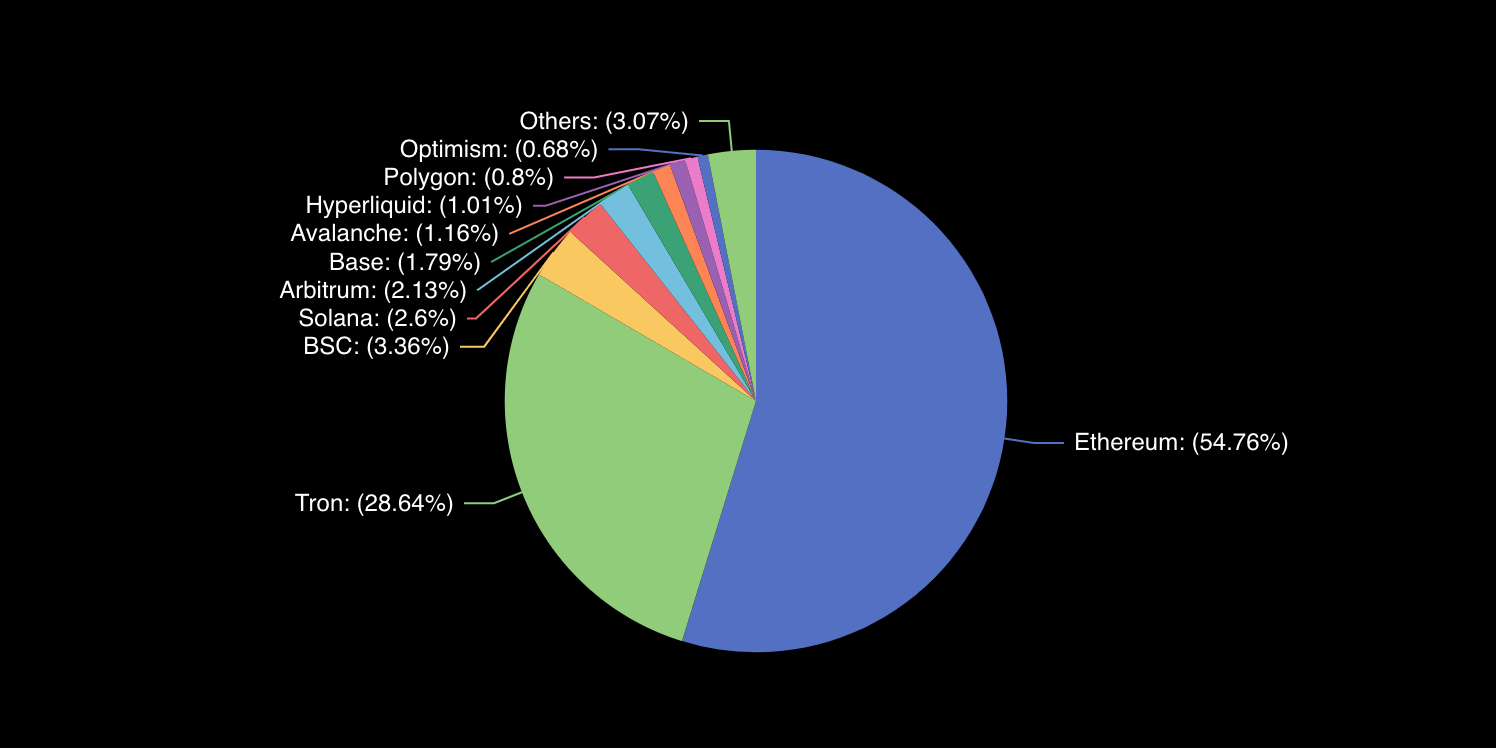

Tether (USDT), the largest player in the space, is at the center of this narrative. Its push toward a $500B valuation reflects both growing demand and deeper integration with global finance. For beginners, this signals that stablecoins aren’t just speculative instruments anymore – they’re increasingly being used as digital cash across borders and industries.

