Once considered a fringe risk, cryptocurrency scams have now evolved into a full-blown national security concern in 2025. The scale and sophistication of so-called “pig butchering” and romance frauds have reached unprecedented heights, fueled by global criminal networks and the latest advances in artificial intelligence. For newcomers to crypto, understanding these threats is not just about protecting your wallet, it’s about recognizing how digital crime intersects with geopolitics, forced labor, and the integrity of financial systems worldwide.

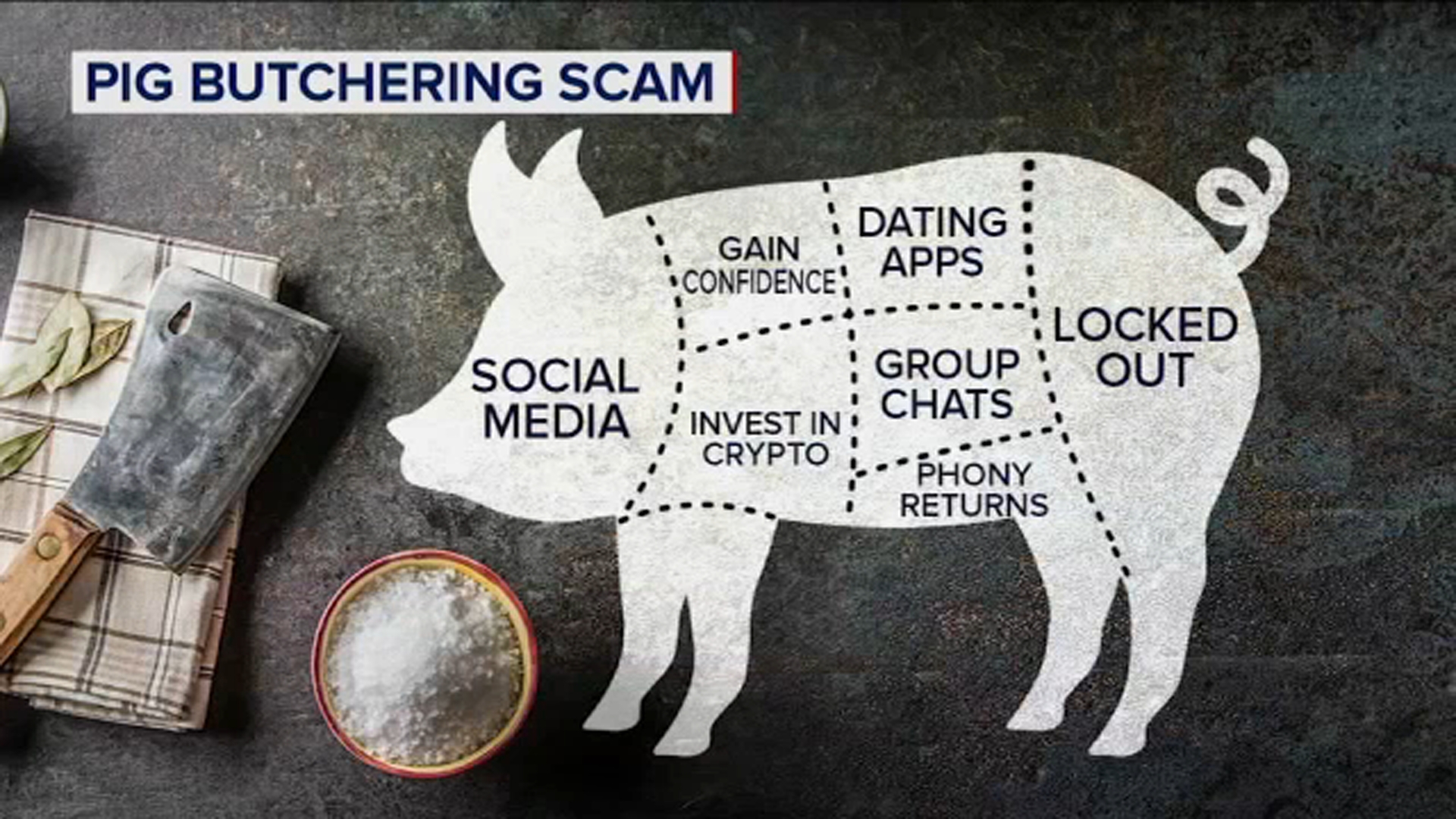

How Pig-Butchering Scams Work, and Why They’ve Exploded

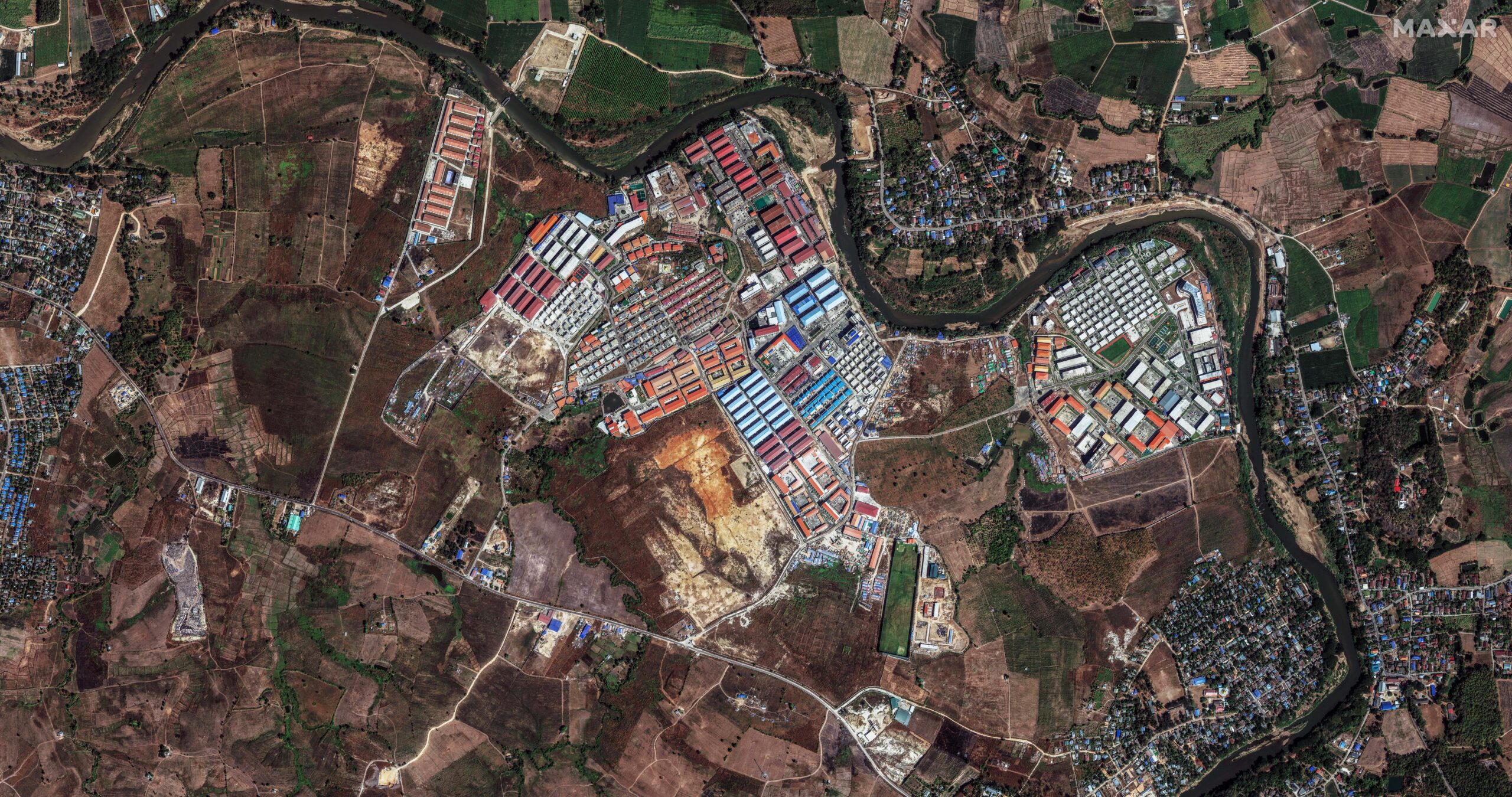

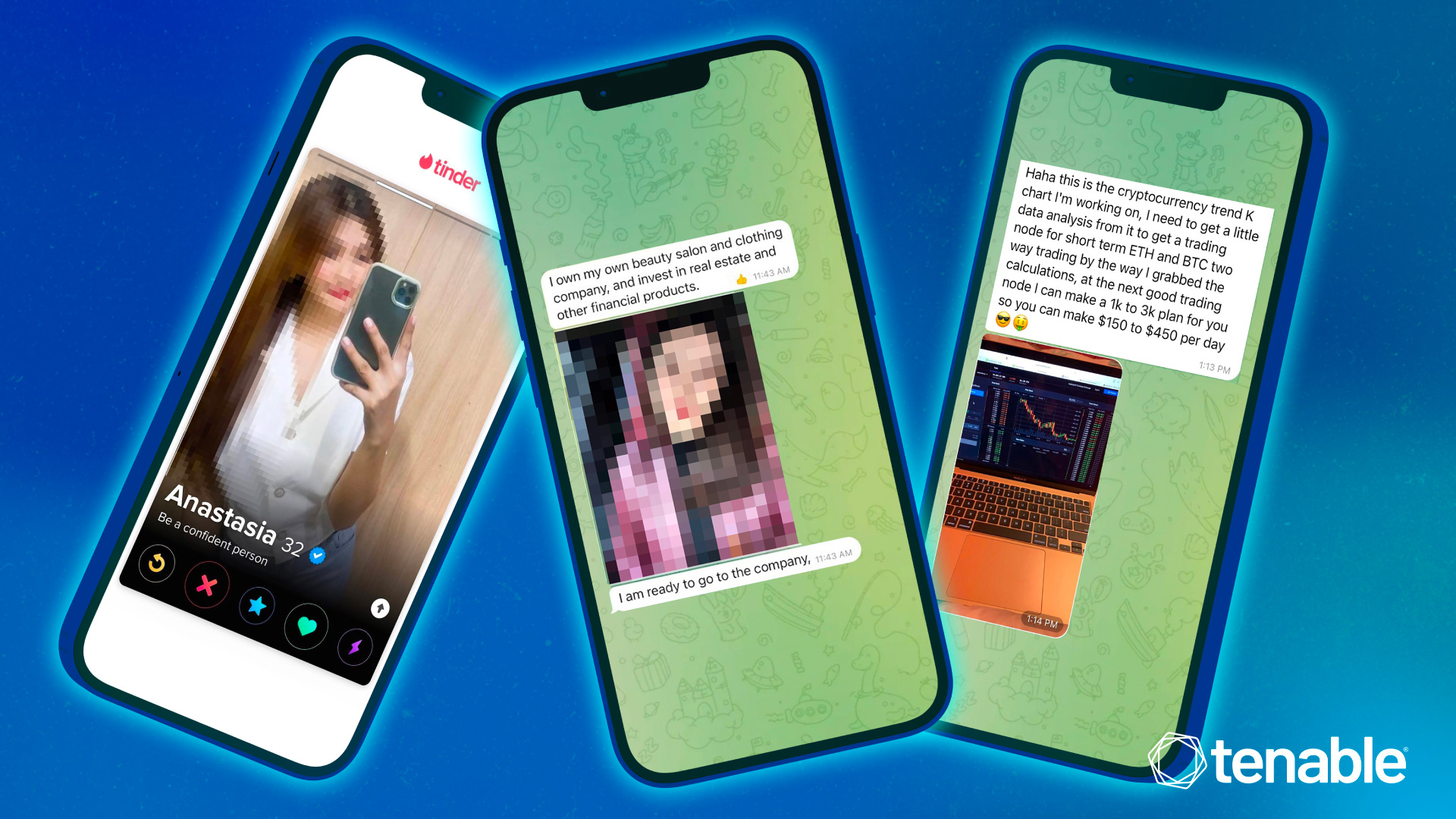

