The IRS crypto tax rules for 2025 represent the most significant shift in digital asset reporting since the agency first recognized cryptocurrency as property. Whether you are new to crypto or a seasoned investor, understanding these changes is critical for avoiding costly mistakes and ensuring full compliance. While only about a quarter of crypto investors have historically complied with their tax obligations, new regulations are designed to close this gap through increased transparency and stricter enforcement.

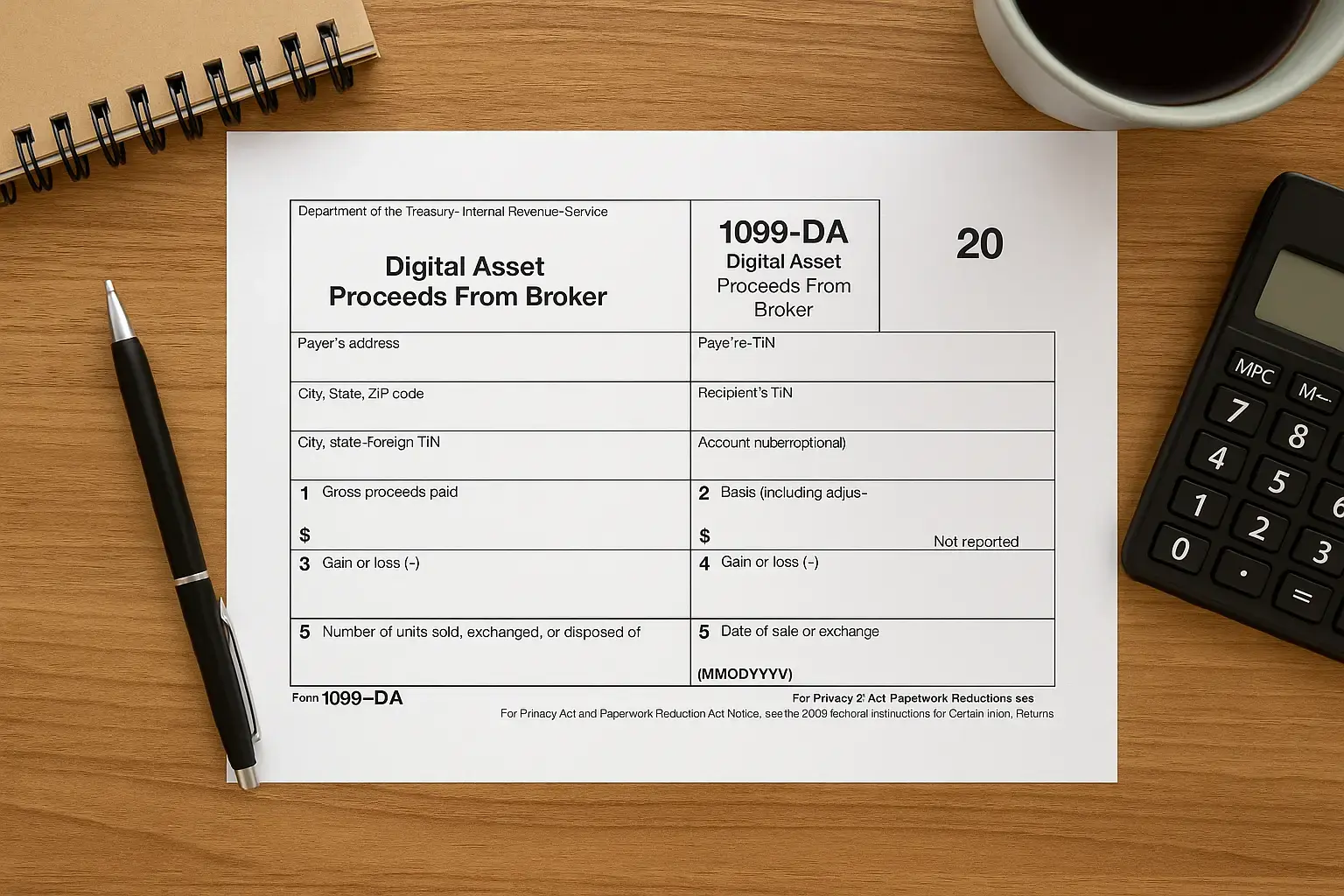

Form 1099-DA: The New Standard for Crypto Tax Reporting

Beginning January 1,2025, all major cryptocurrency exchanges must issue Form 1099-DA to their customers. This new form details your gross proceeds from crypto sales and exchanges, much like the familiar forms used in stock trading. For many investors, this marks a pivotal change: previously, tracking gains and losses relied heavily on self-reporting and manual record keeping. Now, every taxable event processed by a centralized exchange will be reported directly to both you and the IRS.

It is important to note that while Form 1099-DA will be issued starting with the 2025 tax year, its requirements will expand in 2026 to include cost basis information – that is, what you originally paid for your crypto assets. Until then, you are responsible for providing accurate cost basis data when filing your taxes.

