Crypto onboarding in 2025 looks radically different than it did just a year ago. The recent $1 trillion meltdown, with Bitcoin now trading at $84,320 (down 4.17% in 24 hours), has sent shockwaves through the market and forced both new and seasoned investors to rethink their approach. If you’re considering entering the crypto space or expanding your holdings, understanding how this crash reshapes onboarding is absolutely essential.

Bitcoin’s $1 Trillion Meltdown: What Happened?

Let’s set the stage: Just weeks ago, Bitcoin was riding high above $125,000. Fast forward to today and we’re staring at $84,320. That’s not just a dip – it’s a seismic shift that wiped out over $1 trillion in market value. The causes? A perfect storm of geopolitical tensions (think U. S. -China tariff escalations), excessive trader leverage leading to mass liquidations, and regulatory curveballs like the launch of the U. S. Strategic Bitcoin Reserve.

This isn’t just headline fodder. It’s a wake-up call for anyone onboarding into crypto right now. But here’s the kicker: Despite this volatility, a Kraken survey shows that 73% of U. S. crypto holders still plan to continue investing in 2025. So what are they doing differently? And more importantly – what should you do?

The New Rules for Safe Crypto Onboarding in 2025

If there’s one thing we’ve learned from this year’s crash, it’s that onboarding strategies matter more than ever. Here are three actionable strategies every new investor should use to protect themselves:

