The cryptocurrency market in November 2025 has delivered a harsh lesson to new investors, with Bitcoin (BTC), XRP, and Dogecoin (DOGE) all experiencing severe price drops and mass liquidations. After reaching an all-time high of over $125,000 in early October, Bitcoin’s value has now settled at $84,902, erasing nearly all gains for the year. For those new to crypto onboarding during a crash, the volatility can be both bewildering and financially painful.

Why Did the 2025 Crypto Crash Happen? Macro Triggers and Market Structure

The roots of the 2025 crypto crash are multi-layered. The most immediate catalyst was geopolitical: former President Donald Trump’s announcement of steep new tariffs on Chinese imports spooked global markets, triggering panic selling in risk assets and draining liquidity from crypto exchanges. This macro shock was compounded by persistently high interest rates from the Federal Reserve. With traditional assets suddenly more attractive, capital rotated out of speculative tokens like BTC, XRP, and DOGE.

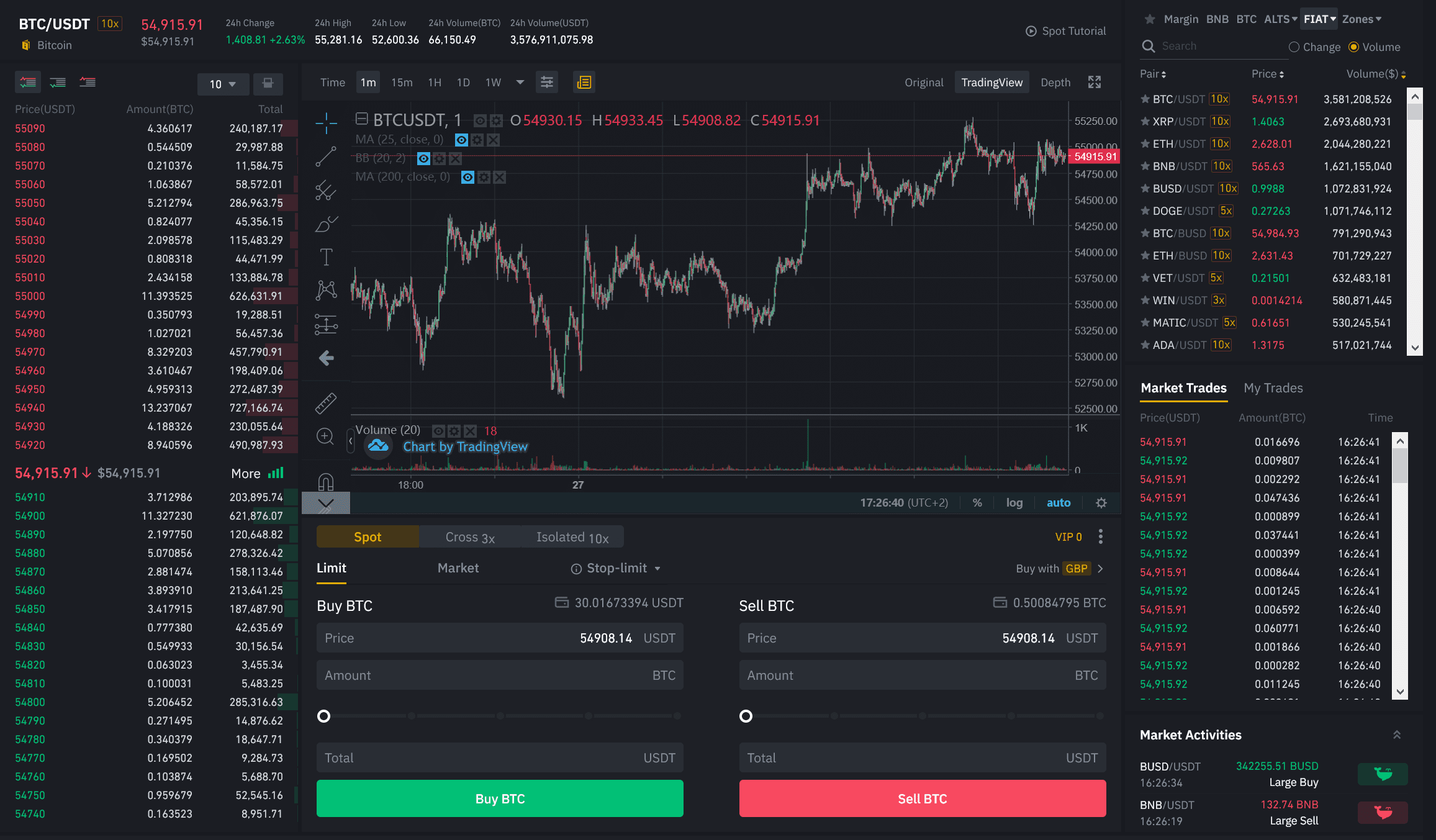

However, structural weaknesses within crypto markets amplified these shocks. Heavy use of leverage, where traders borrow funds to amplify positions, meant that even modest price drops triggered cascading liquidations. According to CoinGlass data, nearly $2 billion in leveraged positions were wiped out in just 24 hours as Bitcoin fell to $82,000 at its lowest point this cycle.

This combination of macroeconomic pressure and market mechanics underscores why risk management is non-negotiable for anyone entering digital assets today.

Bitcoin Liquidation Lessons: From $126K Highs to $84K Reality

The journey from Bitcoin’s $126,000 peak to its current $84,902 level offers a case study in how quickly sentiment can reverse, and how devastating leverage can be for unprepared newcomers. The October crash alone erased over $1.2 trillion in total crypto market capitalization within weeks (details here). When prices fell sharply after the tariff news broke, exchanges automatically liquidated billions in long positions due to margin calls, a process that accelerates sell pressure and deepens losses.

For new investors who entered near the highs or used leverage without understanding liquidation risks, the experience was brutal. Many saw their entire portfolios wiped out overnight as stop-losses failed or were triggered far below intended levels due to low liquidity.

XRP and Dogecoin: Why Altcoins Amplified Investor Pain

While Bitcoin dominated headlines with its historic plunge, altcoins like XRP and Dogecoin suffered even more dramatic declines. As of November 23rd:

- XRP crashed below key support levels ($2.20), with experts predicting further drops toward $1.25 amid whale selling and forced liquidations.

- DOGE fell over 62% from its recent highs before rebounding slightly alongside Bitcoin’s partial recovery.

