Crypto security in 2025 demands a sharper, more methodical approach than ever before. With global crypto scam losses projected to surpass $12 billion this year, Arizona stands at the forefront of regulatory action, enacting new laws to counteract the surge in sophisticated fraud. The proliferation of AI-driven scams and deepfake impersonations targeting wallet holders, combined with the expansion of crypto ATMs into everyday locations, has created a complex threat landscape for both new and experienced users.

Crypto Scams Surge in Arizona: The 2025 Reality

Arizona has become a national case study for both crypto adoption and vulnerability. According to the Arizona Corporation Commission’s Securities Division, crypto ATMs (also called kiosks) have played an outsized role in recent scam activity. In 2024 alone, Arizonans lost $177 million to crypto-related fraud, much of it funneled through these machines. The state’s response? A robust set of new regulations designed to protect consumers and clamp down on illicit operators.

The latest law requires all cryptocurrency kiosks to obtain a license and mandates that operators refund victims who report fraud within 30 days. The Attorney General’s Office has also partnered with the Better Business Bureau (BBB) on public education campaigns, warning about evolving scam tactics and emphasizing due diligence when using ATMs or online platforms (source).

Five Critical Steps for Crypto Wallet Safety in 2025

Staying secure isn’t just about avoiding obvious pitfalls; it’s about proactively adapting your security posture as threats evolve. Below is a data-driven list of expert-recommended steps tailored for Arizona’s regulatory landscape and the most prevalent scam vectors seen this year:

Five Steps to Secure Your Crypto Wallet in 2025

-

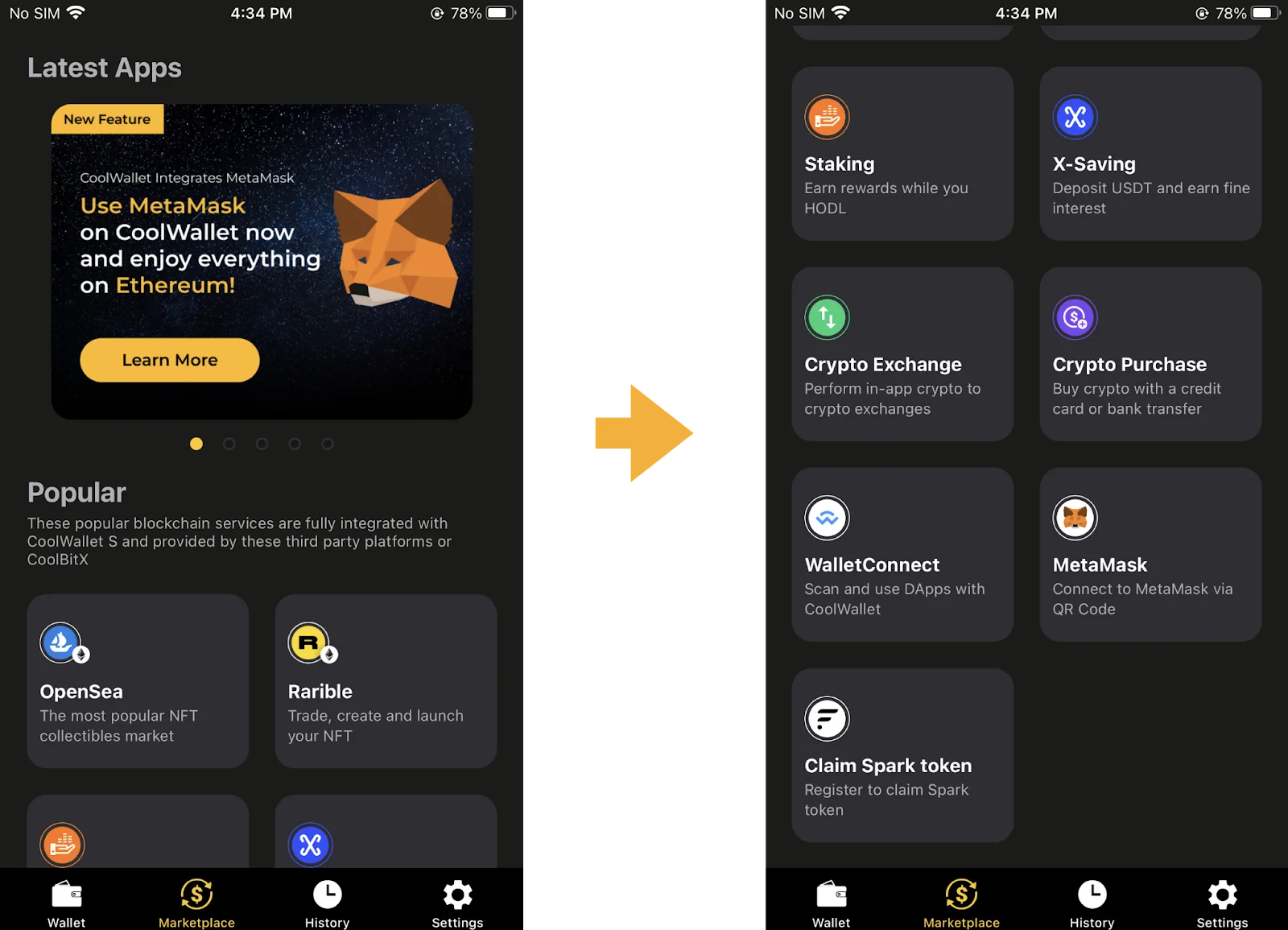

Use Non-Custodial Wallets with Multi-Factor AuthenticationOpt for reputable non-custodial wallets like MetaMask, Trust Wallet, or Ledger Live that support multi-factor authentication (MFA). MFA adds an extra layer of security, making unauthorized access significantly harder, even if your password is compromised.

