The cryptocurrency market has always been sensitive to geopolitical shocks, but the events of October 2025 set a new benchmark for volatility and investor anxiety. On October 10, President Donald Trump announced a sweeping 100% tariff on all Chinese imports in response to China’s rare earth export controls. Within hours, over $200 billion evaporated from the crypto market cap, with Bitcoin plunging to a low of $109,743 before rebounding to its current level of $114,979.00. Ethereum followed suit, dropping sharply to $3,637. The scale and speed of this crash have left both new and experienced investors scrambling for answers and risk management strategies.

How Trump’s China Tariffs Sparked the 2025 Crypto Crash

Historically, cryptocurrencies have reacted violently to macroeconomic news, but few events have triggered such a synchronized sell-off across centralized and decentralized platforms. The moment Trump’s tariff threat became official policy, automated trading algorithms kicked in across major exchanges. Liquidations surged as stop-losses were triggered en masse, wiping out 6,300 wallets in a matter of hours and causing a $19 billion liquidation event (source).

This reaction underscores how closely Bitcoin and Ethereum are now tied to global risk sentiment. As the U. S. -China trade war reignited fears of recession and supply chain disruption, crypto holders rushed for the exits – despite narratives about digital assets as safe-haven alternatives.

Current Market Data: Bitcoin Holds Above $114,000

As of October 12, Bitcoin is trading at $114,979.00, up nearly $4,000 since its post-announcement low but still well below pre-crash levels. Ethereum sits at $3,637. Volatility remains elevated as traders digest ongoing headlines about tariffs and potential Chinese countermeasures.

For context on recent price movements:

- 24h High: $115,496.00

- 24h Low: $109,743.00

- 24h Change: and $3,966.00 ( and 0.0357%)

This data highlights just how quickly markets can move in response to geopolitical catalysts.