3 Essential Onboarding Strategies for 2025 Crypto Investors

-

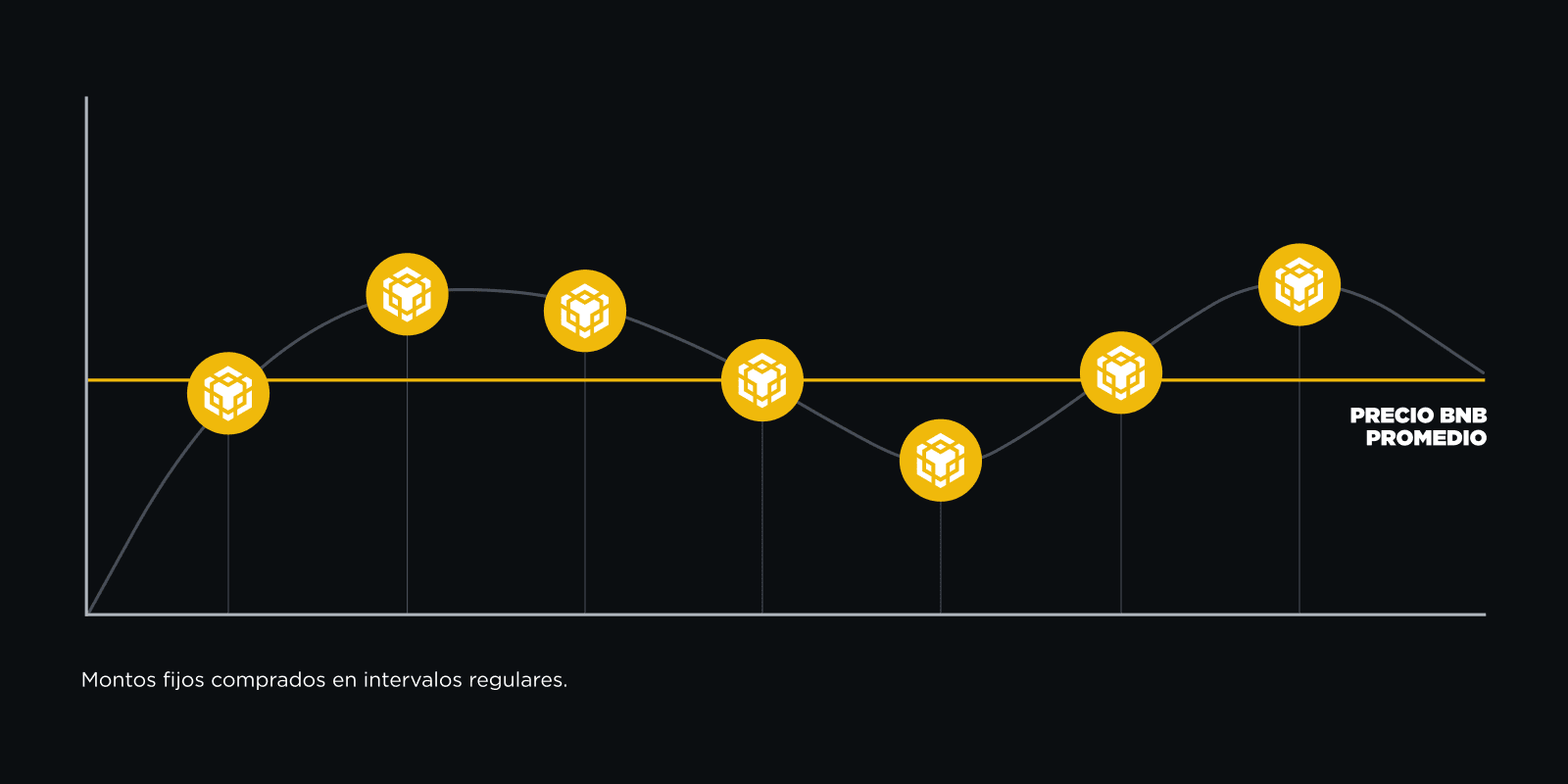

Implement Tiered Investment and Dollar-Cost Averaging (DCA): Avoid lump-sum investments by spreading purchases over time and allocating only a small portion of your portfolio to crypto. This approach helps minimize exposure to sharp downturns, as seen in Bitcoin’s fall from over $125,000 to $84,320 in 2025.

-

Utilize Automated Risk Management Tools: Leverage features such as stop-loss orders, portfolio rebalancing bots, and liquidation alerts offered by major platforms. These tools help proactively manage downside risk and avoid forced liquidations during market crashes.

- Prioritize Secure, Regulated Onboarding Platforms: In volatile times like these, choosing exchanges and wallets with robust regulatory compliance is non-negotiable. Look for platforms such as Kraken or Coinbase that offer transparent security protocols and have an established track record. This reduces your counterparty risk if markets get even choppier.

- Implement Tiered Investment and Dollar-Cost Averaging (DCA): Forget FOMO-fueled lump-sum buys! Spread your purchases over time using DCA and only allocate a small portion of your portfolio to crypto. This way, you minimize exposure if another sharp downturn hits – just like we saw when BTC plummeted from over $125K down to today’s level.

- Utilize Automated Risk Management Tools: Platforms like Kraken now offer stop-loss orders, portfolio rebalancing bots, and liquidation alerts. These tools can help you proactively manage downside risk so you don’t get caught off guard by sudden crashes or forced liquidations.

Navigating Volatility: What New Investors Need To Know Now

The biggest lesson from Bitcoin’s rapid descent? No one is immune to volatility. Even with all-time highs still fresh in memory, sharp reversals can erase months of gains almost overnight. As a newcomer, resisting knee-jerk reactions is crucial – especially when headlines scream panic.

Your best defense is knowledge plus smart systems:

- Diversify beyond just crypto.

- Avoid margin unless you fully understand the risks.

- Stay informed about global events and new regulations.

If you want more deep dives on how this crash impacts onboarding specifically (including how altcoin sell-offs fit into the picture), check out our related analysis at this link.

Bitcoin Price Prediction 2026-2031

Post-2025 Crash Recovery Outlook: Conservative, Baseline, and Bullish Scenarios for BTC

| Year | Minimum Price (Bearish) | Average Price (Baseline) | Maximum Price (Bullish) | Potential % Change (Avg. YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $68,000 | $92,000 | $135,000 | +9% | Recovery phase; volatility remains high, regulatory clarity improves, institutions cautiously return |

| 2027 | $75,000 | $105,000 | $155,000 | +14% | Adoption resumes, possible ETF expansion, Kraken IPO drives mainstream attention |

| 2028 | $82,000 | $120,000 | $185,000 | +14% | Macro stabilization, new use cases (e.g., RWA tokenization), improved risk management tools |

| 2029 | $90,000 | $137,000 | $210,000 | +14% | Next halving cycle anticipation, increased global adoption, competition from CBDCs |

| 2030 | $98,000 | $155,000 | $240,000 | +13% | Mature regulatory frameworks, Bitcoin as a reserve asset narrative strengthens |

| 2031 | $110,000 | $175,000 | $270,000 | +13% | Wider integration in financial systems; potential for new ATHs amidst cyclical consolidation |

