In 2025, BlackRock has made headlines with a series of bold Ethereum acquisitions, culminating in a $499.2 million purchase on July 16 that brought its total ETH holdings to 2.02 million, valued at approximately $6.94 billion. This aggressive accumulation, set against Ethereum’s current price of $4,337.59, signals more than just a portfolio adjustment by the world’s largest asset manager – it represents a seismic shift in institutional crypto adoption and a potential inflection point for mainstream onboarding.

BlackRock’s Ethereum Bet: A New Benchmark for Institutional Adoption

For years, Bitcoin was the institutional favorite. BlackRock’s pivot toward Ethereum is not just about diversification; it is an endorsement of Ethereum’s evolving technology and its role at the heart of decentralized finance (DeFi). The firm’s moves have been methodical and sizable:

- February 4,2025: Acquired 100,535 ETH (~$276 million)

- April 29,2025: Added 27,537 ETH (~$50 million)

- May 3,2025: Bought 10,955 ETH (~$20.1 million)

- July 16,2025: Purchased $499.2 million worth of ETH

This sustained buying spree has contributed to ETH’s resilience and recent appreciation – with the coin trading at $4,337.59 as of October 9,2025. BlackRock’s confidence appears rooted in Ethereum’s Layer 2 scalability upgrades and its dominance in DeFi protocols. The launch of BlackRock’s iShares Ethereum Trust ETF (ETHA), which saw $266.5 million in inflows on its first day alone (source), further cements this as a watershed moment for both retail and institutional participants.

How BlackRock’s Moves Impact Crypto Onboarding for Individuals

The implications of BlackRock’s strategic shift are profound for newcomers considering their first steps into crypto. When a financial behemoth like BlackRock allocates billions to Ethereum, it signals trust in both the asset and the underlying ecosystem. This institutional stamp of approval has several knock-on effects:

- Market stability: Large-scale holdings by established institutions can help dampen volatility and reduce perceived risk.

- Product accessibility: The growth of spot ETFs and proposed options listings on major exchanges make it easier for everyday investors to gain exposure without navigating complex wallets or exchanges.

- Mainstream validation: BlackRock’s entry encourages other financial players to follow suit, accelerating regulatory clarity and broader acceptance.

But it is not all smooth sailing. As noted by BlackRock executives themselves (source), some constraints remain – such as the inability to offer staking rewards within ETFs, which typically provide annual yields of 3% to 4%. This means retail investors must still weigh the trade-offs between convenience and yield-generating strategies.

Your First Steps: Safe and Strategic Onboarding into Ethereum

If you are considering following BlackRock’s lead into Ethereum or simply want to understand how to enter the crypto market safely, it is crucial to approach onboarding with diligence and clarity. Here are foundational steps to consider:

