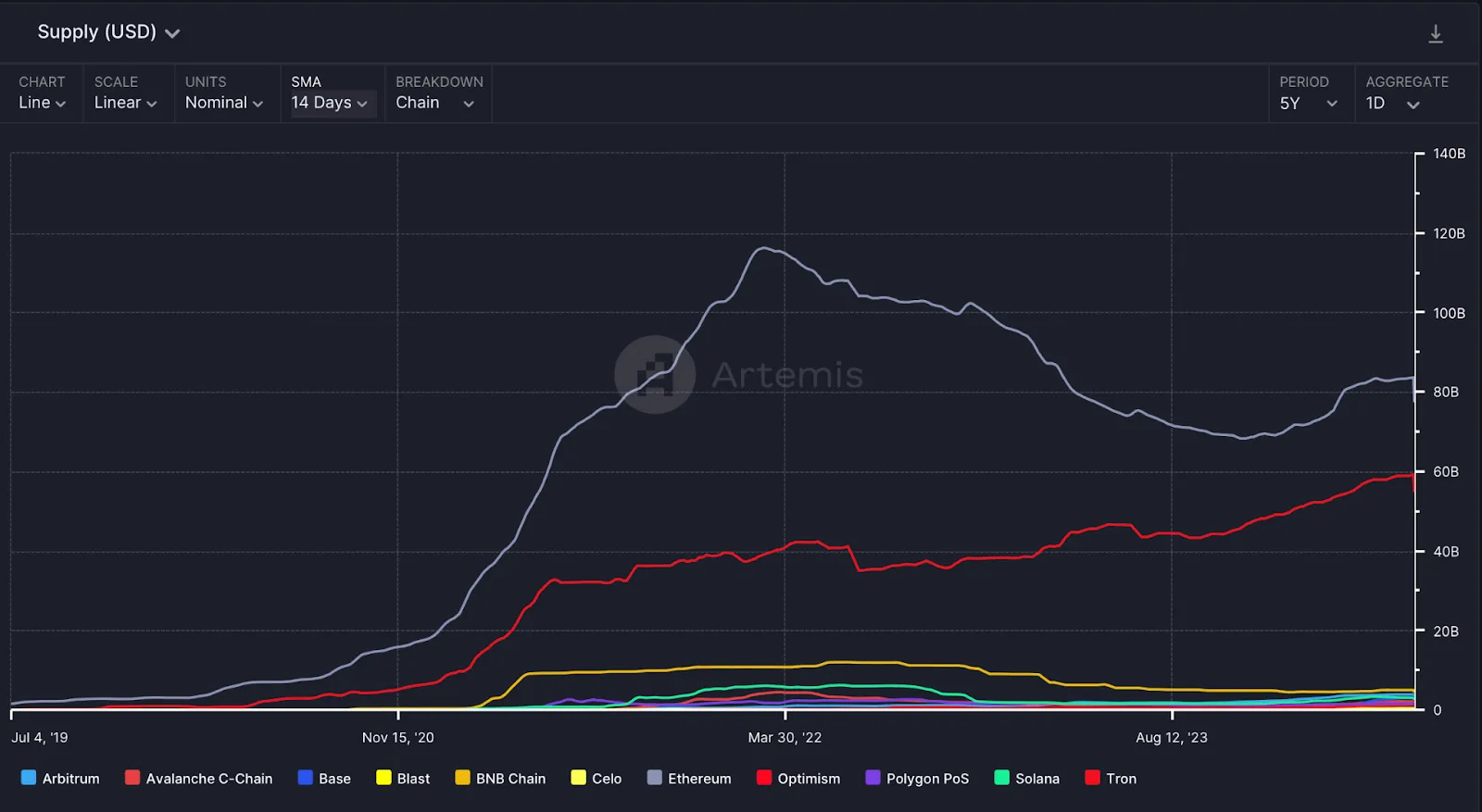

Stablecoins have quietly become one of the most transformative forces in global payments, and the latest a16z State of Crypto 2025 report puts this shift into sharp relief. In just the past year, stablecoins processed an eye-watering $46 trillion in transaction volume, more than doubling from the previous year. Even after adjusting for internal transfers and bot activity, the real-world volume stands at $9 trillion: over five times PayPal’s annual throughput and more than half of Visa’s global volume. For anyone new to crypto, these numbers are not just impressive; they signal a fundamental change in how money moves around the world.

