When the U. S. Department of Justice seized 127,271 bitcoins from Chen Zhi in October 2025, the crypto world didn’t just get a new headline – it got a wake-up call. At today’s Bitcoin price of $108,433.00, that haul is worth roughly $15 billion. For crypto onboarding beginners, this seismic event is a lesson in the raw reality of asset security, regulatory risk, and what it takes to keep your coins safe in a world where digital value can vanish with a single click or a government court order.

Bitcoin Maintains Position Above $100,000: What This Means for New Investors

Let’s get something straight: Bitcoin is no longer an underground experiment. With the U. S. government now holding one of the largest Bitcoin wallets on the planet, the stakes have never been higher. The current price of $108,433.00 isn’t just a number – it’s a signal that crypto is mainstream, regulated, and under scrutiny. If you’re onboarding into crypto now, you’re not beating the system; you’re joining a market watched by regulators, hackers, and law enforcement alike.

The lesson? Security is non-negotiable. The DOJ’s historic seizure happened because criminals failed to hide their tracks. But for regular investors, even a minor slip – using a weak password, trusting the wrong exchange, or clicking a phishing link – can mean losing everything. The bar for asset protection is rising fast.

Crypto Security Tips: Protecting Your Assets in a Post-Seizure World

Here’s the simple truth: if you don’t control your private keys, you don’t control your coins. The Chen Zhi case exposed how quickly governments can freeze and confiscate digital assets. For beginners, that means:

Essential Crypto Security Tips for Beginners

-

Use Reputable Hardware Wallets: Protect your Bitcoin and other digital assets by storing them in industry-leading hardware wallets like Ledger or Trezor. These devices keep your private keys offline and out of reach from hackers.

-

Enable Multi-Factor Authentication (MFA): Always activate MFA on major crypto exchanges such as Coinbase and Kraken. This adds an extra layer of security beyond just your password.

-

Stay Updated on Regulatory Changes: Follow updates from the U.S. Securities and Exchange Commission (SEC) and Department of Justice (DOJ) to understand new crypto regulations, like the 2025 Strategic Bitcoin Reserve policy.

-

Verify Exchange Reputation Before Trading: Only use established, regulated exchanges such as Binance.US, Coinbase, or Kraken. Check for recent security audits and compliance with U.S. regulations.

-

Beware of Social Engineering and Scams: Learn to recognize ‘pig butchering’ and other crypto scams. Use resources from TRM Labs and BitAML to stay informed about current threats.

