Vanguard’s recent about-face on cryptocurrency ETFs feels like a seismic shift for everyday investors eyeing Bitcoin exposure. After years of sidelining these products as too speculative, the firm now permits trading of select crypto ETFs on its platform, effective December 1,2025. This comes amid BlackRock’s iShares Bitcoin Trust (IBIT) shattering records with $8 billion in single-day volume on November 21, part of a whopping $11.5 billion across Bitcoin ETFs. At $52.74 today, up 2.09% with a high of $53.40 and low of $52.08, IBIT underscores maturing liquidity that beginners can tap into without the hassles of direct crypto custody.

This policy pivot aligns with broader institutional momentum. Bank of America is greenlighting 1%-4% portfolio allocations to crypto ETFs for wealth clients starting in 2026, advising advisors across 15,000 desks to consider Bitcoin exposure. As a balanced portfolio strategist, I see this as validation: crypto’s role in diversification is gaining traction, not as a gamble, but as a measured hedge against traditional assets. For bitcoin etf beginners guide 2025 seekers, Vanguard’s move simplifies crypto onboarding vanguard dramatically.

Vanguard’s Reversal: What Changed and Why It Matters Now

Vanguard built its reputation on low-cost, long-term investing, often shunning high-volatility assets like Bitcoin. Yet investor demand evolved, and crypto markets matured with spot ETFs proving their mettle. The new rules allow ETFs holding Bitcoin, Ether, XRP, and others, reflecting a pragmatic nod to client preferences. No longer must Vanguard users detour to other brokers for vanguard bitcoin etf buy access; it’s all under one roof.

Consider the timing. IBIT’s volume explosion highlights liquidity that rivals blue-chip stocks, reducing slippage risks for retail trades. This isn’t hype; it’s infrastructure catching up to reality. Beginners benefit most: familiar brokerage interfaces mean no wallets, no keys, no tax headaches from self-custody. Pair this with Bank of America’s endorsement of up to 4% allocations, and you have a roadmap for prudent entry. I recommend starting small, viewing Bitcoin as a 1-2% slice of a diversified portfolio to capture upside while capping downside.

“Balance is the key to growth, ” a mantra that rings true as giants like Vanguard adapt.

IBIT’s Record Volumes: A Liquidity Milestone for Beginners

November 21,2025, etched itself in ETF history when Bitcoin funds traded $11.5 billion daily, IBIT alone commanding $8 billion. That’s institutional muscle flexing, with 57 million shares changing hands recently at $52.74. Such depth means your ibit etf trading volume buys execute efficiently, a far cry from crypto exchanges’ occasional chaos.

Why does this excite me for newcomers? High volumes signal conviction from big players like BlackRock, whose IBIT offers spot Bitcoin tracking without the tech barriers. Current price action reinforces stability: from $52.08 low to $53.40 high today, volatility tamed relative to Bitcoin’s spot price swings. For context, this mirrors how stock ETFs onboarded novices decades ago. Bank of America’s bank of america bitcoin allocation push amplifies the signal, urging clients toward similar vehicles.

In my hybrid analysis blending technicals and macros, IBIT’s momentum suggests sustained interest. Support holds firm around recent lows, while volume spikes point to accumulation. Beginners, this is your cue: leverage Vanguard’s platform for seamless entry.