Essential Ethereum Onboarding Tips for Beginners

-

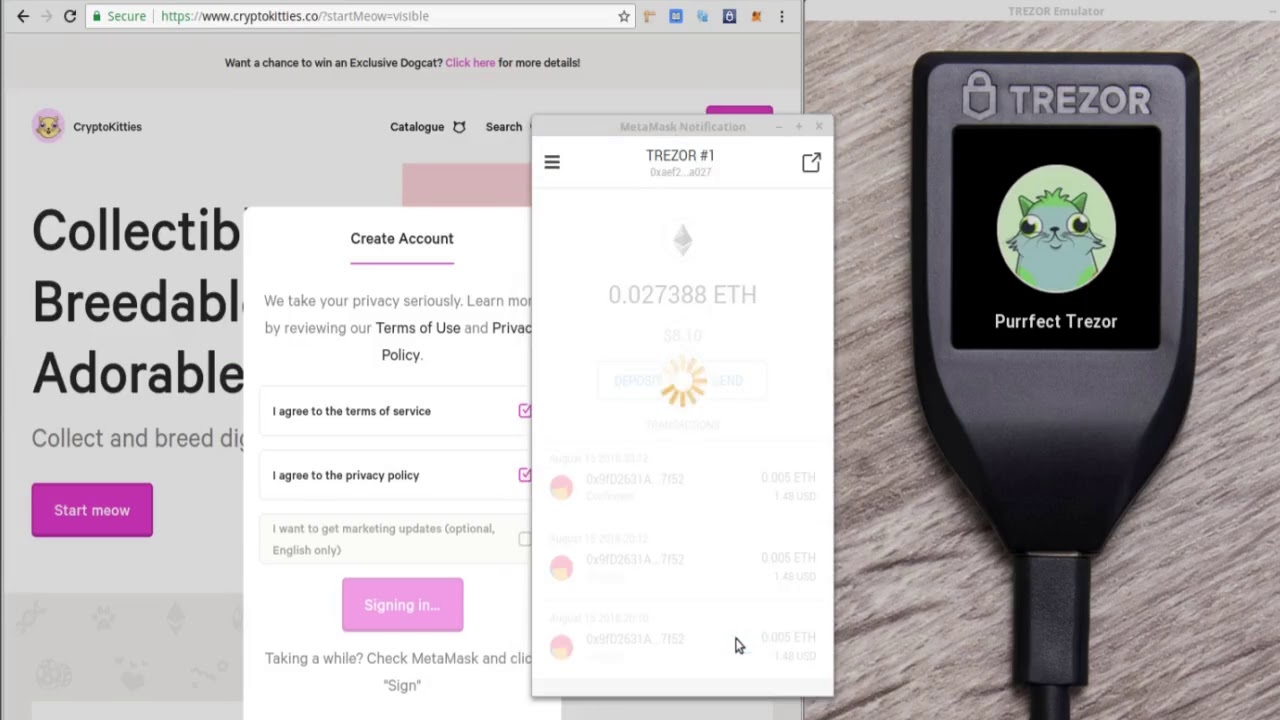

Set Up a Secure Wallet: After purchasing ETH, transfer your funds to a personal wallet. Use trusted options like MetaMask (browser/mobile), Ledger Nano (hardware), or Trezor for enhanced security and control over your assets.