-

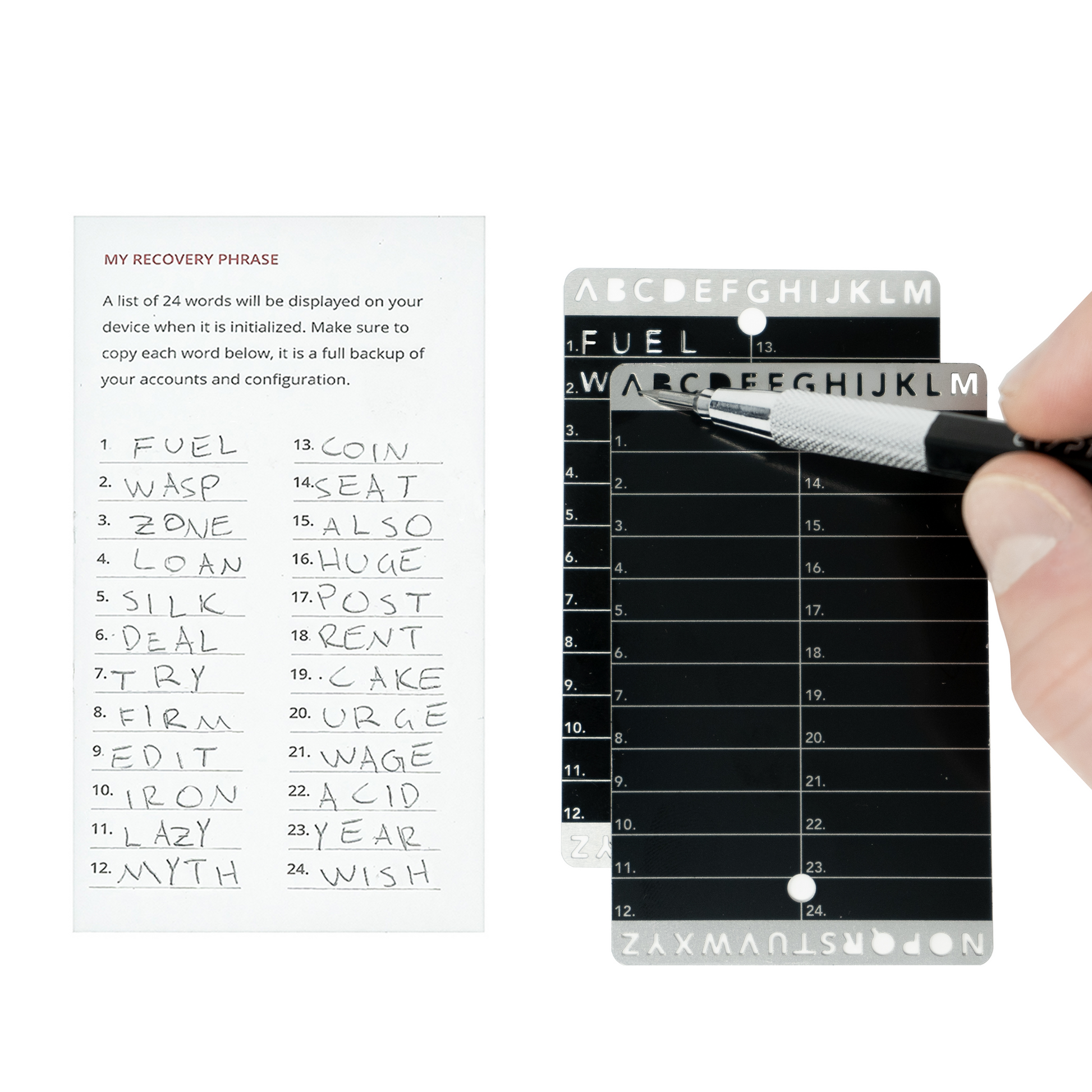

Back Up Your Recovery Phrases Securely: Write down your wallet’s seed phrase and store it in a secure, offline location. Never share it digitally or with untrusted parties.

-

Conduct Due Diligence on New Projects: Research any crypto project or token before investing. Use trusted sources like CoinGecko or CoinMarketCap for project histories and market data.

Don’t just trust exchanges with your funds. Use hardware wallets or multi-signature setups. Set up two-factor authentication everywhere. And always verify URLs before entering sensitive information. For a deeper dive on best practices, check out this guide on security tips for 2025.

Regulation and Crypto: The New Reality for Onboarding

The U. S. government’s move to create a Strategic Bitcoin Reserve in 2025 is a game-changer. Instead of auctioning off seized BTC, authorities are now holding it as a hedge against inflation and as a strategic asset. This shift is a clear signal: regulation isn’t coming – it’s already here. Compliance is now part of the onboarding process. Know Your Customer (KYC) checks, anti-money laundering rules, and wallet monitoring are the norm, not the exception.

If you’re new to crypto, you need to understand how regulation impacts your assets. The rules are evolving fast, and ignorance is no excuse. Stay up to date with the latest regulatory moves – it’s your best defense against unexpected freezes or legal headaches. For more on how major crypto seizures shape best practices, see this breakdown of recent enforcement actions.

Crypto Scams and Asset Protection: Staying Ahead of Threats

Scams like the notorious ‘pig butchering’ operations that led to the Chen Zhi bust are getting more sophisticated. They prey on beginners who are eager but unprepared. If you’re onboarding into crypto in 2025, assume you are a target. Double-check every message. Never share your seed phrase. And if something sounds too good to be true, it’s a trap.