This outsized volatility is typical during major downturns; altcoins often lack deep liquidity pools or institutional buyers willing to step in when panic sets in. For beginners attracted by outsized returns during bull runs, and who may have ignored risk management basics, the lesson is clear: what goes up fast can come down even faster.

Bitcoin (BTC) Price Prediction 2026-2031 After the 2025 Crash

Professional forecast for BTC price recovery and growth scenarios after the 2025 market crash, incorporating macroeconomic, regulatory, and crypto-specific factors.

| Year | Minimum Price | Average Price | Maximum Price | Yearly Change (%) | Market Outlook |

|---|---|---|---|---|---|

| 2026 | $62,000 | $84,000 | $110,000 | -2.5% to +29.5% | Volatile recovery, regulatory scrutiny, possible double-bottom |

| 2027 | $66,000 | $92,000 | $125,000 | +9.5% | Gradual stabilization, increased institutional interest |

| 2028 | $78,000 | $105,000 | $145,000 | +14.1% | Bullish cycle, halving-driven rally, mainstream adoption |

| 2029 | $90,000 | $120,000 | $168,000 | +14.3% | New ATH potential, improved macro climate |

| 2030 | $105,000 | $138,000 | $190,000 | +15.0% | Wider crypto integration, strong tech upgrades |

| 2031 | $120,000 | $159,000 | $220,000 | +15.2% | Mature market, competition from CBDCs, regulatory clarity |

Price Prediction Summary

Following the sharp downturn in late 2025, Bitcoin is expected to experience a period of volatility and consolidation through 2026, with prices potentially dipping further before a gradual recovery. From 2027 onward, market stabilization and renewed adoption could drive BTC back toward and beyond previous all-time highs, especially as macroeconomic headwinds ease and technological advancements continue. By 2030-2031, Bitcoin could see new highs, but increasing competition from traditional finance and digital currencies may temper extreme gains.

Key Factors Affecting Bitcoin Price

- Macroeconomic policy (interest rates, inflation, global trade tensions)

- Regulatory developments (crypto laws, ETF approvals, taxation)

- Adoption rates among retail and institutional investors

- Bitcoin halving events and supply shocks

- Technological upgrades (scalability, security, energy efficiency)

- Competition from altcoins, stablecoins, and central bank digital currencies (CBDCs)

- Market sentiment and risk appetite post-2025 crash

- Geopolitical stability and capital flow trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Role of Liquidations: How Automated Selling Magnifies Losses

Liquidations are not just technical events, they are a core reason why crashes spiral out of control. When leveraged traders cannot meet margin requirements as prices fall, exchanges forcibly sell their holdings at market prices regardless of current demand or fair value. This creates a feedback loop where falling prices trigger more liquidations which then drive prices lower still, a situation painfully evident during October’s record-breaking $19 billion liquidation wave.