Your First Steps: Onboarding to Vanguard Bitcoin ETFs

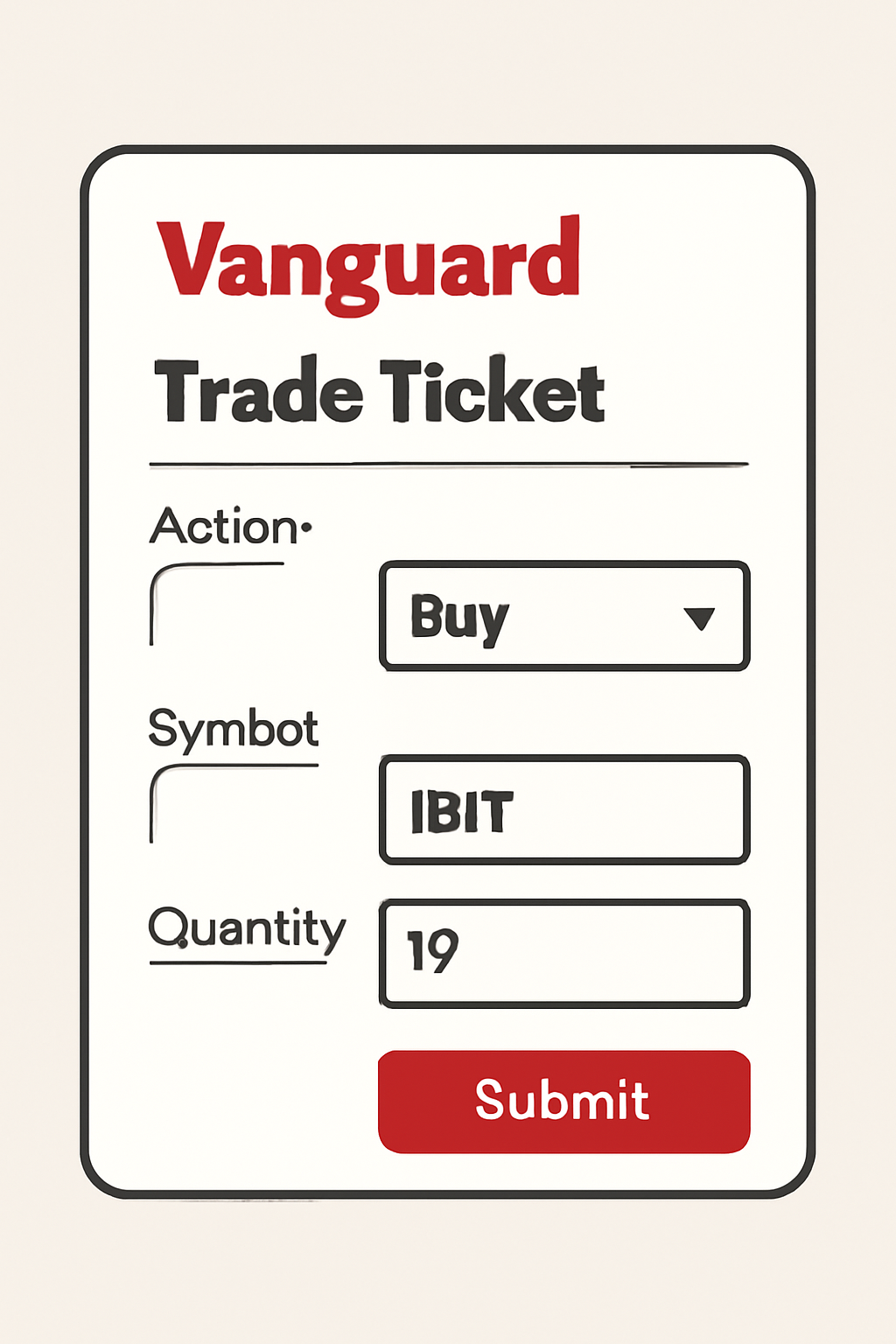

Ready to act? Log into your Vanguard account or open one; it’s straightforward with no crypto-specific hurdles anymore. Search for IBIT under ETFs, review its prospectus for the 0.25% expense ratio, and place a limit order at or near $52.74 to control entry. Fund via bank transfer for settlement in T and 1 days.

- Verify account: Ensure brokerage access enabled.

- Research allocation: Aim 1-2% initially, per BofA guidance.

- Execute trade: Buy shares during market hours.

Dollar-cost average to smooth volatility, setting buys weekly. Tax perks? ETFs report via 1099s, simplifying filings over direct holdings. As pressures mount from policy shifts, this path democratizes access.

iShares Bitcoin Trust (IBIT) Price Prediction 2026-2031

Forecasts based on institutional adoption (Vanguard policy shift, Bank of America allocations), record ETF volumes, and Bitcoin price trends from current $52.74 baseline

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2026 | $58.00 | $85.00 | $125.00 | +61.2% |

| 2027 | $75.00 | $115.00 | $170.00 | +35.3% |

| 2028 | $95.00 | $155.00 | $230.00 | +34.8% |

| 2029 | $120.00 | $210.00 | $310.00 | +35.5% |

| 2030 | $150.00 | $280.00 | $420.00 | +33.3% |

| 2031 | $185.00 | $370.00 | $560.00 | +32.1% |

Price Prediction Summary

IBIT is set for strong upward trajectory driven by accelerating institutional inflows from Vanguard and Bank of America, record trading volumes ($8B for IBIT on peak days), and Bitcoin’s maturation. Average prices projected to grow from $85 in 2026 to $370 by 2031, with bullish maxima reflecting ETF adoption and macro tailwinds, while minima account for potential volatility and regulatory risks.