Stablecoins: From Speculation to Real-World Payments

In crypto’s early years, stablecoins were mostly a tool for traders seeking shelter from volatility. Fast-forward to today, and they have evolved into a practical payment rail, especially for cross-border commerce. According to a16z, September 2025 alone saw $1.25 trillion in adjusted monthly stablecoin transactions. This shift from speculative instrument to payment backbone is a key theme of the 2025 report and a sign that mainstream adoption is well underway.

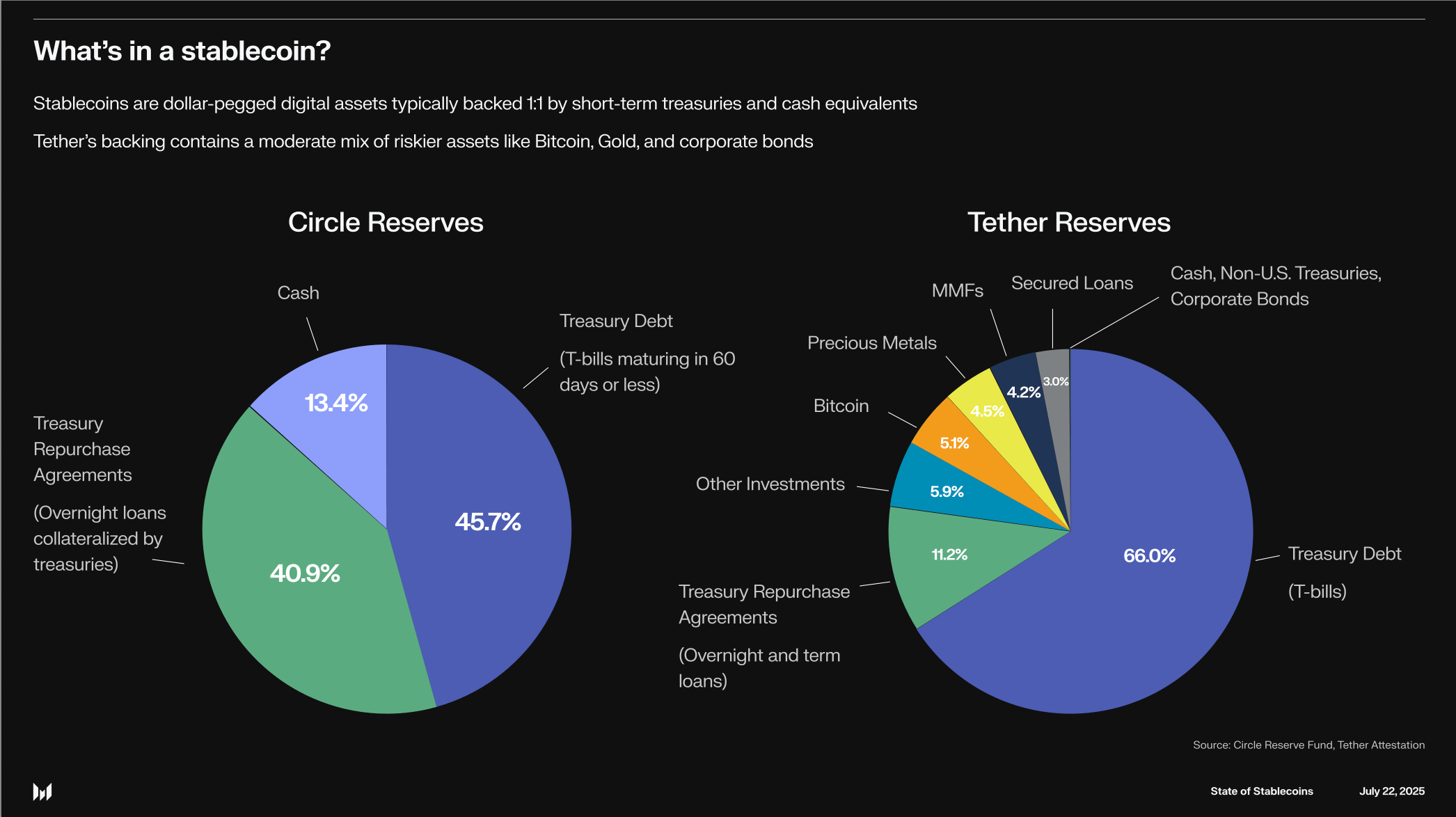

But what makes stablecoins so compelling for global payments? At their core, stablecoins are digital tokens pegged to traditional currencies like the US dollar. This makes them immune to the wild price swings of typical cryptocurrencies, allowing users to send and receive value instantly, 24/7, with minimal fees. For millions in emerging markets or those facing high remittance costs, this is nothing short of revolutionary.