Cost Basis Reporting: No More Universal Wallets

The IRS has tightened its approach to cost basis reporting. You can no longer use a universal wallet method to aggregate your transactions across platforms or wallets. Instead, each sale must be reported based on the specific wallet or account where the asset was held. This means meticulous record keeping is no longer optional – it is essential.

The implementation of these cost basis rules has been delayed until January 1,2026; however, proactive organization now will save time and stress later. Investors should track acquisition dates, purchase prices (including transaction fees), and details for every transaction by wallet or exchange account.

DeFi Platforms: Regulatory Repeal Changes the Landscape

A major development in April 2025 was President Trump’s repeal of expanded IRS reporting obligations for decentralized finance (DeFi) platforms. This means DeFi brokers operating without traditional intermediaries are not required to issue Form 1099-DA or similar reports under current law. Centralized exchanges remain under strict scrutiny; DeFi users must still self-report all taxable events such as sales or swaps but may not receive standardized documentation from platforms.

This regulatory divergence places greater responsibility on DeFi participants to maintain their own records and understand which transactions are taxable events under U. S. law.

Taxation of Staking Rewards and DeFi Income

The IRS has clarified that all staking rewards must be reported as ordinary income at the time they are received – not just when they are sold or exchanged. The same applies to income from DeFi lending or yield farming activities; any rewards or interest earned must be included in your taxable income even if paid out in tokens rather than cash.

This update closes previous gray areas around timing and recognition of income from digital assets. Accurate tracking of reward receipts is now non-negotiable for anyone earning yield through staking or decentralized finance protocols.

With these clarifications, ignoring or underreporting staking or DeFi income is no longer a viable option. The IRS has explicitly stated that all such income is subject to taxation when received, regardless of whether it is immediately converted to fiat currency. This shift increases the importance of using reliable portfolio tracking tools and maintaining a disciplined approach to documentation.

Enforcement: Data Analytics and Increased Scrutiny

The IRS is not relying on voluntary compliance alone. Through partnerships with blockchain analytics firms, the agency now has advanced capabilities to trace crypto transactions across public ledgers and exchanges. This technology-driven enforcement means that even seemingly private or obscure transactions can be identified and matched to individual taxpayers. Non-compliance risks triggering audits, penalties, and even criminal charges in cases of willful evasion.

Investors should expect more correspondence from the IRS regarding unreported crypto activity, especially as Form 1099-DA adoption becomes widespread. If you receive such a notice, address it promptly and consider consulting a tax professional with digital asset experience.

Key IRS Crypto Tax Changes for 2025

-

Form 1099-DA Introduced: Starting January 1, 2025, crypto exchanges like Coinbase and Kraken must issue Form 1099-DA to customers, reporting all crypto sales and exchanges to both users and the IRS.

-

Cost Basis Reporting Overhaul: Investors must now report the cost basis for each crypto sale by specific wallet or account, ending the previous universal wallet approach. Detailed record-keeping is essential for every transaction.

-

Delay in Cost Basis Implementation: The IRS has postponed the new cost basis reporting rules until January 1, 2026, giving brokers and taxpayers more time to adapt to the changes.

-

Repeal of DeFi Reporting Obligations: In April 2025, legislation nullified IRS rules requiring DeFi platforms to report user transactions. Only centralized exchanges are now obligated to report under the new rules.

-

Taxation of Staking and DeFi Income Clarified: Staking rewards and DeFi lending/yield farming income must be reported as ordinary income when received, not just when sold or converted.

-

Increased IRS Enforcement: The IRS is partnering with blockchain analytics firms to monitor crypto transactions, aiming to detect non-compliance and ensure accurate tax reporting.

Best Practices for Crypto Tax Compliance in 2025

Whether you are just starting your crypto journey or have been trading for years, adopting a systematic approach to tax compliance will help you avoid costly surprises. Here are some practical strategies:

- Automate Record-Keeping: Use reputable portfolio trackers that integrate with your wallets and exchanges to log every transaction in real time.

- Understand What’s Taxable: Selling, swapping, earning rewards, or receiving payment in crypto all create taxable events, even if no fiat currency changes hands.

- Separate DeFi from CEX Activity: Since reporting standards differ between decentralized platforms and centralized exchanges, keep clear records for each type of activity.

- Prepare for Cost Basis Reporting: Even though full implementation starts in 2026, begin organizing your purchase history by wallet/account now.

- Consult Experts: If you’re unsure about any aspect of your crypto taxes, seek guidance from professionals familiar with current IRS rules.

Frequently Asked Questions: Crypto Tax Rules for 2025

The landscape of crypto taxation is evolving rapidly. The introduction of Form 1099-DA marks a new era of transparency for centralized exchange users while the repeal of DeFi reporting rules creates a bifurcated system that places more onus on self-reporting. Meanwhile, heightened enforcement signals that the days of flying under the radar are over for U. S. -based investors.

The best defense against future audits or penalties is proactive compliance today. By staying informed about new regulations, keeping impeccable records, and seeking professional advice when needed, both beginners and experienced investors can navigate the complexities of crypto taxation with confidence, and focus on building their portfolios rather than worrying about tax season surprises.