-

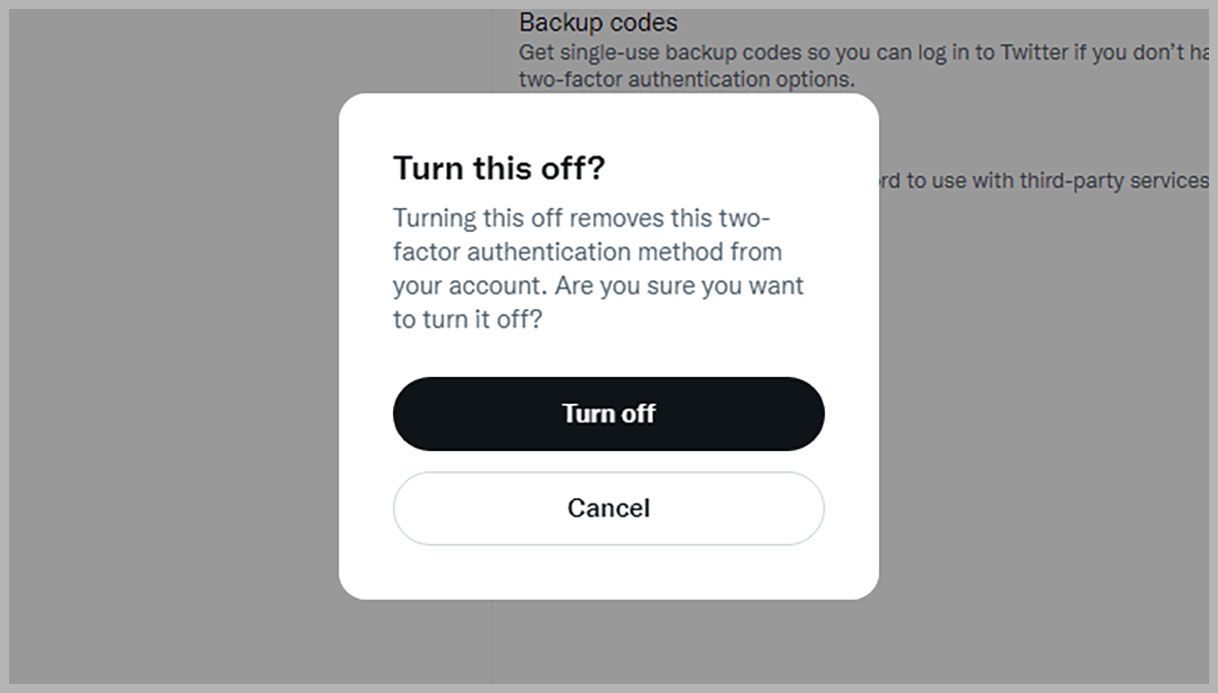

Enable Two-Factor Authentication (2FA): Protect your exchange and wallet accounts by activating 2FA through apps like Authy or Google Authenticator. This extra layer of security helps prevent unauthorized access to your ETH holdings.