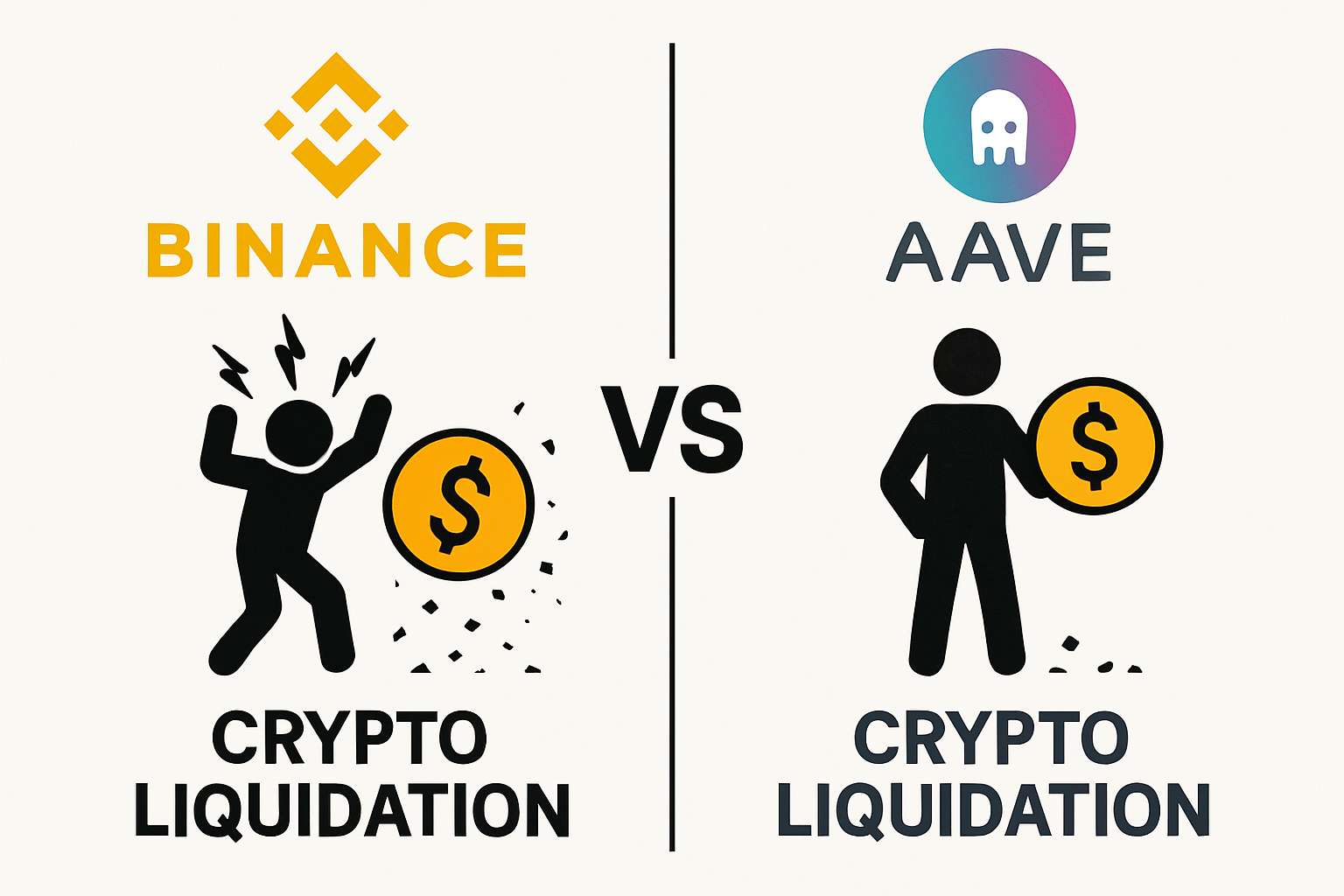

DeFi Resilience vs Centralized Chaos: What We Learned from Binance’s Response

The crash exposed critical differences between centralized exchanges (CEX) like Binance and decentralized finance (DeFi) protocols when it comes to risk management. Binance launched a 72-hour compensation plan after user outcry – but crucially excluded losses caused by normal market moves rather than technical failures or outages.