But rapid growth brings complexity:

Key Risks and Opportunities in the $500B Stablecoin Market

-

Regulatory Uncertainty: While regulations like the GENIUS Act are advancing, the global regulatory landscape for stablecoins remains fragmented, especially in emerging markets. This creates both risks of sudden rule changes and opportunities for compliant projects.

-

Institutional Adoption: Major financial institutions are increasingly integrating stablecoins, driving market growth and liquidity. This opens up new opportunities for beginners to access stablecoin-backed products on platforms like Coinbase and Binance.

-

Emerging Market Expansion: Stablecoins are gaining traction in developing countries for cross-border payments and remittances. However, Moody’s warns this may threaten local monetary policy and banking stability, presenting both risks and avenues for financial inclusion.

-

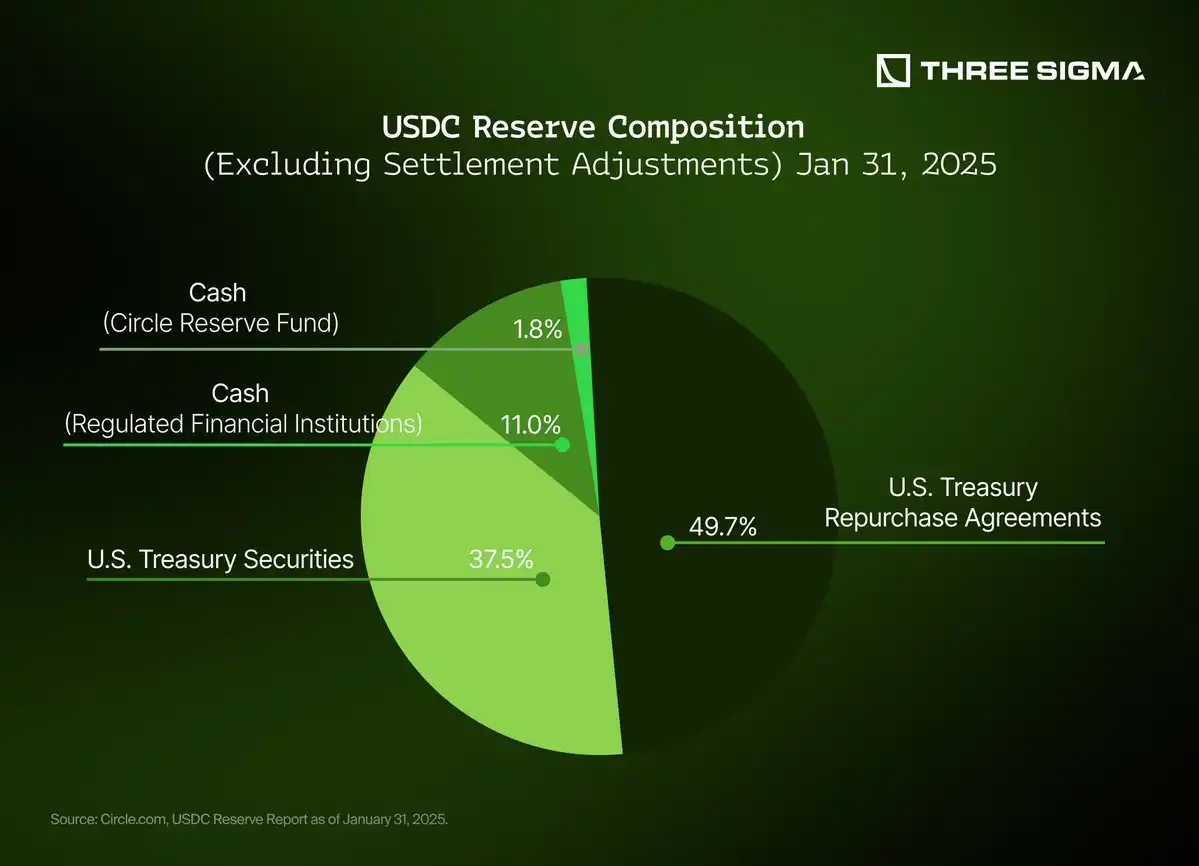

Counterparty and Collateral Risks: Not all stablecoins are backed by transparent or high-quality reserves. Beginners should research leading stablecoins like Tether (USDT) and USD Coin (USDC) to understand their collateral frameworks and associated risks.

