Bitcoin’s historic surge past $125,000 in October 2025 has sent ripples through both institutional and retail investor communities. For those new to crypto, this milestone is more than a headline – it’s a signal of shifting market fundamentals, evolving investor sentiment, and rapidly growing mainstream adoption. As of October 7,2025, Bitcoin is trading at $124,356.00, just below its all-time high of $126,157.00 set within the last 24 hours.

Bitcoin Sustains Record Highs: What’s Driving the Rally?

This latest move above $125,000 is not an isolated event but the result of powerful converging forces. The most prominent catalyst has been the explosion in Bitcoin ETF inflows, which have surpassed $3.24 billion in net new investment over the past week alone (source: Yahoo Finance). These inflows reflect a significant vote of confidence from both institutional asset managers and retail investors seeking regulated exposure to Bitcoin.

Additionally, favorable U. S. government policies under President Donald Trump and a weakening U. S. dollar have amplified demand for alternative stores of value. The correlation between Bitcoin’s price action and recent gains in U. S. equities further underscores its growing integration into broader financial markets.

Navigating FOMO: A Beginner’s Guide to Entering at All-Time Highs

The temptation to buy at record highs is real – especially as headlines tout predictions of Bitcoin targeting $150,000. However, for new investors, it’s crucial to approach this moment with a clear strategy grounded in risk management and informed decision-making.

- Volatility remains high: While institutional flows provide some stability, sharp pullbacks are still common after rapid price appreciation.

- Diversification is key: Avoid putting all your capital into a single asset class or cryptocurrency.

- Stay updated on regulations: Policy shifts can dramatically impact market sentiment and access.

- Avoid emotional trading: FOMO (fear of missing out) can lead to poor entry points and impulsive decisions.

If you are onboarding into crypto now, consider starting with small positions or dollar-cost averaging rather than going all-in at once. For more on how ETF inflows are shaping this cycle’s dynamics, see additional analysis at economies. com.

The Role of Institutional Adoption in Crypto’s New Era

The current rally is distinct from previous cycles due to the sheer scale of institutional involvement. ETFs have not only brought new capital but also enhanced transparency and credibility for the asset class. Treasury companies continue accumulating thousands of coins as part of their balance sheet strategies – further reinforcing Bitcoin’s status as a digital reserve asset.

This influx has also attracted sophisticated traders who employ advanced portfolio management techniques rather than speculative hype-driven buying seen in earlier bull markets. As such, the foundation supporting prices above $125,000 appears more robust than ever before.

Bitcoin Price Prediction 2026-2031

Professional Forecasts Based on Current Record Highs and 2025 Market Context

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $90,000 | $135,000 | $175,000 | +8.6% | ETF inflows continue, moderate volatility, regulatory clarity grows |

| 2027 | $100,000 | $150,000 | $200,000 | +11.1% | Mainstream adoption accelerates, global regulation mixed |

| 2028 | $120,000 | $170,000 | $250,000 | +13.3% | Halving cycle impact, increased institutional allocation |

| 2029 | $110,000 | $160,000 | $240,000 | -5.9% | Post-halving correction, market consolidation |

| 2030 | $130,000 | $190,000 | $300,000 | +18.8% | New tech use cases, possible ETF expansion, renewed bull cycle |

| 2031 | $150,000 | $220,000 | $350,000 | +15.8% | Global digital asset integration, Bitcoin as reserve asset |

Price Prediction Summary

Bitcoin’s 2025 breakout above $125,000 sets a new baseline for future growth. Analysts project continued gains, with average prices potentially reaching $220,000 by 2031. The forecast incorporates both bullish and bearish scenarios, reflecting the crypto market’s volatility but also its maturing fundamentals. Periodic corrections are expected, especially after major rallies or halving events, but the long-term trend remains upward as adoption and institutional investment expand.

Key Factors Affecting Bitcoin Price

- Sustained ETF and institutional inflows

- Regulatory clarity and global policy developments

- Bitcoin halving cycles and supply dynamics

- US dollar strength and macroeconomic trends

- Adoption by corporations and nation-states

- Technological improvements (e.g., Lightning Network, scalability)

- Competition from other cryptocurrencies and digital assets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

For those just beginning their crypto journey, this environment offers both unprecedented opportunity and significant risk. The normalization of Bitcoin in institutional portfolios means price discovery is increasingly influenced by macroeconomic factors, regulatory clarity, and global liquidity cycles. Investors must recognize that while the current momentum is strong, sharp corrections are an inherent part of the crypto landscape.