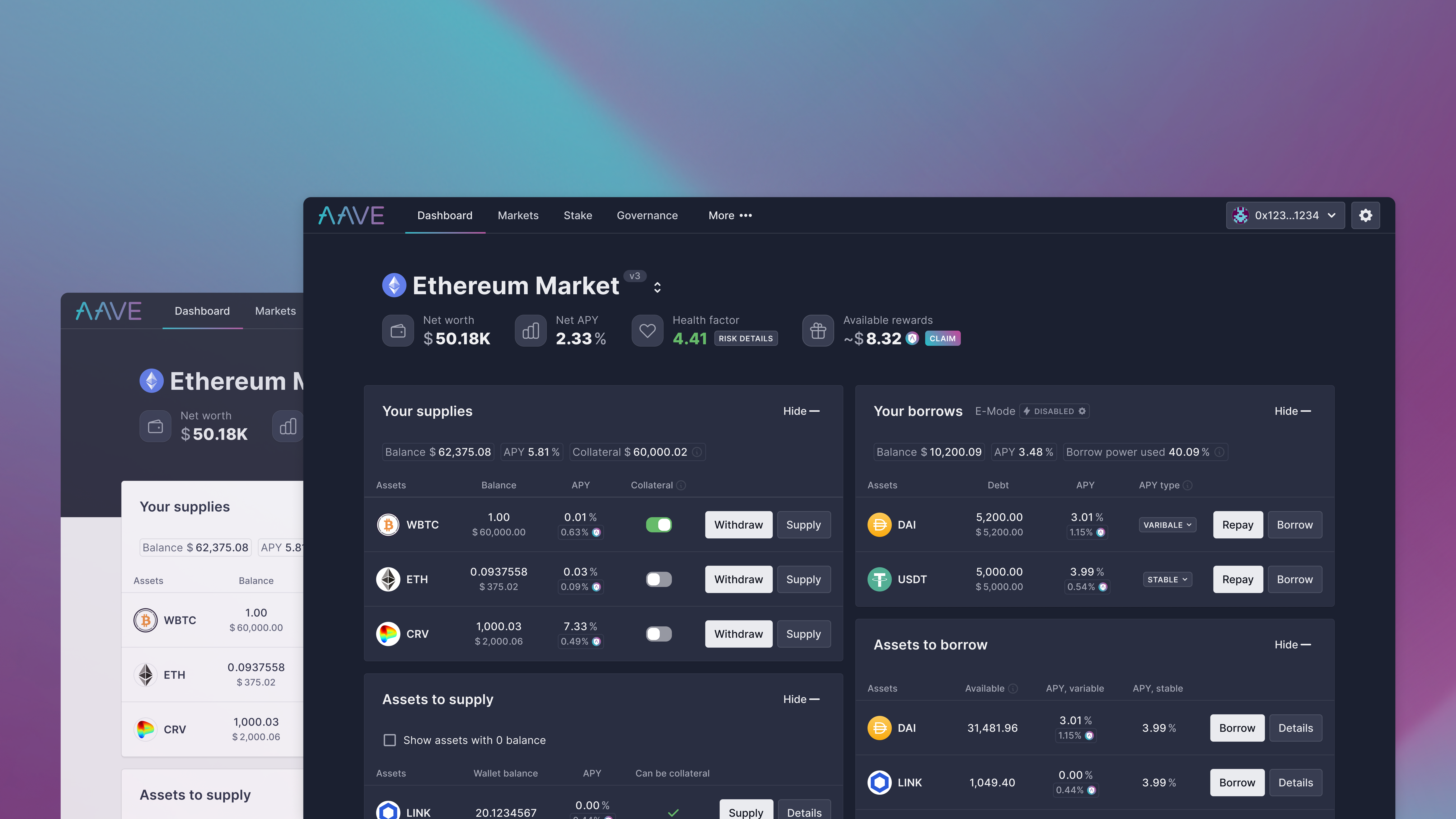

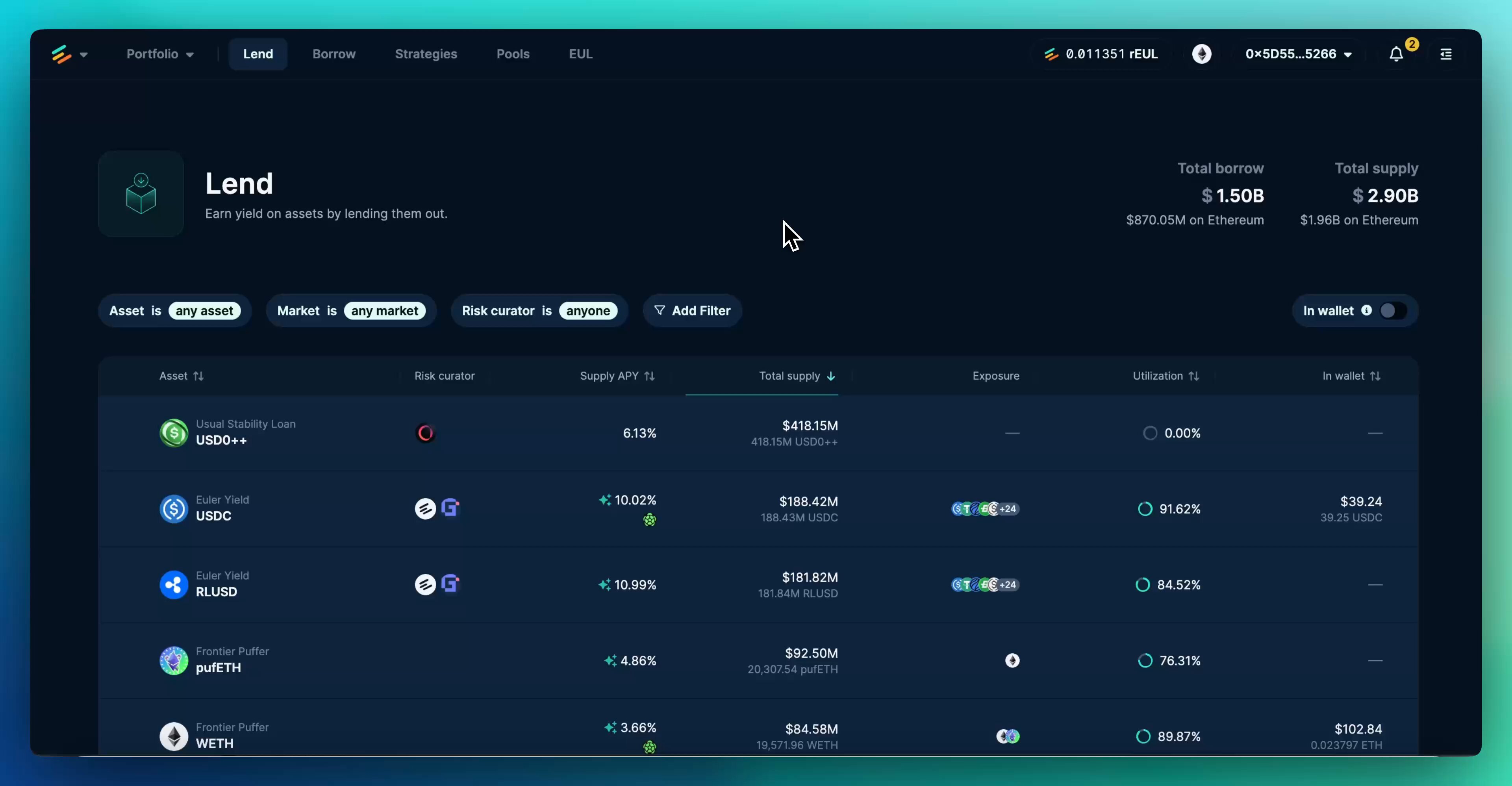

This left many users feeling exposed during extreme volatility events that CEXs have historically struggled to manage in real time. Meanwhile DeFi protocols largely continued operating as coded – liquidating positions according to transparent smart contract logic without discretionary intervention.