-

Verify Crypto ATM Licenses and Compliance Before UseBefore using any crypto ATM in Arizona, confirm that the kiosk is licensed under the new Arizona Cryptocurrency Kiosk License Fraud Prevention law. Look for posted compliance certificates or check the operator’s status via the Arizona Corporation Commission website to avoid unregulated machines linked to scams.

-

Stay Updated on Arizona’s New Crypto Regulations and Scam AlertsRegularly monitor official sources like the Arizona Attorney General’s Office and Arizona Corporation Commission for the latest regulatory updates and scam alerts. These agencies frequently issue warnings about new fraud tactics and changes to crypto laws that can impact your security.

-

Implement Hardware Wallets for Large HoldingsFor substantial crypto assets, use established hardware wallets such as Ledger Nano X or Trezor Model T. These devices keep your private keys offline, protecting your funds from online hacks and malware, which are increasingly prevalent in 2025.

-

Educate Yourself on Common Scam Tactics Targeting Crypto UsersStay informed about trending scams like pig butchering schemes and AI-generated deepfakes by following resources such as BBB scam alerts and the FTC. Knowledge of these tactics helps you recognize and avoid fraud before it happens.

Why Non-Custodial Wallets with Multi-Factor Authentication Are Essential

The first line of defense against both AI-powered phishing attacks and physical theft is your choice of wallet. Non-custodial wallets put you in direct control of your private keys – but this power comes with responsibility. Enabling multi-factor authentication (MFA) adds an indispensable layer of protection against unauthorized access. In 2025, deepfake-enabled social engineering schemes have become so convincing that single-factor security is simply inadequate.

MFA requires at least two forms of verification before granting access to your funds – typically something you know (like a password) plus something you have (such as an authenticator app or biometric ID). This dramatically reduces the risk posed by compromised credentials or SIM-swap attacks.

The New Rules: Verifying Crypto ATM Licenses Before Every Use

If you’re considering buying or selling cryptocurrency at an Arizona ATM or kiosk, always verify that it is properly licensed under state law. The new regulatory framework requires operators to display license information prominently; failure to do so is a red flag. Legitimate machines should also provide clear instructions on reporting suspected fraud.

This step isn’t just bureaucratic box-ticking – unlicensed ATMs are frequently linked to scams where users are tricked into sending funds directly to fraudsters’ wallets under the guise of urgent payments or fake investments. If you encounter suspicious activity at any kiosk location (gas stations, convenience stores, smoke shops), report it immediately via official channels such as the Arizona Attorney General’s Office (source).

As the regulatory landscape tightens, awareness and vigilance are your strongest allies. Arizona’s new crypto ATM laws mean that consumers now have recourse if they fall victim to fraud, operators must refund reported losses within 30 days. This is a significant shift, but it only works if users know their rights and act quickly. Regularly check updates from state agencies and the Better Business Bureau for fresh scam alerts and compliance changes. Staying informed is not optional in 2025; it’s a core part of onboarding crypto securely.

Hardware Wallets: The Gold Standard for Large Holdings

For those managing substantial crypto balances, hardware wallets remain the most secure option. These devices store private keys offline, making them immune to online hacks and AI-driven malware attacks that have exploded in sophistication this year. If you’re holding more than a small trading balance, transferring assets to a hardware wallet dramatically reduces your exposure to both phishing schemes and breaches on centralized platforms.

It’s important to purchase hardware wallets directly from trusted manufacturers or authorized resellers, counterfeit devices have been used in targeted attacks against high-net-worth individuals. Always initialize your device yourself and never share your recovery seed phrase with anyone.

Education: Your Best Defense Against Evolving Scams

Even with robust technology and new regulations, human error remains the most common entry point for scammers. In 2025, AI-generated deepfakes can convincingly impersonate influencers or even customer service agents, luring users into disclosing private keys or downloading malicious software under the guise of “urgent security upgrades. ”

Stay abreast of common scam tactics, such as pig butchering schemes that build trust over weeks before soliciting fake investments, and use available tools like NordVPN’s wallet address checker to verify any destination before sending funds (source). Participate in educational campaigns run by state authorities or reputable exchanges to continually update your knowledge base.

The bottom line: Crypto security in 2025 is an active process, a blend of personal responsibility, regulatory awareness, and technical best practices. By following these five steps:

- Use non-custodial wallets with multi-factor authentication

- Verify crypto ATM licenses and compliance before every use

- Stay updated on Arizona’s regulations and scam alerts

- Implement hardware wallets for significant holdings

- Continuously educate yourself about emerging scam tactics

You dramatically reduce your risk, even as scam threats grow more sophisticated each month.