Crypto Onboarding: Practical Tips for New Investors

Stepping into a market at all-time highs can feel daunting. However, by following a disciplined approach, you can mitigate risks commonly faced by newcomers:

Essential Checklist for New Crypto Investors in 2025

-

Research Bitcoin’s Recent Performance: Understand that Bitcoin recently hit an all-time high of $126,157 (24h high as of October 7, 2025) and is currently trading at $124,356. Analyze the factors driving this surge, such as ETF inflows and institutional adoption.

-

Choose a Trusted Exchange: Open an account with a reputable platform like Coinbase, Kraken, or Binance for secure trading and custody solutions.

-

Set Up Secure Storage: Consider using a hardware wallet such as Ledger Nano X or Trezor Model T to safeguard your crypto assets offline.

-

Understand Volatility and Risk: Recognize that Bitcoin and other cryptocurrencies are highly volatile, with daily price swings (e.g., 24h low of $123,373 and high of $126,157 on October 7, 2025). Invest only what you can afford to lose.

-

Diversify Your Portfolio: Don’t put all your funds into Bitcoin. Explore established cryptocurrencies like Ethereum (ETH) and Solana (SOL) to spread risk.

-

Stay Informed on Regulations: Follow updates from sources like CoinDesk, Cointelegraph, and U.S. Securities and Exchange Commission (SEC) to keep up with evolving crypto regulations.

-

Monitor ETF Developments: Track Bitcoin ETF products such as iShares Bitcoin Trust (IBIT) and Grayscale Bitcoin Trust (GBTC), as ETF inflows are a major driver of current price action.

-

Enable Two-Factor Authentication (2FA): Protect your exchange and wallet accounts by activating 2FA through apps like Google Authenticator or Authy.