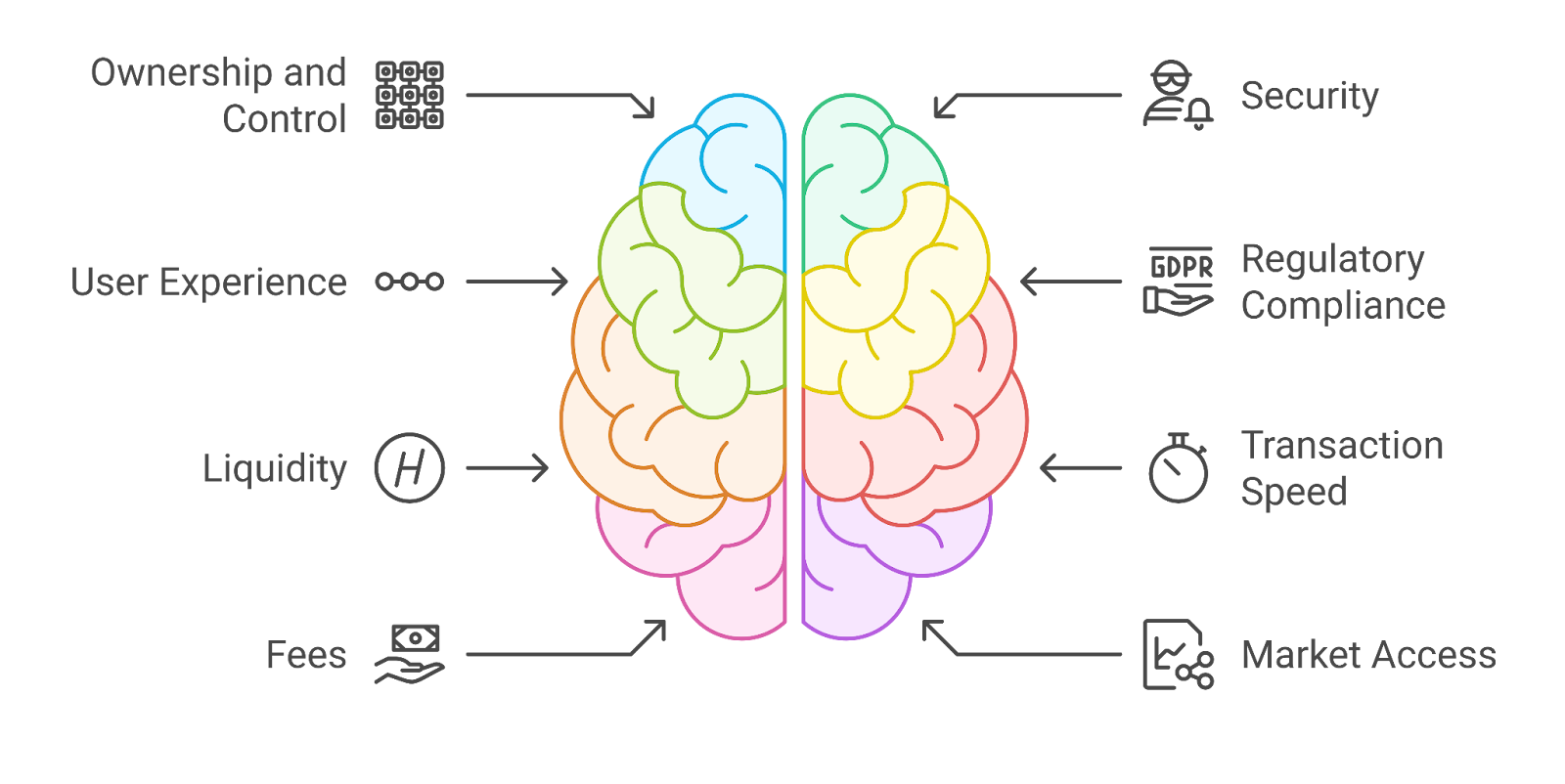

CEX vs DeFi: Key Differences During Crypto Crashes

-

Custody of Funds: Centralized exchanges (CEXs) like Binance hold user assets in custodial wallets, meaning users rely on the platform’s security and operational stability. In contrast, DeFi platforms (e.g., Uniswap, Aave) allow users to retain direct control of their funds via self-custody wallets, reducing counterparty risk during volatile events.

-

Withdrawal Restrictions: During the October 2025 crash, CEXs like Binance temporarily restricted or delayed withdrawals to manage liquidity and platform stability. DeFi protocols remained accessible 24/7, allowing users to withdraw or trade assets at any time, though network congestion and high gas fees were common.

-

Transparency and Risk: CEXs operate with limited transparency regarding reserves and internal risk management, as seen when Binance’s compensation plan excluded market-driven losses. DeFi platforms function on open-source smart contracts, offering real-time visibility into liquidity pools and protocol health, though they are not immune to smart contract risks.

-

Liquidation Events: The $19 billion liquidation on October 10, 2025, disproportionately affected users on CEXs due to centralized margin and leverage trading systems. DeFi platforms also experienced liquidations, but these were executed automatically by smart contracts, providing predictable and transparent rules for all participants.

-

Compensation and User Protection: After the crash, Binance offered a 72-hour compensation plan, but it excluded market-driven losses, highlighting gaps in user protection. DeFi platforms typically lack compensation mechanisms; users are solely responsible for their risk management, emphasizing the importance of personal due diligence.

Navigating Market Volatility: Risk Management Strategies for All Investors

The events surrounding the crypto crash 2025 serve as a stark reminder that both new entrants and seasoned investors must prioritize robust risk management frameworks when trading digital assets during periods of macro uncertainty.

If you’re looking for actionable guidance on how to diversify your portfolio or set up effective stop-loss orders in this environment, it’s essential to stay informed about breaking news and adapt your strategy accordingly.

Bitcoin Price Prediction 2026-2031 Post-2025 Crypto Crash

Forecasts reflect heightened volatility following the 2025 US-China tariff shock and subsequent crypto market crash.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg, YoY) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $90,000 | $120,000 | $155,000 | +5% | Potential for continued volatility as global trade tensions persist; recovery aided by institutional accumulation and DeFi resilience. |

| 2027 | $105,000 | $135,000 | $180,000 | +12.5% | Market stabilization likely as regulatory clarity improves; halving anticipation and new use cases could drive renewed interest. |

| 2028 | $120,000 | $155,000 | $220,000 | +14.8% | Bullish cycle expected post-2028 halving; growing adoption in global settlements and increased integration into traditional finance. |

| 2029 | $115,000 | $170,000 | $260,000 | +9.7% | Potential for both consolidation and upward movement as macroeconomic conditions shift; competition from emerging crypto assets increases. |

| 2030 | $130,000 | $185,000 | $300,000 | +8.8% | Steady growth as Bitcoin matures as a store of value; possible regulatory headwinds but offset by technology improvements. |

| 2031 | $140,000 | $200,000 | $340,000 | +8.1% | Gradual price appreciation amid mass adoption scenarios; risks from global policy shifts and disruptive innovations remain. |

Price Prediction Summary

Bitcoin is projected to recover from the 2025 tariff-induced crash, with moderate but steady growth expected through 2031. Prices will likely remain volatile in the near term due to ongoing geopolitical uncertainty, but long-term prospects are supported by increasing institutional adoption, technological advancements, and potential supply shocks from halvings. The min-max ranges reflect the potential for both bearish and bullish market cycles, with a general upward trajectory as Bitcoin continues to cement its role in the global financial system.

Key Factors Affecting Bitcoin Price

- Ongoing effects of US-China trade tensions and global economic shifts.

- Regulatory developments in major markets (US, EU, Asia).

- Institutional adoption and integration into traditional finance.

- Technological upgrades (e.g., Bitcoin scaling, DeFi integration).

- Market cycles, including halving events and macro trends.

- Competition from Ethereum, CBDCs, and emerging digital assets.