Key Factors Affecting iShares Bitcoin Trust Stock Price

- Vanguard’s Dec 2025 policy reversal enabling Bitcoin ETF trading for brokerage clients

- Bank of America approving 1%-4% crypto ETF allocations for 15,000+ advisors starting 2026

- Record Bitcoin ETF volumes ($11.5B daily, IBIT $8B) signaling institutional demand

- BlackRock’s low-cost IBIT structure providing secure BTC exposure amid rising liquidity

- Macro factors: potential rate cuts, regulatory clarity, and Bitcoin halving cycles

- Bearish risks: market corrections, geopolitical tensions, or delayed adoption

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

But let’s temper enthusiasm with realism. While Vanguard’s doors are open, Bitcoin remains volatile. IBIT mirrors spot prices faithfully, so expect swings beyond today’s $52.08-$53.40 range. That’s why Bank of America’s 1%-4% allocation guidance resonates: it positions crypto as a portfolio enhancer, not dominator. In my practice, I cap it at 2% for conservative beginners, scaling up only after monitoring macro cues like interest rates or ETF inflows.

Navigating Risks: Smart Safeguards for Your IBIT Position

Volatility tops the list. Even with record ibit etf trading volume, IBIT can drop sharply on sentiment shifts. Regulatory tweaks, though unlikely post-ETF approvals, linger as tail risks. Counter this with position sizing: never exceed what a 30% drawdown won’t rattle. Use stop-limits below key supports, like recent $52.08 lows, but avoid over-trading; ETFs shine in buy-and-hold strategies.

Fees matter too. IBIT’s 0.25% expense ratio is competitive, yet compounds over time. Compare via Vanguard’s tools before committing. Taxes simplify versus direct crypto, but harvest losses annually to offset gains. Emotionally, dollar-cost averaging at levels near $52.74 builds discipline, turning dips into opportunities.

This methodical approach embodies balanced growth. Pair IBIT with broad equities and bonds for hybrid resilience, echoing my decade blending assets.

Portfolio Fit: Integrating Bitcoin ETFs Like a Pro

Think allocation first. Bank of America’s nod to bank of america bitcoin allocation of 1%-4% suits varied risk appetites: 1% for retirees, 4% for growth chasers. I advocate a tiered model: start at 1%, add 0.5% yearly if Bitcoin holds above key averages. Rebalance quarterly to prevent drift.

Why now? Vanguard’s policy shift accelerates crypto onboarding vanguard, merging crypto’s asymmetry with traditional ease. IBIT’s liquidity, evidenced by 57 million shares traded lately, ensures smooth exits. Monitor via Vanguard’s dashboard, setting alerts at $53.40 highs for profit-taking.

Real-world example: A $100,000 portfolio gets $1,000-$2,000 in IBIT at $52.74/share, roughly 19-38 shares. That’s exposure without overwhelm, capturing upside as institutions pile in.

These shifts signal crypto’s permanence. Vanguard’s reversal, BofA’s recommendations, IBIT’s volumes, all point to normalized access. Beginners, seize this window prudently.

Looking Ahead: 2026 and Beyond for Bitcoin ETF Investors

Expect more platforms to follow, deepening liquidity. IBIT could test $60 and if inflows persist, buoyed by today’s $52.74 stability. Macro tailwinds like potential rate cuts favor risk assets. Yet stay vigilant: diversify, dollar-cost, rebalance.

For bitcoin etf beginners guide 2025, Vanguard simplifies the leap. No more silos; one account handles it all. My hybrid lens sees Bitcoin complementing stocks amid fiat uncertainties. Start small, learn continuously, and let balance guide your path.

Vanguard’s pivot isn’t just permission; it’s an invitation to thoughtfully diversify.