The landscape for crypto onboarding is undergoing a dramatic transformation in 2025, as sweeping regulatory reforms across the European Union and Asia redefine how beginners access digital assets. For those new to crypto, understanding these changes is not just a matter of compliance but a key to ensuring a secure and efficient entry into the market. Let’s break down how these frameworks are shaping the future of buying crypto in regulated markets, with a focus on user experience and security.

EU Crypto Regulation 2025: MiCA Ushers in a New Era

The European Union’s Markets in Crypto-Assets (MiCA) regulation, fully enforced as of 2025, marks the most comprehensive overhaul of crypto oversight in Europe’s history. The days of fragmented national rules are over; all crypto-asset service providers (CASPs) must now obtain authorization from their respective national authorities. This means that any platform offering services to EU residents must meet rigorous standards for anti-money laundering (AML), counter-terrorist financing (CTF), capital adequacy, and operational resilience.

For beginners, this regulatory clarity brings both advantages and challenges. On one hand, onboarding processes now require more thorough identity verification – think passport scans, proof of address documents, and real-time selfie checks. While this may extend the time it takes to open an account, it also drastically reduces fraud risk and increases transparency for all users.

Essential MiCA Onboarding Requirements for EU Crypto Platforms

-

Mandatory Licensing for All Crypto-Asset Service Providers (CASPs): Under MiCA, every crypto platform must obtain authorization from a national competent authority before offering services within the EU. This ensures only vetted and compliant firms can onboard users.

-

Comprehensive Identity Verification (KYC): Platforms are required to conduct thorough Know Your Customer (KYC) checks, including passport scans, proof of address, and verification against sanction lists. This step is crucial for preventing fraud and ensuring regulatory compliance.

-

Strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Compliance: Onboarding processes must include robust AML and CTF checks, with platforms monitoring transactions and reporting suspicious activity to authorities.