Price Prediction Summary

Following the sharp correction in 2025, Bitcoin is expected to gradually recover, though volatility and macro risks persist through 2026. As institutional confidence rebuilds and regulatory clarity improves, Bitcoin could regain momentum, especially if mainstream adoption and technology improvements accelerate. By 2031, BTC may approach or surpass previous all-time highs, though the path will likely include periods of sharp corrections and recoveries. Investors should expect a wide range of outcomes, with prudent risk management essential.

Key Factors Affecting Bitcoin Price

- Macroeconomic conditions and global risk appetite (especially geopolitical tensions)

- Regulatory evolution, especially in the U.S. and EU

- Institutional adoption (e.g., ETFs, corporate treasuries, Kraken IPO impact)

- Advancements in Bitcoin scalability and security

- Competition from CBDCs and next-generation blockchains

- Cyclicality of crypto markets (halving cycles, speculative booms/busts)

- Market psychology and adoption trends among retail investors

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

While the market’s recent shakeout has rattled nerves, it’s also sparked a renewed focus on building resilience from day one. Let’s break down how you can put these onboarding strategies into play, no matter your experience level.

How to Put These Strategies Into Action

1. Prioritize Secure, Regulated Onboarding Platforms

If you’re just starting out or moving funds after the Bitcoin price crash of 2025, don’t compromise on security. Exchanges like Kraken and Coinbase have doubled down on compliance and transparency, especially following the recent volatility. They offer two-factor authentication, insurance coverage for custodial assets, and clear communication about regulatory changes, essentials for minimizing counterparty risk when markets get rocky.

2. Implement Tiered Investment and Dollar-Cost Averaging (DCA)

The days of YOLO-ing your entire paycheck into Bitcoin are over, and that’s a good thing. By splitting your investments into smaller tranches over weeks or months (a technique called DCA), you blunt the impact of sudden price swings like those seen when BTC tumbled from $125,000 to $84,320. Pair this with only allocating a modest slice of your overall portfolio to crypto; it’s about exposure without overexposure.

3. Utilize Automated Risk Management Tools

Don’t try to outsmart the market with gut feelings alone. Instead, leverage automated tools now widely available on major platforms. Stop-loss orders help cap your downside; portfolio rebalancing bots keep your allocations in check as prices move; liquidation alerts give you time to act before forced sell-offs hit your account. These features aren’t just for pros, they’re table stakes for anyone serious about surviving crypto’s wild cycles.

Why These Steps Matter More Than Ever in 2025

This year’s $1 trillion Bitcoin meltdown wasn’t just another blip, it exposed the urgent need for smarter onboarding and risk discipline across all investor levels. The fact that 73% of U. S. crypto holders still plan to invest speaks volumes: faith in blockchain tech remains strong, but the approach is evolving.

The upcoming Kraken IPO, rumored for Q1 2026, could inject new legitimacy and institutional trust into the sector, potentially stabilizing some volatility long-term. But until then, expect more turbulence as regulatory frameworks shift and macro events unfold.

Your Crypto Onboarding Checklist for 2025:

- Vet all platforms for regulatory compliance

- Diversify beyond crypto assets

- Set up stop-losses and portfolio alerts immediately after funding accounts

- Avoid leverage unless fully understood (and even then, use extreme caution)

- Keep learning, crypto shouldn’t be cryptic!

If you want a deeper look at how these strategies work during altcoin sell-offs or want more context on market psychology post-crash, our detailed guide is available here.

Final Thoughts: Turning Lessons Into Long-Term Wins

The 2025 crypto crash was brutal, but it’s also an opportunity to build smarter habits from day one. If you treat onboarding as more than just clicking “buy” on an app, and instead focus on secure platforms, disciplined investment pacing, and automated risk controls, you’ll be far better positioned than most when the next big move comes.

I always say: “The trend is your friend, until it ends. ” In this new era of digital assets, let that mantra guide not just your trading but how you enter the space in the first place.