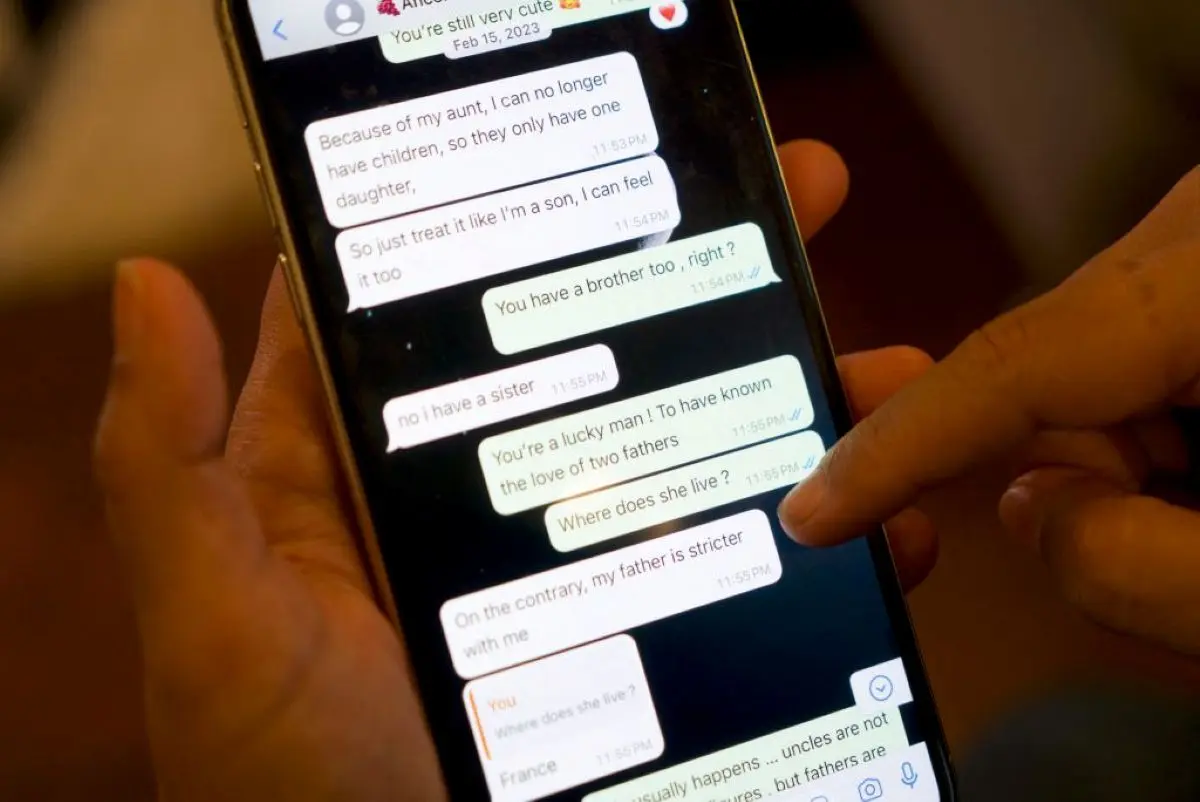

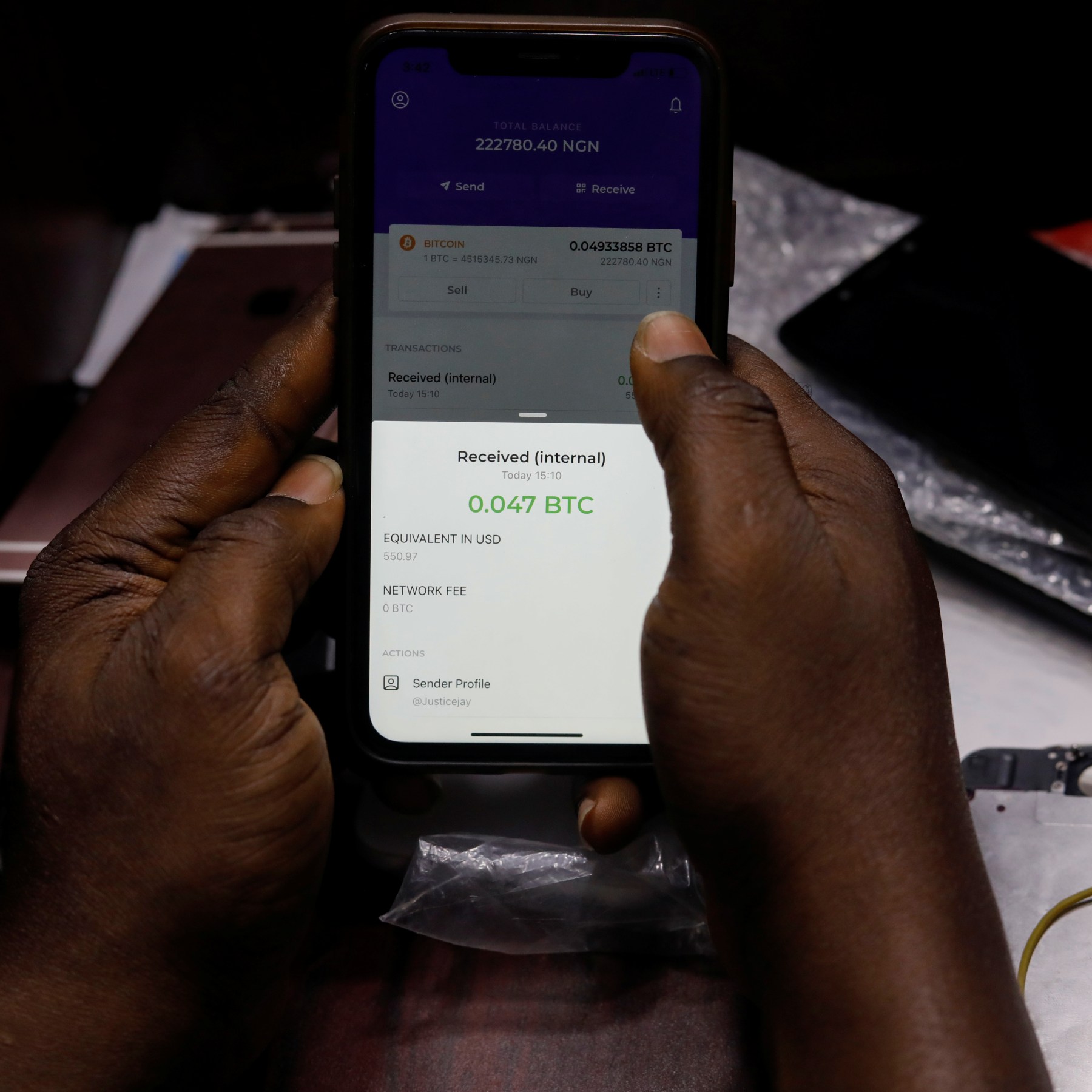

The term pig butchering may sound bizarre, but it describes a chillingly effective long-game scam. Criminals, often operating from compounds in Southeast Asia, use social engineering to “fatten up” their victims through months of online relationship-building. Posing as friends, business partners, or romantic interests on apps or social media, they slowly gain trust before introducing lucrative-sounding crypto investments.