-

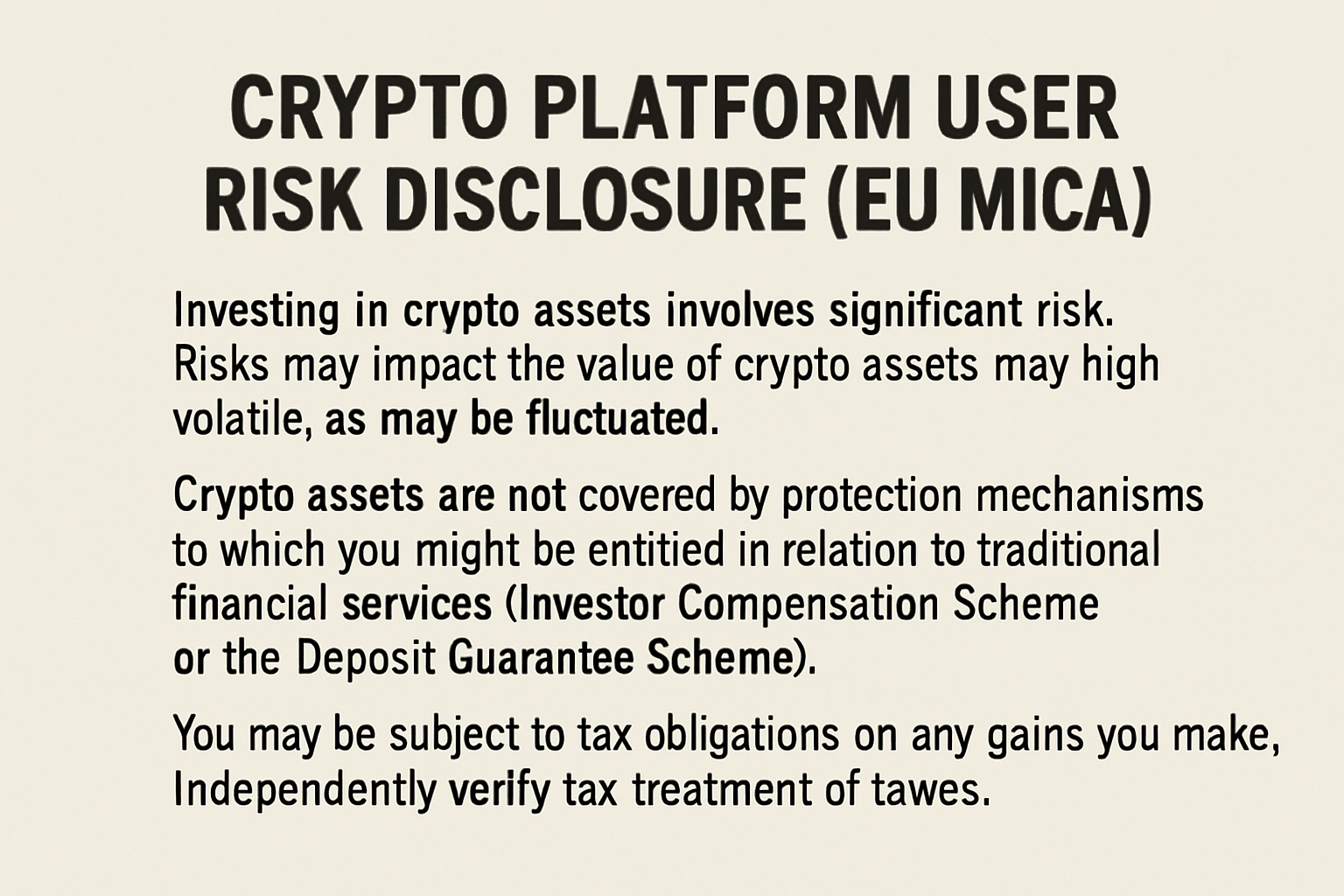

Clear and Transparent User Disclosures: Platforms must provide new users with comprehensive information about risks, fees, and the legal status of crypto-assets. This transparency is designed to protect beginners from hidden costs and misunderstandings.

-

Enhanced Data Protection and Security Standards: MiCA enforces strict requirements for safeguarding user data and digital assets, including secure storage solutions and incident response protocols during onboarding.

-

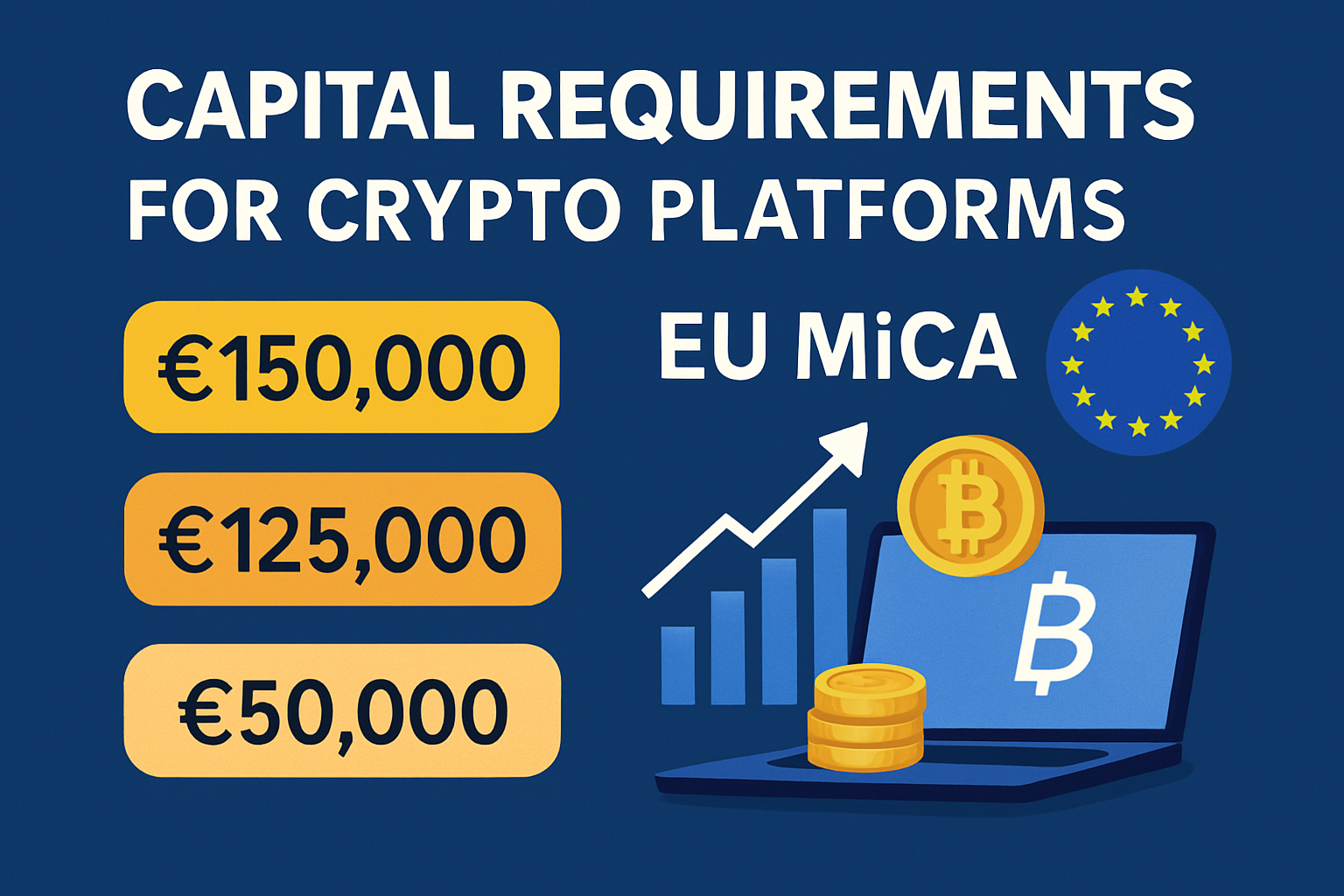

Minimum Capital and Operational Requirements: Platforms must meet specific capital thresholds and demonstrate adequate internal controls before onboarding users, ensuring financial stability and operational resilience.