If you’re onboarding into crypto during such periods, or even if you’re just watching from the sidelines, it’s crucial to understand how these mechanisms work before risking capital.

For those who weathered the storm, the 2025 crypto crash has been a masterclass in why robust risk management and emotional discipline are essential for survival. The speed and scale of liquidations in Bitcoin, XRP, and Dogecoin exposed the dangers of over-leveraging and chasing hype without a clear exit plan. This is especially relevant for new investors who may have entered the market with little appreciation for how quickly fortunes can reverse when volatility spikes.

Practical Risk Management: Surviving and Learning from the Downturn

With Bitcoin now trading at $84,902, many newcomers are asking: what should I do next? The answer starts with recognizing that drawdowns are a structural feature of crypto markets, not an anomaly. Here are several actionable risk management principles that can help new investors navigate future downturns:

Top Risk Management Tips for Crypto Beginners

-

Avoid Excessive Leverage: Platforms like Binance Futures and Kraken Futures offer leverage, but using high leverage increases liquidation risk, as seen when over $1 billion in positions were wiped out in a single day in November 2025.

-

Diversify Your Portfolio: Spread investments across established cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), XRP, and Dogecoin (DOGE) to reduce exposure to single asset crashes.

-

Monitor Macroeconomic Events: Track major financial news on platforms like CoinDesk and Yahoo Finance for updates on interest rates, inflation, and political events—such as tariff announcements—that can trigger market volatility.

-

Keep Emotions in Check: Use portfolio tracking apps like Blockfolio or Delta to make informed decisions based on data, not panic or hype, especially when markets swing rapidly.

- Avoid excessive leverage: Leverage magnifies both gains and losses. Most liquidations during this crash were triggered by leveraged positions.

- Diversify across assets: Don’t put all your capital into one token or sector. Even large caps like BTC and XRP can suffer steep drops.

- Use stop-losses wisely: Set realistic stop-loss levels but understand they may not always execute at your chosen price during high volatility.

- Keep cash reserves: Having dry powder allows you to take advantage of opportunities when prices dislocate.

- Focus on long-term fundamentals: Don’t let short-term price swings dictate your entire strategy. Consider dollar-cost averaging into quality projects.

The above checklist isn’t theoretical, it’s drawn directly from lessons learned by thousands of traders during this year’s crash (see more onboarding insights here). By implementing these steps, new investors can reduce their vulnerability to forced selling and panic-driven mistakes.

Opportunities Amidst Chaos: Is It Time to Enter or Wait?

The aftermath of a major market selloff often presents unique opportunities. Historically, periods following sharp corrections have delivered some of the best long-term entry points for disciplined investors willing to wait out further volatility. However, it’s crucial not to blindly “buy the dip”: especially if you don’t have a clear thesis or risk controls in place.

This is where patience and research pay off. Use this period to study macroeconomic drivers (such as interest rates and global trade policy), understand how liquidation cascades work, and evaluate which projects have real staying power beyond speculation. Remember that while Bitcoin has rebounded from similar corrections before, altcoins like XRP and DOGE may take longer, or never fully recover, depending on broader sentiment shifts.

Key Takeaways for New Crypto Investors in 2025

- The current price landscape is unforgiving but educational: With Bitcoin at $84,902 after peaking at $126,000 just weeks ago, complacency is costly.

- XRP’s slide below $2.20 support shows how quickly sentiment can sour, even on large-cap tokens, and why diversification matters.

- The Dogecoin rollercoaster (-62% before partial recovery) highlights both the risks and potential rewards inherent in speculative altcoins.

If you’re onboarding now or considering re-entry after being sidelined by liquidations, focus on developing a measured approach grounded in risk awareness rather than FOMO-driven decision making. There will always be another cycle, but only those who learn from past crashes will be positioned to benefit when stability returns.

For further reading on how liquidations shape market structure during crashes, and what every investor should watch for, visit our deep dive: How Crypto Liquidations Impact Prices During Market Crashes.