- Global risk appetite and shifts in investor sentiment.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

For those who experienced their first major market downturn, the crypto crash 2025 was a trial by fire. Panic selling, forced liquidations, and network congestion exposed weaknesses in both centralized and decentralized systems. Yet, this environment also provided a real-world stress test for every investor’s discipline and technical setup.

Lessons for New and Experienced Crypto Investors

One of the clearest takeaways from this event is the necessity of proactive risk management. Relying solely on exchange safeguards or hoping for compensation after the fact is not a sustainable strategy. The Binance compensation plan, which excluded losses from normal market volatility, highlighted the limits of centralized protection mechanisms during systemic events.

Meanwhile, DeFi’s automated liquidations may seem harsh, but their transparency and predictability can be a double-edged sword. Investors who understood protocol rules and collateral thresholds were generally better prepared to weather the storm. Those caught off guard by sudden price swings faced steep losses that were enforced without appeal.

Key principle: Know the rules of your trading environment, whether CEX or DeFi, and build your risk management plan accordingly.

How to Prepare for Future Volatility

The October 2025 crash was driven by external macroeconomic forces beyond any single investor’s control. However, there are proven strategies to help minimize damage and capitalize on recovery opportunities:

Essential Crypto Risk Management Tips for Volatile Markets

-

Monitor Geopolitical Events in Real Time: Stay updated on major developments, such as President Trump’s 100% China tariff announcement, which triggered the recent $19B crypto liquidation. Use reputable sources like Reuters and Cointelegraph for timely alerts.