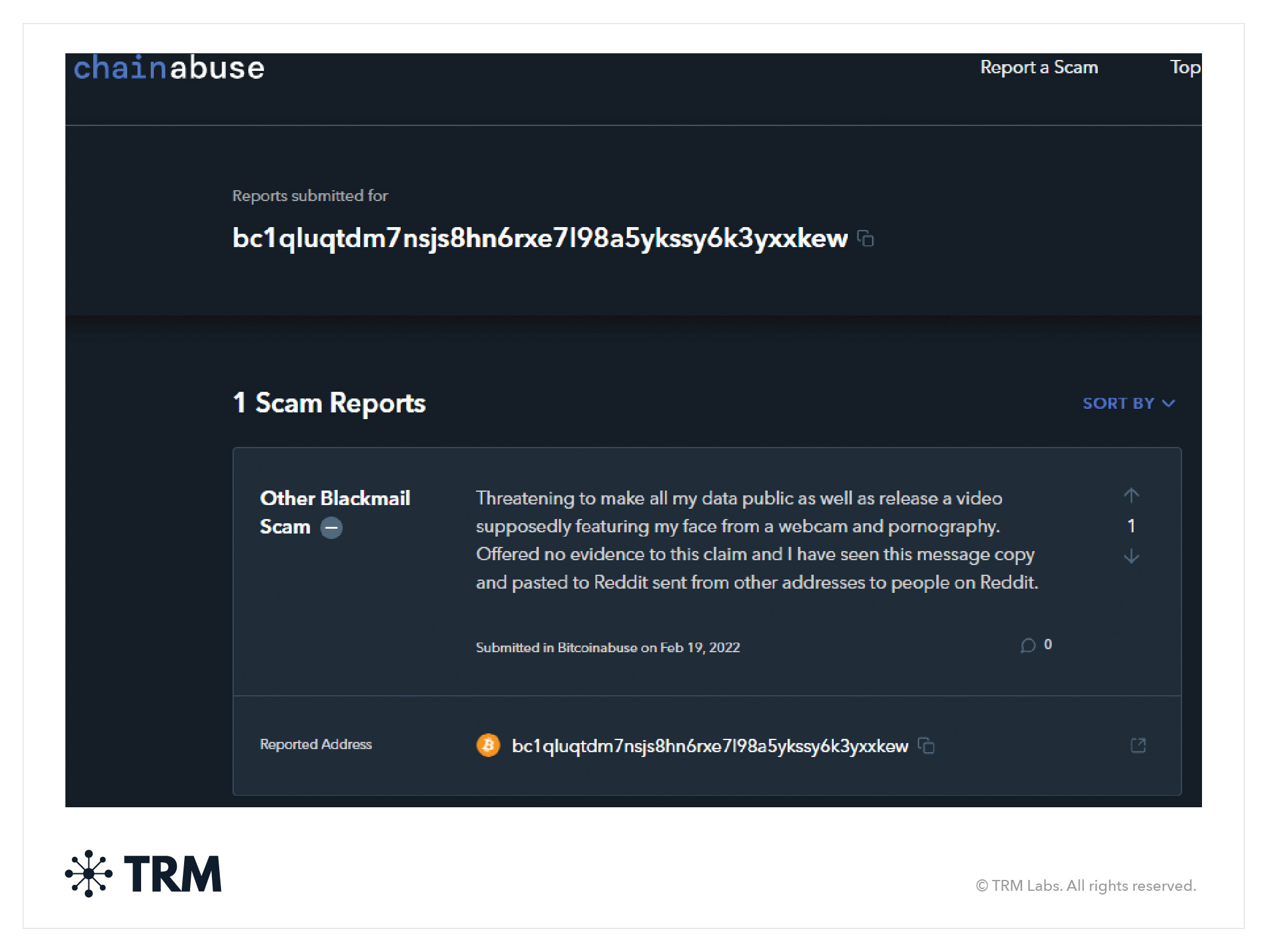

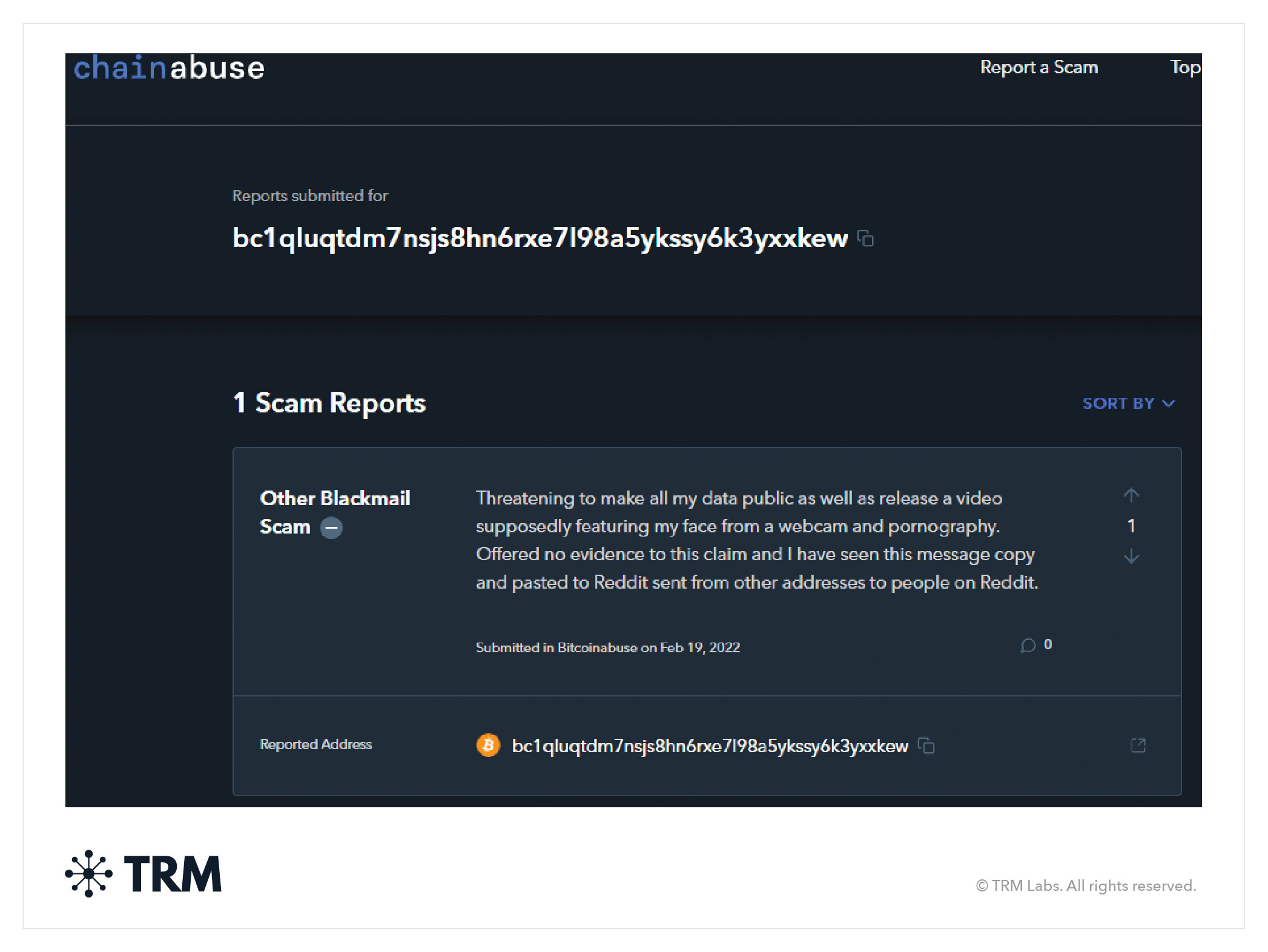

Victims are guided to deposit funds into what appear to be legitimate trading platforms. These sites often mimic real exchanges and show fake profits to encourage bigger deposits. But when victims try to withdraw their money, or even their supposed gains, they discover it’s all an elaborate illusion. According to the U. S. Secret Service (see more), this approach has proven devastatingly effective: “The key thing is to report the scam to any financial regulator or law enforcement. ”

The National Security Dimension: Beyond Individual Losses

What makes 2025 different isn’t just the record-breaking sums involved, such as the recent $15 billion Bitcoin seizure from Chen Zhi’s international syndicate, but how these scams now threaten national security. Forced labor is increasingly used by criminal organizations running scam compounds across Southeast Asia. Workers are trafficked and coerced into targeting Westerners online, creating a humanitarian crisis that extends far beyond mere financial theft.

The U. S. Treasury’s sanctions against Funnull Technology Inc. , a Philippines-based infrastructure provider for scam websites, signal that authorities now view these operations as strategic threats. By enabling cybercriminals at scale, through bulk IP address sales and anonymization services, companies like Funnull provide cover for transnational money laundering and data exfiltration.

Romance Fraud Meets AI: The New Face of Crypto Crime

Romance fraud has always been about emotional manipulation, but in 2025, scammers wield generative AI tools that make them almost indistinguishable from real people online. Synthetic profile images, deepfake video calls (or excuses for avoiding them), and personalized chatbots allow criminals to target victims at scale with unprecedented psychological precision.

This technological leap explains why losses from crypto-related investment frauds have soared this year. As Chainalysis reports, high-yield investment scams, especially pig butchering variants, dominated illicit revenues in 2024 and show no sign of slowing down.

What Every Crypto Newcomer Must Know Today

If you’re new to digital assets in 2025, vigilance is your first line of defense against these evolving threats:

- Be wary of unsolicited investment offers, especially those promising high returns with little or no risk.

- Verify all platforms independently. Never trust links sent by strangers; use official app stores or direct URLs.

- Insist on video calls before sending money. Refusal or repeated excuses should be treated as red flags.