-

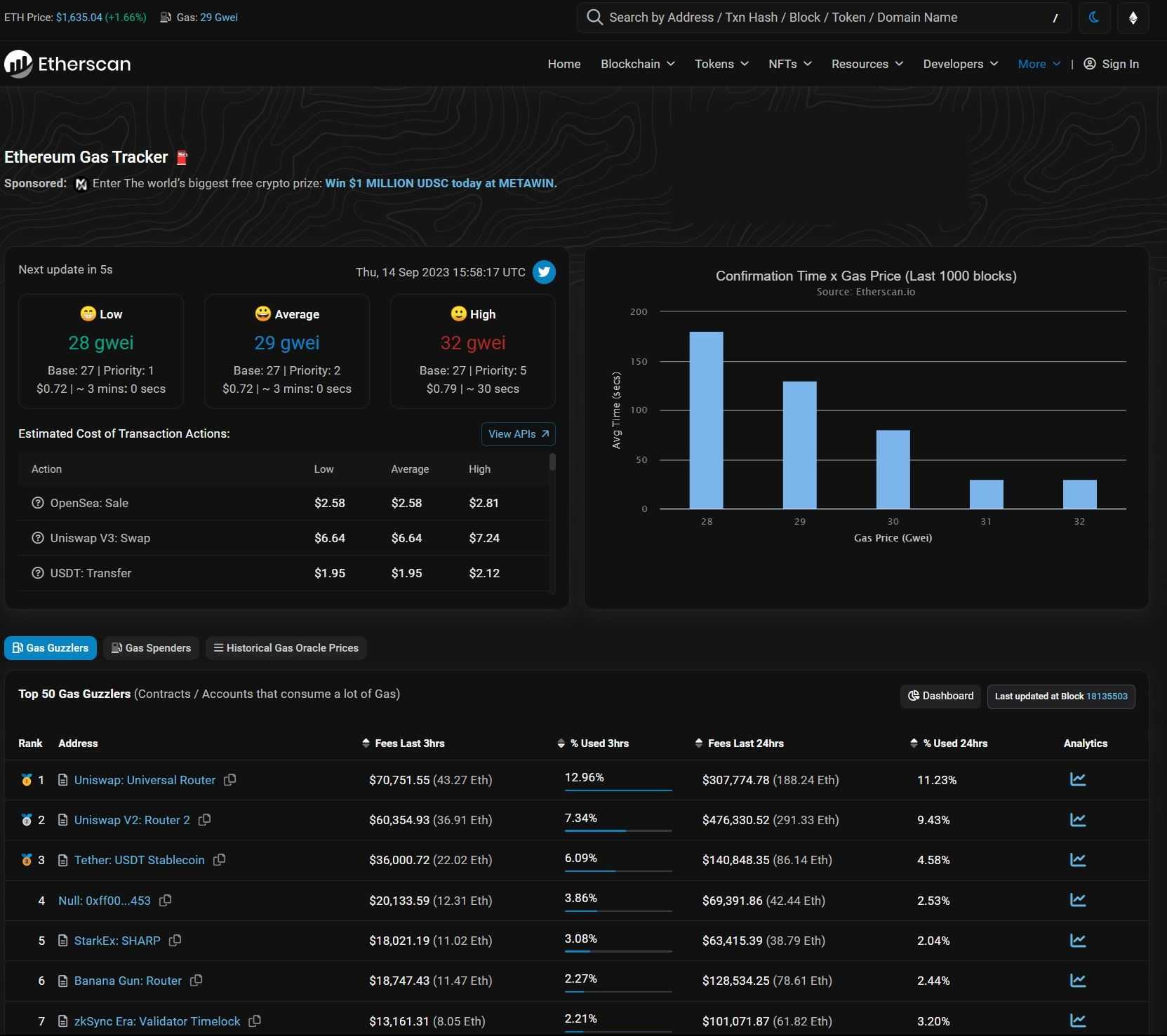

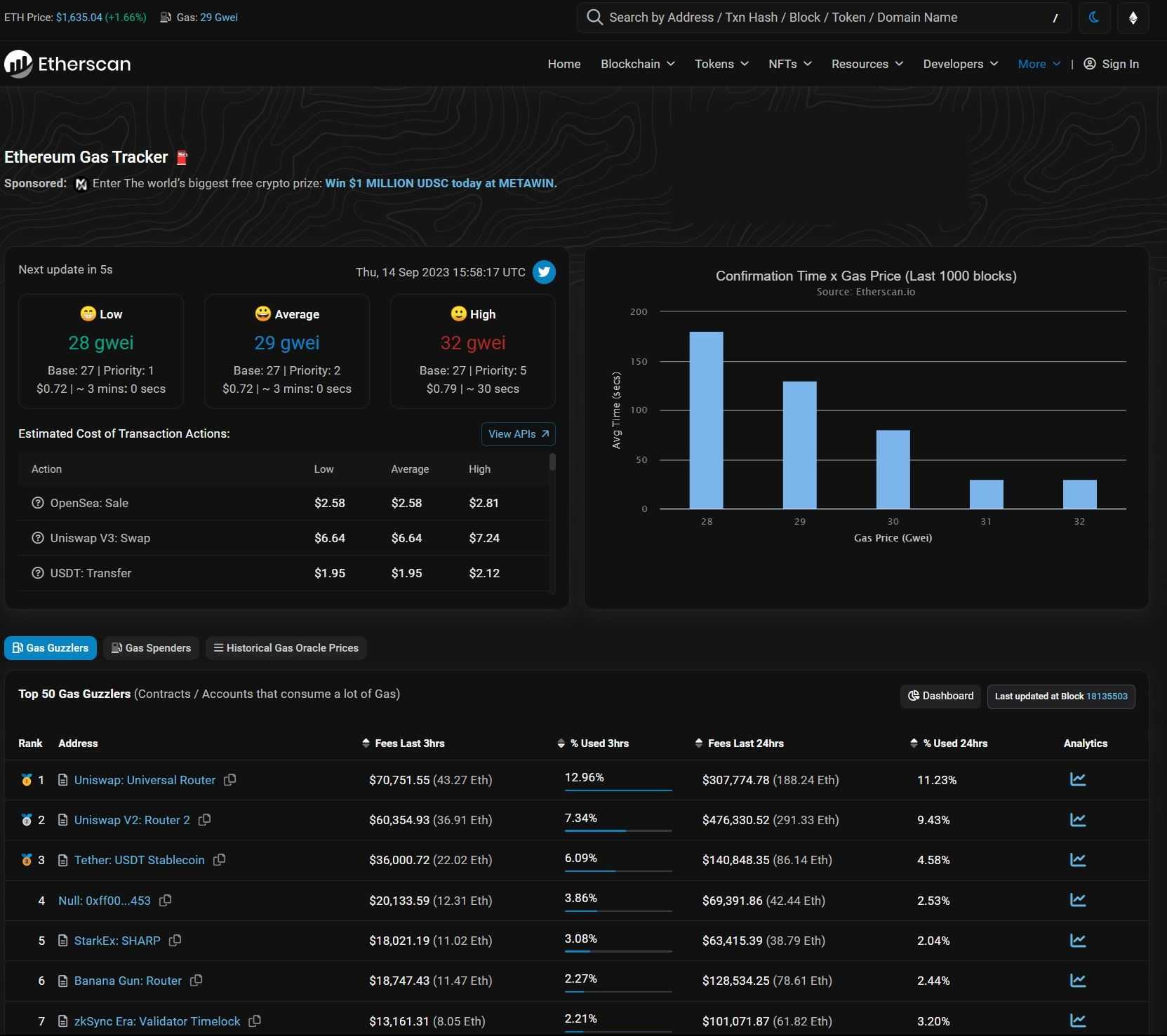

Understand Ethereum Gas Fees: Learn how Ethereum transaction fees (gas) work, especially when ETH prices fluctuate. Use platforms like Etherscan Gas Tracker to monitor real-time fees and optimize your transaction timing.