-

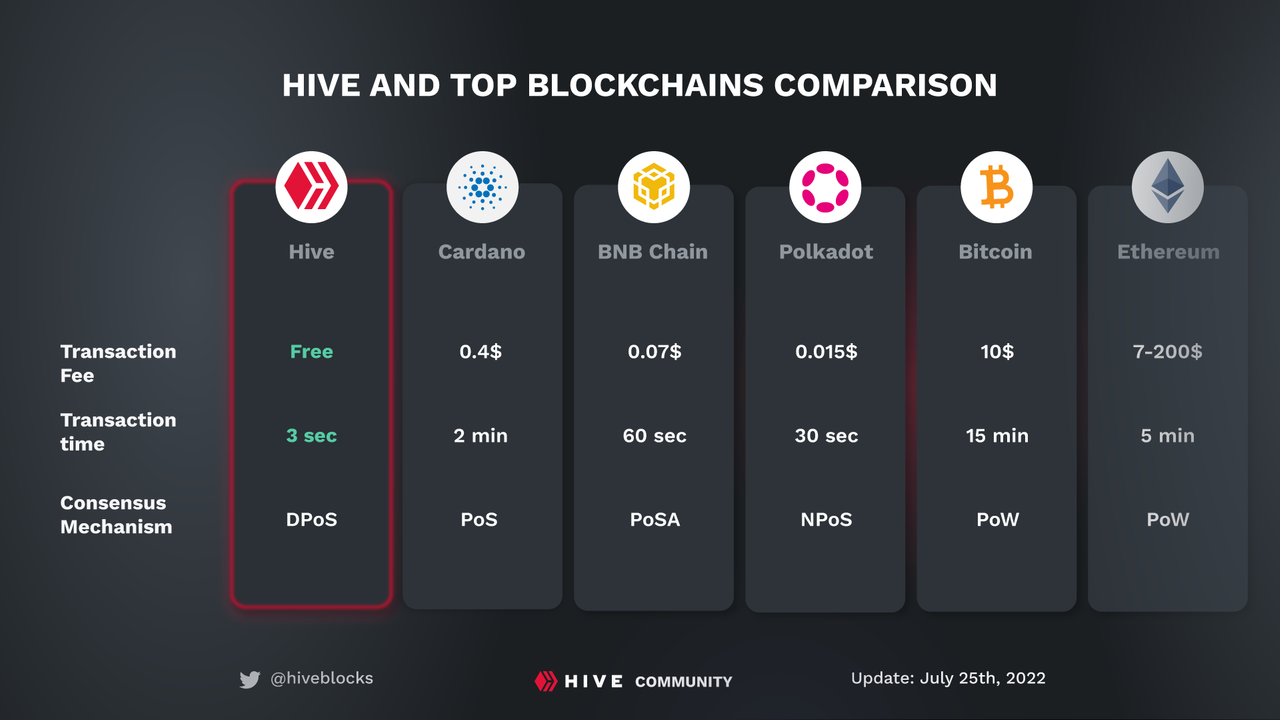

Technological Vulnerabilities: Smart contract bugs or platform hacks can impact stablecoin reliability. Opt for established platforms with strong security records, such as Ethereum and Circle.

-

Market Liquidity and Volatility: Although stablecoins aim for price stability, market events can cause short-term depegging. Monitoring liquidity on major exchanges like Binance and Coinbase is crucial for safe trading.

If you’re considering using or investing in stablecoins like Tether or USDC, it’s crucial to understand how these assets work under the hood. Most major stablecoins claim to be backed by reserves like cash or short-term government bonds. However, transparency around those reserves can vary – and that’s where counterparty risk comes into play.