-

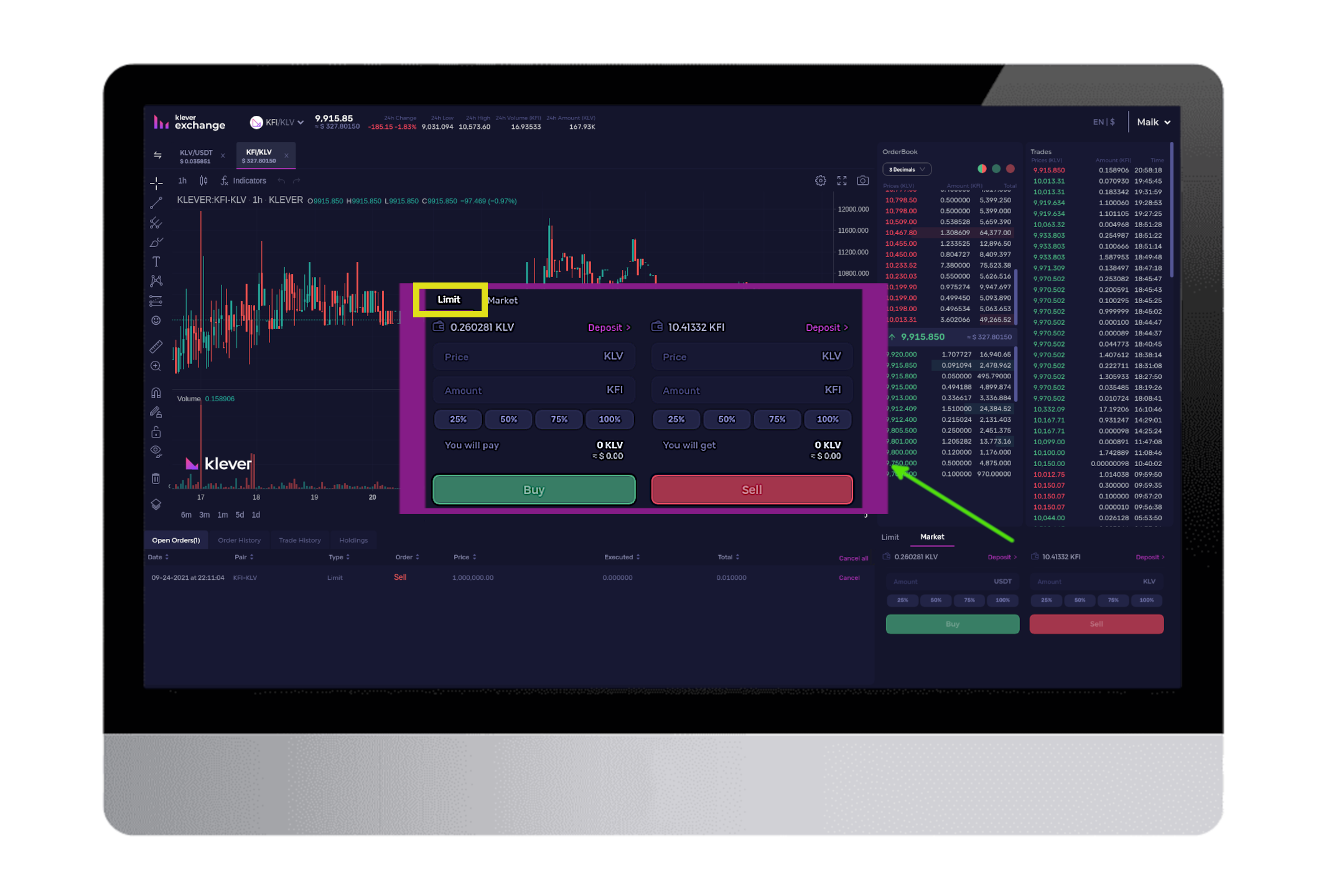

Have an Exit Strategy: Decide in advance your profit-taking or stop-loss points, and consider using features like limit orders available on major exchanges.

-

Beware of Scams and Phishing: Only use official websites and apps. Double-check URLs and never share your private keys or seed phrases.

First, educate yourself on the mechanics of blockchain and how exchanges operate. Use reputable platforms with strong security protocols and transparent fee structures. Second, set clear investment goals, are you seeking long-term appreciation or shorter-term speculation? Your time horizon should dictate your asset allocation and risk tolerance.

Third, understand custody options. While many opt for exchange wallets initially, consider hardware wallets or other secure storage methods as your holdings grow. Finally, stay informed about tax implications in your jurisdiction, crypto gains are often taxable events.

FOMO vs. Fundamentals: Staying Grounded Amid Hype

The psychological pressure to act quickly as prices surge is real. Yet history shows that parabolic moves often retrace before finding new support levels. Avoid chasing green candles; instead, focus on building a position gradually through dollar-cost averaging or limit orders set below current market prices.

Remember: No asset moves up in a straight line, even Bitcoin at $124,356.00 will experience volatility on its path forward.

Looking Ahead: What Could Come Next?

Analysts point to several variables that could shape Bitcoin’s price action through the end of 2025:

- Further institutional adoption: More pension funds and sovereign wealth funds may allocate to Bitcoin as regulatory frameworks mature.

- ETF inflows sustainability: Watch for continued momentum or potential slowdowns in net new capital entering ETFs.

- Macroeconomic shifts: Inflation trends, monetary policy changes, and geopolitical events can all impact crypto markets.

If Bitcoin holds above key psychological levels such as $125,000, and especially if it pushes toward $150,000, it could spark another wave of mainstream attention and onboarding activity. But this will also attract increased regulatory scrutiny and competition from alternative digital assets.

youtube_video: A video breakdown of how ETFs are changing the dynamics of the 2025 Bitcoin bull run]

The Bottom Line for New Crypto Investors

The breakout to $124,356.00, just shy of its all-time high this week, marks a pivotal moment for crypto adoption worldwide. For beginners entering at these levels, patience and education are your best allies. Stick to proven risk management strategies, diversify across assets where possible and never invest more than you’re prepared to lose.

This cycle’s rally is powered by forces far more sophisticated than retail hype alone; understanding these dynamics will help newcomers navigate volatility with confidence rather than fear.