The upside? Users can expect fewer “fly-by-night” exchanges and more robust consumer protections. The downside is that first-time buyers will need patience as platforms adapt to stricter compliance protocols. However, these measures aim to build trust and attract more institutional players into the ecosystem – ultimately benefiting everyone involved.

Asia’s Regulatory Shift: Vietnam, Hong Kong and South Korea Lead

Across Asia, regulatory momentum is equally intense but highly localized. Vietnam, for example, has introduced its first licensing regime under Resolution No. 05/2025/NQ-CP, limiting participation to just five pilot exchanges with extremely high entry barriers. According to Vietnam Briefing, only large banks or securities firms are likely to qualify – meaning retail investors will have fewer choices but greater assurance of legal compliance.

This move coincides with Vietnam’s new Law on Digital Technology Industry (effective January 2026), which provides legal recognition for “crypto assets” and “virtual assets. ” The law also mandates AML/CTF compliance and establishes a regulatory sandbox for controlled testing – an innovative approach designed to foster adoption while minimizing systemic risk.

Hong Kong, meanwhile, has enacted its Stablecoin Ordinance effective August 1,2025. Stablecoin issuers must maintain fully backed reserves and guarantee redemption rights – every transaction requires full KYC procedures even for unhosted wallets. While this boosts institutional confidence in stablecoins as payment rails or trading pairs, it also chips away at the frictionless user experience that drew many early adopters.

South Korea is taking a cautious route with its proposed Digital Asset Basic Act. Policymakers are weighing the benefits of local-won stablecoins against potential risks to capital controls and monetary policy stability – no small feat given that US dollar-pegged stablecoin transaction volumes on Korean exchanges hit an estimated $41 billion in Q1 2025 alone.

What Do These Changes Mean for Beginners?

If you’re new to digital assets in 2025, expect onboarding journeys to look very different depending on your jurisdiction:

- More paperwork: Prepare for multiple layers of identity verification wherever you sign up.

- Narrower exchange options: In some Asian markets like Vietnam or Hong Kong, only a handful of licensed platforms will be available initially.

- Tighter compliance checks: AML/CTF screening is now standard everywhere – not just at signup but often at every major transaction threshold.

- Bigger emphasis on education: Many regulated platforms now offer beginner crypto guides or tutorials as part of their onboarding flow.

What is your biggest concern about stricter crypto onboarding requirements in 2025?

With the EU, Vietnam, and other Asian countries introducing tougher rules for crypto onboarding—including more detailed identity checks and longer verification times—what worries you most as a beginner or returning user?

The net effect? While jumping through regulatory hoops may test your patience at first, these safeguards are designed to protect your funds from scams or mismanagement – making long-term participation safer than ever before.

For those taking their first steps, the practical reality is a more deliberate and transparent onboarding process. Platforms now routinely require detailed KYC (Know Your Customer) checks, passport scans, liveness video verification, and even proof of income in some cases. This can initially feel burdensome, but it’s a direct response to regulatory mandates aimed at minimizing illicit activity and protecting new investors from fraud.

How to Navigate Onboarding in Regulated Crypto Markets

Beginners should approach onboarding with preparation and patience. Start by gathering all necessary documents before registering on any platform, this includes government-issued ID, proof of address, and sometimes bank statements. Be ready for platforms to request additional information or clarification as part of their compliance checks.

It’s also vital to select exchanges that are officially licensed in your jurisdiction. In the EU, check for MiCA-compliant providers; in Vietnam, only use one of the five pilot exchanges authorized under Resolution No. 05/2025/NQ-CP. For Hong Kong and South Korea, consult local financial authorities’ lists of approved platforms. This reduces your risk and ensures you’re covered by local consumer protection laws.

Crypto Compliance Tips for First-Time Buyers

- Double-check exchange credentials: Look for clear evidence of licensing and regulatory oversight on the platform’s website or app.

- Understand local tax obligations: Many jurisdictions now require you to report crypto holdings or gains, failing to do so can result in fines or legal trouble.

- Use strong security practices: Enable two-factor authentication (2FA), use unique passwords, and consider hardware wallets for storing larger balances.

The heightened focus on compliance is already changing user expectations. According to industry surveys, most beginners say they value extra security, even if it means longer wait times, over the risk of using unregulated platforms prone to hacks or exit scams.

The regulatory tide is rising globally. The winners will be those who adapt early, prioritize transparency, and invest in user education.

The Road Ahead: Opportunities Despite Friction

This new era isn’t without its growing pains. Some users will be frustrated by limited exchange options (especially in Vietnam), while others may balk at repeated identity checks for seemingly small transactions (a reality now in Hong Kong). Yet these measures are not arbitrary, they’re a calculated tradeoff between accessibility and safety as governments seek to legitimize digital assets within mainstream finance.

If you’re just starting out, take advantage of the growing ecosystem of beginner crypto guides offered by compliant exchanges. These resources demystify everything from wallet setup to understanding AML/CTF rules, empowering you with knowledge before making your first purchase.

The bottom line? While stricter onboarding may slow down initial access to digital assets, it also raises the bar for trust and stability across global markets. For those willing to navigate these new requirements thoughtfully, and with a focus on education, the door remains wide open for safe participation in the next evolution of crypto finance.