Crypto headlines are buzzing: Coinbase Europe just took a $24.7 million hit for anti-money laundering (AML) failures, and the ripple effects are big news for anyone looking to safely onboard into crypto. If you’re new to digital assets, you might be wondering: what does this mean for me? Let’s break it down so you can make smarter, safer choices when picking your first exchange.

Coinbase’s $24.7M Fine: What Actually Happened?

Here’s the gist: The Central Bank of Ireland fined Coinbase Europe Limited €21.5 million ($24.7 million) after discovering that over 30 million transactions, worth more than €176 billion ($202 billion), went unmonitored for AML compliance between April 2021 and March 2025. That’s nearly 31% of all activity on Coinbase Europe during that time! The cause? A critical coding error in their transaction monitoring system left these transactions off the compliance radar for an entire year.

It took Coinbase almost three years to review those missed transactions and file about 2,700 suspicious transaction reports, covering roughly €13 million in value. The fine was actually reduced from an even steeper €30.66 million because Coinbase admitted the problem early and cooperated with regulators.

Why Crypto Compliance Matters More Than Ever

If you’re just starting your crypto journey, this story is a powerful reminder that compliance isn’t optional. It’s essential for protecting both exchanges and users from financial crime, fraud, and regulatory blowback. When an exchange drops the ball on AML or Know Your Customer (KYC) checks, it doesn’t just risk fines; it puts your funds and personal data at risk too.

Regulators worldwide are tightening their grip on crypto businesses, demanding better oversight and transparency. This isn’t just about ticking boxes – it’s about building trust in an industry that has too often been seen as the Wild West of finance.

How Do Exchanges Monitor Transactions?

Let’s get practical: how do exchanges like Coinbase normally keep things above board? Here are some key steps:

- KYC Verification: Before you can trade, you’ll need to provide ID so the platform knows who you are.