-

Stay Informed with Reliable News Sources: Follow reputable outlets like CoinDesk, The Block, and Reuters Crypto for the latest on Ethereum, including institutional moves like BlackRock’s acquisitions.

Understanding the institutional landscape can help you set realistic expectations and avoid common pitfalls as you begin your crypto journey.

Ethereum (ETH) Price Prediction Table: 2026–2031 (Post-BlackRock Institutional Accumulation)

Forecasts reflect BlackRock’s ongoing institutional investment, evolving ETF markets, and Ethereum’s Layer 2 and DeFi adoption.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,900 | $4,800 | $6,200 | +10.7% | Consolidation phase as ETFs mature, possible volatility from regulatory reviews |

| 2027 | $4,250 | $5,600 | $7,800 | +16.7% | New Layer 2 scaling solutions boost usage; ETF inflows continue |

| 2028 | $4,700 | $6,850 | $9,500 | +22.3% | DeFi and tokenization adoption accelerates; competition from rival blockchains |

| 2029 | $5,300 | $8,200 | $12,000 | +19.7% | Mainstream institutional adoption, improved regulatory clarity |

| 2030 | $6,200 | $9,900 | $15,000 | +20.7% | Broader utility in finance, strong ETF growth, potential bull market |

| 2031 | $7,100 | $11,200 | $18,000 | +13.1% | Ethereum cements role as infrastructure for decentralized economy; possible emergence of new competitors |

Price Prediction Summary

Ethereum’s price outlook from 2026 to 2031 is bullish overall, driven by sustained institutional investment (notably BlackRock), maturing ETF markets, and growing adoption of Layer 2 solutions and DeFi. While regulatory uncertainty and competition could bring volatility, the overall trend points toward higher averages and expanding price ranges, with ETH potentially reaching $11,200 on average by 2031 in a continued adoption scenario.

Key Factors Affecting Ethereum Price

- BlackRock and other institutions’ sustained accumulation and ETF inflows

- Ethereum Layer 2 scaling and protocol upgrades (e.g., Dencun, Proto-Danksharding)