-

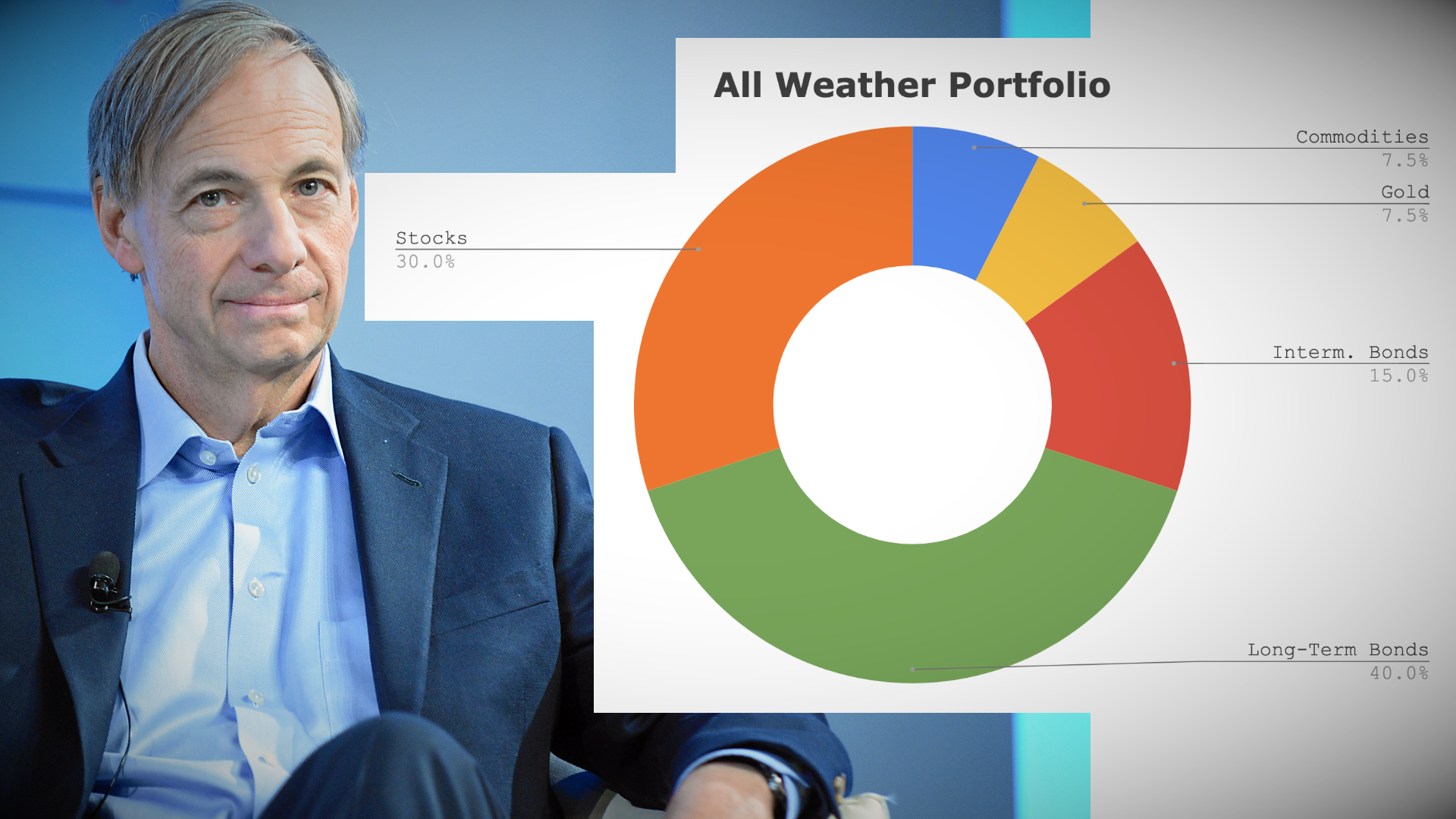

Diversify Across Assets and Platforms: Reduce exposure to single-asset volatility by allocating funds among Bitcoin, Ethereum, and stablecoins like Tether (USDT), and consider both centralized and decentralized platforms for added resilience.

-

Regularly Review Exchange Compensation Policies: After events like Binance’s 72-hour compensation plan (which excluded market-driven losses), it’s crucial to understand what protections your chosen exchange offers during extreme volatility.

Stay informed: Rapid news cycles can trigger algorithmic trading and mass liquidations within minutes. Set up alerts for major geopolitical headlines related to trade policy, especially those involving the U. S. and China.

Diversify: Don’t concentrate your exposure in a single asset or platform. Spread holdings across different coins, stablecoins, and both CEX/DeFi venues when possible.