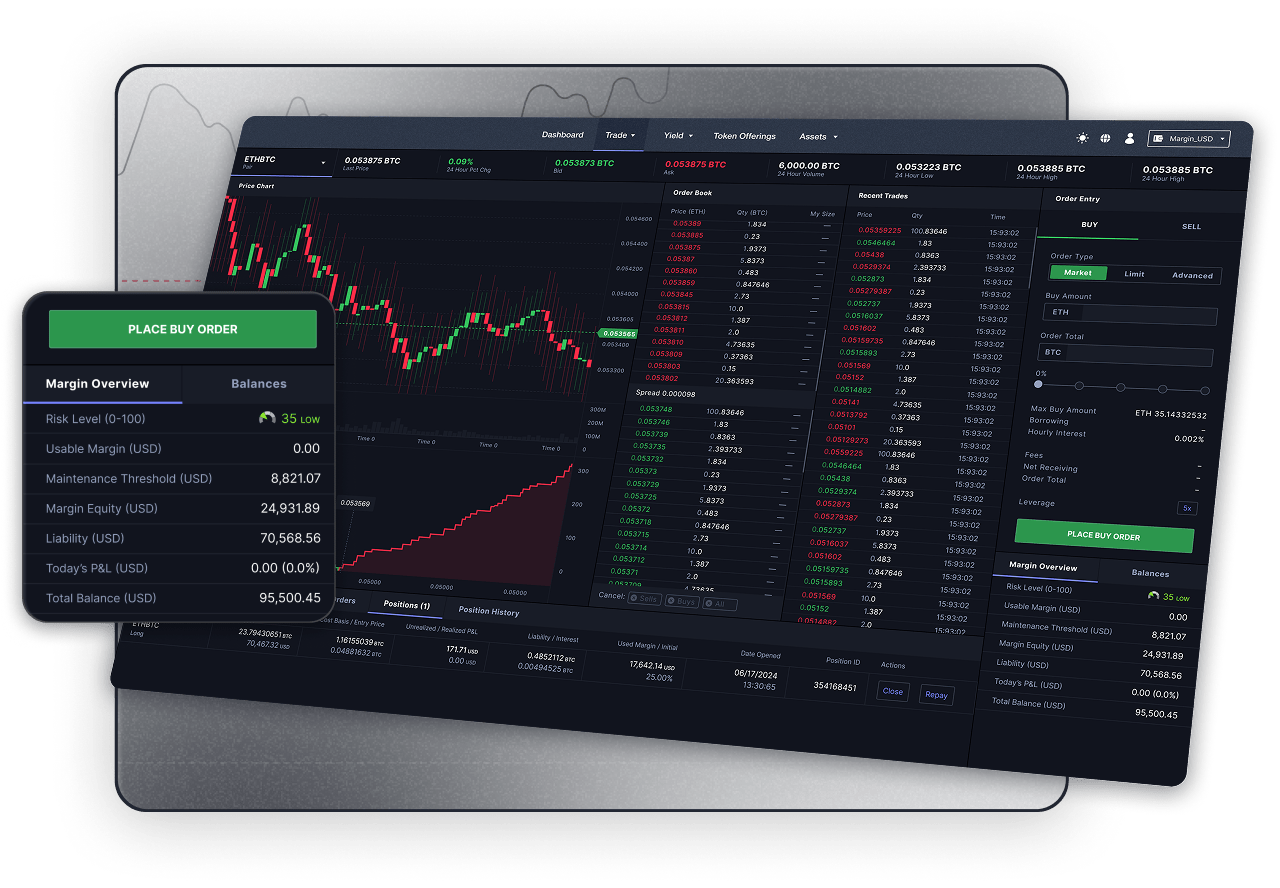

- Ongoing Transaction Monitoring: Automated systems scan trades for suspicious patterns or large transfers that could indicate money laundering or terrorist financing.

- Suspicious Activity Reporting: If something looks off, the exchange is required to flag it with regulators, fast.

The trouble at Coinbase happened because a technical bug let millions of transactions slip through without proper monitoring, meaning potentially risky activity wasn’t caught in time. For beginners, this highlights why robust technology and regular audits matter so much when choosing where to buy your first crypto.

The Impact on Safe Crypto Onboarding

This isn’t just a big-company problem, it affects everyone entering crypto today. As digital asset adoption grows, exchanges are under more pressure than ever to get compliance right. For newcomers, here’s why it matters:

- Your funds are safer on compliant platforms, which have controls to spot scams or illicit activity quickly.

- You’re less likely to face sudden account freezes or regulatory headaches, since compliant exchanges work closely with authorities.

- You help legitimize crypto as a whole, supporting its long-term growth by choosing platforms that play by the rules.

If you’re curious how these evolving regulations could impact your onboarding experience as a new user, or want deeper insights into how major players like Coinbase are shaping future rules, check out our resource on Coinbase’s push for federal crypto regulation.

But here’s the twist: even a giant like Coinbase, with its massive resources and regulatory focus, can get tripped up by technical failures. This proves that no exchange is immune to compliance risks. For crypto beginners, it’s a wake-up call to not just trust a brand name blindly, do your own due diligence before you deposit a single dollar.

What Coinbase Is Doing Now, and What It Means for You

After the fine, Coinbase has pledged to overhaul its monitoring systems. They’re investing heavily in stricter pre-deployment code reviews, more comprehensive testing, and routine quality assurance checks. This is good news for users, but it’s also a reminder that compliance is an ongoing process, not a box you check once and forget about.

Here’s why this matters if you’re just getting started:

What to Look For in a Safe Crypto Exchange

-

Regulatory Compliance: Choose exchanges registered with recognized regulators (like Central Bank of Ireland or U.S. SEC). This ensures oversight and adherence to anti-money laundering (AML) laws.

-

Robust Transaction Monitoring: Look for platforms that use advanced transaction monitoring systems to detect suspicious activity. Recent fines (like Coinbase’s $24.7M penalty) highlight why this matters.

-

Transparent Security Practices: Safe exchanges openly share information about their security measures, such as cold storage, two-factor authentication (2FA), and regular audits.

-

Clear User Onboarding & KYC: Reliable platforms require thorough identity verification (KYC) to prevent fraud and comply with regulations. This protects both you and the exchange.

-

Responsive Customer Support: Top exchanges offer fast, accessible customer service to help resolve issues and answer compliance questions quickly.

Coinbase’s $24.7 million penalty isn’t an isolated event, it’s part of a global trend toward tougher crypto oversight. Regulators are watching closely, and exchanges are being forced to raise their game or pay the price (literally). As more people flock to digital assets, platforms that cut corners on compliance are finding themselves out of favor, and sometimes out of business.

How to Protect Yourself When Onboarding

If you’re about to open your first crypto account, use this moment as motivation to be extra cautious. Here are some practical steps every beginner should take:

Remember: the safest exchanges aren’t always the flashiest or the ones with the most aggressive marketing. Look for platforms that are transparent about their compliance procedures and responsive when problems arise.

The Bigger Picture: Crypto Compliance in 2025

The Coinbase saga highlights how fast crypto regulation is evolving. With COIN trading at $309.14, market confidence remains high, but reputation can change overnight if trust breaks down. Expect even more sophisticated AML tools powered by AI and blockchain analytics in the near future, as both regulators and exchanges work overtime to keep bad actors out.

Ultimately, safe onboarding isn’t just about avoiding fines or bad headlines, it’s about building an industry where everyone can participate without fear of scams or regulatory chaos. If you want to dive deeper into how these changes could impact your experience as a new user (and how major players like Coinbase are pushing for smarter rules), check out our resource on Coinbase’s push for federal crypto regulation.