- Mainstream adoption of DeFi and tokenization

- Regulatory clarity and global ETF approval pace

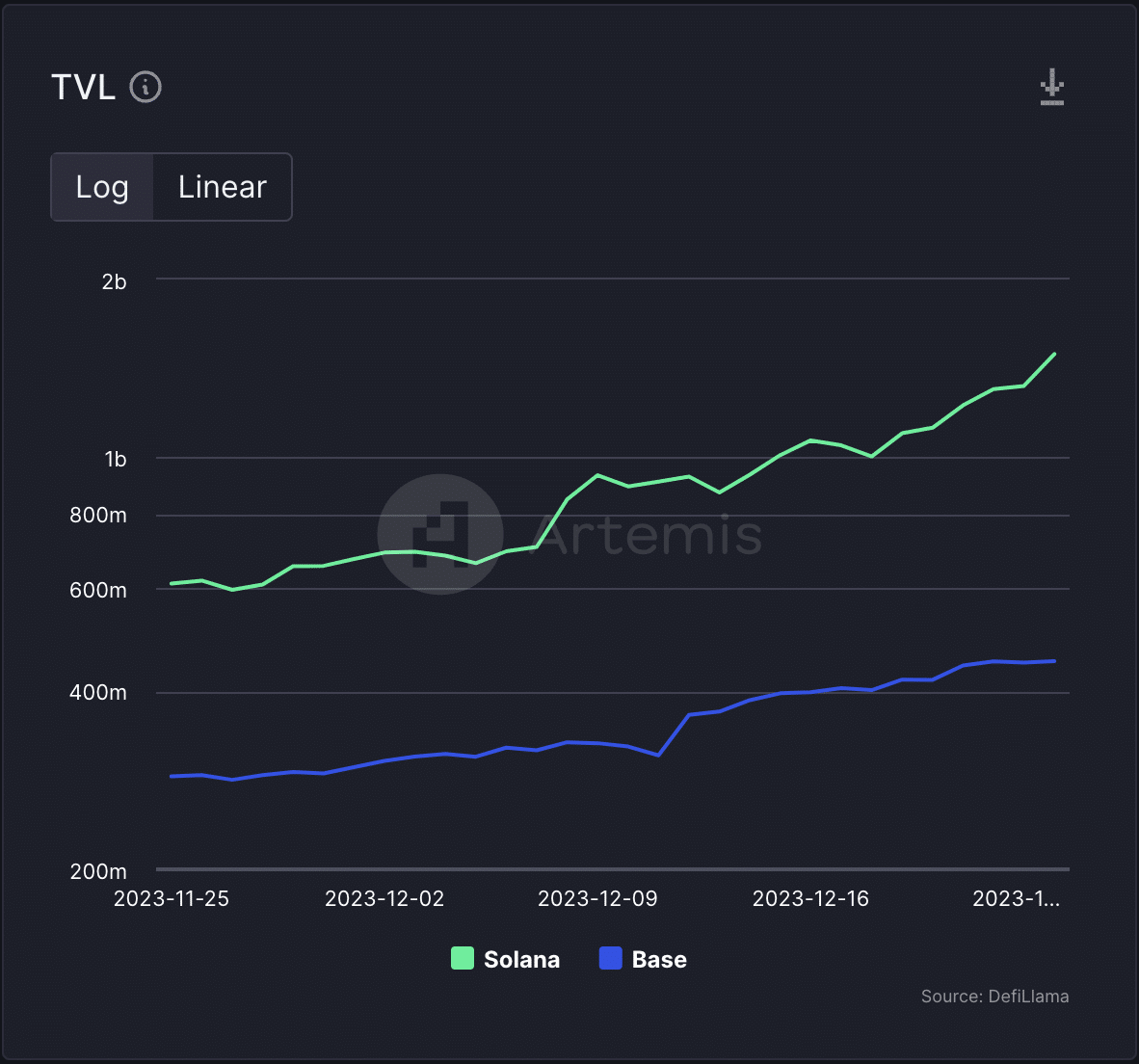

- Competition from alternative smart contract platforms (e.g., Solana, Avalanche)

- Staking rewards and the impact of ETF structures on ETH demand

- Macro market cycles (crypto bull/bear markets)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

BlackRock’s Ethereum accumulation is not just a headline for Wall Street insiders. It has ripple effects that shape how regulators, fintech startups, and even retail investors perceive digital assets. The presence of a trusted asset manager with $6.94 billion in Ethereum holdings at the current price of $4,337.59 lends a sense of legitimacy that was previously lacking in crypto’s wilder years.

For those new to the space, this institutional vote of confidence can be reassuring. It also means that the infrastructure supporting crypto onboarding is rapidly maturing. From regulated custodians to insurance-backed wallets and user-friendly ETF products, the barriers to entry are falling. However, the need for personal responsibility and education remains paramount.

What to Watch: Risks and Opportunities in Today’s Market

While BlackRock’s moves have added a layer of market stability, Ethereum remains an inherently volatile asset. The price can swing dramatically within hours, as illustrated by its 24-hour range between $4,328.58 and $4,555.56. Even with institutional adoption, crypto markets are susceptible to regulatory changes, technological risks (such as smart contract bugs), and macroeconomic shocks.

On the flip side, BlackRock’s advocacy for options trading on Ethereum ETFs could unlock new ways for individuals to manage risk or seek yield. As these products become available (source), expect increased sophistication in how both institutions and retail investors approach crypto exposure.

Key Takeaways for Newcomers

If you are entering the market now, your timing is interesting: you benefit from improved access and oversight but must also navigate a landscape shaped by large players whose actions can move prices quickly. Here are some points to keep in mind:

Essential Ethereum Onboarding Tips for Beginners

-

Set Up a Secure Wallet: After buying ETH, transfer your funds to a trusted non-custodial wallet like MetaMask, Trust Wallet, or a hardware wallet such as Trezor. This ensures you control your private keys and enhances security.