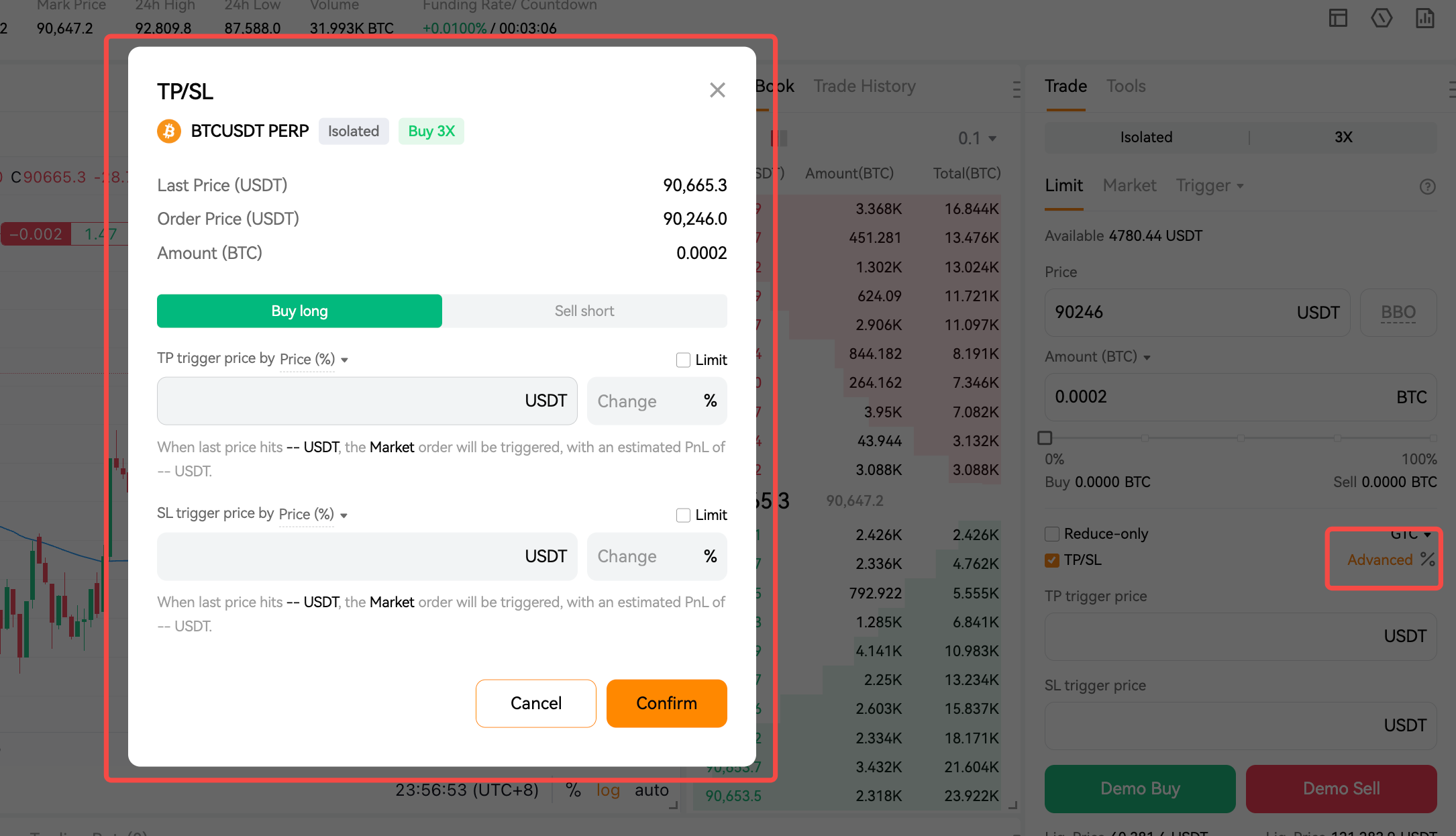

Use stop-loss orders intelligently: But beware of cascading liquidations in thinly traded markets. Consider trailing stops or manual monitoring if possible during high-volatility periods.

Test your exit strategies: Practice withdrawing funds and executing trades in advance of crisis moments. Network congestion can delay transactions when you need them most.

Community Sentiment: What Are Investors Saying?

The emotional toll of this week’s events cannot be underestimated. Social feeds are filled with stories of missed opportunities, hard lessons, and, among some experienced hands, resilience built on years of disciplined trading. For every panic seller, there was a long-term holder (or “diamond hands”) ready to buy the dip at $109,743.00.

Where Do We Go From Here? Expert Price Predictions

With Bitcoin currently holding at $114,979.00 and Ethereum at $3,637, analysts remain divided about short-term direction. Much depends on how quickly global trade tensions de-escalate, or escalate further. Volatility is likely to persist as markets digest new data and potential policy responses from China or other economic powers.

Bitcoin Price Prediction 2026-2031 (Post-2025 Tariff Crash Scenario)

Forecasts incorporate heightened volatility after the 2025 US-China tariff shock, factoring in macroeconomic risks and potential for market recovery.

| Year | Minimum Price | Average Price | Maximum Price | YoY Change (Avg) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $85,000 | $110,000 | $145,000 | -3.5% | Volatility persists; recovery attempts face resistance as trade war impacts global risk appetite. |

| 2027 | $92,000 | $124,000 | $172,000 | +12.7% | Gradual stabilization; institutional accumulation resumes, regulatory clarity improves sentiment. |

| 2028 | $108,000 | $137,000 | $193,000 | +10.5% | Halving year drives bullish expectations, but macro headwinds linger; DeFi sector shows resilience. |

| 2029 | $120,000 | $159,000 | $230,000 | +16.1% | Global adoption grows, technology upgrades (e.g., Layer 2, scalability) boost utility. |

| 2030 | $142,000 | $185,000 | $265,000 | +16.4% | Broader institutional adoption and regulatory frameworks support higher valuations. |

| 2031 | $165,000 | $210,000 | $315,000 | +13.5% | Matured market, increased integration in global finance, but still sensitive to macro shocks. |

Price Prediction Summary

Bitcoin’s price outlook for 2026-2031 is shaped by the aftermath of the 2025 US-China trade war escalation. While near-term volatility and downside risk remain elevated, medium- and long-term prospects improve as the market absorbs shocks, regulatory clarity increases, and adoption trends strengthen. Expect a wide range between bearish and bullish scenarios, reflecting ongoing macroeconomic and geopolitical uncertainties.

Key Factors Affecting Bitcoin Price

- US-China trade tensions and global macroeconomic stability

- Regulatory responses to crypto after the 2025 crash

- Institutional investor sentiment and adoption pace

- Technological improvements (e.g., scalability, security, DeFi integration)

- Market cycles (e.g., Bitcoin halving events and their historic impact)

- Competition from other digital assets and emerging blockchain platforms

- Potential for new use cases and integration into traditional finance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

For now, the key is vigilance. Whether you’re a newcomer or a veteran, use this historic event as a catalyst to strengthen your approach to crypto risk management. The next macro shock could be just around the corner, and preparation is your best defense against uncertainty.