“Stablecoins are now one of the only mediums, besides cash and gold, to operate without centralized gatekeepers like payment networks and central banks. ”: a16z Crypto

The Data Behind Stablecoin Adoption in 2025

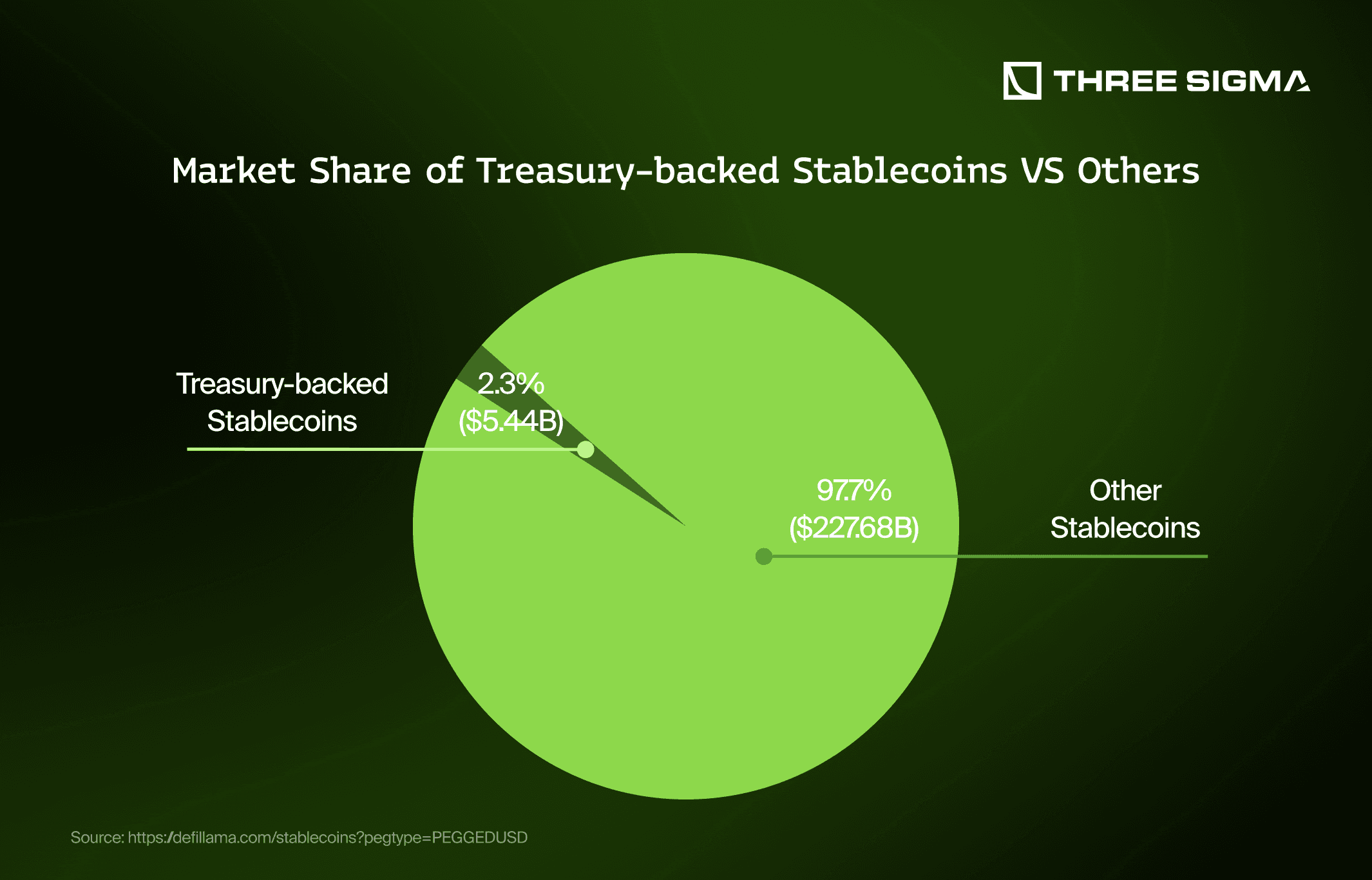

The numbers in a16z’s latest report are staggering. The total supply of stablecoins has surpassed $300 billion, with Tether (USDT) and USD Coin (USDC) dominating at 87% of the market. Most of this activity happens on Ethereum and Tron, which together processed $772 billion in adjusted transactions just in September 2025. These blockchains are now the arteries through which digital dollars flow globally.