Bitcoin Price Prediction 2026-2031

Based on October 2025 market data, regulatory shifts, and major Bitcoin seizures impacting supply and sentiment.

| Year | Minimum Price | Average Price | Maximum Price | Yearly Change (%) | Key Scenario |

|---|---|---|---|---|---|

| 2026 | $95,000 | $120,000 | $155,000 | -12% to +43% | Volatility after U.S. SBR creation; regulatory clarity, potential DOJ auctions |

| 2027 | $110,000 | $138,000 | $175,000 | +16% to +13% | ETF inflows, further SBR accumulation, global regulatory harmonization |

| 2028 | $125,000 | $160,000 | $205,000 | +14% to +17% | Halving cycle (Q2 2028), increased institutional adoption |

| 2029 | $140,000 | $185,000 | $240,000 | +12% to +17% | Wider adoption, scaling solutions, potential SBR strategic sales |

| 2030 | $155,000 | $210,000 | $285,000 | +11% to +19% | Global monetary instability, Bitcoin as digital reserve asset |

| 2031 | $170,000 | $235,000 | $330,000 | +10% to +16% | Matured market, new regulatory frameworks, competition from CBDCs |

Price Prediction Summary

Bitcoin’s price outlook for 2026-2031 remains bullish overall, despite short-term volatility from large-scale government seizures and regulatory uncertainty. The U.S. Strategic Bitcoin Reserve (SBR) marks a new era, potentially reducing market supply and increasing institutional confidence. Key events—such as the 2028 halving and ongoing global regulation—are expected to drive steady growth. However, government sales or auctions of seized BTC could temporarily pressure prices, while continued adoption and innovation support long-term upward trends.

Key Factors Affecting Bitcoin Price

- Impact of U.S. government holding or releasing large Bitcoin reserves (SBR policy)

- Global regulatory clarity and new compliance frameworks (SEC, DOJ, international coordination)

- 2028 Bitcoin halving and its effect on supply/demand dynamics

- Institutional adoption, including ETFs, corporate treasuries, and sovereign wealth funds

- Advancements in Bitcoin scalability, security, and integration with traditional finance

- Competition from alternative digital assets and central bank digital currencies (CBDCs)

- Potential macroeconomic shocks or shifts in global monetary policy

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

But protecting your assets isn’t just about dodging scams and hackers. The regulatory landscape is changing by the week, and new laws now allow for faster crypto seizures to help scam victims, sometimes at the expense of innocent holders caught in the crossfire. This means you need more than just technical security; you need situational awareness. Keep records of your transactions, understand the source of your funds, and be ready to prove ownership if challenged.

With governments holding massive reserves, like the U. S. Strategic Bitcoin Reserve at today’s $108,433.00 per BTC, the line between personal finance and geopolitics is blurring. Regulators are watching not just for criminal activity but also for compliance lapses by regular investors. If you’re onboarding now, treat every step with caution: verify who you’re dealing with, document everything, and keep your security setups up-to-date.

Asset Safety Checklist: What Every Beginner Must Do Right Now

Don’t get complacent. With Bitcoin holding above $100,000 and government wallets swelling with seized coins, the risks, and rewards, are higher than ever. Here’s what separates survivors from victims:

- Self-custody: Learn how to use a hardware wallet before you buy your first coin.

- KYC readiness: Always keep a record of your purchase history and wallet addresses.

- Stay informed: Follow regulatory news so you’re never caught off guard by sudden enforcement actions or policy shifts.

- Community matters: Join reputable crypto forums and user groups for real-time scam alerts and peer support.

If you want context on how earlier mega-seizures shaped today’s best practices, read this deep-dive: How the $6.75 Billion Bitcoin Seizure Impacts Crypto Buyers.

Staying Agile: Your Edge in Volatile Times

This market moves fast, and so should you. The DOJ’s seizure proved that both bad actors and average investors can lose access overnight if they aren’t prepared. React fast, manage risk: that’s not just a tagline; it’s survival advice in a world where one wrong click or missed regulation can cost you everything.

The bottom line? Don’t let headlines paralyze you, but don’t ignore them either. With Bitcoin at $108,433.00, every decision counts more than ever before. Take charge of your security today so that tomorrow’s news is just another data point, not a disaster for your portfolio.