Moody’s Stablecoin Risk Warnings: The Dark Side of “Cryptoization”

The surge has caught the attention of global regulators and credit agencies. Moody’s has repeatedly warned that unchecked stablecoin adoption could threaten monetary policy and financial stability in emerging markets (Coindesk.com). The phenomenon known as “cryptoization” occurs when citizens bypass local banks entirely by holding their savings in dollar-linked digital coins instead of local currency.

This has several consequences:

- Banks may see deposit outflows as users flock to stablecoins.

- Central banks could lose control over monetary policy tools if large parts of their economies operate outside traditional channels.

- Poorly regulated issuers could pose systemic risks if reserves are mismanaged or redemption requests spike during crises.

Despite these warnings, the appetite for stablecoins in regions with volatile currencies continues to grow. For many, stablecoins represent a practical escape from inflation and capital controls, even if that means navigating new types of risk. As Moody’s points out, the fragmented nature of global regulation leaves gaps that both users and issuers must carefully consider.

Navigating the New Stablecoin Landscape: Practical Tips for Crypto Onboarding

If you’re new to crypto, approaching stablecoins with a blend of curiosity and caution is wise. Here are some steps to help you get started safely in the growing stablecoin market 2026:

Smart Tips for Beginners Using Stablecoins Safely

-

Choose Reputable Stablecoins: Stick with well-established stablecoins like USDT (Tether), USDC (USD Coin), and DAI, which have high liquidity and are widely supported on major exchanges. Always check for recent audits and regulatory updates.