-

Enable Two-Factor Authentication (2FA): Protect your accounts on exchanges and wallets by enabling 2FA using apps like Authy or Google Authenticator. This adds an essential layer of security against unauthorized access.

-

Understand Ethereum Gas Fees: Before making transactions, learn how gas fees work on the Ethereum network. Use tools like Etherscan Gas Tracker to check current fees and optimize transaction timing.

-

Start Small and Diversify Carefully: Begin your crypto journey with manageable amounts of ETH and consider diversification through regulated products like the iShares Ethereum Trust ETF (ETHA), which saw $266.5 million in inflows on its first day. ETFs can offer exposure with added regulatory oversight.

-

Stay Informed with Trusted Sources: Follow major news outlets like CoinDesk, Cointelegraph, and official Ethereum channels for up-to-date information on market trends, security updates, and institutional moves like BlackRock’s acquisitions.

-

Beware of Scams and Phishing: Always verify URLs and never share your private keys or seed phrases. Use browser extensions like MetaMask Phish Detector to help identify suspicious sites.

Above all, remember that while BlackRock’s presence may help stabilize things over time, crypto remains an emerging asset class with unique risks and rewards. Your strategy should reflect your own goals, risk tolerance, and time horizon, not just what institutions are doing.

The Road Ahead: Will Institutional Adoption Drive Mainstream Use?

The real test will be whether institutional adoption translates into practical use cases and everyday transactions for ordinary people. With Ethereum powering much of the DeFi ecosystem and NFTs, not to mention ongoing Layer 2 upgrades designed to improve speed and reduce costs, there is genuine momentum behind mainstream onboarding.

Ethereum (ETH) Price Prediction 2026-2031 Post-BlackRock Institutional Accumulation

Forecasts reflect ongoing institutional adoption, Layer 2 upgrades, and evolving regulatory and market conditions.

| Year | Minimum Price | Average Price | Maximum Price | Annual % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,950 | $5,250 | $7,000 | +21% | Sustained institutional accumulation; potential for increased ETF inflows but possible macroeconomic headwinds. |

| 2027 | $4,500 | $6,350 | $8,800 | +21% | Layer 2 scaling and DeFi adoption drive usage; regulatory clarity improves ETF demand. |

| 2028 | $5,100 | $7,500 | $10,200 | +18% | Broader Web3 adoption; ETH staking demand rises, but competition from other smart contract platforms increases. |

| 2029 | $5,800 | $8,900 | $12,500 | +19% | Global regulatory progress and new ETH ETF products expand institutional and retail access. |

| 2030 | $6,600 | $10,200 | $15,000 | +15% | Ethereum cements position as DeFi backbone; Layer 2 innovations increase throughput and reduce fees. |

| 2031 | $7,400 | $11,800 | $17,500 | +16% | Mainstream adoption accelerates, but market cycles and tech competition create volatility. |

Price Prediction Summary

Ethereum is projected to experience steady price appreciation from 2026 to 2031, fueled by sustained institutional investment (notably BlackRock), Layer 2 upgrades, and expanding DeFi and Web3 use cases. While average annual growth is expected to remain robust, prices will likely fluctuate within broad ranges due to market cycles, regulatory shifts, and increasing competition. ETH’s role as a financial and technology backbone positions it for continued long-term relevance, though volatility will persist.

Key Factors Affecting Ethereum Price

- Ongoing institutional adoption, especially via ETFs and large asset managers like BlackRock.

- Layer 2 scaling solutions and Ethereum network upgrades improving throughput and user experience.

- Global regulatory clarity on crypto ETFs and staking rewards.

- Expanding DeFi, NFT, and Web3 ecosystem driving real-world use cases.

- Competition from alternative smart contract platforms (e.g., Solana, Avalanche, Cardano).

- Macro-economic factors, including inflation, interest rates, and global risk appetite.

- Potential for future crypto market cycles (bull/bear phases).

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Whether you are investing $100 or $100,000, understanding these shifts will help you make more informed decisions in a rapidly evolving landscape. As always in crypto: stay curious, stay cautious, but don’t underestimate the significance of institutional moves like BlackRock’s latest play.