- If something feels off, even emotionally, pause immediately. Scammers prey on urgency and isolation.

Reporting is not just a formality. Law enforcement agencies worldwide, from the U. S. Secret Service to specialized DOJ Strike Forces, have ramped up their response, but they rely on timely victim reports to trace funds, dismantle scam infrastructure, and rescue forced laborers trapped in scam compounds. In 2025, your vigilance helps protect not just yourself, but countless others.

Spotting Red Flags: The New Scam Playbook

Today’s pig-butchering scams are more sophisticated than ever. Criminals use professional-looking websites, fake regulatory certificates, and even staged customer service chats to lull victims into a false sense of security. Generative AI enables scammers to create convincing LinkedIn profiles and tailor communication styles to each target. Some operations now deploy entire teams posing as support staff or investment advisors.

Top Warning Signs of Pig-Butchering & Romance Crypto Scams in 2025

-

Unsolicited Messages from Strangers: Scammers often initiate contact via social media, messaging apps, or dating platforms, striking up friendly or romantic conversations out of the blue.

-

Promises of Guaranteed High Returns: Be wary of anyone promoting crypto investments with guaranteed profits or little risk. Legitimate investments never promise fixed, high returns.

-

Requests to Move Conversations Off-Platform: Fraudsters frequently push victims to switch from reputable apps to encrypted or less-regulated messaging platforms, making scams harder to trace.

-

Pressure to Act Quickly: Scammers create urgency, claiming limited-time offers or exclusive opportunities to pressure victims into sending money before verifying details.

-

Reluctance to Meet or Video Chat: If someone consistently avoids video calls or in-person meetings, it’s a major red flag—especially if they’re asking for money.

-

Requests to Use Unfamiliar Crypto Platforms: Victims are often directed to unknown or unregulated exchanges or fake investment websites, sometimes linked to entities like Funnull Technology Inc.

-

Complex, Overly Technical Explanations: Scammers may use jargon or complicated explanations to confuse victims and mask fraudulent schemes.

-

Stories of Sudden Wealth or Success: Fraudsters often claim they made huge profits in crypto and can help you do the same, leveraging fake screenshots or testimonials.

-

Requests for Personal or Financial Information: Be alert if someone you met online asks for sensitive details, such as your ID, banking info, or wallet keys.

-

Reluctance to Provide Verifiable Company Details: Legitimate investment opportunities are transparent about company registration, licensing, and leadership. Scammers evade such questions or provide fake documentation.

Beyond the digital smoke and mirrors, some warning signs remain timeless: requests for secrecy, pressure to act fast on “limited-time” opportunities, or sudden changes in communication style once money is involved. If you encounter any of these signals, step back and consult trusted sources.

What To Do if You Suspect a Scam

If you believe you’ve been targeted by a pig-butchering or romance crypto scam:

- Cease all communication immediately with the suspected scammer.

- Document everything: save chat logs, emails, transaction records, and screenshots of websites or profiles involved.

- Report promptly: Contact your local law enforcement and relevant regulators such as the U. S. Secret Service or the Department of Financial Protection and Innovation.

- Avoid sending more funds, even if pressured with threats or promises of recovery.

The faster you act, the better your chances of limiting losses, and potentially helping authorities disrupt larger criminal networks.

A Community Approach: Staying Safe While Onboarding Into Crypto

The fight against crypto scams is not just individual; it’s collective. As more newcomers enter digital assets in search of opportunity, communities must foster a culture of skepticism and education. Share resources about scam prevention with friends and family, especially those who may be less tech-savvy. Participate in reputable forums where experienced users share recent scam tactics and safety tips.

For deeper guidance on how these scams are evolving, and practical steps for newcomers, see our detailed resource here: How Crypto Scams Like Pig Butchering Are Evolving: What Newcomers Must Know After $225M Seizure.

The Bottom Line for 2025

As digital finance becomes ever more entwined with global security issues, knowledge remains your best hedge against risk. Pig-butchering scams are no longer isolated incidents, they’re part of an international criminal ecosystem that adapts as quickly as technology itself. By staying informed, questioning too-good-to-be-true offers, and reporting suspicious activity promptly, every crypto newcomer can play a role in turning the tide against this new breed of fraudster.