Stablecoins have also become a macroeconomic force. With over $150 billion in U. S. Treasuries held by stablecoin issuers, these digital assets are now the 17th largest holder of Treasuries worldwide. More than 1% of all U. S. dollars exist today as tokenized stablecoins on public blockchains, a figure that would have seemed unthinkable just a few years ago.

Why This Matters for Crypto Beginners

If you’re new to crypto, you might wonder why all this matters. The answer is simple: stablecoins are now the bridge between traditional finance and the world of digital assets. They offer a reliable, dollar-pegged alternative to volatile cryptocurrencies, making them an entry point for millions who want to send money abroad, pay freelancers, or simply store value digitally.

This is especially relevant for those exploring how to use stablecoins safely and effectively. As adoption accelerates and infrastructure matures, understanding how stablecoins work is becoming a core part of crypto literacy. For merchants and individuals alike, the ability to transact globally, without waiting days or paying exorbitant fees, represents a real-world use case that is finally living up to the early hype.

For crypto beginners, the rise of stablecoins is more than a headline, it’s a practical onramp into digital finance. Unlike speculative tokens, stablecoins are designed for usability: their value tracks established currencies, and their infrastructure now rivals traditional payment networks in reach and speed. This means you can send money across borders instantly, often for pennies in fees, and without needing to trust a single company or bank.

Key Benefits of Using Stablecoins for Global Payments

-

Rapid, Low-Cost Cross-Border Transfers: Stablecoins enable near-instant, affordable global transactions, bypassing traditional banking delays and high remittance fees. In 2025, stablecoins processed $46 trillion in transaction volume, highlighting their efficiency for international payments.

-

Price Stability Compared to Other Cryptocurrencies: Unlike volatile digital assets, stablecoins like Tether (USDT) and USD Coin (USDC) are pegged to fiat currencies, providing a reliable medium of exchange for merchants and consumers worldwide.

-

Widespread Adoption and Liquidity: With a total stablecoin supply exceeding $300 billion and major blockchains like Ethereum and Tron processing $772 billion in adjusted transactions in a single month, users benefit from deep liquidity and broad acceptance.

-

Access Without Centralized Gatekeepers: Stablecoins operate on public blockchains, allowing users to transact globally without relying on banks or payment networks, increasing financial inclusion especially in underbanked regions.

-

Seamless Integration with Traditional Finance: Stablecoins have become a macroeconomic force, holding over $150 billion in U.S. Treasuries and representing more than 1% of all U.S. dollars in tokenized form, bridging the gap between crypto and traditional financial systems.

Getting Started: How to Use Stablecoins

Onboarding into crypto can be daunting, but stablecoins simplify the process. Most major exchanges and wallets support USDT and USDC, the two giants accounting for 87% of the $300 billion total supply. Here’s how you can start:

Once you’ve acquired stablecoins, you can use them to pay freelancers abroad, shop with merchants who accept crypto, or even save in digital dollars if your local currency is unstable. The technology is borderless, transactions settle in minutes on blockchains like Ethereum or Tron, which processed $772 billion in adjusted volume just last month.

Risks and What to Watch For

No innovation comes without caveats. While stablecoin adoption is surging provides $1.25 trillion in adjusted monthly transactions as of September 2025, users should be aware of risks:

- Issuer Risk: Not all stablecoins are equally transparent about their reserves.

- Regulatory Uncertainty: Governments are still figuring out how to oversee these assets.

- Blockchain Fees: While generally low, network congestion can occasionally spike costs.

If you want a deeper dive into both the opportunities and the risks as we approach a projected $500 billion market cap, see our guide on stablecoin risks and opportunities for 2026.

The Future: Stablecoins as the New Normal?

a16z’s report frames 2025 as “the year the world came on-chain. ” With more than 1% of all U. S. dollars now existing as tokenized assets on public blockchains, and over $150 billion in Treasuries held by issuers, the macro implications are profound. We’re witnessing not just technological progress but also institutional validation at scale.

The safest bet is to prepare now: educate yourself, experiment with small amounts, partner with reputable platforms, and plan for a stablecoin-powered future.

The bottom line? Stablecoins have moved from niche instruments to essential infrastructure for global payments, and every beginner now has an accessible entry point into this new financial era.