-

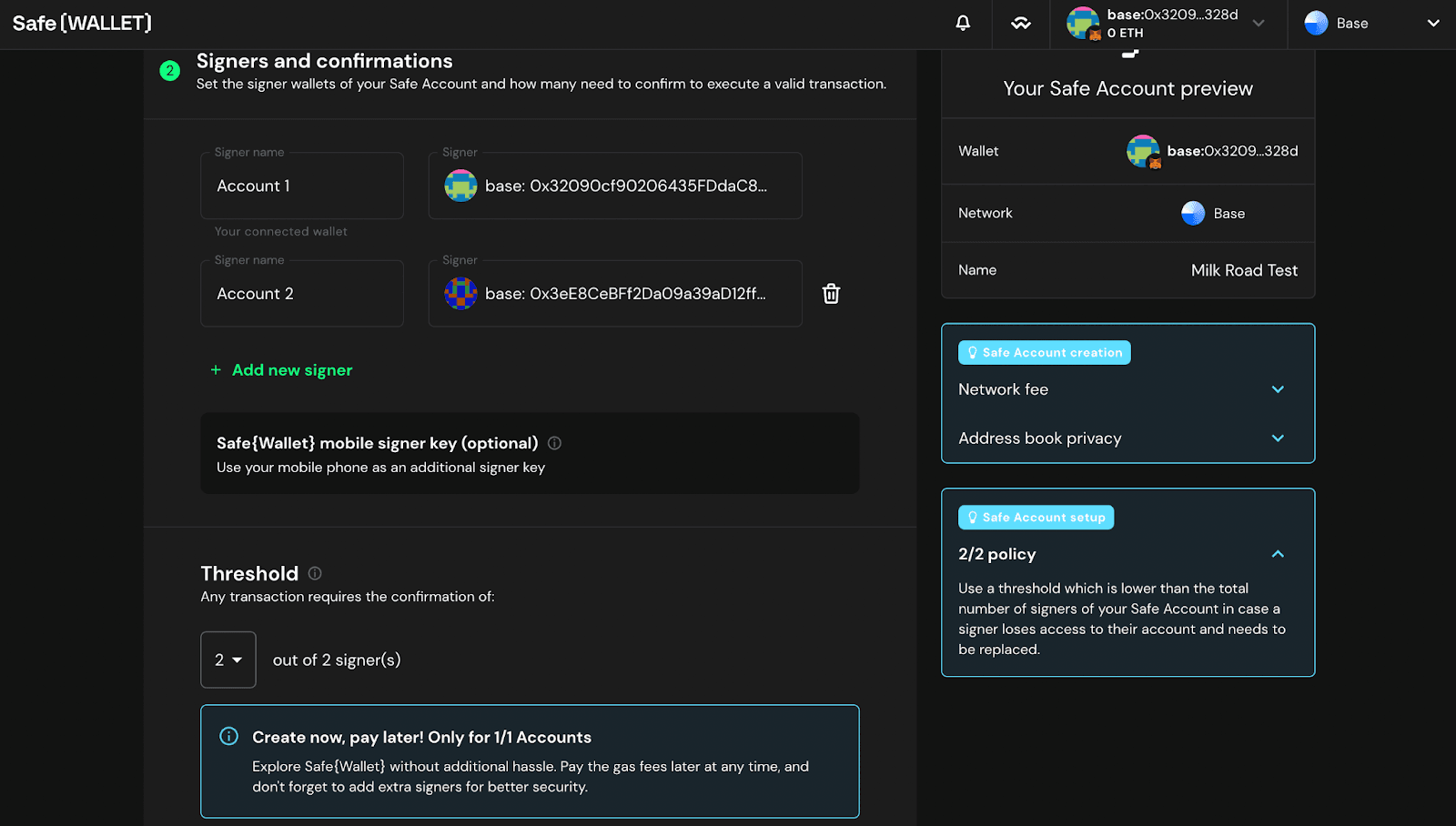

Use Trusted Wallets: Store your stablecoins in secure, reputable wallets such as Ledger (hardware), MetaMask (software), or Coinbase Wallet. Enable two-factor authentication and back up your recovery phrases offline.

-

Verify Platform Security: When using exchanges like Coinbase, Binance, or Kraken, ensure they have robust security measures, insurance policies, and a transparent history of handling user funds.

-

Understand Regulatory Risks: Stay updated on local regulations and global developments, such as the GENIUS Act in the US, as rules for stablecoins are evolving and can impact your access or use.

-

Beware of Counterparty and Collateral Risks: Research how your chosen stablecoin is backed (fiat, crypto, or algorithmic) and who manages the reserves. Platforms like Circle (for USDC) and Tether (for USDT) publish regular reserve reports.

-

Practice Safe Transfers: Always double-check wallet addresses, use small test transactions, and avoid sharing private keys. Consider using services like Fireblocks or Gnosis Safe for added transaction security if handling larger amounts.

-

Monitor Market and Liquidity Conditions: Use tools like CoinGecko or CoinMarketCap to track stablecoin supply, trading volume, and price stability—especially during periods of market stress.

Transparency is your best friend. Before buying or using any stablecoin, check whether the issuer publishes regular audits or attestation reports. Platforms like Coinbase and Circle have made strides in this area, but not all projects are equally forthcoming. Regulatory clarity is also evolving; keep an eye on updates tied to initiatives like the GENIUS Act (Coinbase.com).

For those interested in real-world use cases, look beyond trading. Stablecoins are increasingly embedded in payment apps, e-commerce platforms, and even DeFi protocols offering savings accounts with yields based on underlying reserves.

Looking Ahead: Stablecoins as a Bridge to Mainstream Finance?

The next few years will likely see even more integration between traditional finance and digital assets. While forecasts vary, JPMorgan sees $500B by 2028 (Coindesk.com), while Standard Chartered projects up to $2 trillion by 2026, the trendline is clear: stablecoins are here to stay.

For beginners, this means more options but also new responsibilities. Whether you’re sending remittances home or parking cash between investments, always weigh transparency, regulation status, and platform security before diving in.

The bottom line? The race toward a $500B stablecoin market cap brings both promise and peril. With careful research and a balanced approach, valuing both opportunity and risk, crypto newcomers can harness these digital dollars without falling into common pitfalls.